Idaho mileage reimbursement rates & calculator

Idaho law under Section 67-2004 for private vehicle use for business work mandates mileage reimbursement for state employees. However, as a private employer, this code does not obligate you legally to reimburse.

Nevertheless, understanding Idaho mileage reimbursement laws is crucial, as you still need to comply with Workers' Compensation rules under Codes 72-432 and 72-433, which detail mileage reimbursement for medical visits. That's not all — here are some other benefits of offering mileage reimbursement despite it's not a legal boundation for you.

- Keep your business compliant with the general labor law under Title 44-1502, which addresses minimum wages.

- Reimburse fairly to ensure you retain talented employees.

Idaho business mileage reimbursement rates

For 2026, Idaho businesses reimburse state employees at a mileage rate of $0.725 per mile for using personal vehicles on official state business, set by the IRS.

Here are the latest Idaho mileage reimbursement rates in compliance with the IRS rates in 2026, alongside a year-on-year rate increase analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Idaho mileage reimbursement calculator

Using the Idaho mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Idaho mileage reimbursement laws

Section 67-2004 in Idaho mandates mileage reimbursement for state employees using personal vehicles for official state business.

Adhering to this law isn't mandatory for you as a private employer, but alignment can reduce the risk of unintentionally violating Idaho's Workers' Compensation Rules, detailed in Sections 72-432 and 72-433, which cover mileage for medical travel related to work injuries.

Engage with these Idaho mileage reimbursement laws in more detail.

Section 67-2004 for state employees'[1] mileage reimbursement

This code stipulates that state employees using personal vehicles for official duties are reimbursed at the current state-approved mileage rate of $0.725 per mile.

The calculation is based on the shortest or most efficient route as verified by reliable mapping services like Google Maps. It's also important to remember the following things.

- Don't substitute mileage reimbursement with gas expenses.

- Reimburse only half the mileage rate if a state vehicle was available and a personal vehicle was used without a valid reason.

ITD-633 for mileage reimbursement when traveling to airports[2]

This one is again for state employees traveling to airports for business. ITD-633 dictates that the following is your responsibility as an employer.

- Reimburse state employees for the lesser distance between their residence or official workstation and the airport.

- Ensure state funds are used efficiently, requiring employees to choose the most cost-effective travel option.

Reimbursement also includes airport parking fees, provided that your employee submits the original receipt with expense claim.

Worker's compensation rules (codes 72-432 and 72-433)

While the above two codes aren't legally binding for you as a private employer, adhering to them can enhance your compliance with Idaho's mandatory Workers Compensation Act, specifically Codes 72-432 and 72-433.

These codes require you to:

- Reimburse mileage when employees travel for medical examinations or treatments related to work injuries.

- Provide mileage at the state-approved rate, excluding the first 15 miles of any round trip.

Title 44-1502 for minimum wages

Although this section is primarily concerned with establishing minimum wage standards, its implications extend into how you handle employee reimbursements. Title 44-1502 sets the baseline wage at $7.25 per hour, which is aligned with the federal minimum wage.

For tipped employees, the direct wage paid by you must be at least $3.35 per hour, with the expectation that tips will supplement this to meet the minimum wage.

You must ensure that an employee's combined tips and direct wages never fall short of the minimum wage due to mileage non-reimbursement.

Upgrade to automated mileage tracking with Ramp

Getting a grip on Idaho's mileage reimbursement laws and offering fair compensation shows you care about your team. Proper reimbursement practices also fulfill legal requirements by the Worker's Compensation Rules and the Minimum Wage Act in Idaho. This approach will help you:

- Create a positive work environment

- Enhance financial accuracy, reimbursing employees fairly

- Lead to employee satisfaction and talent retention

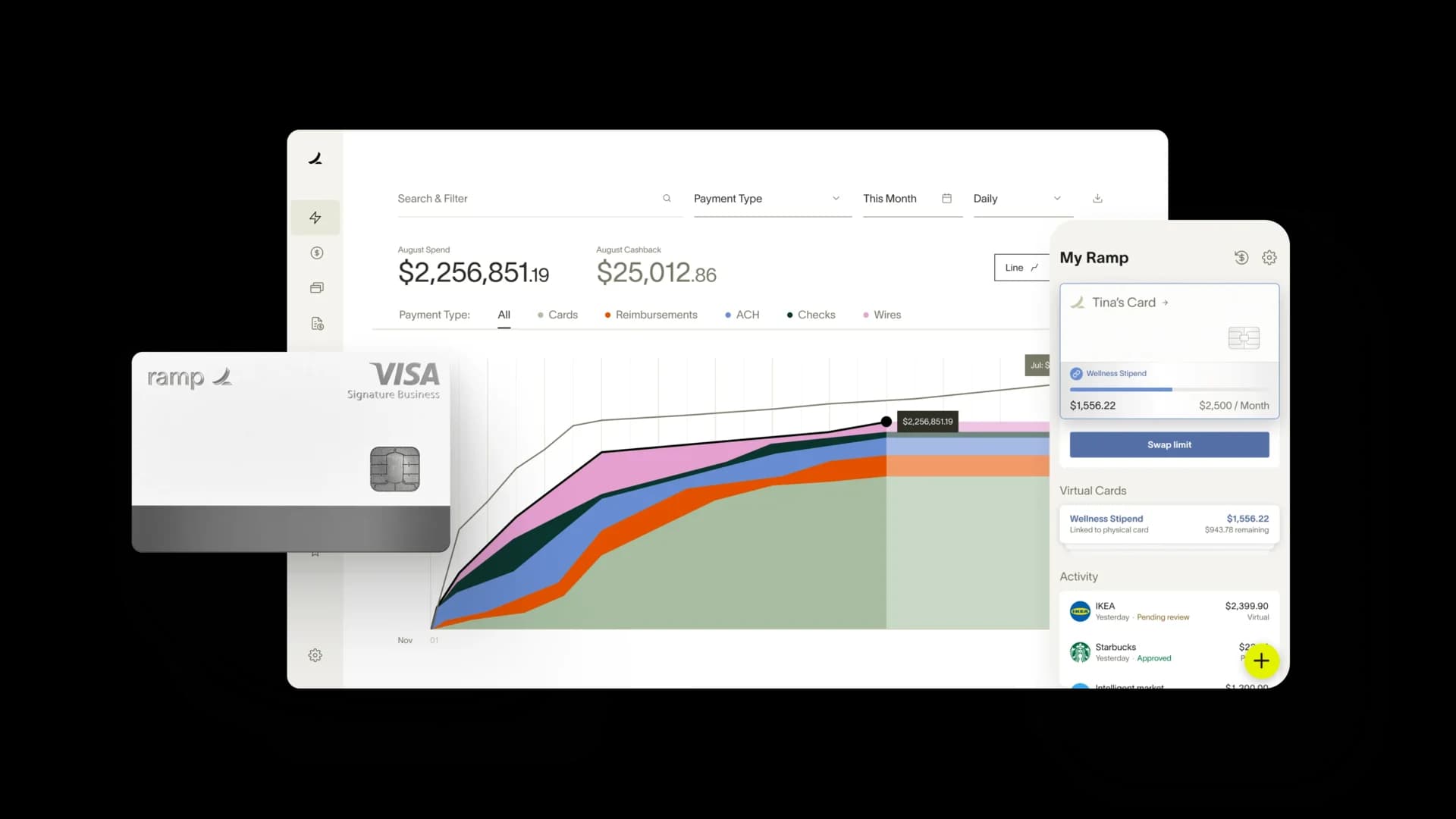

To streamline this critical aspect of business management, consider using Ramp. Ramp's AI-backed expense management software simplifies the mileage tracking and reimbursement process, ensuring that every mile your employees travel for business is accurately logged and compensated according to Idaho laws.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under ‘Mode and Route of Travel’: https://www.sco.idaho.gov/Documents/BOE%20Policies/State-Travel-Policies-and-Procedures.pdf

[2] Under ‘Personal Transportation to and from the Airport’: https://apps.itd.idaho.gov/apps/pt/grants/ITDTravelGuidelines.pdf