QuickBooks AP automation: A full guide on what it is and how it works

- What is QuickBooks and does it provide AP automation?

- How to set up AP automation tools with QuickBooks

- What to do when you’re all set up

- Using Ramp AP software alongside QuickBooks

- Case study: Bubble’s success integrating Ramp with QuickBooks

- Maximize your QuickBooks software with Ramp Bill Pay

Managing accounts payable can be time-consuming and prone to errors, especially when relying on manual processes. QuickBooks, as accounting software, simplifies AP tasks, like recording invoices and managing payments.

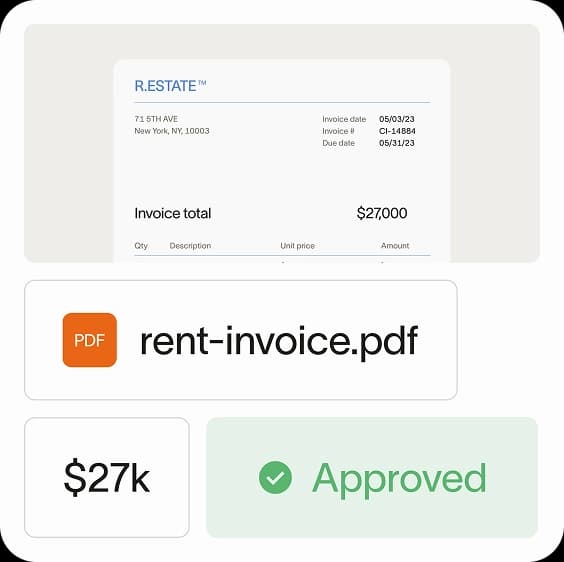

And to further streamline accounts payable with QuickBooks, users can integrate it with third-party AP automation tools to handle tasks like invoice processes, approvals, and payment scheduling more efficiently.

Let’s explore how QuickBooks works, how it can be used with AP automation softwares like Ramp, and how these tools together can add more value to your business.

What is QuickBooks and does it provide AP automation?

QuickBooks it primarily an accounting software and not an AP automation solution, but it does support third-party integrations with AP tools to extend its functionality. These integrations automate key accounts payable tasks such as invoice uploads, data extraction, and payment approvals, which QuickBooks alone cannot fully address.

By working alongside these integrations, QuickBooks becomes a more powerful platform for managing accounts payable. This approach allows businesses to retain the simplicity of QuickBooks while leveraging advanced AP automation capabilities tailored to their needs.

How does it work?

While we’ll review this in more detail later, using third-party AP automation tools like Ramp with QuickBooks creates a streamlined process for managing invoices and payments, such as:

- Invoice uploads: Bills can be uploaded into the third-party software, which extracts invoice details and syncs them with QuickBooks.

- Data synchronization: Payment details, vendor records, and expense categories are updated in QuickBooks automatically, reducing manual input.

- Approval workflows: Advanced tools allow for multi-step invoice approvals outside of QuickBooks, which then sync approved payments back to the platform.

This minimizes errors, improves visibility, and saves time by automating repetitive tasks that QuickBooks alone cannot handle.

Why should I use third-party AP automation software with QuickBooks?

Automating accounts payable processes with advanced AP software like Ramp reduces inefficiencies and eliminates manual errors, helping businesses operate more smoothly. By focusing automation on repetitive tasks like data entry and payment scheduling, companies can improve accuracy and allocate resources to higher-value activities.

The result is not just time savings but also better cash flow management and stronger vendor relationships.

How to set up AP automation tools with QuickBooks

Integrating QuickBooks with AP automation apps is straightforward, but preparation is key to making the process smooth and efficient. Here’s what you need to get started:

Prerequisites for integration

- A QuickBooks Online or Desktop subscription that includes AP functionality

- Administrator credentials to access and configure third-party apps

- Vendor invoices saved in supported formats, such as PDF, JPEG, PNG, or GIF

Steps to connect AP automation tools in QuickBooks

Steps will differ depending on what AP automation tool you choose to integrate with. However, here are the typical steps when setting it up with QuickBooks:

- Choose an AP automation tool: Select an integration compatible with QuickBooks.

- Connect your accounts: Log in to QuickBooks and the chosen AP software, then authorize the connection.

- Configure settings: Map expense categories, accounts payable workflows, and approval rules.

- Upload invoices: Use the AP automation tool to upload invoices, verify details, and sync with QuickBooks.

- Monitor and adjust: Regularly review invoices and workflows to ensure the integration is running smoothly.

What to do when you’re all set up

Once your QuickBooks integration with an AP automation tool is ready to go, you can begin using its features to simplify and improve your accounts payable processes. Here are a few AP best practices to follow:

Invoice management

Automation uses AI-powered tools like OCR for AP processing to extract details from complex invoices, such as vendor names, amounts, line items, and payment terms, and automatically sync this data to QuickBooks. This eliminates manual data entry and ensures invoices are categorized accurately for future reporting. There is no built-in invoice scanning function in QuickBooks, so you'll need to look to your third-party integration for support.

Best practices: Upload invoices in high-quality supported formats (PDF, JPEG, PNG) to minimize errors during data extraction. Periodically audit extracted details in QuickBooks for consistency with original invoices.

Payment scheduling

With AP automation software, you can schedule payments directly through the platform, ensuring they sync to QuickBooks with the correct accounts and expense categories. Features like batch payment processing and multi-method support (ACH, cards, checks, and wires) streamline vendor payments and avoid late fees.

Best practices: Use reminders and scheduling features to plan payments strategically based on cash flow needs. Regularly reconcile payment records in QuickBooks with bank statements to ensure alignment.

Approval workflows

Intelligent AP approvals automate multi-step processes by assigning roles and thresholds for invoice reviews. For example, invoices exceeding a set amount may trigger escalations to specific approvers, while routine payments can be processed without delays. All approvals sync seamlessly to QuickBooks for tracking.

Best practices: Regularly review and update your QuickBooks approval workflows to reflect organizational changes, and use automatic alerts to prevent bottlenecks in the process.

Real-time reporting

QuickBooks and integrated AP automation tools work together to provide real-time insights into outstanding payables, upcoming payments, and cash flow trends. You can generate detailed AP reports for budgeting, vendor analysis, and spending projections.

Best practices: Use the dashboard to monitor metrics such as DPO (Days Payable Outstanding) and identify vendors with recurring late payments. Export reports periodically to evaluate and refine your AP strategy.

By leveraging these capabilities, QuickBooks and AP automation tools transform accounts payable into a more accurate, efficient, and scalable operation. You’ll gain better visibility into your finances while reclaiming time for strategic growth initiatives.

Using Ramp AP software alongside QuickBooks

Ramp Bill Pay is an advanced accounts payable automation tool designed to simplify invoice processing, enhance payment workflows, and deliver real-time financial insights, enabling businesses to save time and operate more efficiently.

Using Ramp Bill Pay alongside QuickBooks allows for additional opportunities for efficiency, accuracy, and scalability.

Here’s what our AP software brings to the table:

- AP aging report: Directly access your AP Aging Report within Ramp Bill Pay.

- Custom field integration: Ramp imports custom fields for coding, treating them like standard fields. Required fields are auto-enabled, with optional fields activated in accounting settings.

- Automatic vendor creation: Ramp can add new vendors from transactions to QuickBooks (available to Owner, Admin, and Bookkeeper roles). Vendors are created after transactions are clear.

- Multi-line invoice coding: Split and code invoices into multiple categories in Ramp Bill Pay by each line individually.

- Mid-payment switching: If you switch accounting software, Ramp syncs bills for initiated payments, even mid-transition.

- Bill importing: While you can mark bills as paid outside Ramp, importing already-paid bills into Ramp is not supported.

- Receipt Sync: Receipts uploaded in Ramp are automatically attached to transactions in QuickBooks.

By using Ramp alongside QuickBooks, businesses can achieve a highly efficient AP process that minimizes manual effort, reduces errors, and supports future growth.

Case study: Bubble’s success integrating Ramp with QuickBooks

Bubble, a bootstrapped software company, faced fragmented financial processes that complicated reporting and GAAP compliance. Without a finance team until 2022, closing books efficiently and identifying cost-saving opportunities were persistent challenges.

To solve these issues, Bubble partnered with Ramp to centralize spend management and automate AP tasks like invoice processing and vendor payments. Ramp’s integration with QuickBooks improved bookkeeping accuracy, ensured a clear audit trail, and reduced manual workloads, allowing Bubble to streamline workflows and focus on strategic goals.

The results? Here’s how much Bubble saved with Ramp’s integration:

- More than $30k saved through Ramp’s vendor negotiation services

- 30 hours per month freed up by automating bookkeeping and closing processes

- Over $100k in cashback rewards annually by using Ramp cards and Bill Pay for vendor payments

“We’re able to push everything that happens on the Ramp platform to QuickBooks. It also helps to reconcile expenses more easily because you’re able to leave a very clear trail,” said Yiwen Ding, Controller at Bubble.

By using Ramp AP automation software with QuickBooks, Bubble transformed its financial processes, achieving greater efficiency, improved accuracy, and substantial cost savings.

Maximize your QuickBooks software with Ramp Bill Pay

QuickBooks, when paired with third-party AP automation software, helps streamline accounts payable processes by saving time and addressing challenges like manual data entry and missed payments. And when integrated with Ramp, QuickBooks gains enhanced AP capabilities, making it more effective for managing accounts payable.

Get started with Ramp Bill Pay to complement your QuickBooks accounts payable processes for smarter, better AP management.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group