Calculate Iowa’s per diem allowance for your business travel

Per diem rates simplify managing business travel expenses by setting standardized reimbursements for lodging, meals, and incidentals. This helps you control costs and ensure fair compensation, while also aligning with your company’s expense policy to avoid confusion around travel expenses.

Following clear guidelines streamlines expense reporting and keeps your business compliant with federal regulations. Understanding Iowa's per diem rates is important, especially since certain cities have higher travel costs, even if most of the state remains consistent.

Iowa per diem calculator

To calculate your per diem allowance, simply enter your travel dates and destination details, including the location, county, and city.

Iowa per diem rates

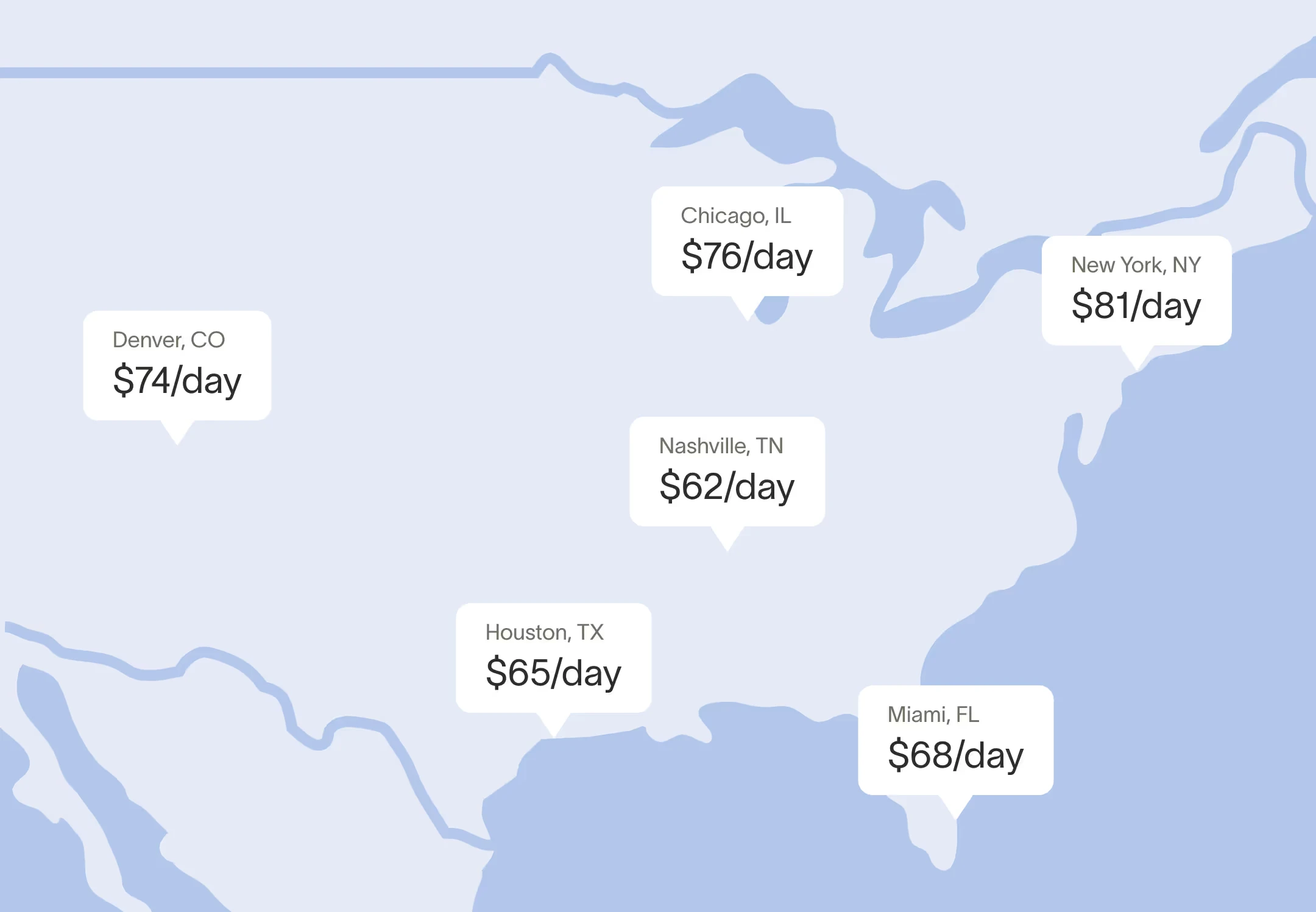

If your team is traveling to an Iowa city without a specific per diem rate, the standard federal rates apply. According to the General Services Administration (GSA), effective from October 2025 to September 2026, the standard rates are $110 per night for lodging and $68 per day for meals and incidental expenses.

However, the GSA recognizes that certain cities have higher travel costs. For these destinations in Iowa, you can claim higher per diem allowances:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Dallas | $115 | $115 | $115 | $115 | $115 | $115 | $115 | $115 | $115 | $115 | $115 | $115 |

| Polk | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Dallas | $80 |

| Polk | $80 |

Automate travel spend controls based on per-diem rates

Staying informed about Iowa’s per diem rates helps your business comply with state and federal regulations, reducing the risk of non-compliance. Clear per diem practices promote transparency and provide employees with clear guidelines for managing their travel expenses, fostering efficiency and trust.

While business travel can be complex, managing the associated costs doesn’t have to be. With Ramp, you can set precise, location-based per diem rates for Iowa and beyond, ensuring compliance and cost control. Features like GSA rate integration and custom multipliers make managing per diem allowances easy. This helps your team know their spending limits and makes it easier to manage expenses.

Simplify your business travel from booking to expense tracking with Ramp