Illinois mileage reimbursement rates & calculator

If you're running a business in Illinois, it's crucial to understand mileage reimbursement, which is a legal requirement. This ensures your employees are compensated for using their personal vehicles for work purposes.

Adopting Illinois mileage reimbursement rates can keep your business in compliance with the Illinois Wage Payment and Collection Act (820 ILCS 115/9.5), which requires you to cover all necessary job-related expenses.

Moreover, when employees know they will be fairly reimbursed for mileage, they worry less about money and focus more on their jobs. The ultimate results are job satisfaction and talent retention.

Illinois business mileage reimbursement rates

For 2026, the Illinois business mileage reimbursement rate is $0.725 per mile, aligning with the IRS standard. While you're free to reimburse above or below this rate, keep in mind that any extra over the IRS standard is taxable.

It's worth noting that the below-listed standard rates, calculated by the IRS, consider average vehicle costs, including fuel, maintenance, and depreciation.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Illinois mileage reimbursement calculator

Using the Illinois mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Illinois mileage reimbursement laws

In Illinois, if you employ people who use their personal vehicles for work-related duties, you must ensure they're reimbursed appropriately.

Under the Illinois Wage Payment and Collection Act (820 ILCS 115/9.5), mileage reimbursement is not just a nice gesture for employee satisfaction — it's the law.

- Make sure to reimburse your employees for all necessary expenses — not just the obvious ones like gas. This includes maintenance, insurance, and even vehicle depreciation.

- Ensure your employees submit their mileage and associated costs within 30 days. Establish a clear policy for how and when expenses should be reported.

- Stay above the state minimum wage. You could be in legal trouble if the wages are too low and cause any employee's earnings to dip below the state minimum wage.

Legal implications of non-compliance with Illinois wage payment and collection act

If you fail to properly reimburse employees for necessary mileage expenditures, you're looking at potential legal action. In such cases of non-compliance, you will have to:

- Bear additional damages calculated at 5%[1] of the underpayment total for each month the reimbursement remains unpaid. This is in addition to repaying any owed amounts in full.

- Face fines ranging from $250 to $1,000[2], payable to the Illinois Department of Labor, as enforcement for compliance with the law.

Please note: These fines are in addition to any federal penalties for minimum wage violations.

Federal vs Illinois mileage reimbursement laws

Generally, mileage reimbursement at the federal level is only mandated to avoid wage and hour violations. Illinois mileage reimbursement laws, on the other hand, go beyond federal requirements.

The Illinois Wage Payment and Collection Act (820 ILCS 115/9.5):

- Mandates that you reimburse all necessary expenditures incurred by your employees that are directly related to their employment duties.

- Defines these reimbursements as part of the employee's compensation, making it a more comprehensive requirement than federal law.

Streamline mileage tracking and reimbursement with Ramp

Understanding and complying with Illinois mileage reimbursement laws, such as the Illinois Wage Payment and Collection Act, is essential for maintaining a fair workplace and avoiding costly penalties.

Proper reimbursement practices safeguard your business against legal issues and boost employee satisfaction by ensuring they are compensated for their work-related expenses.

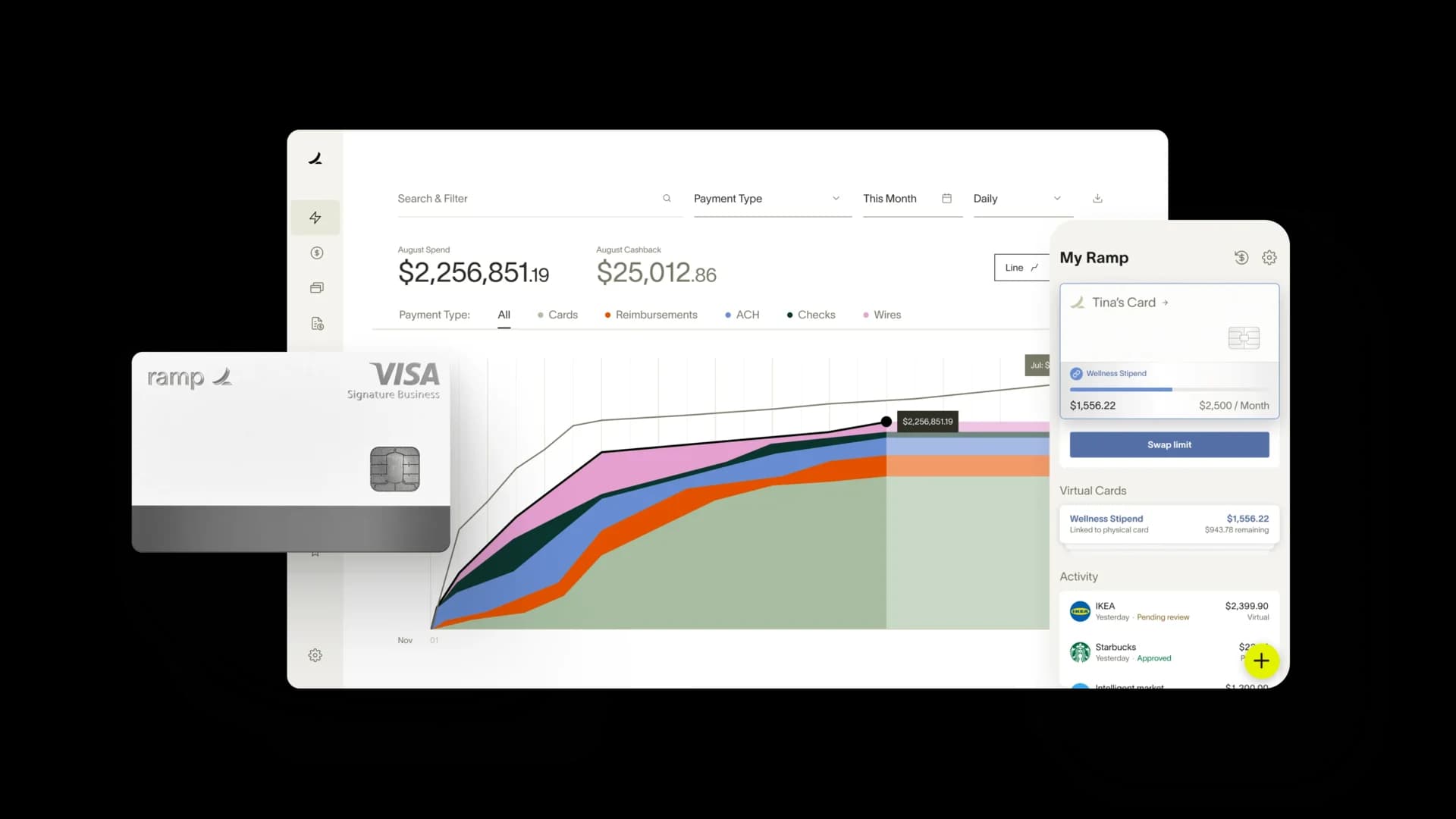

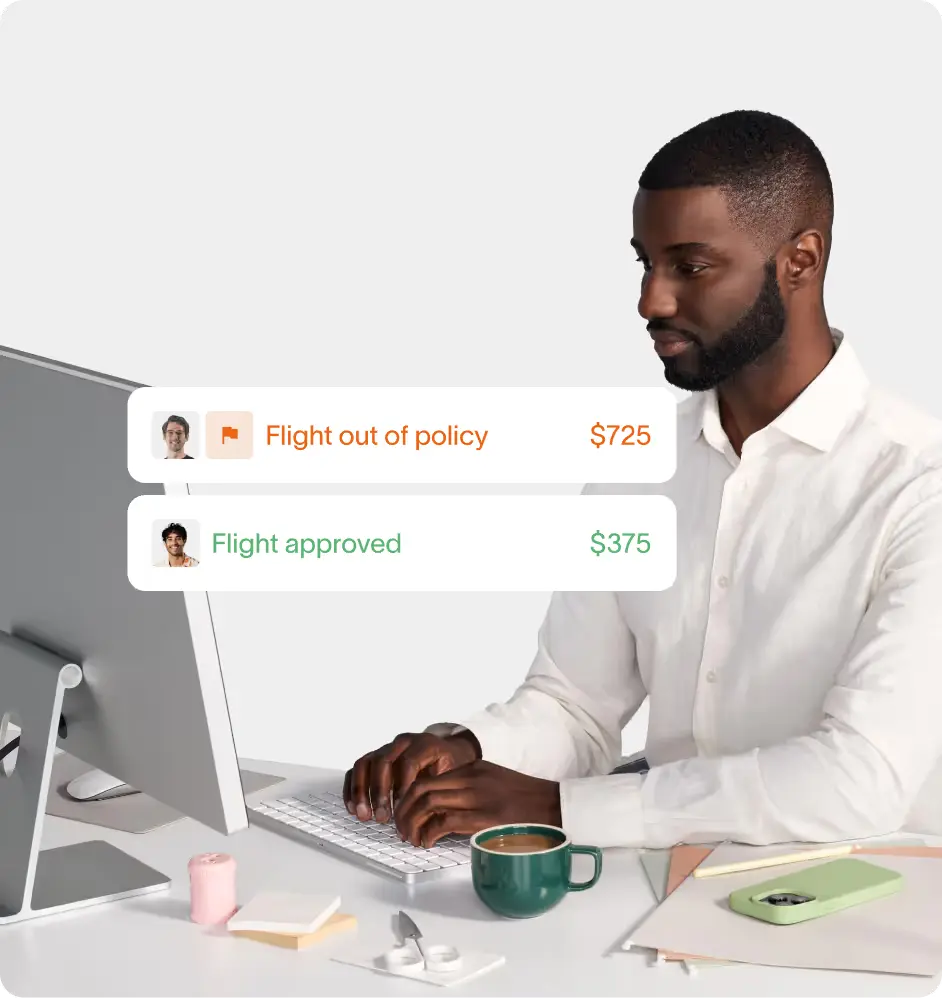

Ramp simplifies this process by automating mileage tracking, making it easier than ever for your business to adhere to these laws.

With Ramp's AI-powered expense management software, you can effortlessly calculate reimbursements, reduce administrative burdens, and ensure full compliance with Illinois regulations.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1]: Under the header, ‘(820 ILCS 115/14) (from Ch. 48, par. 39m-14)’: https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2402&ChapterID=68

[2]: Under header ‘(820 ILCS 115/14) (from Ch. 48, par. 39m-14)’: https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2402&ChapterID=68