Maryland mileage reimbursement rates & calculator

Maryland updates its mileage reimbursement guidance annually through the Workers’ Compensation Commission. While private employers aren’t generally required to reimburse mileage, setting a clear policy can still be a practical business decision.

In certain situations, Maryland’s Workers’ Compensation Law does require mileage reimbursement for both public and private employers. A consistent reimbursement approach can also help you:

- Cover employee travel costs tied to business duties

- Apply fair, defensible mileage rates across your team

- Stay aligned with Maryland wage and labor requirements

Maryland business mileage reimbursement rates

In 2026, Maryland employers typically reimburse employees at the same rate used for state employees: $0.725 per mile for business-related travel, set by the IRS.

The table below shows how Maryland’s mileage reimbursement rate has changed year over year.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Maryland mileage reimbursement calculator

Using the Maryland mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Maryland mileage reimbursement laws

In Maryland, mileage reimbursement laws for state employees are well-defined. However, if you are a private employer in Maryland, adhering to this rate isn't mandatory.

Mileage reimbursement for state employees

When state vehicles are available, Maryland encourages their use by offering a reduced reimbursement rate for employees who still opt to use their personal vehicles. Such employees are reimbursed at half the standard rate of $0.725 per mile, which is $0.3625 per mile.

If you're managing state employees, it's also worth noting that the Maryland mileage reimbursement rate includes the cost of vehicle insurance[1]. Hence, you don't have to cover any additional insurance costs that arise from using a private vehicle for state business.

Having said that, know that mileage reimbursement doesn't have to be provided for regular commutes between home and assigned offices.

Workers' compensation act and mileage reimbursement

This law applies to all you private employers.

When injured employees travel to and from medical treatments related to the compensable injury, the state's Workers' Compensation Law mandates that you offer them mileage reimbursement.

In fact, the Workers' Compensation Commission has set this rate to $0.70 per mile in 2025. This adjustment reflects Maryland's recognition of these miles as akin to business miles traveled because of the work-related nature of the injuries.

Maryland Minimum Wage Act

The Minimum Wage Act in Maryland does not explicitly mandate that you should reimburse your employees for mileage. Instead, it ensures your employees are paid fairly for their work hours so that out-of-pocket expenses never drop their wages below the state minimum. Clearly, it's indirectly related to mileage reimbursement.

The state-wide minimum wage in most of Maryland is $15 per hour. However, there's a slight variation in the minimum wages in certain counties, such as Montgomery and Howard counties.

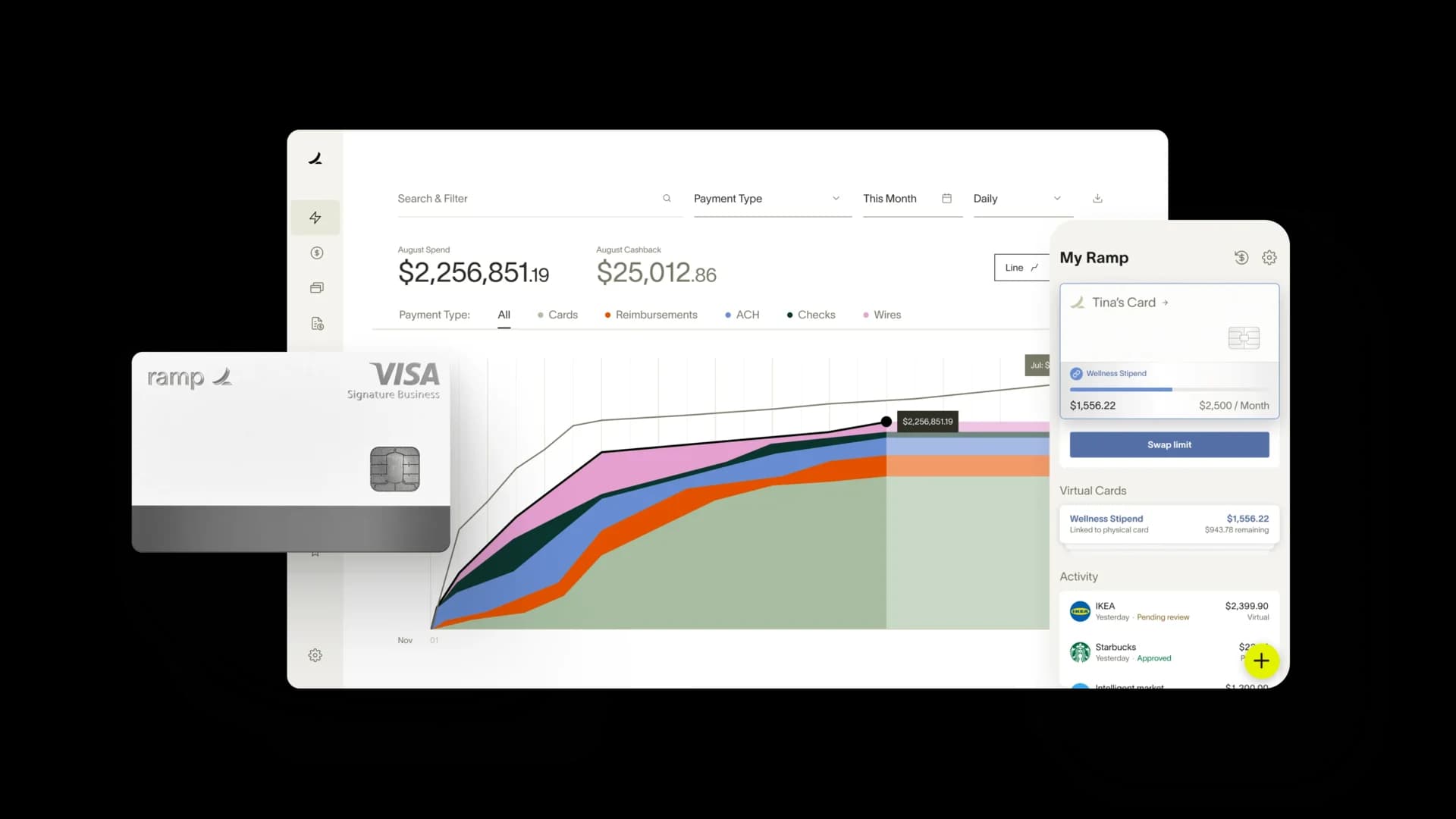

Switch to Ramp for automated mileage tracking

In Maryland, the state provides clear guidelines for mileage reimbursement for state employees. As a private employer, aligning your company's mileage reimbursement policies with these standards can offer several advantages:

- Ensure compliance with local regulations, reducing the risk of potential legal issues.

- Build trust with employees by demonstrating your commitment to their well-being.

To streamline and simplify your mileage reimbursement processes, consider using Ramp. Ramp's advanced AI-driven expense management solution automates the recording and reporting of mileage, ensuring accuracy.

By integrating Ramp, you can eliminate manual tracking errors, reduce administrative overhead, and ensure that reimbursements are prompt and compliant.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under, ‘8.2 REIMBURSEMENT FOR USE OF PRIVATELY OWNED VEHICLES’: https://dbm.maryland.gov/Documents/FleetManagementServices/fleet_mgmt_manual.pdf