Missouri mileage reimbursement rates & calculator

Are you familiar with how mileage reimbursement functions under Missouri regulations for your business? While you are not mandated by any state law to offer mileage reimbursement to employees as a private employer in Missouri, it's considered a best practice for maintaining fairness within your workplace.

In contrast, state regulations like CSR 10-11.010 define reimbursement protocols for state employees, while provisions under Missouri Workers' Compensation law outline necessary travel reimbursements for medical treatments related to work injuries.

Overall, embracing fair mileage reimbursement can ensure:

- Employee satisfaction and retention

- Your business complies with employer obligations under Missouri Workers' Compensation

Missouri business mileage reimbursement rates

For 2026, Missouri's business mileage reimbursement rate for IRS purposes is $0.725 per mile.

On the other hand, state employees benefit from a defined rate of 70 cents per mile for mid-size sedan, while the fleet rate is 36.0 cents per mile.

Here's a standard table that reflects the IRS reimbursement rates – you can adopt them too, but know that any reimbursed amount above IRS rates is taxable.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Missouri mileage reimbursement calculator

Using the Missouri mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Missouri mileage reimbursement laws

As a Missouri employer, it's crucial to understand the distinct rules for mileage reimbursement that apply to your team.

Whether you manage state employees or oversee a private workforce, the nuances of the Missouri mileage reimbursement laws – discussed below – directly impact how you should compensate for travel.

State employees and CSR 10-11.010

You're required to follow specific guidelines when reimbursing state employees. This year, the reimbursement rate is set at 34.0 cents per mile, following the state fleet rate.

Adhering to this regulation will:

- Ensure employees are compensated fairly for travel required on official state business.

- Accurately reflect the operational costs of the vehicles used.

Private employees and the Missouri wage act

It's crucial to note that while Missouri doesn't mandate mileage reimbursement for private sector employees, the Missouri Wage Act suggests you cover any travel expenses that predominantly benefit the company.

If failing to reimburse these costs causes an employee's effective wage to drop below the 2026 state minimum wage of $15.00 per hour, you might face legal challenges.

Missouri workers' compensation law

Under Missouri Workers' Compensation law, you have specific responsibilities if an employee travels for medical treatment due to a work-related injury.

- Reimburse for such travel if the medical services are sought outside the employee's county of principal employment, up to a maximum of 250 miles[1] each way.

- Support employees during their recovery. Ensure they are not financially burdened by work-related injuries they faced while traveling for business.

Missouri mileage reimbursement laws vs federal laws

Your mileage reimbursement strategy should accommodate both Missouri-specific statutes and broader federal guidelines.

Federal laws provide a baseline, often suggesting reimbursement at the IRS rate, which can serve as a guideline but is not obligatory. If non-reimbursement would reduce an employee's earnings below the federal minimum wage, only then would it become a legal responsibility.

On the other hand, Missouri's requirements, particularly regarding workers' compensation, are often more stringent and require careful attention to ensure full compliance so the minimum wage does not drop below $15.00 per hour.

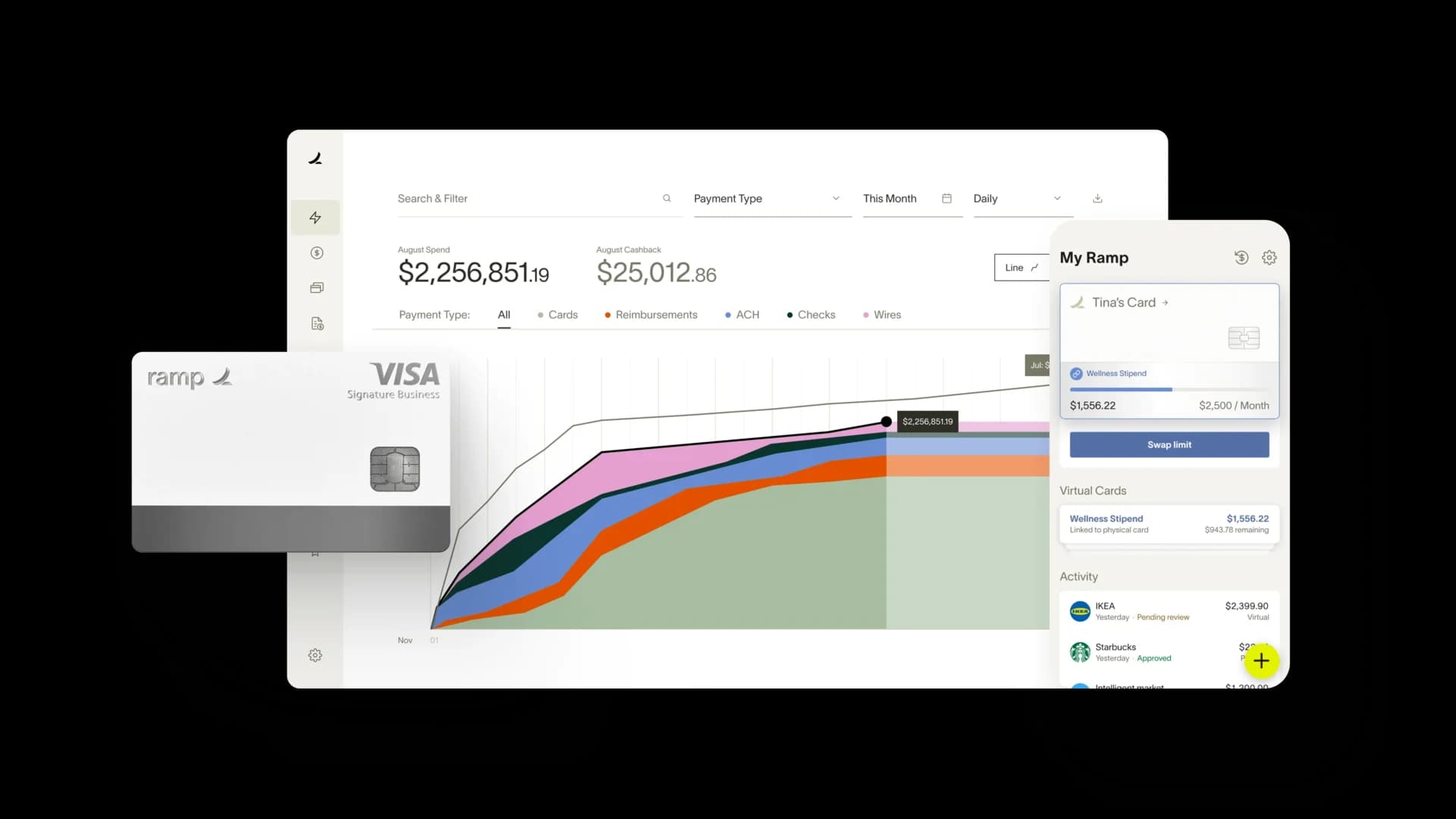

Experience automated mileage tracking with Ramp

Understanding and complying with Missouri's mileage reimbursement laws is crucial for maintaining a fair and legal workplace. Proper reimbursement practices:

- Safeguard compliance with the Missouri Wage Act

- Enhance employee satisfaction by ensuring they are compensated fairly

- Creates a positive work environment

- Reinforces your reputation as a responsible employer

Thinking about how you can make mileage logging easy, accurate, and efficient for your business? Ramp can prove to be your ultimate companion.

Ramp’s AI-driven expense management software will automatically integrate with Google Maps, accurately recording the miles driven. Your entire mileage reimbursement process will become automated, saving time on manually processing claims. Get started with Ramp and eliminate manual logging errors now.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under, ‘Benefits provided under Missouri’s Workers’ Compensation Law’: https://www.schuchatcw.net/wp-content/uploads/sites/1300588/2020/06/Handbook-on-Missouri-Workers-Compensation-Law-434673.pdf