Acumatica AP automation: What it is and how it works

- What is Acumatica accounts payable software?

- Features of Acumatica AP software

- How to use Acumatica and its integrations

- What to do when you’re all set up

- Using Ramp’s AP software alongside Acumatica

- How integrating Ramp has helped businesses streamline their AP workflows

- Maximize your Acumatica software with Ramp

Managing accounts payable manually is frustrating. Mistakes pile up, approvals get delayed, and keeping track of payments feels like an endless juggling act. Acumatica ERP software takes the pressure off by streamlining workflows and improving invoicing accuracy with its standard AP module.

We’ll walk through how Acumatica’s AP functions work, best practices, and how to integrate with third-party software like Ramp to further optimize your AP processes.

What is Acumatica accounts payable software?

Acumatica AP Software

Acumatica AP software is a module within Acumatica ERP designed to streamline accounts payable processes, including invoice management, vendor payments, and cash flow tracking.

Acumatica offers built-in tools to simplify key AP tasks such as invoice entry, document linking, and payment scheduling. These features help digitize and streamline foundational steps in the accounts payable process—like matching invoices to supporting documents and calculating taxes within the system.

For teams looking to further extend these capabilities, Acumatica also integrates with a variety of AP automation solutions. These integrations can help enhance workflows by introducing more advanced features like intelligent invoice capture, multi-layered approvals, or exception handling.

What AP processes should be automated and why?

Critical AP processes, including data entry, invoice approval workflows, and payment scheduling, should be automated to reduce manual workloads and improve accuracy. Automation ensures that payments are made on time, strengthens vendor relationships, and keeps cash flow under control.

Acumatica’s AP module within its ERP provides the foundation for an efficient AP workflow, and when using it with automation integrations, it can help businesses achieve end-to-end automation that scales effortlessly.

Features of Acumatica AP software

Acumatica’s current accounts payable features can still simplify essential processes and provide a clear path to better financial management without a full set of automation tools. In more detail, Acumatic’s standard AP module offers:

- Source document attachment: Attach and organize supporting documents for every invoice, improving record accuracy and audit readiness.

- Streamlined approval workflows: Has predefined workflows to ensure invoices are routed to the appropriate approvers quickly and without confusion.

- Invoice receipt and entry: Acumatica reduces manual effort by digitizing and importing invoices into its system, though some processes may require manual input.

- Tax compliance tools: Automatically calculate taxes and verify tax zones to ensure compliance while preventing costly errors.

- Efficient payment processing: Batch process vendor payments using ACH or other supported methods, eliminating repetitive tasks.

Acumatica ERP equips businesses with the tools they need to streamline AP tasks, and combining these capabilities with a robust AP integrations can unlock the full potential of automation.

How to use Acumatica and its integrations

Getting started with Acumatica software involves both setting up the core AP functionality and integrating automation tools to fill in gaps and enhance efficiency.

Before beginning, ensure your vendor data is accurate, B2B payment methods are defined, and internal roles for managing accounts payable are clearly assigned. This foundation minimizes errors and creates a seamless integration experience.

Then (although steps may vary) log into Acumatica and navigate to the AP module on the dashboard to configure AP functions. To use a third-party software, make sure that it is compatible, and follow the given set up instructions.

What to do when you’re all set up

Once your third-party AP automation software is running, you’ll be able to use key capabilities that streamline your operations and improve overall efficiency. Here are some AP best practices after you’re all set up:

- Invoice management: Ensure vendor profiles include accurate tax zones and payment terms, and regularly review invoice data for discrepancies to maintain compliance and consistency.

- Payment processing: Set up automated payment schedules aligned with vendor discounts and use approval thresholds to speed up routine transactions while maintaining control.

- Tax compliance: Regularly review tax reports for accuracy and configure default tax zones for each vendor to avoid miscalculations or delays in compliance filing.

- Real-time insights: Use AP aging reports to identify overdue invoices and configure alerts for upcoming payments to ensure vendor relationships stay strong.

Using Ramp’s AP software alongside Acumatica

Acumatica's ERP provides a solid foundation for automation, and with its integration with Ramp, more AP capabilities can be layered on to optimize your AP workflows.

Here's what Ramp provides and why it’s a top Acumatica integration:

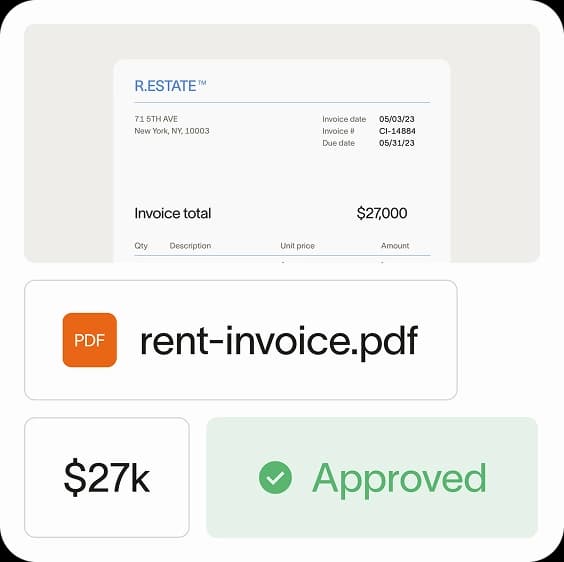

- Automated bill entry: Ramp automatically populates all fields on the bill form based on the coding completed within Ramp, ensuring accuracy and time savings.

- Multi-entity support: Ramp supports multi-entity configurations, accommodating the specific ways your legal entities are represented in Acumatica.

- Vendor management: Default vendors in Acumatica are synced with Ramp and new vendors created in Ramp Bill Pay are created back in Acumatica for consistent vendor management across systems.

- Chart of Accounts integration: Ramp integrates your Acumatica chart of accounts, allowing easy financial coding. This includes syncing vendors, expense branches, items, projects, subaccounts, and inventory items, ensuring your accounting records are accurate and up-to-date.

- Bill integration: Bills can be synced directly from Ramp into Acumatica. Once bills are released in Acumatica, corresponding bill payments are synced back into Ramp for a complete, end-to-end record of transactions.

From simplifying complex workflows to providing deeper insights into cash flow, Ramp’s tools help businesses achieve enhanced efficiency.

How integrating Ramp has helped businesses streamline their AP workflows

Ramp doesn’t currently have a formal AP automation case study published with Acumatica (yet). However, our integrations with other top ERPs and accounting platforms highlight the transformative results businesses can expect when integrating Ramp with Acumatica ERP.

Here’s one way Ramp effortlessly synced with an ERP to increase AP efficiency.

Ramp and NetSuite integration: Precision Neuroscience’s story

Precision Neuroscience, a med-tech company, struggled with an inefficient and fragmented procurement and accounts payable process. The team spent excessive time on manual data entry across disconnected systems, which often led to errors and slowed down workflows, creating unnecessary challenges for the finance team and employees.

By integrating Ramp with NetSuite, Precision Neuroscience replaced its cumbersome setup with an automated, centralized platform for managing procurement and AP. The transition eliminated redundant tools and introduced a streamlined, user-friendly solution.

Key outcomes from the integration included:

- 50% faster procurement processes: Automated approval workflows allowed for quicker submission of purchase orders (POs) and smoother vendor communication.

- Time savings: Ramp’s OCR technology automated data entry for 20–30 POs per week, enabling the team to focus on higher-value activities.

- Reduced errors: Duplicate invoices were flagged automatically, preventing unnecessary approvals and wasted effort.

- Streamlined month-end close: Precision Neuroscience reduced their month-end close process from several days to just 1–2 days.

"Ramp’s OCR has been so useful on the procurement side," said Brian Lautenbach, Financial Controller at Precision Neuroscience. "It automatically takes all the information from the quote and saves all the data entry that we would have otherwise had to type into a purchase order.”

By using Ramp with Acumatica, businesses can achieve similar results, transforming complex accounts payable workflows into a seamless, efficient, and error-free financial management system.

Maximize your Acumatica software with Ramp

Acumatica ERP software, along with its AP module, provides a solid framework for managing invoices, payments, and compliance, helping businesses reduce errors and save time. And with its direct integration with Ramp, Acumatica's automation capabilities for AP are even more elevated.

Need advanced automation features that simplify even the most complex AP workflows? Integrate Acumatica with Ramp Bill Pay.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°