Intercompany loans: How they work and best practices

- What are intercompany loans?

- Common reasons businesses use intercompany loans

- Legal and tax compliance requirements

- Pros and cons of intercompany loans

- How do intercompany loans work? 7 steps to manage your loan

- Best practices for managing intercompany loans

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Intercompany loans let you move money between entities in your corporate group. They're particularly useful in parent-subsidiary relationships, where headquarters can fund regional operations or sister companies can help each other during seasonal ups and downs.

These loans help you optimize cash flow and boost liquidity across your organization. When one division has extra cash and another needs capital, you can reduce external borrowing costs and support growth initiatives like market expansion or product development.

We cover the basics of intercompany loans, how they work, and best practices for managing them effectively.

What are intercompany loans?

Definition

An intercompany loan is a financing arrangement between different entities within your company or corporate group. These transactions create formal business debt obligations with specific terms, interest rates, and repayment schedules.

Most commonly, a parent company lends money to its subsidiaries. For example, your multinational holding company might fund equipment purchases for a manufacturing subsidiary, or your regional headquarters might finance working capital needs for a local entity during expansion. This approach lets you put capital where it creates the most value.

The parties must have a parent-subsidiary or affiliate relationship for a loan to qualify as intercompany. These loans typically offer more favorable terms than external financing, like:

- Lower interest rates

- More flexible repayment terms

- Fewer collateral requirements

You still need proper legal agreements for regulatory compliance. As the lending entity, you'll have more control over the terms, making it easier to adjust financing to match your group's financial goals.

Common reasons businesses use intercompany loans

Intercompany loans offer more than a convenient way to move money internally; they’re a smart way to strengthen your business’s overall financial strategy. Here are some of the most common reasons companies use them.

You need to balance cash flow across your entities

Intercompany loans help you optimize cash flow and liquidity within your corporate group. When one subsidiary has excess cash and another needs funds temporarily, internal lending balances your resources. For instance, your retail division with strong holiday sales can lend to your manufacturing division during production ramp-up, reducing the need for expensive external financing.

You want to reduce your overall tax burden

You can also gain tax benefits if you structure these loans correctly. By shifting interest income to entities in lower-tax jurisdictions and creating tax-deductible interest expenses in higher-tax locations, you can reduce your overall tax burden. Just make sure you comply with tax laws and transfer pricing regulations.

You need to fund growth without external delays

Intercompany loans provide fast, flexible capital for subsidiary expansions, research and development (R&D), or capital expenditures without the delays or restrictions of external financing. This helps you execute strategic priorities without waiting for third-party financing.

You want to manage risk during downturns

During economic downturns, intercompany loans serve as effective risk management tools. They offer flexible funding when external credit markets tighten, allowing your stronger entities to support those facing challenges. This financial buffer helps maintain operational stability and preserves your relationships with external lenders when you need additional capital.

Legal and tax compliance requirements

To stay compliant, you need to structure your intercompany loans on arm's length terms. This means setting interest rates and conditions similar to what unrelated parties agree to in comparable situations.

This approach meets global transfer pricing standards and helps you avoid scrutiny from tax authorities looking for base erosion or profit shifting. Regulators pay special attention to financing arrangements mainly designed for tax advantages rather than legitimate business needs.

You'll need proper documentation, including:

- Formal loan agreements detailing all terms

- Board resolutions authorizing the transaction

- Supporting materials showing the commercial rationale

Key tax considerations include:

- Thin capitalization rules that limit interest deductibility based on debt-to-equity ratios

- Withholding taxes on cross-border interest payments

- Transfer pricing regulations, which vary by country

It's smart to involve legal and tax professionals early in the process. They can help ensure you address all compliance requirements while optimizing your loan structure for both operational and tax efficiency.

Pros and cons of intercompany loans

It’s important to weigh the benefits of intercompany loans and the potential drawbacks when deciding whether to use internal financing or seek funding from external sources.

Pros

- Lower costs than external financing: Intercompany loans usually have lower interest rates because there is less risk within your corporate group. You also avoid transaction fees, commitment charges, or arrangement costs from banks, and you don’t need compensating balances or minimum deposits.

- High flexibility: You can tailor loan terms to fit the borrower’s cash flow needs, like offering interest-only periods or seasonal adjustments. You can also modify repayment schedules without penalties as business conditions change.

- Tax efficiency: By structuring loans strategically across tax jurisdictions, you can reduce your overall tax burden. For example, you can shift interest income to lower-tax locations while creating deductible interest expenses in higher-tax areas, provided you maintain proper documentation and a legitimate business purpose.

- Alignment with strategic goals: Intercompany loans allow you to fund projects that support your long-term business interests, even if immediate returns are modest. This approach helps you respond faster to new opportunities and support initiatives that may not qualify for external funding due to restrictive covenants.

Cons

- Regulatory and compliance risks: If you don’t follow arm’s length principles, you risk having interest deductions disallowed, facing penalties for underreported income, or double taxation if tax authorities in different countries disagree.

- Administrative complexity: Your finance team must track all loan activities, including interest calculations, payment tracking, and currency translations for cross-border loans. Meeting audit requirements means maintaining comprehensive documentation of the business purpose, approval process, and ongoing management, adding to your workload.

- Power imbalances: Power imbalances between lending and borrowing entities can create conflicts. Parent companies might set terms that favor their own interests, affecting subsidiary autonomy or creating tension in resource allocation. If financing becomes a control mechanism, it can undermine entrepreneurial spirit in subsidiary operations.

- Opportunity costs: Capital you direct to one subsidiary limits investments elsewhere or reduces overall returns. You need to analyze internal financing decisions carefully to ensure your capital allocation truly benefits the group, rather than simply shifting resources based on politics or tradition.

How do intercompany loans work? 7 steps to manage your loan

Follow these seven key steps to set up, monitor, and adjust your intercompany loan effectively:

1. Identify business needs and assess financing options

Clearly define why you need the funding, whether for working capital or equipment purchases. Then, compare internal and external financing sources while considering costs, availability, and timing. Consider how the loan will affect your business’s cash flow and any existing debt agreements you have in place.

2. Determine appropriate loan terms

Set the loan amount based on your business needs and your ability to repay. Make sure the interest rate is fair and market-based by comparing similar third-party loans or published benchmarks. Then, agree on repayment schedules and maturity dates that align with your expected cash flow.

3. Obtain necessary approvals

Prepare documentation that explains why you need the loan, the proposed terms, and how it will impact your business financially. Present your proposal properly, addressing any potential conflicts of interest. Be sure to get approval from all required decision-makers at your company and the lending entity, while following all bylaws and local regulations.

4. Draft and execute legal agreements

Create formal loan agreements that specify all material terms, including principal, interest rate, payment schedule, events of default, and any security provisions. Include language on applicable law, dispute resolution, and amendment procedures, and secure all necessary signatures and authorizations.

5. Disburse funds and establish tracking mechanisms

Transfer the loan amount through banking channels, referencing the loan agreement. Set up separate general ledger accounts to track principal, accrued interest, and payments for both entities. Business accounting software can help you with everything from balance monitoring to calculating interest and generating payment reminders.

6. Implement proper accounting for intercompany loans

Record the initial transaction with journal entries that show your cash transfer and the corresponding debt/receivable. Calculate and record interest accruals at the right intervals, and perform regular reconciliations to ensure both entities maintain matching records, resolving discrepancies quickly.

7. Monitor and adjust as needed

Regularly check how your loan is performing compared to your expectations and any changes in your business. Keep records showing you’re following all tax and legal rules, and update your documents whenever your business needs or regulations change to ensure the loan still supports your goals.

Best practices for managing intercompany loans

Successful processes help you maximize the benefits of intercompany financing while minimizing risks and administrative burdens. Here are some best practices to follow:

- Establish a clear loan policy: Your policy should align with your overall finance strategy and set straightforward guidelines for approval thresholds, documentation standards, and compliance requirements. Clear policies create consistency in how you initiate, monitor, and terminate loans, and clarify who's responsible for what.

- Keep detailed loan documentation: Loan records should include executed loan agreements, board and management approvals, and transfer pricing analyses justifying the interest rates. Store these documents centrally to easily access them during regulatory reviews or audits.

- Streamline management with automation: Specialized accounting software can reduce manual work and maintain accurate records for you. These tools help reduce manual errors, generate alerts for upcoming payments, flag compliance issues, and produce documentation.

- Schedule regular reviews and audits: Periodic assessments of your loan portfolio help maintain ongoing compliance and alignment with business needs. These reviews are opportunities to optimize loan structures and catch potential issues early.

- Foster communication and coordination: Regular touchpoints between your finance, legal, and tax teams ensure you address all aspects of your intercompany loan and create consistency across jurisdictions.

- Understand key accounting standards: Know the differences between International Financial Reporting Standards (IFRS) and generally accepted accounting principles (GAAP), particularly in currency translation, impairment, and disclosures. These impact the reporting of intercompany loans and inform your loan documentation.

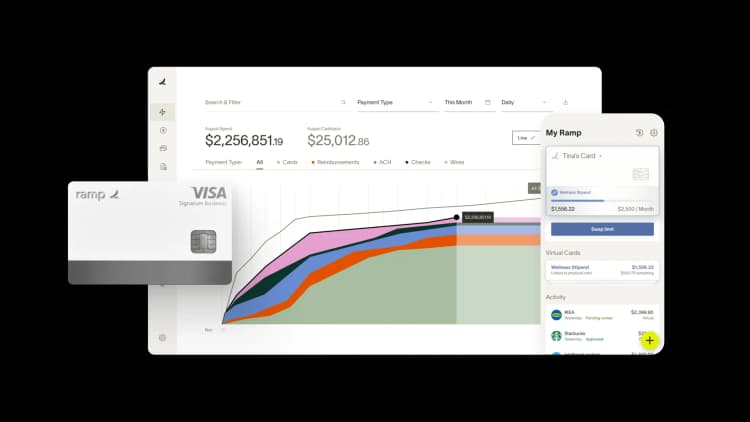

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

In accounting, intercompany refers to transactions between two or more entities under the same corporate group. You must properly record and eliminate these transactions during consolidation to avoid double-counting.

An intercompany journal entry records a transaction between two entities within the same corporate group. Each entity logs the entry on its own books, typically as a receivable for the lender and a payable for the borrower, to reflect the transfer of funds or assets.

Intercompany loans are legitimate debt obligations between related entities within your corporate group. When you structure them properly with formal agreements, market-based interest rates, and realistic repayment terms, tax authorities and accounting standards recognize these arrangements as true debt rather than disguised equity contributions.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits