Calculate Kentucky’s per diem allowance for your business travel

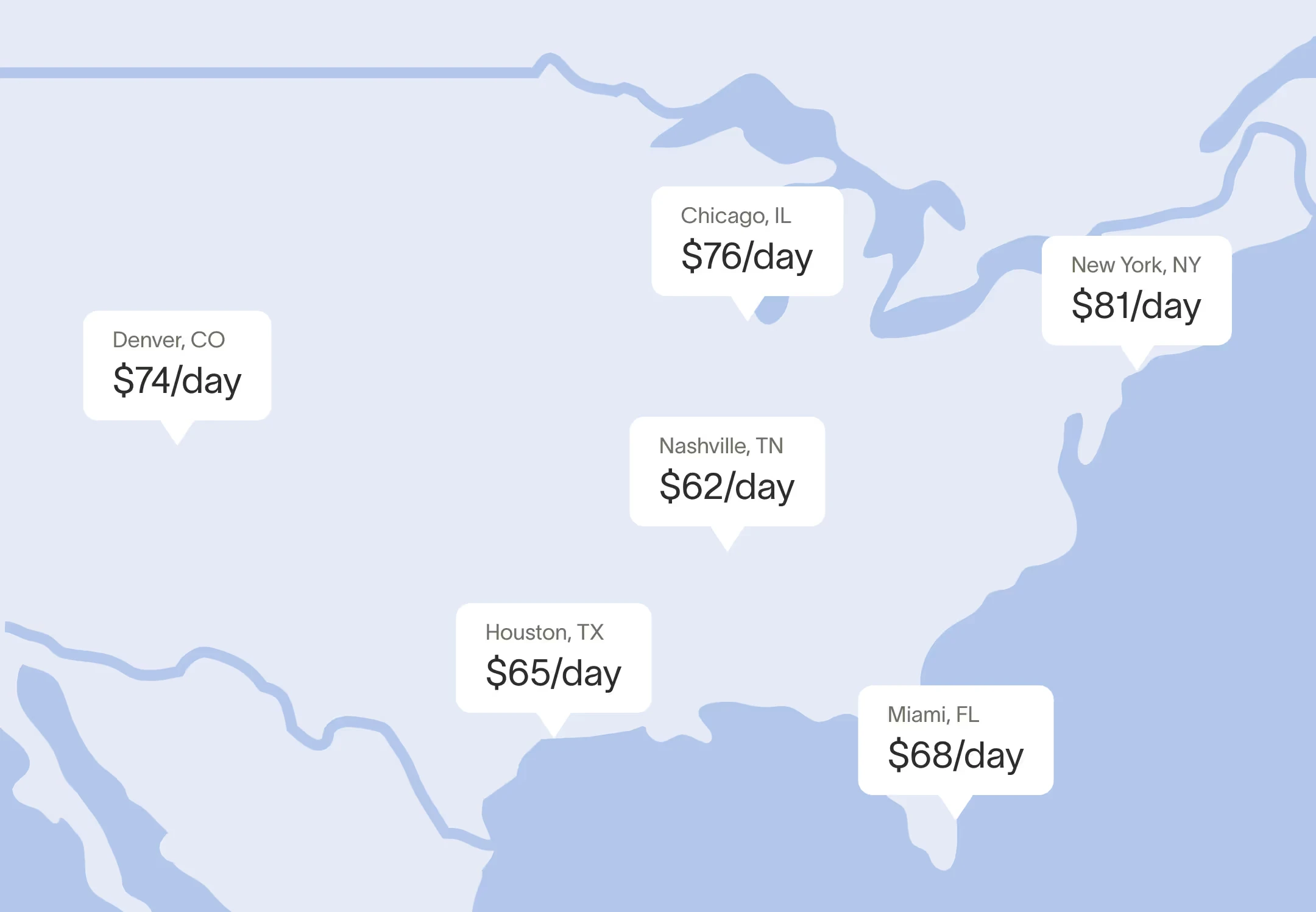

Per diem rates are more than just a way to reimburse travel expenses—they help create a structured approach to managing business travel. By standardizing allowances for lodging, meals, and incidentals, per diem rates ensure fair compensation and remove uncertainty around spending.

In a state like Kentucky, where travel costs can vary, understanding these rates helps your business maintain a consistent travel policy, making expense management easier while staying compliant with federal guidelines.

Kentucky per diem calculator

To calculate your per diem allowance, enter your travel dates and destination city and county for Kentucky.

Per diem rates in Kentucky

When your employees travel to cities in Kentucky without specific per diem rates, the standard federal rates apply. As set by the General Services Administration (GSA) for the period from October 2025 to September 2026, these rates are $110 for lodging and $68 per day for meals and incidentals.

However, certain cities in Kentucky have specific per diem rates due to differences in local costs. Being aware of these rates allows your business to budget accurately and reimburse employees appropriately. Here are the Kentucky cities with their designated per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Boone | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 |

| Fayette | $118 | $118 | $118 | $118 | $118 | $118 | $118 | $118 | $118 | $118 | $118 | $118 |

| Jefferson | $164 | $120 | $120 | $120 | $155 | $155 | $155 | $155 | $134 | $134 | $134 | $164 |

| Kenton | $163 | $163 | $163 | $163 | $163 | $163 | $163 | $163 | $163 | $163 | $163 | $163 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Boone | $68 |

| Fayette | $80 |

| Jefferson | $80 |

| Kenton | $86 |

Optimize your travel efficiency, from booking to expense reports

By using Kentucky’s per diem rates, your business stays compliant with state and federal regulations, and clear guidelines help prevent disputes over travel costs. With Ramp, you can set accurate, location-based rates to control expenses and simplify travel management. Employees can easily track their allowances while traveling, ensuring they stay within budget and have a clear view of their spending.

Ramp has advanced features like GSA rate integration and custom multipliers. These features make per diem management easier for both your team and your business.

Simplify your business travel from booking to expense tracking with Ramp