California mileage reimbursement rates & calculator

Mileage reimbursement in California means compensating your employees for the miles they drive using their own vehicles for any work-related activities. This reimbursement is not optional but is required by Section 2802 of California's labor law.

As an employer, it's your job to make sure this payment is accurate and fair to avoid legal problems and protect your company's reputation.

It's also important for your employees to be updated about the latest California mileage reimbursement rates, ensuring they get fully paid for their business travel.

California business mileage reimbursement rates

As of 2027, California uses the IRS standard mileage rate of $0.725 per mile for business travel. This rate, which was implemented in January 2026, is designed to cover the actual expenses of using a vehicle, including (but not limited to):

- Fuel cost

- Depreciation from wear and tear

- Maintenance and repair costs

- Vehicle registration fees

- Insurance cost

- Breakdown and collision costs[1]

Here’s a tabulated snapshot of mileage reimbursement rates in California as per IRS standards in 2026 and their year-by-year analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

California mileage reimbursement calculator

Using the California mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

California mileage reimbursement laws

California has strong protections for employees using their own vehicles for work. Under Labor Code Section 2802, you must cover all costs your employees rack up while doing their job. This includes mileage for activities like:

- Meeting with current and potential clients

- Attending off-site meetings

- Traveling on business trips

- Making deliveries

- Running business-related errands

Key provisions of labor code section 2802

Labor Code Section 2802 mandates that you reimburse your employees for all expenses or losses incurred as a direct consequence of discharging their job duties. This includes mileage expenses, which are calculated based on the actual miles driven for work-related purposes minus commutes.

The goal is to ensure your employees aren’t paying out of their own pockets just to do their jobs. It’s up to you to keep accurate records and ensure everyone is compensated fairly.

California mileage reimbursement laws vs. federal laws

Did you know that federal law doesn't require employers to reimburse for mileage? Under federal guidelines, the IRS offers a standard mileage rate, but it's optional.

However, as a California employer, you're legally required to reimburse mileage under Labor Code Section 2802. But that’s not all. Here are other major pointers you should know.

- Reimburse your employees in full. Federally, the choice to do so or not depends on the employer. But in California, you are mandated by the law to cover all actual expenses your employees incur while they drive personal vehicles for business-related matters.

- Use any compensation method (lump-sum, actual expense, or FAVR), but ensure it fully compensates your employees in California. Federally, the IRS rate is optional and mainly for tax purposes.

- Address non-compliance seriously in California. Failure to do so could lead to lawsuits, including class actions and penalties. Federally, reimbursement disputes are settled internally unless they breach *FLSA rules.

*Please note: FLSA stands for Fair Labor Standards Act (a law passed in 1938). At the federal level, there is no specific mandate requiring mileage reimbursement. However, if failing to reimburse expenses drops an employee’s adequate earnings below the federal minimum wage, it could be viewed as a violation of the FLSA.

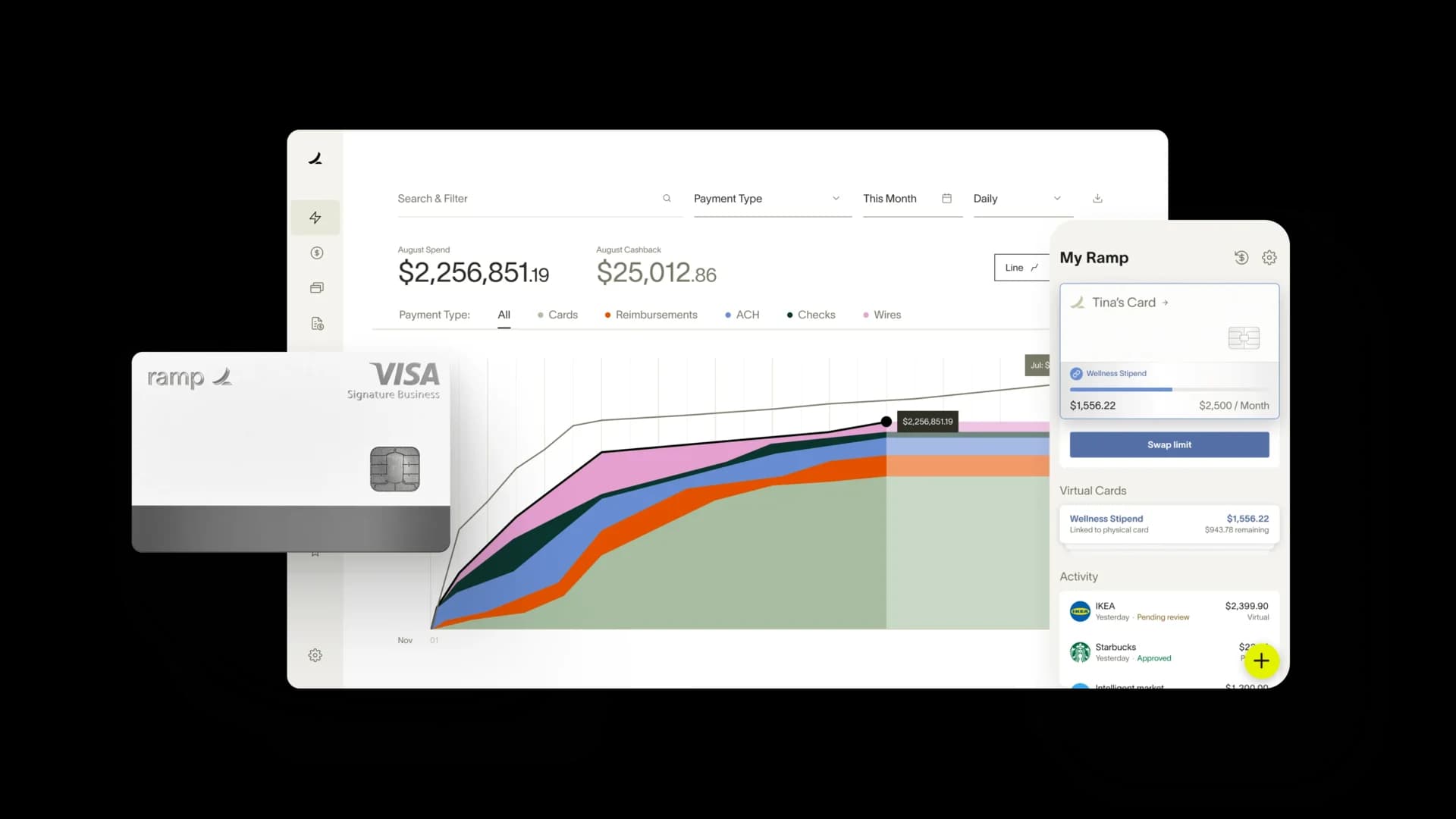

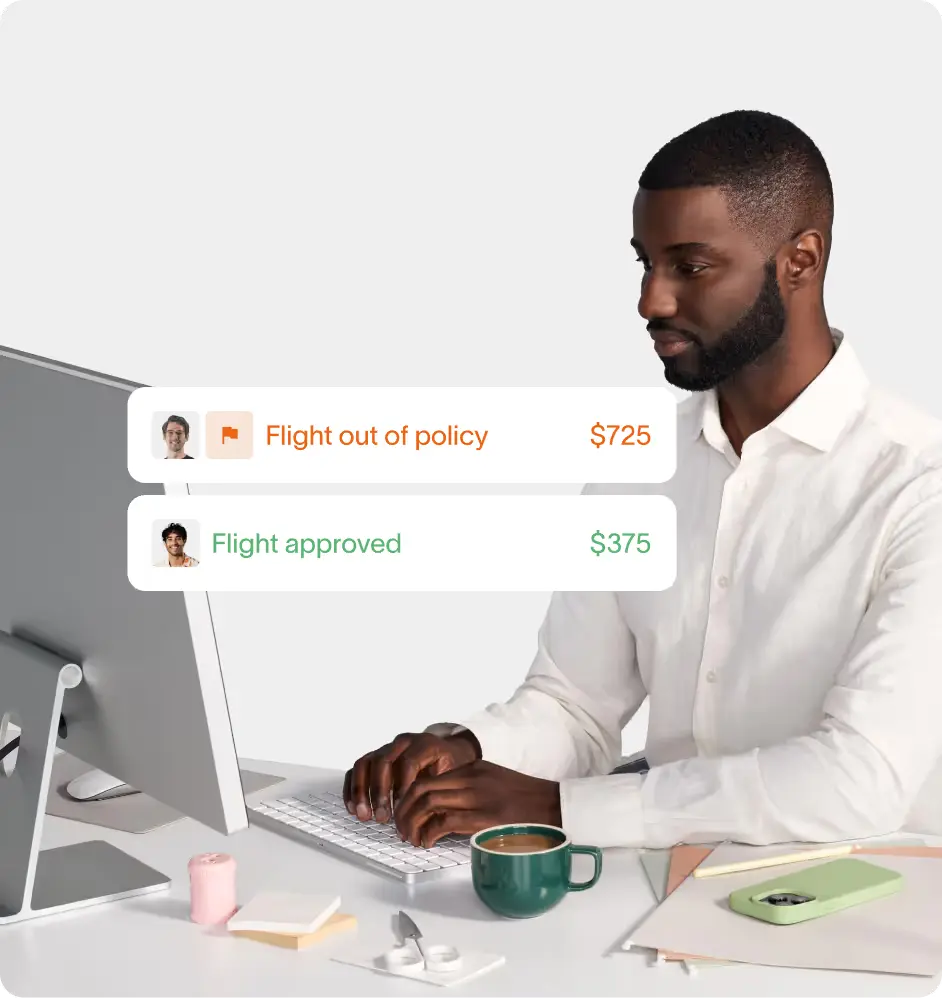

Automate your mileage tracking with Ramp

When you comply with California mileage reimbursement laws under Labor Code Section 2802, you can:

- Minimize risks of disputes with your employees by being fair and consistent with compensation.

- Keep your reimbursement policies transparent so your employees have clear expectations.

- Create a happier workplace because when employees are content, they help your business thrive with happy customers.

Wondering how you can streamline the mileage reimbursement process in your company? Let Ramp help you with this.

Our AI-powered expense management software integrates directly with Google Maps to ensure every business mile is accurately logged — no manual entries, no forgotten trips.

Beyond mileage, Ramp effortlessly handles all your on-the-road expenses, from meals to parking fees.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘Personal vehicle mileage reimbursement policy’: https://hrmanual.calhr.ca.gov/Home/ManualItem/1/2202