Microsoft Dynamics AP automation: What is is and how it works

- What is Microsoft Dynamics 365 software?

- Microsoft Dynamics ERPs: A quick breakdown of their AP functions

- Setting up AP automation tools with Microsoft Dynamics

- What to do when you’re all set up

- Using Ramp Bill Pay alongside Microsoft Dynamics

- How integrating Ramp Bill Pay transforms AP workflows

- Maximize the capabilities of Microsoft Dynamics ERPs with Ramp Bill Pay

Managing accounts payable manually is a constant struggle. To address these challenges, many businesses turn to enterprise resource planning (ERP) systems to improve AP efficiency and centralize their financial workflows.

Microsoft Dynamics 365, particularly the Finance & Operations (F&O) and Business Central modules, provides a strong foundation for AP management. For some, businesses also choose to enhance their AP processes by integrating with third-party solutions.

In this guide, we’ll explore how Microsoft Dynamics 365 handles AP workflows, what its standard AP capabilities are, and why pairing it with a third-party AP software like Ramp can create even greater opportunities for optimization.

What is Microsoft Dynamics 365 software?

Microsoft Dynamics 365

Microsoft Dynamics 365 is a suite of ERP and customer relationship management (CRM) applications designed to help businesses manage financials, operations, and customer relationships.

Built on the Microsoft Cloud, it connects data across departments to provide a unified view of financials, operations, sales, and customer interactions. Its modular approach allows businesses to select the tools they need, scaling functionality as their requirements evolve.

Dynamics 365 also uses machine learning tools and AI to automate AP, such as Microsoft Copilot, to enhance decision-making and automate routine processes, from generating financial forecasts to identifying trends in payment behavior.

Does Microsoft Dynamics 365 have AP automation?

While Dynamics 365 includes AP management features, such as invoice capture, compliance tools, and basic automation workflows, it does not offer a standalone AP automation software solution. Instead, its ERP modules, like F&O and Business Central, provide foundational tools for managing invoices, payments, and approvals.

Why do businesses look to third-party AP solutions?

For companies with more complex AP workflows, third-party software or add-ons from Microsoft’s AppSource marketplace, such as ExFlow, can extend the platform’s capabilities.

While Dynamics 365 provides essential AP functions, some companies opt to complement it with third-party AP software to meet workflow needs that Dynamics may not fully address. For example, AP automation tools like Ramp are valued for advanced features such as line-item invoice processing with OCR, AI-powered auto-coding, and customizable workflows that cater to more specialized requirements.

This flexibility makes Microsoft Dynamics ERPs versatile by being capable of evolving with a company’s requirements through integrations that complement its core functionality.

Microsoft Dynamics ERPs: A quick breakdown of their AP functions

Understanding the specific role of each Microsoft Dynamics system and their standard AP capabilities can be complex. For now, we’ll provide a walk through of Dynamics 365 Finance & Operations and Dynamics 365 Business Central and how they handle AP management.

Dynamics 365 Finance & Operations

Dynamics 365 Finance & Operations (F&O) is designed for large enterprises with complex financial and operational needs. It provides advanced tools for managing global financial processes, regulatory compliance, and multi-entity operations.

Here’s a high-level overview of what Dynamics F&O covers for accounts payable:

- Invoice capture with OCR: Automates invoice data extraction to minimize manual input and reduce errors.

- Global compliance tools: Simplifies tax calculations, reporting, and multi-currency management for international operations.

- AI-driven workflows: Speeds up invoice processing and payment scheduling with automation powered by Microsoft Copilot.

- Cash flow insights: Offers intelligent forecasting and analytics to help businesses optimize liquidity and payment planning.

- Regulatory flexibility: Adapts to evolving tax rules with customizable tools for accurate compliance.

Dynamics 365 Business Central

Dynamics 365 Business Central caters to small and medium-sized businesses looking for an all-in-one ERP solution. It is designed to streamline operations, improve financial management, and integrate seamlessly with familiar tools like Microsoft Excel, Outlook, and Teams.

Here’s a quick breakdown of what its AP capabilities is able to perform:

- Financial data overview: Provides a simple view to oversee budgets, automated bank reconciliation, fixed asset tracking, and unlimited dimension use.

- Role-based dashboards: Provides tailored views for AP teams, helping them prioritize tasks and monitor progress along with pre-built, industry-specific apps.

- Seamless integrations: Extends AP capabilities with third-party tools through Microsoft AppSource for advanced invoice management.

- Microsoft 365 compatibility: Connects with familiar tools like Excel and Outlook to make workflows more intuitive.

- AI-powered assistance: Automates repetitive tasks and offers insights to reduce time spent on manual processes.

Third-party AP automation integrations

As stated earlier, Microsoft Dynamics’ AP features provide foundational capabilities, but businesses with more complex workflows can benefit from integrating advanced automation tools. So whether businesses choose to expand AP functionality through Microsoft’s ecosystem or integrate with external software like Ramp, these solutions help centralize AP operations and deliver deeper financial insights.

Setting up AP automation tools with Microsoft Dynamics

Implementing AP automation within Microsoft Dynamics is a straightforward process, but preparation is essential to ensure a smooth setup. Start by verifying that your Dynamics 365 ERP is updated, your financial data is well-organized, and your team has access to the necessary tools and licenses.

How to configure Microsoft Dynamics for AP automation

Though steps may vary, the typical process for setting up AP automation tools with Microsoft Dynamics is:

- Set up Accounts Payable parameters: Go to the Accounts Payable module, open Setup, and adjust the parameters under the Vendor Invoice Automation tab to match your organization’s requirements.

- Integrate OCR for invoice capture: Microsoft Finance's OCR is natively built-in. However, if you choose to integrate a third-party OCR service, connect it to Dynamics 365 and define its scanning parameters for vendor invoices.

- Define approval workflows: Create or modify workflows in the Workflow Editor under the Accounts Payable module to define the routing of invoices for review, approval, or rejection.

- Test automation workflows: Run test scenarios to verify that invoices are being captured, routed, and processed correctly based on your configured automation rules.

To further enhance AP automation, you can integrate third-party tools like Ramp with Microsoft Dynamics. Start by confirming the software's compatibility with your Dynamics ERP, then follow the integration steps in Dynamics’ settings menu.

What to do when you’re all set up

With your AP automation software fully configured, managing accounts payable becomes more efficient and streamlined. To get the most out of your system, consider these best practices:

- Optimize invoice processing: Keep invoice capture settings updated to accommodate vendor changes or new formats, ensuring data accuracy and preventing disruptions in processing.

- Refine approval workflows: Set clear approval thresholds and train stakeholders to confidently manage reviews, using notifications to ensure timely approvals and prevent delays.

- Maintain vendor records: Regularly update vendor details to reflect current terms, aligning payments with negotiated discounts and deadlines while fostering stronger vendor relationships.

- Leverage real-time financial insights: Build dashboards that spotlight key metrics like outstanding invoices and cash flow trends, using these insights to fine-tune your strategy and make proactive decisions.

Using Ramp Bill Pay alongside Microsoft Dynamics

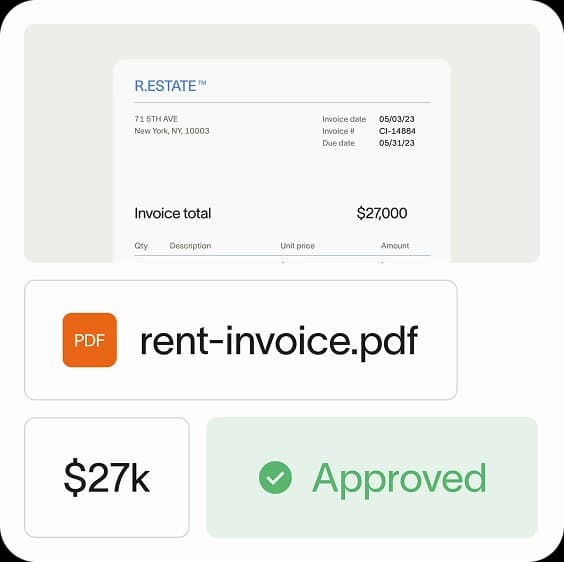

Ramp Bill Pay automates AP approval workflows to reduce manual workloads while delivering real-time insights to enhance efficiency. When used alongside Microsoft Dynamics ERPs, Ramp fills gaps by providing deep analytics, strong controls, and more adaptable workflows to complement Dynamics’ existing functionality.

Here’s how Ramp Bill Pay enhances your AP operations when used alongside Microsoft Dynamics:

- Vendor creation: Ramp identifies vendors missing from your Business Central instance and provides the option to add them directly. These vendors appear in the Vendor/Employee column as “New:...,” and syncing them automatically creates the vendor in Business Central.

- Chart of accounts & dimensions: Ramp imports all fields, including dimensions, from Business Central, ensuring detailed and accurate transaction coding.

- Multi-entity support: For customers using Microsoft Business Central with the supported multi-entity management extension, Ramp enables streamlined management of multiple entities within the integration.

- Bill integration: Bills from Ramp appear as unposted purchase invoices in Business Central, complete with the attached invoice PDF as an "incoming document file" for easy reference.

- Project general ledger journals: Ramp supports Project G/L Journals, a subtype of General Journals. These allow project details to appear by default within the Business Central UI, offering greater visibility into project-related transactions.

By using Ramp with Microsoft Dynamics, businesses gain a powerful combination of tools that extend their ERP’s capabilities, streamline workflows, and provide actionable insights tailored to their unique needs. This collaboration empowers teams to operate more efficiently and stay focused on strategic priorities.

How integrating Ramp Bill Pay transforms AP workflows

Although Ramp has not published a formal accounts payable automation case study with Microsoft Dynamics just yet, its proven success with other integrations, such as NetSuite, demonstrates its ability to optimize financial workflows. Here’s one example that showcases how Ramp helps businesses improve efficiency, save time, and streamline processes for finance teams.

How Ramp and NetSuite helped Pair Eyewear streamline AP operations

Pair Eyewear is a direct-to-consumer brand, faced inefficiencies in managing accounts payable when their company expanded. Their previous expense management system relied heavily on spreadsheets and manual processes, creating a significant burden for their finance team.

Without seamless integration with NetSuite or automation for AP workflows, their system struggled to meet the company’s growing needs.

That’s when Pair Eyewear adopted Ramp alongside NetSuite, creating a centralized platform to handle credit cards, bill pay, and reimbursements. Ramp’s intuitive automation features and seamless integration with NetSuite streamlined the company’s workflows.

And the results made Pair Eyewear more than just a happy Ramp customer. Our impact provided:

- Time savings: Saved 10 hours per month with automated expense coding.

- Faster reimbursements: Reduced reimbursement times from two weeks to just two days.

- Consolidation of tools: Reduced reliance on three separate systems by centralizing operations with Ramp.

“We love NetSuite and Ramp together. It’s like they’re long-lost cousins and they’ve come back together. It’s like they were built for each other,” said Staci Robinson, AP Manager at Pair Eyewear.

Ramp’s extensive integrations illustrate how your business can transform disconnected processes into cohesive systems, boosting efficiency and saving time and money.

Maximize the capabilities of Microsoft Dynamics ERPs with Ramp Bill Pay

Ramp AP automation software can enhance ERP systems like Microsoft Dynamics by addressing specific workflow gaps. With features like AI-driven OCR, customizable approval processes, and real-time spend analytics, Ramp allows businesses to streamline operations, save time, and gain better financial visibility.

Pair Microsoft Dynamics with Ramp Bill Pay and see how it can transform your financial workflows.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits