13 key AP automation benefits every team should know

- Why manual processes result in missed AP automation benefits

- Industry benchmarks show businesses gradually adopting AP automation tools

- 13 key accounts payable automation benefits your team should know

- How to choose the right AP automation solution

- How Ramp Bill Pay is the best way to streamline AP at scale

- What makes Ramp Bill Pay worth it?

Automation is a growing accounts payable trend that replaces manual processes with software-driven workflows, saving time, cutting costs, and improving accuracy. Beyond efficiency, it helps avoid costly errors, strengthens supplier relationships, and gives you better control over financial health.

In this article, we’ll highlight the top 13 benefits of AP automation and how it can transform your business operations and financial strategy.

Why manual processes result in missed AP automation benefits

Manual accounts payable processes waste time and money. Staff spend hours keying data from paper invoices or emails into accounting systems instead of focusing on strategic work. This manual data entry introduces errors—from simple typos to misclassified expenses—creating accounting discrepancies that take even more time to fix.

Invoices get stuck in email inboxes or physical routing systems, causing payment delays that trigger late fees and prevent you from capturing early payment discounts. Without centralized tracking, you can't accurately forecast cash flow or see your outstanding liabilities.

Manual processes also increase fraud risk. Without automated matching and verification, you might pay the same invoice twice or miss fraudulent submissions. Compliance becomes harder too, as manual record-keeping makes audit preparation labor-intensive and increases documentation gaps. Automating accounts payable helps you stay competitive by freeing your team to focus on what matters.

Industry benchmarks show businesses gradually adopting AP automation tools

The adoption of AP automation is on the rise. A recent report indicates that the global accounts payable automation market hit $3.08 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.8% from 2024 to 2030. This growth reflects the increasing recognition of the benefits AP automation can offer.

The primary objectives of using AP automation software are:

- Efficiency: Automating invoice processing to reduce manual workload

- Accuracy: Minimizing human errors in data entry and payment processing to ensure accurate financial records

- Cost savings: Lowering administrative expenses by reducing paper usage, storage needs, and labor costs

- Financial control: Providing real-time visibility into cash flow and outstanding liabilities, enabling better financial decision-making

- Compliance: Ensuring adherence to regulatory requirements through standardized and auditable processes

By achieving these objectives, businesses can enhance their financial operations, maintain stronger supplier relationships, and position themselves competitively in the market.

13 key accounts payable automation benefits your team should know

Benefit | Description |

|---|---|

Reduced processing costs | Cuts invoice processing expenses by eliminating manual data entry and paper handling |

Accelerated processing speed | Shortens invoice approval cycles from weeks to days or even hours |

Enhanced data accuracy | Eliminates human error through automated data capture and validation |

Improved cash flow management | Provides real-time visibility into liabilities and enables strategic payment timing |

Fraud prevention | Implements automated controls and verification to detect suspicious activities |

Strengthened vendor relationships | Creates consistent, timely payments and transparent communication channels |

Capture of early payment discount | Identifies and secures available discounts through faster processing |

Elimination of late payment penalties | Prevents missed deadlines through automated scheduling and reminders |

Simplified audit preparation | Maintains complete digital audit trails with searchable documentation |

Increased staff productivity | Redirects AP team focus from data entry to strategic financial activities |

Seamless scalability | Handles growing invoice volumes without proportional increases in staffing |

Enhanced compliance | Enforces consistent policy application and maintains regulatory documentation |

Real-time reporting and analytics | Delivers actionable insights into spending patterns and process efficiency |

Let's look at each benefit in detail, with practical tips to help you get the most value from AP automation.

1. Reduced processing costs

One of the most immediate AP automation benefits is the reduction in invoice processing costs. Manual accounts payable workflows are time-intensive and expensive—factoring in labor, materials, and storage, processing a single invoice can cost anywhere from $10 to $30.

By digitizing everything from invoice receipt through payment, automated accounts payable software significantly cuts those costs. Features like optical character recognition (OCR) and machine learning extract invoice data automatically, replacing time-consuming data entry. With cloud-based AP software, physical document handling is replaced with digital routing, while cloud storage removes the need for physical archives.

Pro tip: Calculate your current cost per invoice by measuring the time spent on manual AP tasks, multiplying by labor costs, and adding any material or storage expenses. Use that baseline to quantify your ROI after implementing AP automation.

Here’s how reducing processing costs plays out for businesses of different sizes:

- Startups: Process invoices efficiently without hiring additional staff

- Mid-sized businesses: Reduce processing costs by 60–80%, handling growing invoice volumes with existing headcount

- Enterprises: Standardize AP workflows across departments or entities, cutting redundant roles and driving cost savings at scale

2. Accelerated processing speed

Another key benefit of AP automation is the ability to process invoices dramatically faster. Automation can shorten invoice lifecycles from weeks to days—or even hours—by routing them to the correct approvers based on pre-set rules. If someone is unavailable, the system escalates approvals automatically to avoid delays.

This speed addresses a major pain point: approval bottlenecks. With manual systems, invoices often sit idle in inboxes or on desks, delaying payments and frustrating vendors. Automated AP platforms with mobile approvals let managers approve invoices from anywhere, keeping workflows moving.

Pro tip: Set up automated reminders and escalation paths for invoices approaching their due date to ensure nothing falls through the cracks.

Here’s how faster AP approval processing helps different organizations:

- Startups: Maintain strong vendor relationships with timely payments and a polished, professional experience

- Mid-sized businesses: Reduce processing time from 2–3 weeks to 2–3 days

- Enterprises: Eliminate variability in approval timelines across departments and regions

3. Enhanced data accuracy

Manual AP processes are prone to data entry errors, from mistyped numbers to mismatched invoices. One of the most valuable accounts payable automation benefits is data precision. AP automation uses OCR with machine learning to extract invoice details accurately, and validation rules flag inconsistencies between purchase orders, receipts, and invoices.

The result is fewer payment errors, better reporting accuracy, and less time spent fixing mistakes. Automated three-way matching ensures that only accurate, authorized payments are approved.

Pro tip: Regularly refine your validation rules based on recurring exceptions. This improves your straight-through processing rate and reduces manual corrections.

What improved data accuracy looks like at different growth stages:

- Startups: Prevent errors that could cause cash flow issues or damage vendor trust

- Mid-sized businesses: Accelerate month-end close and reduce time spent on reconciliations

- Enterprises: Lower the risk of financial misstatements across high-volume, multi-entity operations

4. Improved cash flow management

Accounts payable automation gives finance teams real-time visibility into outstanding invoices, approval statuses, and upcoming payments. With this data at your fingertips, you can better forecast liabilities and align payment timing with cash availability.

Instead of scrambling to make last-minute payments—or paying bills too early—teams can strategically schedule payments to balance vendor terms, available cash, and discount opportunities.

Pro tip: Build a cash flow dashboard that combines AP data with receivables to improve working capital management.

Cash flow benefits by company size:

- Startups: Gain tighter control over limited cash reserves without sacrificing vendor relationships

- Mid-sized businesses: Confidently invest in growth with real-time visibility into payables

- Enterprises: Optimize cash flow across accounts and entities, potentially freeing up millions in working capital

5. Fraud prevention

Payment fraud is a growing concern for finance teams. One of the more essential AP automation benefits is enhanced fraud protection. Automated controls—like role-based access, vendor validation, and dual-approval thresholds—make unauthorized payments harder to execute.

Systems also flag suspicious patterns like duplicate invoices, payment changes, or unusual amounts. With digital audit trails and automated three-way matching, you can spot and stop problems before money leaves your account.

Pro tip: Require multi-step verification for vendor payment detail changes and monitor exception reports regularly.

How AP automation reduces fraud risk across different company sizes:

- Startups: Implement enterprise-grade fraud controls without needing a full compliance team

- Mid-sized businesses: Gain centralized oversight even as spend decentralizes across teams

- Enterprises: Apply consistent controls across divisions to mitigate risk in large, distributed environments

6. Strengthened vendor relationships

Reliable payments build trust. One of the lesser-discussed but high-impact benefits of AP automation is stronger vendor relationships. By automating payment timing and communication, you remove common frustrations like late payments and unclear invoice statuses.

Vendor portals give suppliers a self-service option to submit invoices and check payment updates—reducing inbound support requests and showing vendors you’re organized and responsive.

Pro tip: Use AP data to identify top vendors and explore early payment terms for high-value partners.

Vendor relationship benefits by business size:

- Startups: Build credibility and secure favorable terms early in your lifecycle

- Mid-sized businesses: Stand out as a reliable partner, especially in competitive supply environments

- Enterprises: Deliver a consistent payment experience to vendors across business units and locations

7. Capture of early payment discounts

Many suppliers offer early payment incentives—often 1–2% for paying within 10 days. These add up, but manual systems make it hard to track and act on them consistently. AP automation tools can identify eligible invoices and fast-track them through the approval process so you never miss out on discounts.

Over time, these savings generate meaningful returns—especially for mid-sized or enterprise companies processing high volumes.

Pro tip: Negotiate early payment terms with strategic vendors and configure your system to prioritize those invoices.

Why this matters by business size:

- Startups: Every percent saved improves runway and reduces cost pressure

- Mid-sized businesses: Recoup significant spend with minimal effort, improving margins

- Enterprises: Unlock substantial savings by capturing discounts at scale

8. Elimination of late payment penalties

Late fees from invoices are a waste of money—and usually a sign of broken processes. With automated accounts payable systems, due dates are tracked automatically, reminders are sent to approvers, and escalations ensure bottlenecks don’t lead to missed deadlines.

Recurring invoices can be auto-processed, so no one forgets to pay the rent or a software subscription again.

Pro tip: Set up automation rules to flag high-priority or recurring invoices for early approval.

How avoiding late fees benefits different teams:

- Startups: Preserve capital and establish strong vendor credit from the start

- Mid-sized businesses: Improve supplier scores and build leverage in negotiations

- Enterprises: Avoid unnecessary spend across departments and improve compliance

9. Simplified audit preparation

Audit prep doesn’t have to be painful. With AP automation, every invoice, approval, and payment action is logged in a searchable, digital trail. That means no more digging through email chains or paper folders.

Auditors get the documentation they need quickly, and your team avoids last-minute scrambles or missing files.

Pro tip: Coordinate with your auditors to build standardized reports that align with their requests.

Audit readiness benefits by company size:

- Startups: Establish credibility with investors and prepare for due diligence

- Mid-sized businesses: Reduce audit costs and free up your finance team’s time

- Enterprises: Simplify multi-entity audits and reduce both external fees and internal workload

10. Increased staff productivity

One of the most tangible benefits of accounts payable automation is reclaiming your team’s time. Automation shifts finance teams away from data entry and manual tracking and into more strategic work—like vendor analysis, forecasting, and process improvement.

With exception-based processing, staff only get involved when something needs attention. That means more output per person, without burnout.

Pro tip: Use automation to upskill AP staff into higher-impact roles like analytics and vendor management.

Productivity gains by business size:

- Startups: Operate lean while handling more transactions

- Mid-sized businesses: Redeploy staff to growth-focused finance initiatives

- Enterprises: Centralize AP into shared service hubs and scale without increasing headcount

11. Seamless scalability

As invoice volume grows, manual AP becomes a bottleneck. Accounts payable automation lets you scale your finance operations without increasing your team or workload. The system handles higher volumes while keeping processing time and accuracy consistent.

Whether you're adding new vendors, departments, or entire business units, automation helps you grow without friction.

Pro tip: Choose an AP solution with volume-friendly pricing and infrastructure that scales with you.

Scalability benefits by company size:

- Startups: Scale fast without overbuilding your back office

- Mid-sized businesses: Handle busy seasons without hiring temporary staff

- Enterprises: Onboard newly acquired entities into your AP process with ease

12. Enhanced compliance

From accounts payable policy enforcement to regulatory requirements, AP automation software brings consistency and accountability to every transaction. It enforces approval limits, segregation of duties, and audit trails—reducing the risk of non-compliance.

For companies in regulated industries like healthcare, government contracting, or financial services, AP systems help enforce external compliance frameworks as well.

Pro tip: Review your compliance configuration quarterly to align with changing regulations and internal audit feedback.

Compliance gains across business sizes:

- Startups: Build trust with investors and external partners through strong controls

- Mid-sized businesses: Apply enterprise-grade compliance without a full compliance department

- Enterprises: Enforce consistent standards across regions and regulatory environments

13. Real-time reporting and analytics

When AP is manual, performance data is delayed or incomplete. With automated AP platforms, finance teams gain real-time visibility into processing times, exception rates, and approval trends. This transparency helps identify bottlenecks and guide process improvements.

Structured data also enables more advanced spend analysis, vendor performance tracking, and strategic forecasting.

Pro tip: Create role-specific dashboards so every stakeholder—from AP clerks to CFOs—can act on the data that matters most.

Reporting benefits by business type:

- Startups: Make informed decisions with limited resources

- Mid-sized businesses: Identify cost-saving opportunities and consolidate vendors

- Enterprises: Standardize reporting across locations and leverage insights for better contract negotiations

A month of work done in minutes.

Handle 10x the invoices in half the time. Our standard tier is free.

How to choose the right AP automation solution

Choosing the wrong AP automation solution can create more problems than it solves. Systems that don't integrate well with your existing accounting infrastructure can cause data synchronization issues and force manual workarounds. Solutions with poor user interfaces face adoption resistance, while those lacking security controls introduce new compliance and fraud risks.

Inadequate solutions can also lead to unexpected costs—customization, ongoing maintenance, or transaction-based pricing that becomes expensive as you grow. Without proper planning, you might get locked into systems that can't scale or adapt to changing regulatory requirements.

Evaluation criteria | Key considerations |

|---|---|

Integration capabilities | Compatibility with existing ERP/accounting systems, API availability, data synchronization methods |

Scalability | Ability to handle growing invoice volumes, multi-entity support, international capabilities |

Compliance features | Configurable approval workflows, audit trails, regulatory documentation |

User experience | Intuitive interfaces, mobile accessibility, vendor portal functionality |

Reporting capabilities | Standard and custom reporting options, dashboard functionality, data export capabilities |

Customer support | Implementation assistance, training resources, ongoing technical support |

Total cost of ownership | Licensing model, implementation costs, maintenance fees, transaction costs |

Not every organization needs the same feature set from their accounts payable automation software. The right platform depends on your team’s structure, existing systems, and growth stage. Here's how different types of businesses should compare AP automation tools:

- Startups: Prioritize ease of implementation, predictable pricing, and built-in scalability. A lightweight solution that supports automation from day one can help you stay lean while building financial discipline.

- Mid-sized businesses: Look for AP tools that integrate seamlessly with your existing accounting software, offer real-time visibility, and require minimal training. A user-friendly platform with customizable workflows helps your team stay productive as invoice volume grows.

- Enterprises: Focus on advanced capabilities like multi-entity support, robust compliance configurations, audit controls, and sophisticated approval routing. These are essential for scaling AP across departments, regions, and subsidiaries.

- Industry-specific businesses: Whether you're in healthcare, education, government contracting, or nonprofit work, make sure your AP solution supports your compliance standards and documentation needs—like HIPAA, FAR, or tax-exempt reporting requirements.

Is AP automation worth it?

While you should consider the upfront investment before switching to AP automation, the long-term advantages outweigh the costs. By switching from manual tasks to automated processes, AP automation can help minimize errors and optimize business cash flow. And there’s plenty available on the market, ranging from top-rated AP software for small businesses to reliable enterprise AP solutions for more complex needs.

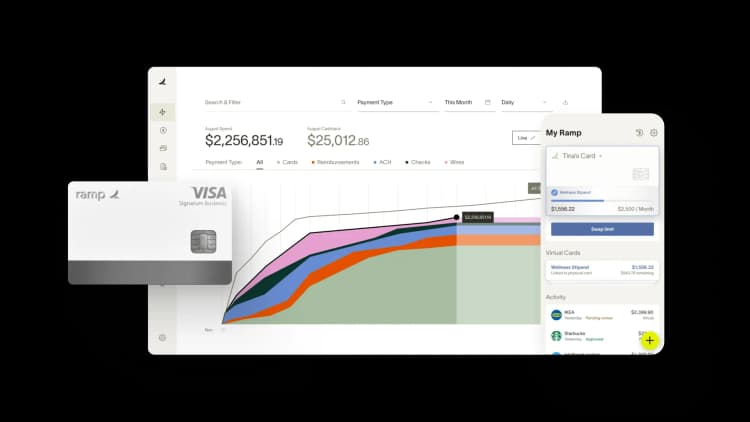

How Ramp Bill Pay is the best way to streamline AP at scale

Ramp Bill Pay is an autonomous accounts payable platform where four AI agents make your AP process touchless. They handle invoice coding, fraud detection, approval summaries, and card payments without any manual work. Ramp's OCR hits 99% accuracy and captures line-item details automatically, processing invoices 2.4x faster than legacy AP software1.

You can use Ramp Bill Pay as a standalone AP solution, or connect it with corporate cards, expenses, and procurement for a unified finance platform. Either way, it adapts to how your business works. Up to 95% of businesses report better visibility into payables after switching to Ramp2.

Top Ramp Bill Pay capabilities

- Four AI agents: Learn from your transaction history to classify expenses, identify fraudulent patterns in real time, create detailed approval packets with vendor context and pricing trends, and pay bills directly through vendor payment portals using virtual cards

- Intelligent invoice capture: Reads and digitizes every field on an invoice with 99% accuracy

- Custom approval workflows: Create multi-tier approval paths that route invoices based on department, amount, or vendor type

- Automated PO matching: Compares invoices to purchase orders using two-way or three-way verification, flagging discrepancies before you authorize payment

- Roles and permissions: Set up access controls that keep financial responsibilities properly separates

- Payment methods: Choose from ACH, virtual or physical cards, checks, and wire transfers

- Recurring bills: Schedule automatic payments for subscriptions and regular vendor invoices

- Batch payments: Pay dozens of vendors at once instead of processing them one by one

- Real-time ERP sync: Sync vendor data both ways with major ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct—keeping your books audit-ready

- Vendor onboarding: Request and store W-9s, validate TINs, and organize 1099 information in one system

- Ramp Vendor Network: Pay pre-approved vendors faster by skipping redundant verification steps

- Vendor Portal: Give your vendors a self-service hub where they can update bank details, track payments, and reach your AP team directly

- Bulk W-9 collection: Send one request to all vendors for W-9s and electronic signatures instead of following up individually

- AI-powered 1099 prep: Ramp reviews your bill pay activity and categorizes it into the right 1099 boxes, calculating totals automatically

- One-click IRS filing: Submit 1099s to federal and eligible state tax authorities without switching platforms or creating new accounts

What makes Ramp Bill Pay worth it?

Ramp Bill Pay delivers touchless, automated AP at a speed legacy systems can't match. Over 2,100 verified G2 reviews give Ramp a 4.8-star rating, and users consistently rank it as one of the easiest AP platforms to use. Finance teams rely on Ramp to cut out busywork, prevent costly mistakes, and finish month-end close faster.

You don't have to use Ramp's other products to get value from Bill Pay—it's a complete AP solution on its own. But if you're looking to manage bill payments, card spending, employee expenses, and procurement in one system, Ramp makes that possible. Set it up the way your business needs it.

Ramp offers a free plan with essential AP features. For $15 per user per month, Ramp Plus adds advanced capabilities.

Manual AP drains your time. Learn how Ramp Bill Pay doesn’t.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

Most businesses begin seeing tangible benefits within 30–90 days of implementation, though the timeline varies based on implementation approach and organizational readiness. Immediate benefits typically include reduced paper handling and faster approval cycles. Cost savings from staff reallocation and early payment discounts usually materialize within 3–6 months.

The benefits timeline generally follows this pattern:

- 1–30 days: Improved visibility into invoice status and reduction in vendor inquiries

- 30–90 days: Faster processing times and capture of early payment discounts

- 3–6 months: Measurable cost-per-invoice reduction and staff productivity improvements

- 6–12 months: Strategic benefits from improved cash flow management and spend analytics

To accelerate time-to-value, focus initial implementation on high-volume vendors and most frequent invoice types. This approach delivers the greatest immediate impact while building organizational experience with the new system.

Successful change management starts with clear communication about why the organization is implementing AP automation and how it benefits each stakeholder group. Involve key users early in the selection process to build ownership and address concerns proactively.

Develop role-specific training that focuses on the tasks each user group will perform rather than general system capabilities. Provide multiple training formats including hands-on sessions, quick reference guides, and video tutorials to accommodate different learning styles. Consider incentives for early adoption and recognition for teams that embrace the new processes.

After implementation, monitor adoption metrics and proactively reach out to users who aren't engaging with the system. Schedule regular check-ins during the first 90 days to address questions and reinforce training. Remember that change management isn't complete until the new process becomes the established norm.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits