- Do Sage ERPs provide accounts payable features?

- Key accounts payable features

- How to set up AP automation features

- What to do when you’re all set up

- Using Ramp's AP software alongside Sage ERPs

- How Ramp easily integrates with Sage ERPs to optimize AP management

- Integrate Ramp with Sage Intacct

Manual accounts payable processes often lead to delays, errors, and frustration for finance teams. The accounts payable features in Sage ERP solutions reduces these roadblocks by streamlining workflows, reducing manual effort, and improving visibility into cash flow.

From addressing common challenges like late payments, fraud risks, and duplicate invoices, automation gives businesses a more efficient way to manage their AP operations.

In this guide, we’ll explore how AP automation works in different Sage ERPs, their core features, and how using third-party solutions adds another layer of advanced AP optimization.

Do Sage ERPs provide accounts payable features?

Various Sage ERPs provide AP automation features that automate repetitive and error-prone tasks. They capture invoices, route approvals, schedule payments, and provide actionable insights, all in one system.

Designed to enhance efficiency, reduce errors, and provide real-time financial visibility, Sage ERPs provide AP tools that help businesses maintain better control over cash flow while improving vendor relationships.

The platform provides two specialized software solutions, each catering to different business needs: Sage Intacct and Sage 50.

Sage Intacct

Built for medium to large businesses, Sage Intacct’s AP automation capabilities come from its advanced cloud architecture that integrates AI-powered tools to optimize invoice processing. It supports complex financial structures, including multi-entity consolidation, while offering real-time dashboards that deliver multidimensional insights for enhanced decision-making.

Sage 50

Designed for small businesses, Sage 50 combines desktop functionality with cloud connectivity, offering straightforward tools for bank reconciliation, cash flow tracking, and detailed reporting. It simplifies everyday tasks while providing advanced capabilities like inventory tracking and customizable workflows, ensuring flexibility without unnecessary complexity.

Key accounts payable features

Sage Intacct and Sage 50 both provide modules that simplify how businesses handle accounts payable by offering a suite of features tailored for clarity. The two main solutions serve different business needs, ensuring companies of all sizes can benefit from automation.

Here’s what each solution brings to the table in more detail:

Shared features

- Automated invoice capture: Both solutions allow businesses to process invoices automatically, reducing manual input and errors

- Workflow automation: Both platforms streamline AP approvals with routing, tracking, and notifications, though Sage Intacct offers more advanced approval hierarchies

- Real-time reporting: Each provides customizable reporting, with Sage Intacct offering multi-dimensional, real-time dashboards for deeper insights

- Expense management: Both solutions provide tools to monitor spending, though Sage 50 focuses on simpler workflows, while Sage Intacct supports multi-entity expenses

- Vendor management: Both enable businesses to manage vendor profiles and payment terms effectively, though Sage Intacct supports more complex vendor relationships

- Integration capabilities: Both integrate with third-party tools, but Sage Intacct offers connections with larger systems like Salesforce, while Sage 50 supports essentials like Microsoft 365

Specific to Sage Intacct

- AI-powered accounting: Sage Intacct uses AI to detect anomalies and automate time-consuming processes for larger organizations

- Multi-entity and global consolidation: Ideal for businesses managing multiple entities, Sage Intacct consolidates financials across locations

Specific to Sage 50

- Inventory management: Sage 50 provides advanced tools for tracking stock levels, purchase orders, and inventory movement, ideal for smaller businesses

- Cloud-connected flexibility: Combines desktop functionality with remote access, making it accessible for smaller teams working from different locations

To reiterate, Sage Intacct is best suited for medium to large businesses requiring advanced cloud-based tools, AI capabilities, and multi-entity financial management. In contrast, Sage 50 is designed for small businesses that prioritize desktop functionality with cloud connectivity, offering a more straightforward approach to AP management.

Tip: If you need solutions designed for smaller teams, our guide to the best accounts payable software for small businesses is a great place to start.

How to set up AP automation features

Getting started with Sage Intacct and Sage 50 is straightforward, but preparation is key. Ensure your software is up to date, financial records are organized, and your team has access to the necessary tools and training.

How to configure AP features in Sage ERPs

Though steps may vary, the typical process for getting set up with AP features for different Sage ERPs:

- Connect your system to your financial data: Log in to your Sage account and confirm that vendor details, payment histories, and charts of accounts are properly entered and up to date.

- Configure automated invoice capture: Enable the invoice capture feature by uploading sample invoices. Set up field mapping to extract critical data like amounts, due dates, and vendor names.

- Establish approval workflows: Define approval hierarchies and thresholds to ensure invoices are routed to the correct stakeholders. Use Sage’s notification settings to keep everyone on track.

- Schedule payments: Use Sage’s scheduling tools to automate recurring payments, aligning with vendor terms and avoiding late fees.

- Test your setup: Run a test cycle to confirm invoices are being captured, routed, and processed accurately. Adjust settings as needed for smooth operation.

If you’re looking to connect Sage ERP software to third-party AP automation tools, choose external software compatible with your Sage ERP, such as Ramp. Then, navigate to your Sage ERP’s integrations menu and follow the provided instructions to connect the third-party tool

After you’re all set up, configure rules to route invoices based on criteria like project type, invoice amount, or department. Then, define exceptions to handle outliers without disrupting the flow.

What to do when you’re all set up

Once your Sage ERP is fully configured, you’ll gain access to its capabilities that make managing accounts payable easier, faster, and more effective. Here’s some best practices for using AP automation software:

- Invoice processing: Periodically review and update invoice capture settings to align with vendor changes or new invoice formats. This ensures ongoing accuracy and efficiency.

- Approval workflows: Set clear approval thresholds and provide training for stakeholders to ensure timely and accurate reviews. Use notifications strategically to reduce delays.

- Vendor management: Regularly update vendor records to reflect current terms and ensure payments are aligned with any agreed-upon discounts or deadlines.

- Real-time financial insights: Customize dashboards to highlight accounts payable KPIs like outstanding invoices, cash flow trends, and payment schedules. Regularly review these insights to adapt your strategy as needed.

Using Ramp's AP software alongside Sage ERPs

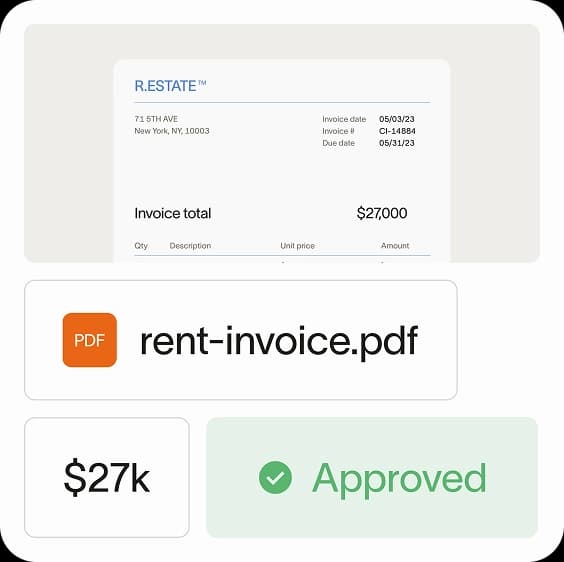

Using Ramp with Sage's ERP systems adds an extra layer of efficiency to your accounts payable processes. Ramp's AP software, through its direct and standard UCSV or custom API build, can complement Sage ERPs to provide advanced features that are not natively available within the ERP system.

Here’s what Ramp's AP software brings to the table:

- Automate invoice processing with OCR: Ramp’s AI-powered OCR accurately captures and codes even the most complex invoices and line items, significantly reducing the need for manual input and minimizing errors.

- Streamline repetitive workflows: Automate recurring bills, batch payments, and vendor onboarding, with bulk editing ensuring quick updates and minimal manual input.

- Optimize approval workflows: Create intelligent, multi-layered approval flows with customizable routing rules and automated alerts for significant changes, ensuring a streamlined review process.

- Unify payment management: Manage all domestic and international vendor payments, whether by check, card, ACH, or wire, on one platform with comprehensive visibility and control.

Together, these systems help streamline workflows, reduce errors, and improve your overall AP management.

How Ramp easily integrates with Sage ERPs to optimize AP management

Ramp has been successfully integrated into multiple businesses to streamline their accounts payable processes through its connection with different Sage ERPs. Here’s a success story showcasing how Ramp integrates with Sage Intacct to reduce REVA Air Ambulance's AP processing time.

How Ramp reduced REVA’s AP processing time by over 80%

REVA Air Ambulance faced significant challenges with manual, time-consuming accounts payable and expense management workflows. Their legacy system created inefficiencies that delayed reimbursements, extended month-end close times, and left finance teams scrambling for visibility into spending. By integrating Ramp with Sage Intacct, REVA streamlined its processes and achieved transformative results.

The table below highlights the impact of Ramp’s AP software integration on REVA’s operations:

Result | Details |

|---|---|

80%+ reduction in AP process time | Reduced AP processing time from 15–20 minutes per invoice to under 3 minutes, saving hours monthly. |

6 weeks saved on reimbursements | Streamlined receipt uploads and transaction matching, reducing reimbursement time from weeks to one day. |

2-week faster time to close | Enabled reconciliation every few days, allowing books to close by the 4th or 5th of the month. |

Seth Miller, REVA’s Controller, praised the integration, saying, “We were able to mold Ramp to our company to set it up as needed within departments. But the biggest selling feature to us was the automatic, real-time integration with Sage.”

By automating AP and expense workflows, REVA’s finance team no longer chases receipts or relies on outdated manual processes. Ramp’s tools allowed employees to upload receipts on the go, reduce AP effort, and expedite vendor payments with drag-and-drop invoicing and automatic coding.

Integrate Ramp with Sage Intacct

Different Sage ERPs help transform accounts payable by reducing manual tasks, streamlining approvals, and improving financial visibility. To complement Sage's ERP capabilities, Ramp offers tools that take AP automation even further. With advanced features and enhanced reporting, Ramp helps elevate your AP processes for greater efficiency and control.

Elevate your accounts payable workflow—experience the impact of Ramp Bill Pay.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits