Calculate Rhode Island’s per diem allowance for your business travel

Rhode Island’s diverse landscape, from bustling cities to scenic coastlines, makes it an appealing destination for business travel. The state’s per diem rates support your corporate travel planning by providing standardized daily allowances for lodging, meals, and incidentals.

These clear guidelines help you budget accurately, ensure fair reimbursements, and stay compliant with federal regulations, giving both you and your employees a predictable approach to travel expenses. With per diem rates in place, you can better control costs and simplify expense reporting for your team.

Rhode Island per diem calculator

Enter your travel dates and destination details—city and county—to calculate your per diem allowance.

Rhode Island per diem rates

If you're traveling to a city in Rhode Island without a specific per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply. These rates are set by the General Services Administration (GSA) and are effective from October 2025 to September 2026.

For cities with location-specific rates, the GSA provides fixed per diem amounts to account for cost variations. Here are the Rhode Island cities with specific per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Bristol | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 |

| Newport | $218 | $141 | $141 | $141 | $141 | $141 | $141 | $141 | $268 | $268 | $268 | $218 |

| Providence | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Bristol | $80 |

| Newport | $80 |

| Providence | $80 |

Automate travel spend controls based on per-diem rates

Following Rhode Island’s per diem rates brings consistency to your travel expense management, helping you control costs effectively and reimburse employees fairly. Setting the right amount of money each day prevents unexpected costs. This creates a well-organized travel process that helps both your finance team and employees who are on the go.

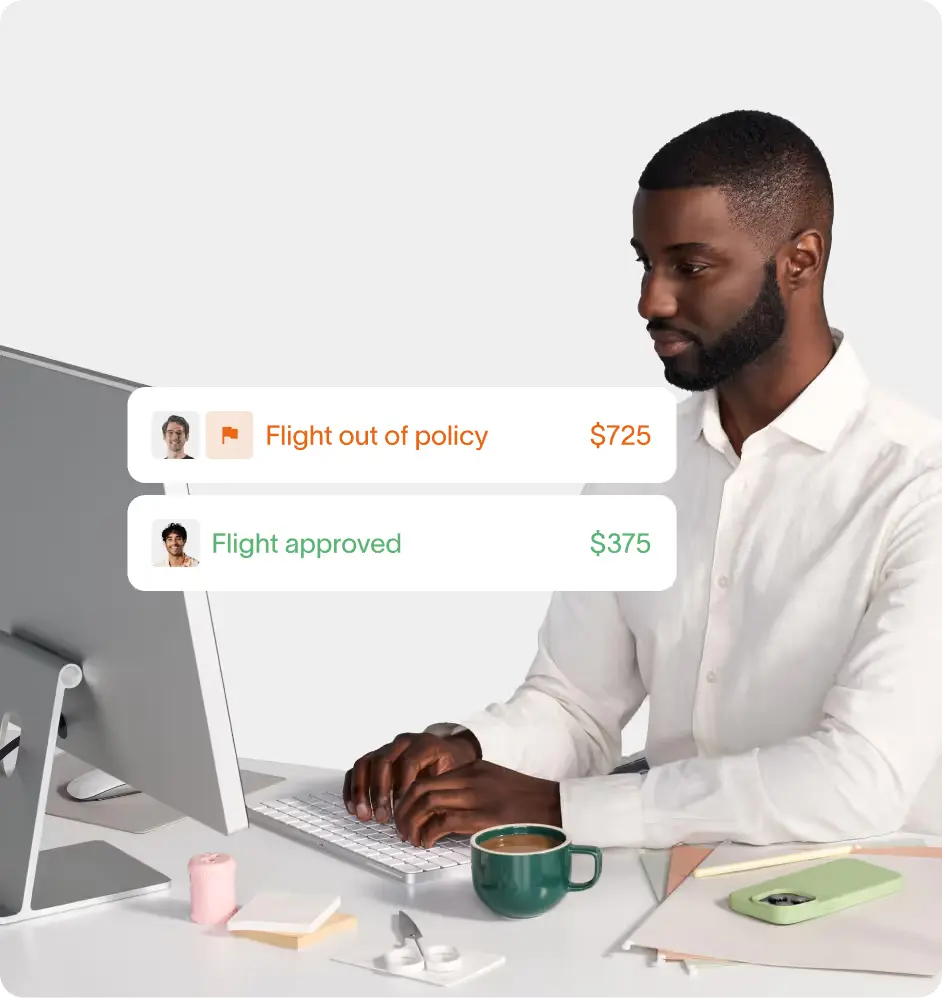

Ramp takes business travel management a step further by offering location-based per diem settings that keep expenses compliant and controlled. Employees can easily track their allowances in real time, staying within budget and understanding their spending limits. With features like GSA rate integration and customizable multipliers, Ramp makes per diem management simple and effective, supporting both administrators and employees for a seamless travel expense process.

Simplify your business travel from booking to expense tracking with Ramp