Modern expense management for retail companies.

A unified suite of corporate cards, expense management, and accounts payable automation for retail finance teams.

Improve cash flow visibility.

Delight customers.

Ramp gives retail finance teams real-time visibility into store and vendor spend, helping them spot trends faster, forecast more accurately, and reinvest in the products and experiences their customers value most.

Enforce policies without the hassle.

Ensure compliance with built-in controls that block spend on unapproved categories, merchants, or limits. Automate policy alerts, request repayment for out-of-policy charges, and easily lock cards when additional restrictions are needed.

Corporate cardEmployee expenses, on-the-go.

Ramp prompts, collects, and matches receipts at the time of the transaction—automatically or via SMS, mobile app, email integrations, Amazon Business, or other resources. This means more accurate reporting and more timely receipt submission.

Expense management

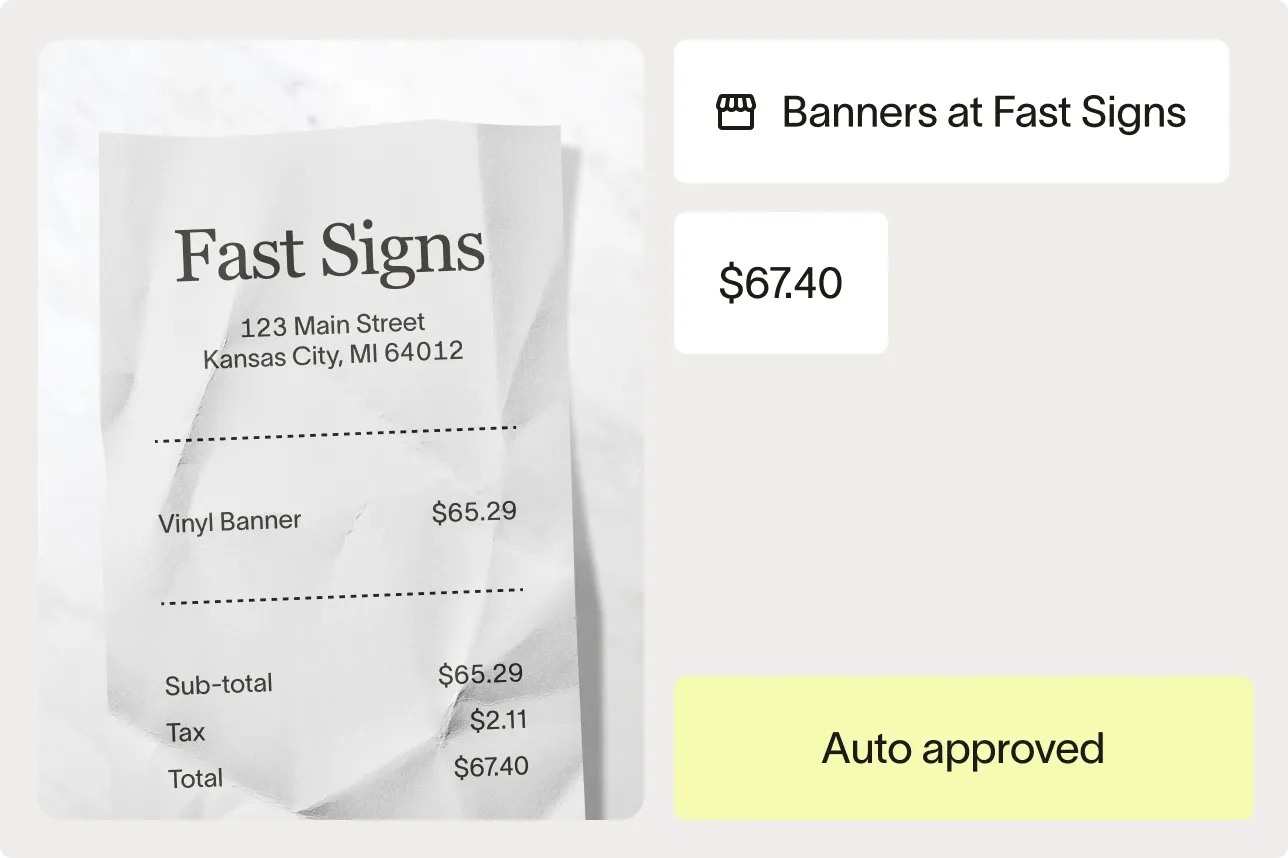

Simplify and automate payments.

Handle payments across every location without the manual work. Ramp captures line-item details with 99% accuracy, routes invoices through custom approval flows, and automates recurring payments, so your team can focus on growth, not paperwork.

Accounts payableIntegrate with your existing tools.

Make month-end easier by syncing your data in real time and reliably connecting with your accounting solution. Easily map transactions to store locations, product lines, or cost centers to close your books on time.

Accounting automation

“We’re constantly tweaking our process and finding ways to get even more efficient. It’s really important that we have a platform like Ramp that encourages us to keep evolving. It’s good for the team and it’s good for the business.”

Senior Manager of Financial Systems