Minnesota mileage reimbursement rates & calculator

In Minnesota, it is mandatory to offer mileage reimbursement to state employees who use their personal vehicles for work-related duties. The rates, however, vary depending on whether a state-owned vehicle is available but declined and the type of vehicle used.

As for you, a private employer in Minnesota, offering mileage reimbursement is not a legal obligation. However, you still have the Workers' Compensation Statute to answer to. Moreover, offering a fair mileage reimbursement will help you in the following ways.

- Keep you in alignment with the Minnesota Minimum Wage Law

- Build your brand as a business that cares about its employees

Minnesota business mileage reimbursement rates

In 2026, Minnesota's standard business mileage reimbursement rate is $0.725 per mile. However, these rates can fluctuate under certain scenarios, listed below.

- When state-owned vehicles are present but declined by the employee, the reimbursement allowance is $0.655 cents per mile.

- When specially equipped vans with modifications like ramps or lifts for wheelchair access are used, the reimbursement allowance is $0.79 cents per mile.

Here's a snapshot table showcasing the Minnesota mileage reimbursement rate that aligns with standard IRS rates and a year-on-year rate analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Minnesota mileage reimbursement calculator

Using the Minnesota mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Minnesota mileage reimbursement laws

As an employer in Minnesota, you need to know that while mileage reimbursement is required for state employees, it isn't mandatory for you in the private sector. However, regardless of the sector, you must comply with the Workers' Compensation Claim Statute and the Minnesota Minimum Wage Law.

Below, you'll find detailed insights into all Minnesota's statutes and regulations governing mileage reimbursement.

Minnesota mileage reimbursement for state employees[1]

For state employees in Minnesota, offering both a mileage allowance and a periodic allowance simultaneously creates non-compliance. Only one form of reimbursement should be provided.

Beyond mileage, Minnesota also reimburses state employees for parking fees and tolls as actual costs. However, the state does not provide reimbursement for the following:

- Mileage for commuting between home and the regular workplace.

- Expenses that exceed the limits set by standard commercial costs.

Minnesota workers' compensation claims statute

These claims are your legal obligation even as an employer in the private sector. Under Minnesota's Workers' Compensation system, when your employees sustain injuries or illnesses related to their job, they are entitled to mileage reimbursement for travel related to medical treatment and vocational rehabilitation activities.

The Workers' Compensation Act also mandates that you do the following.

- Cover the cost of travel mileage and parking when your employees need to engage in rehabilitation activities.

- Determine actual mileage based on the distance to and from the healthcare provider or rehabilitation facility, adhering to the most direct routes as per state guidelines.

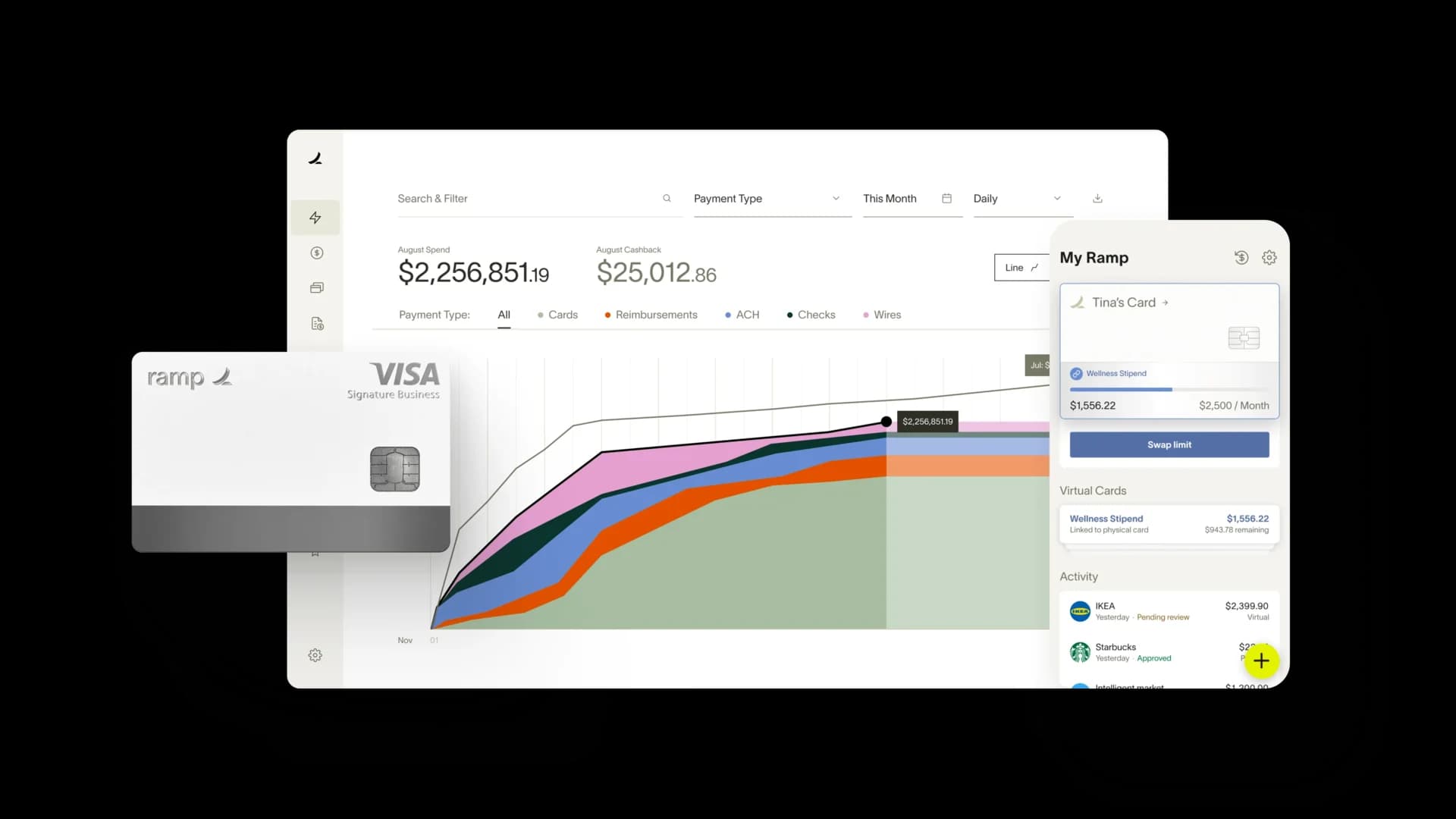

Integrate Ramp to automate mileage tracking

Adhering to state laws can be particularly complex in Minnesota, where mileage reimbursement rates vary depending on vehicle availability and special accommodations.

Properly managing these nuances not only helps you avoid compliance issues but also ensures that your employees are fairly compensated for their travel, boosting morale and trust within your team.

Ramp's AI expense management software automates mileage tracking and calculations for Minnesota's mileage regulations. Easily integrate mileage data with payroll systems, simplify reimbursements, and save time. Maintain transparent operations, managing business needs and employee expectations.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under, ‘Chapter 12: Mileage reimbursement’: https://mn.gov/mmb-stat/000/az/labor-relations/commissioners-plan/contract/Commissioners%20Plan%2023-25%20-%20Redline.pdf