Alaska mileage reimbursement rates & calculator

When you're running a business in Alaska, small details, like mileage reimbursement, can have a big impact. For state employees, clear policies ensure they’re reimbursed for their travel.

As a private employer, you’re not required to follow state guidelines, but offering mileage reimbursement demonstrates that you value your team’s time and effort. It’s also important to note that under Alaska’s Workers’ Compensation Act, covering travel costs for medical appointments is a legal obligation.

In addition, providing mileage reimbursement can help you stay compliant with Alaska’s Minimum Wage Law, ensuring fair compensation for your employees.

Alaska business mileage reimbursement rates

For 2026, the mileage reimbursement rate for using personal vehicles for business in Alaska is $0.725 per mile. The IRS established this rate, which is mandatory for state employees under Policy AAM 60.140.

As a private employer, mileage reimbursement is optional for you unless it's for injured employees under the Workers' Compensation Act.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Alaska mileage reimbursement calculator

Using the Alaska mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Alaska mileage reimbursement laws

When it comes to mileage reimbursement in Alaska, there are specific policies and laws that you, as a private employer, need to be aware of. For state employees, the rules are clearly laid out in Policy AAM 60.140.

However, as a private employer, your obligations differ, especially when dealing with the Workers' Compensation Act under Section 8 AAC 45.084.

Here's a breakdown of all such critical regulations and what they mean for you.

Mileage reimbursement for state employees under policy AAM 60.140

Policy AAM 60.140[1] governs mileage reimbursement for Alaska's state employees. As of January 1, 2025, the reimbursement rate is set at $0.725 per mile, a rate established by the IRS.

The policy outlines that the state will:

- Offer mileage reimbursement only when it is in the state's best interest.

- Offer compensation for official duties outside of the employee's defined Duty Station.

If a state employee chooses to use their personal vehicle instead of a more economical option like a rental car, as per this policy, their reimbursement may be capped at the lower cost.

Section 8 AAC 45.084 of the workers' compensation act for mileage reimbursement

Mileage reimbursement for injured employees is not just a courtesy in Alaska — it's a legal requirement, as stated in Section 8 AAC 45.084 of Alaska's Workers' Compensation Act. As an employer, you're mandated by this law to do the following things.

- Reimburse injured employees for travel to obtain necessary medical treatment.

- Compensate for travel to the nearest capable medical facility.

- Cover the costs for the most reasonable and efficient transportation, whether it's a personal vehicle, bus, or flight.

Please note[2]: Alaska law allows employees to choose their doctor. One change is allowed without prior approval, and further changes require your written consent.

Alaska minimum wage law and its implications on mileage reimbursement

Alaska's Minimum Wage Law currently sets the wage at $13.00 per hour. Even though this law doesn't require you to reimburse your employees for mileage, considering it part of your overall compensation strategy can set you apart.

Offering mileage reimbursement can provide the following benefits.

- Help your employees manage expenses better, especially in a state with significant distances between job sites.

- Align your business with the spirit of the Minimum Wage Law, ensuring wages don't fall below the state minimum due to mileage non-reimbursement.

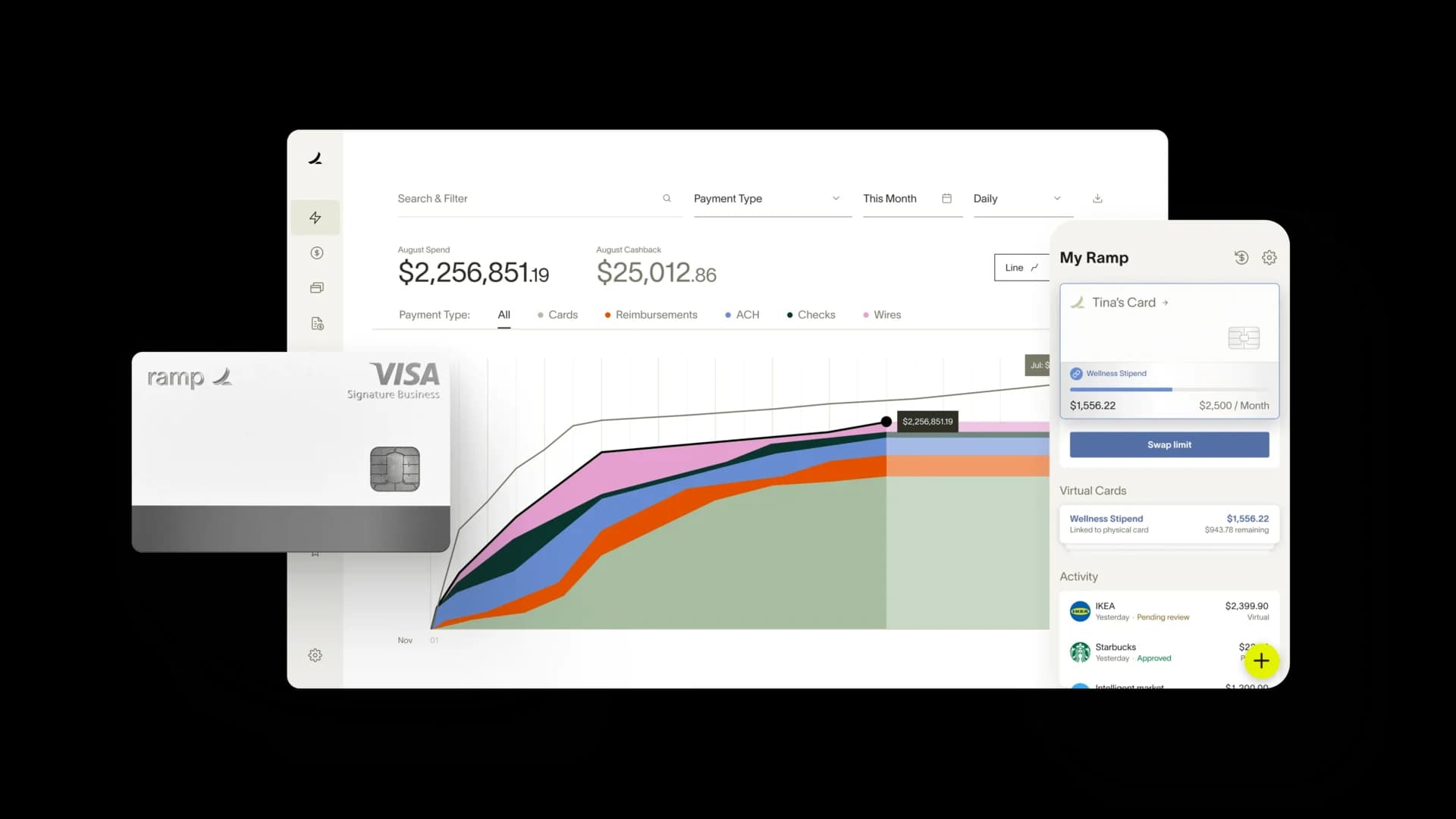

Say goodbye to mileage tracking hassles with Ramp

Mileage reimbursement laws in Alaska aren't just some bureaucratic red tape — they're vital to fair business practices. They ensure your employees are compensated for the miles they put in, whether they're driving across town or the state.

Moreover, proper mileage reimbursement in a state as vast as Alaska will help you create a work environment where your employees feel valued. Ramp takes the complexity out of this process.

By automating mileage tracking, Ramp's AI-boosted expense management solution ensures every mile is accounted for and reimbursed promptly, saving you time and ensuring your team's efforts are recognized and rewarded. With Ramp handling the details, you can keep your focus where it belongs — growing your business.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, 'AAM 60.140 privately owned vehicles': https://doa.alaska.gov/dof/manuals/aam/resource/60t.pdf

[2] Under the header, ‘C. MEDICAL BENEFITS’: https://labor.alaska.gov/wc/publications/wc-brochure.pdf