SAP AP automation: A full guide on what it is and how it works

- What is SAP accounts payable automation?

- SAP ERPs: A quick breakdown of their AP functions

- Setting up accounts payable functions within SAP

- What to do when you’re all set up

- Using Ramp AP software alongside SAP

- How switching to Ramp AP software transforms AP workflows

- Manage invoices 10x faster with Ramp

Manual accounts payable processes are a common source of frustration—leading to wasted time, costly errors, and delayed payments. To address these challenges, many businesses turn to ERP systems that provide standard AP functionality as a foundation for improving efficiency.

SAP ERP systems, such as S/4HANA and Business One, offer standard AP functionality to manage payables. And for businesses looking for advanced automation, SAP extensions can also enhance these ERPs by streamlining AP operations.

But how exactly does SAP software work? We’ll walk through the AP features of SAP ERPs, how third-party tools like Ramp can be used alongside them, and how they collectively enhance your AP operations.

What is SAP accounts payable automation?

SAP AP automation

SAP accounts payable automation refers to the capabilities within SAP’s ecosystem that help streamline and digitize accounts payable workflows. It can also include third-party AP automation software that integrates with SAP ERPs to enhance their efficiency.

SAP ERP systems, such as SAP S/4HANA and SAP Business One, offer tools that automate parts of the AP process, including invoice management and payment scheduling. However, they’re not standalone AP automation solutions. Instead, they provide foundational support for managing payables as part of broader enterprise resource planning.

SAP’s product-line does include add-ons which integrate with SAP ERPs to extend their AP capabilities. Depending on the configuration, these tools offer features such as AI-driven invoice processing, automated approval routing, and detailed dashboard reports.

Why do businesses use third-party AP automation tools with SAP ERPs?

For businesses with unique needs, there are various third-party AP automation tools that are also an option. For example, Ramp can be used alongside certain SAP ERP systems, offering features like OCR that auto-fills bills down to each line item, AI-driven auto-coding, AP aging reports, and more.

So whether an organization stays within SAP’s ecosystem for additional AP functionality or uses third-party software, these solutions can help centralize AP operations and provide actionable financial insights across their business.

SAP ERPs: A quick breakdown of their AP functions

Understanding the specific role of each SAP system and their standard AP capabilities can be complex. Below, we provide a simple walk through of what each SAP tool delivers in relation to accounts payable.

SAP S/4HANA

SAP S/4HANA is a comprehensive ERP system designed to transform business operations across finance, procurement, supply chain, and more. While it includes AP automation capabilities, its primary focus is to act as an ERP. Built on the SAP HANA in-memory database, it delivers real-time insights, process integration, and advanced analytics.

Here’s a high-level overview of what SAP S/4HANA covers for accounts payable:

- Uses AI and machine learning to validate and match invoices in SAP to purchase orders or receipts, minimizing manual intervention.

- Provides advanced payment management by tracking cash flow and outstanding payables with real-time data.

- Connects AP processes with procurement and supply chain operations for a unified experience.

Note: SAP ECC, the predecessor to S/4HANA, offers foundational ERP capabilities but lacks the advanced automation tools of S/4HANA. SAP encouraging businesses to transition for enhanced functionality.

SAP Business One

SAP Business One is a comprehensive ERP platform built for small businesses. It combines tools for managing accounting, sales, inventory, and more in one system. While not solely focused on accounts payable, it includes effective AP capabilities to simplify financial workflows and reduce manual tasks.

Here’s what the AP features in SAP Business One covers:

- Automates the AP process by capturing and reconciling invoice data automatically to reduce errors.

- Syncs AP and inventory data, allowing businesses to plan by material needs, schedule purchases, and process AP invoices.

- Offers clear, actionable insights to support decision-making and compliance through analytics with predefined metrics.

SAP Business ByDesign

SAP Business ByDesign is a cloud-based ERP system created for growing midsize businesses. It unifies core business functions, including accounts payable, procurement, and supply chain management, in one platform. While AP automation is only one aspect of this system, its integration into broader workflows makes it a versatile tool for businesses needing comprehensive support for financial processes.

Here’s a quick breakdown of what its AP capabilities is able to perform:

- Provides a clear overview of AP, AR, and other financial processes, managing cash flow and organizing outstanding balances with vendors.

- Tracks transactions with detailed audit trails, internal controls, and compliance checks.

- Links AP workflows with procurement, supply chain, and financial management for smoother operations.

Third-party software for SAP AP automation

As stated earlier, SAP’s accounts payable features provide foundational capabilities, but businesses often require advanced automation tools for more complex workflows. That’s where third-party software can complement SAP’s existing AP capabilities, offering solutions for more complex and technical AP workflows.

We’ll explore this further by detailing how Ramp can provide advanced AP capabilities after covering best practices for setting up SAP software.

Setting up accounts payable functions within SAP

Implementing SAP software can improve your AP workflows, but the process requires careful planning, technical expertise, and team alignment to ensure success. Before starting, ensure these steps are in place:

- Choose the SAP system that aligns with your business needs

- Confirm that your IT infrastructure is ready to support your selected SAP deployment

- Define your AP automation goals and align your team on implementation timelines

How to set up your SAP software

Though steps may vary, here’s a general process to follow when configuring your SAP software to create your AP workflows:

- Set up the SAP environment: Configure the system infrastructure, whether deploying on-premise, in the cloud, or as a hybrid model, ensuring it meets SAP’s technical requirements.

- Activate the AP module: Navigate to your SAP system’s configuration settings and enable the AP module based on the appropriate steps for your SAP product.

- Define data mappings: Use SAP tools to map essential invoice data fields, such as supplier information, invoice numbers, and payment terms, to streamline invoice capture and processing.

- Use third-party systems (optional): If you already have a SAP ERP but want to use a third-party app like Ramp for AP needs, carefully review with your team about using multiple systems.

- Assign user roles and permissions: Configure access controls for AP team members, and set up automated approval paths, matching invoices to purchase orders.

- Test the setup: Simulate real-world scenarios, such as invoice submission and approval cycles, to validate the automation process before going live.

What to do when you’re all set up

Once your SAP software is in place and properly configured, your accounts payable operations can transition from manual inefficiencies to a more refined process. Here's how to make the most of it through best practices:

Invoice management

Keep supplier information regularly updated to avoid errors and ensure smooth invoice processing. Real-time dashboards can provide valuable insights, allowing you to address invoice exceptions promptly and maintain efficiency.

Vendor management

Prioritize maintaining accurate and up-to-date vendor profiles, including payment terms and contact information. Use analytics to assess vendor performance, identify areas for improvement, and negotiate better terms.

Real-time financial insights

Leverage dashboards to monitor accounts payable metrics like average payment cycle and outstanding payables. Also, scheduling regular reports can also help maintain compliance and proactively address spending anomalies.

Using Ramp AP software alongside SAP

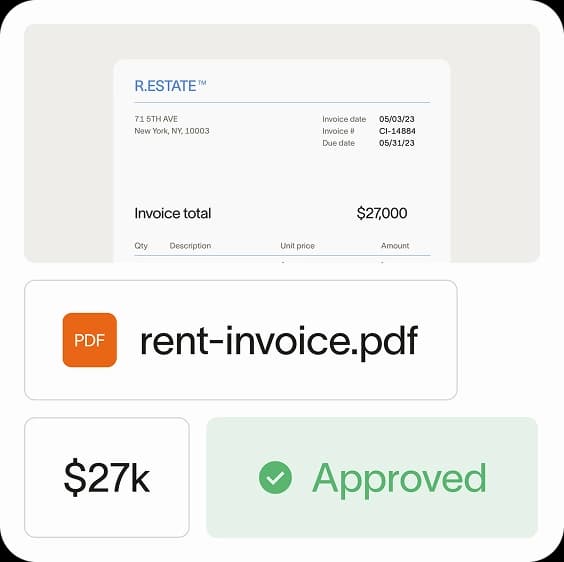

Ramp AP software is an advanced accounts payable automation solution that streamlines invoice processing, optimizes payment workflows, and provides real-time financial insights to help businesses save time and improve efficiency.

Its use alongside accounting systems is able to fill specific AP gaps by providing deeper spend analytics, enhanced controls, and more flexible workflows, to enhance overall functionality.

Here’s what Ramp AP software brings to the table:

- Automated invoice processing: Ramp’s AI-driven OCR technology captures and codes detailed invoices and line items with precision, minimizing manual input and reducing errors.

- Simplified approval workflows: Design smart approval processes with layered routing rules that automate reviews and send alerts only for significant changes, ensuring efficient oversight.

- Centralized payment management: Manage all vendor payments—whether domestic or international—across methods like check, card, ACH, or wire, all within a single platform with enhanced transparency.

- Streamlined repetitive workflows: Automate recurring bills, batch payments, and vendor onboarding, with bulk editing ensuring quick updates and minimal manual input.

By using Ramp along with SAP software, you gain an extended suite of tools tailored to your business needs.

How switching to Ramp AP software transforms AP workflows

Although Ramp has not yet established a formal case study with SAP (yet), its proven success with other integrations, such as Sage Intacct, demonstrates its ability to optimize financial workflows. Here’s one example of an AP automation success story that showcases how Ramp helps businesses improve efficiency, save time, and streamline processes for finance teams.

Ramp and Sage Intacct integration: REVA’s experience

REVA Air Ambulance, a leader in air medical transportation, faced significant challenges with its outdated and time-consuming AP workflows. Manual receipt uploads and delayed expense reporting created inefficiencies for the finance team, leaving them without the timely visibility needed for accurate reimbursements and reconciliations.

The integration of Ramp with Sage Intacct brought transformative changes to REVA’s AP processes. By automating workflows, enabling real-time transaction syncing, and accelerating month-end closes, Ramp helped streamline operations.

“We were able to mold Ramp to our company to set it up as needed within departments. But the biggest selling feature to us was the automatic, real-time integration with Sage,” said Seth Miller, Controller at REVA Air Ambulance.

The impact was immediate and measurable. Ramp:

- Reduced invoice processing time by over 80%, bringing it down from 15–20 minutes to less than 3 minutes.

- Reimbursements, which once took weeks, were processed on the same day.

- Month-end closes were completed two weeks earlier—by the 4th or 5th of the month—thanks to automated workflows and regular reconciliations.

By integrating effectively with Sage Intacct, Ramp helped save time and allowed finance teams like REVA’s to focus on strategic priorities and drive efficiency.

More of our success stories can be found here.

Manage invoices 10x faster with Ramp

Pairing SAP systems with third-party AP tools like Ramp simplifies and optimizes accounts payable management. SAP ERP software provides essential tools for managing payables, procurement, and more, while Ramp Bill Pay provides advanced automation features designed to scale with your business.

Try our interactive demo to see how Ramp automates AP management.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°