Connecticut mileage reimbursement rates & calculator

In Connecticut, Section 31-312(a) of the Workers' Compensation Act ensures that employees injured on the job are reimbursed for travel to medical appointments. Whether you’re a state employee or work for a private company, this regulation guarantees support during the recovery process.

However, as a private employer, you are not legally obligated to offer mileage reimbursement to employees using personal vehicles for business-related work unless they are injured.

That being said, it's still a smart business move to offer fair reimbursement to all employees — injured or otherwise — because the Connecticut Minimum Wage Law demands that employees' minimum wages should never drop below the state minimum.

Connecticut business mileage reimbursement rates

In Connecticut, the go-to mileage reimbursement rate in 2026 is $0.725 per mile, as per the IRS standard business mileage rates.

Below is a table showing a year-over-year analysis of IRS standard mileage rates.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Connecticut mileage reimbursement calculator

Using the Connecticut mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Connecticut mileage reimbursement laws

As an employer in Connecticut, it's vital to understand the specifics of mileage reimbursement under the Workers' Compensation Act as it applies to both private and public sectors. And then there's the Connecticut Minimum Wage law that comes to the rescue of employees.

Not complying with any of these laws can cause legal troubles in your business. Go through all these pivotal Connecticut mileage reimbursement laws below.

Section 31-312(a) of the workers' compensation act

If any of your employees who are covered under workers' compensation get injured on the job and need to drive to medical appointments, Section 31-312(a) mandates that you offer them mileage reimbursement. This applies to public and private sector workers who are eligible for workers' compensation benefits.

Connecticut minimum wage act and mileage reimbursement

While the Connecticut Minimum Wage Act primarily addresses wage standards, it indirectly influences mileage reimbursement practices.

For example, if you pay inadequate mileage expenses, causing an employee's effective earnings to fall below the state minimum wage, you may need to increase the reimbursement amount.

This ensures compliance with wage laws while supporting your employees in maintaining their livelihood through adequate travel compensation.

Connecticut vs federal mileage reimbursement laws

You might wonder how Connecticut's mileage reimbursement compares to federal laws. While federal guidelines don't require you to pay for mileage unless it reduces an employee's wages below minimum wage, Connecticut mandates it in cases like work-related injuries under the Workers' Compensation Act.

Simplify mileage tracking with Ramp

Offering your employees a mileage reimbursement unless they’re traveling for treatment is not a legal obligation for you as a private employer in Connecticut. However, if you still choose to do so, it will:

- Keep your employees motivated

- Keep your business out of legal trouble

- Help you with talent retention

- Keep you aligned with the Minimum Wage Law in Connecticut

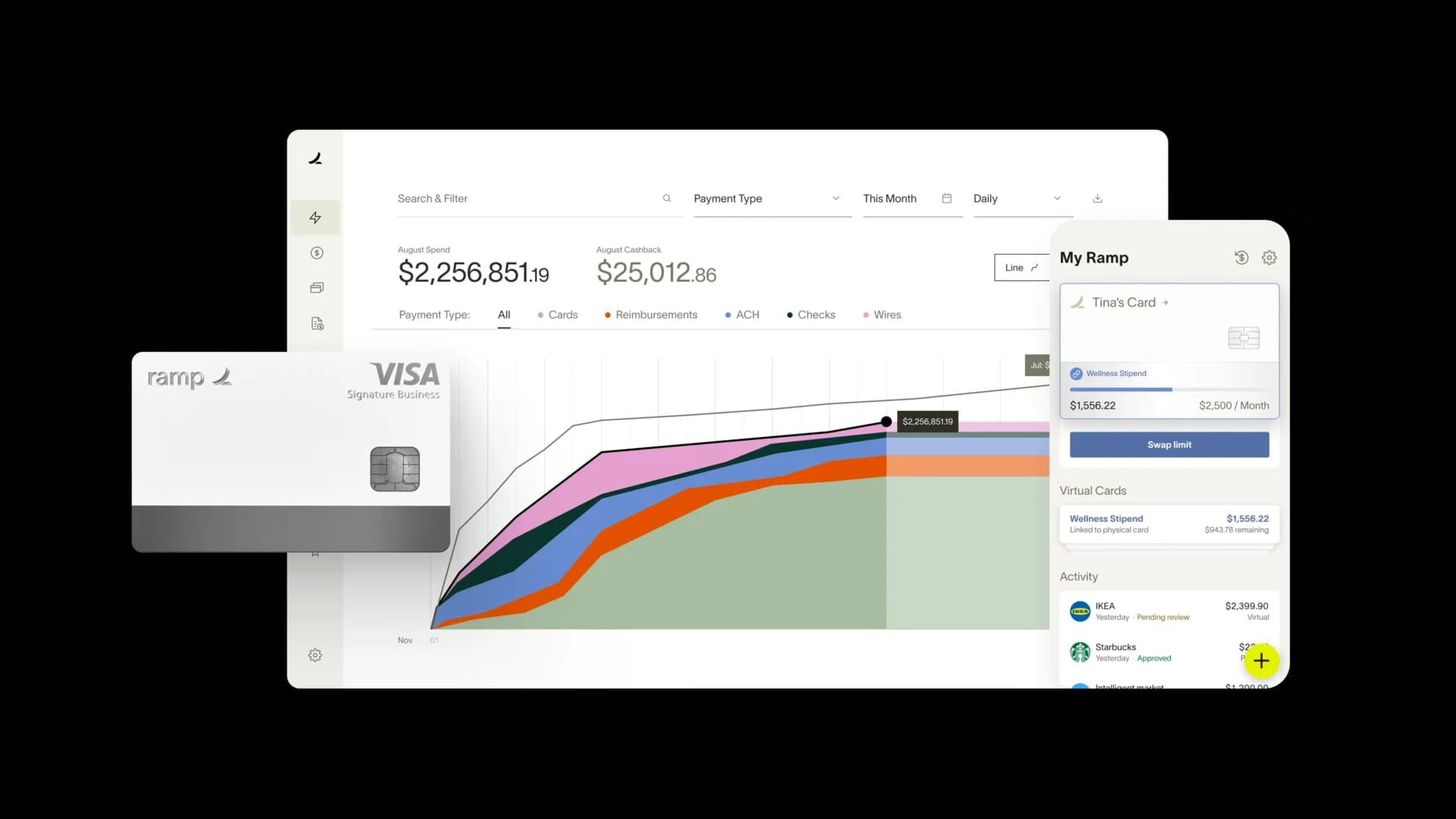

Looking for ways to automate and manage mileage tracking effortlessly? Ramp offers a smart solution.

By integrating Ramp's expense management software into your operations, you can automate the recording and calculation of travel expenses, ensuring accuracy and compliance with ease. Say goodbye to manual tracking and hello to a more streamlined, efficient process that benefits everyone in your company.

See how Ramp automates expense and mileage tracking for 50,000 businesses