Calculate Missouri’s per diem allowance for your business travel

Managing travel expenses for business trips requires both structure and clarity. In Missouri, using per diem rates to set fixed amounts for hotel, meals, and other things helps businesses plan travel budgets well while staying in line with federal rules.

Missouri’s per diem guidelines also bring consistency to your company’s corporate travel policy, whether employees are traveling to cities or rural areas. Clear rules make compliance straightforward and create transparency, giving employees peace of mind when they’re on the road.

Missouri per diem calculator

Enter the dates and locations of your business travel to calculate your per diem allowances.

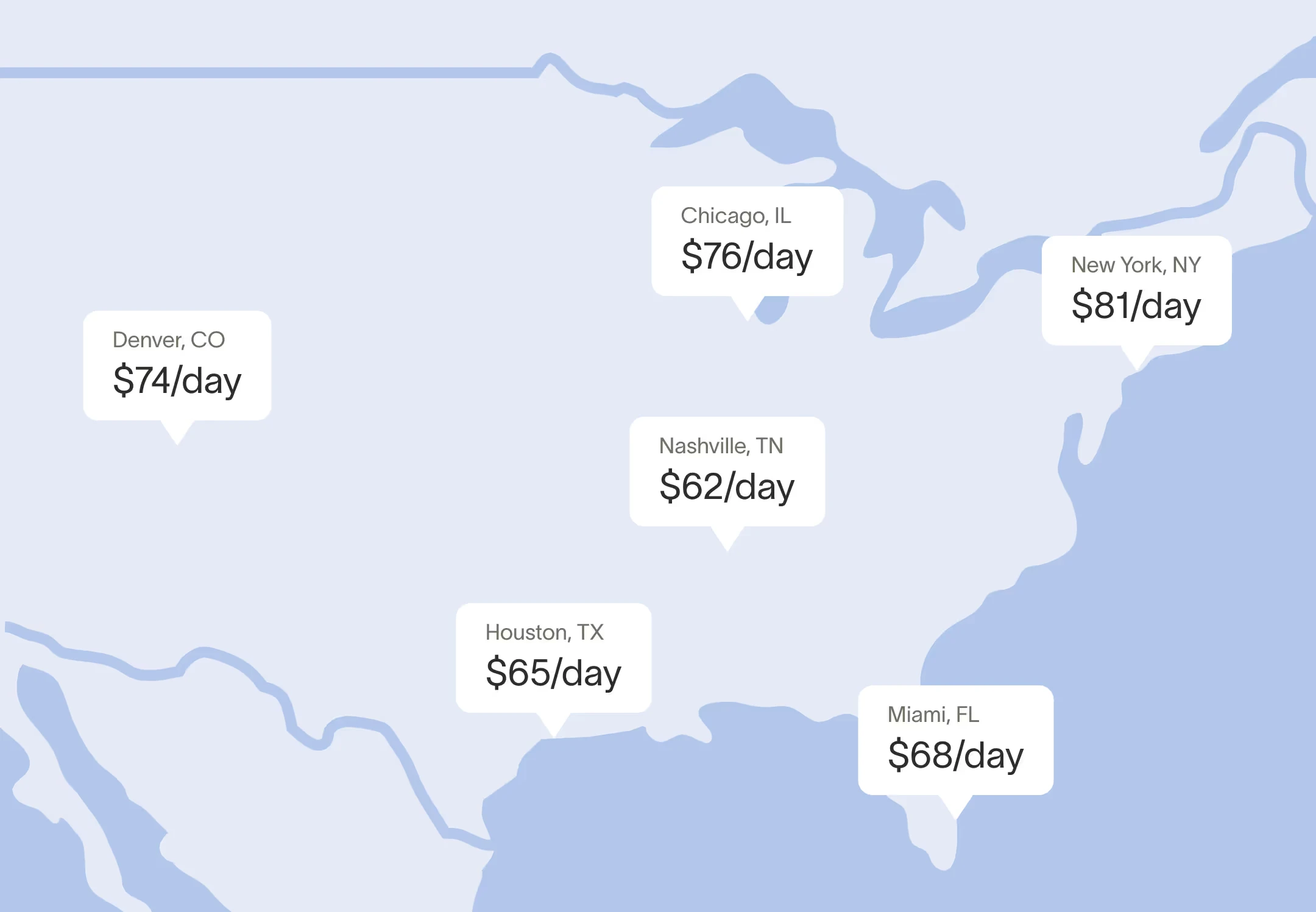

Missouri per diem rates

For cities in Missouri without specific per diem rates, the standard rates are $110 for lodging and $68 per day for meals and incidentals.These rates are set by the General Services Administration (GSA) and are effective from October 2025 to September 2026.

However, certain cities and counties in Missouri have specific per diem rates, such as St. Louis, set by the General Services Administration (GSA). If your employees are traveling to these locations, the following rates apply:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Cass | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 |

| Clay | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 |

| Jackson | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 |

| Platte | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 | $135 |

| St. Charles | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 |

| St. Louis | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 |

| St. Louis City | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Cass | $80 |

| Clay | $80 |

| Jackson | $80 |

| Platte | $80 |

| St. Charles | $86 |

| St. Louis | $86 |

| St. Louis City | $86 |

Optimize your travel efficiency, from booking to expense reports

By using Missouri's per diem rates, your business makes travel policies fair and clear. This lets your employees focus on their work without worrying about unclear costs.

Ramp goes further by offering accurate, location-based rates and automated expense tracking. This makes it easy for employees to get their allowances anytime and stay on budget easily. With GSA rate integration, customizable multipliers, and valuable reporting features, Ramp simplifies per diem management, making it a seamless part of your travel expense workflow.

Simplify your business travel from booking to expense tracking with Ramp