Hawaii mileage reimbursement rates & calculator

Mileage reimbursement helps cover the costs your employees incur when using their vehicles for work purposes. In Hawaii, state employees are entitled to reimbursement under Code §3-10-13 when publicly owned vehicles aren't available.

While it's mandatory for state employees, as a private employer, you are generally not required to provide mileage reimbursement unless it relates to the Workers' Compensation Act (§12-10-25), which mandates covering travel costs for medical treatment.

Even though it is not a legal mandate for you, offering mileage reimbursement has the following additional benefits.

- Keep your business consistently in sync with the state's Minimum Wage Law.

- Keep your employees motivated, creating a stress-free work environment.

Hawaii business mileage reimbursement rates

The standard mileage reimbursement rate in Hawaii for 2026 is $0.725 per mile, as determined and set by the IRS. This rate applies to state employees, but as a private employer, you're not legally required to adopt it unless it's outlined for injured employees.

Here's an overview of mileage reimbursement rates in Hawaii based on the IRS standard rates and their year-by-year rate analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Hawaii mileage reimbursement calculator

Using the Hawaii mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Hawaii mileage reimbursement laws

Understanding (and following) Hawaii's mileage reimbursement laws is essential for ensuring compliance and fairness in your business.

The state provides specific guidelines for state employees and mandates certain requirements laid out in Statute §3-10-13. But what about your responsibilities as a private employer? Understanding critical mileage laws – explained below – will help you effectively manage your obligations and protect your employees' and your interests.

Code §3-10-13 of the mileage reimbursement policy for state employees

Under Hawaii Code §3-10-13[1], state employees are entitled to mileage reimbursement when publicly owned vehicles are unavailable or impractical. This policy allows department heads or their representatives to authorize the use of privately owned vehicles for official business.

The reimbursement rate aligns with the highest rate applicable to any officer or employee, as set by the IRS. The current rate for 2026 is $0.725 per mile.

Please note: The policy mandates biannual mileage reporting for state employees who frequently use their vehicles for work, ensuring accountability and proper use.

Code §12-10-25 for mileage reimbursement under the workers' compensation act

Hawaii's Workers' Compensation Act, as per Code §12-10-25[2], mandates that you reimburse your employees for travel expenses related to medical treatment for work-related injuries.

You must play your part if an employee needs medical care, as listed below.

- Provide mileage reimbursement, especially when public transportation isn't feasible due to their condition or injury.

- Let your employees choose their physician.

- Inform injured employees that they’re allowed to change their physician once, but they must notify you about the same before making the change[3].

Please note: the reimbursement covers the most direct route and only applies to miles beyond everyday commuting.

Hawaii minimum wage law and its impact on mileage

The Hawaii Wage and Hour Law, Chapter 387, sets the state's minimum wage. For 2026, it's $16.00 per hour, with planned increases over the coming years. Here's a quick look at the upcoming rates.

If you've tipped employees, follow the guidelines below.

- Pay up to $1.25 less per hour, effective January 1, 2024.

- Pay up to $1.50 less per hour starting January 1, 2028.

- Maintain accurate time and tip records for compliance.

Although Hawaii's Minimum Wage Law does not directly require mileage reimbursement, the connection is pretty straightforward — if non-reimbursement of mileage violates the state's minimum, you need to make up the difference and ensure your employees' wages are at least $16 per hour.

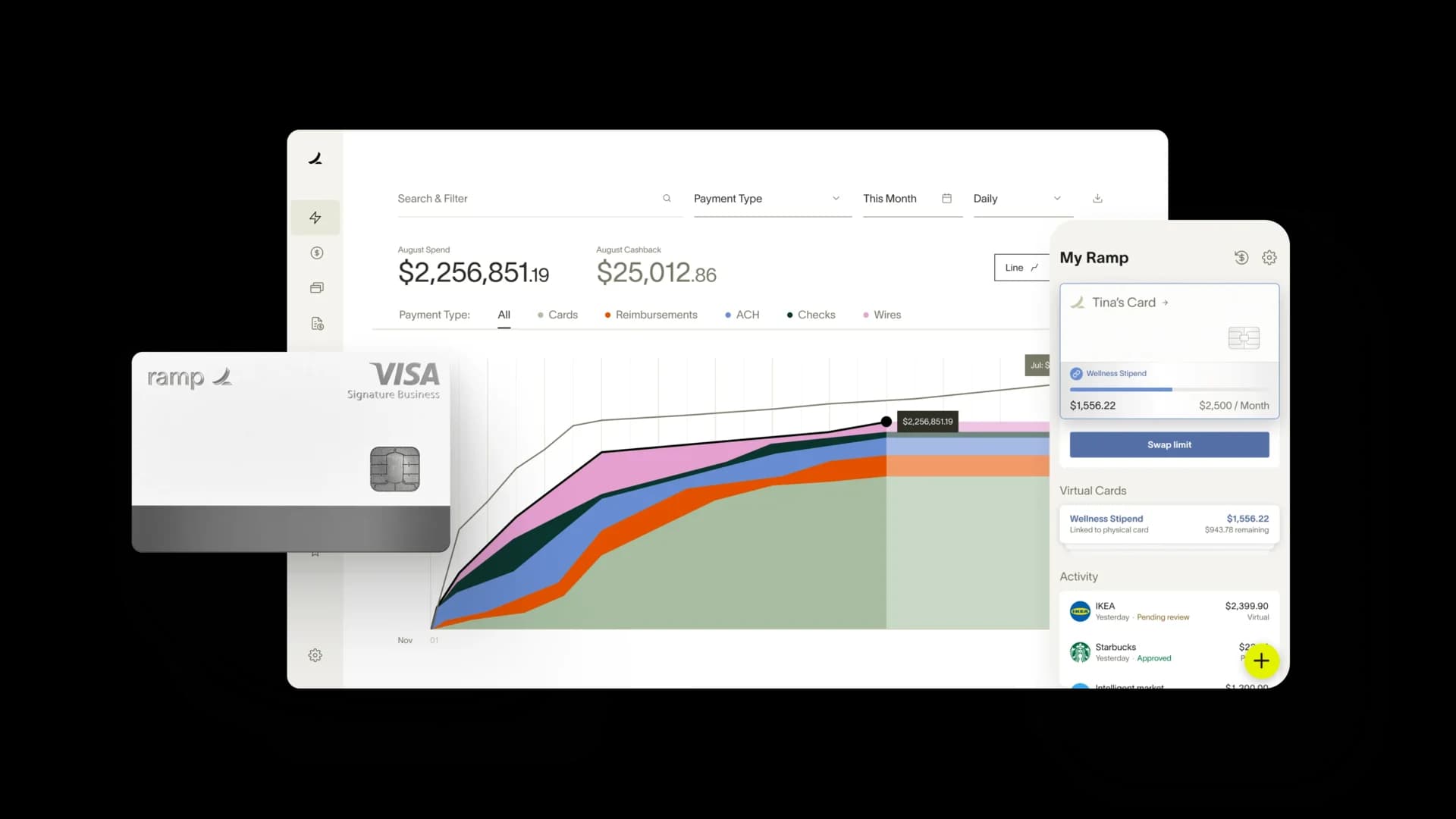

Automate your mileage tracking with Ramp

Understanding and complying with Hawaii's mileage reimbursement laws is crucial for maintaining fairness and legal compliance in your business.

Proper reimbursement practices will help you in the following ways.

- Ensure your employees are fairly compensated for their work-related travel.

- Prevent accidental violations of mandatory laws, including the Minimum Wage Law and the Workers' Compensation Act, to protect your business from potential legal issues.

Want to simplify the entire reimbursement process? Ramp's AI-driven expense management software is the answer. The software will automate mileage tracking, ensuring accuracy and efficiency. It's the safest way to eliminate guesswork.

With Ramp, your reimbursement processes will be smarter and hassle-free, and your business will be compliant with all mandatory mileage reimbursement laws in Hawaii.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘Code §3-10-13 Allowances for privately owned vehicles’: https://spo.hawaii.gov/wp-content/uploads/2013/11/HAR310.pdf

[2] Under the header, ‘§12-10-25 Travel reimbursement’: https://labor.hawaii.gov/dcd/files/2013/09/12-10-rules.pdf

[3] Under the header, ‘From whom can I obtain treatment’: https://labor.hawaii.gov/dcd/frequently-asked-questions/#:~:text=You%20may%20receive%20a%20weekly,up%20to%20a%20specified%20maximum.