Nebraska mileage reimbursement rates & calculator

Mileage reimbursement in Nebraska becomes a legal mandate the minute state employees hop in their personal vehicles to handle work errands. Thanks to Statute 81-1176, state employees are fairly compensated for mileage expenses at rates set by the Department of Administrative Services, in sync with the annual IRS rates.

However, if you're a private employer, you are not legally bound to reimburse for mileage (unless it involves medical travel under Statue 48-120 of the Nebraska Workers' Compensation Act). But here's the thing: offering mileage reimbursement is still a smart move. Here's why you should do it.

- Create a stress-free work atmosphere, retaining (and attracting) talent

- Ensure you don't accidentally violate the Minimum Wage Law

Nebraska business mileage reimbursement rates

The mileage reimbursement rate in Nebraska in 2026 is $0.725 per mile, established by the Department of Administrative Services for state employees under Statute 81-1176.

While this rate is mandatory for state employees, as a private employer, you're not legally required to follow it unless it's related to medical travel under the Workers' Compensation Act.

Here's a tabulated snapshot of IRS-set mileage rates Nebraska has closely followed over the years.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Nebraska mileage reimbursement calculator

Using the Nebraska mileage reimbursement calculator is simple.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Nebraska mileage reimbursement laws

Whether it's state mandates like Statute 81-1176 or Statute 48-120 of the Workers' Compensation Act (which is a legal mandate for your private business, too), you'll realize that these rules – which might seem tailored just for the benefit of employees – can work to your advantage as an employer.

Dive into the nitty-gritty of all such critical laws, starting with Statute 81-1176, which will ultimately keep your business out of legal trouble and your workforce motivated.

Statute 81-1176 for state employees' mileage reimbursement

Mileage reimbursement in Nebraska is a legal requirement governed by Statute 81-1176 for state employees. As of January 1, 2026, the Department of Administrative Services has set the mileage reimbursement rate at $0.725 cents per mile for personal vehicles.

This rate also includes special considerations, as listed below.

- Reimbursement rate for motorcycles: $0.705 cents per mile

- Reimbursement rate for privately-owned aircraft: $1.78 per mile.

What's crucial here is that this statute mandates reimbursement when state employees use their personal vehicles for official business, ensuring that their travel expenses are fairly covered.

Statute 48-120 of workers' compensation law for injured employees' mileage reimbursement

Under Statute 48-120 of Nebraska's Workers' Compensation Act, you must cover mileage for employees needing medical care due to work injuries. The 2026 mileage reimbursement rate for injured employees is $0.725 cents per mile, aligning with the state employees' rate.

This law ensures your employees can access the care they need without bearing additional financial burdens.

According to Statute 48-120, here's what you must do.

- Allow your employees to choose their doctor. If they don't, you can select for them[1].

- Provide mileage reimbursement for necessary medical travel within the treatment scope.

Most importantly, if you delay benefits for more than 30 days, a 50% penalty is added to the original reimbursement amount[2].

Nebraska minimum wage law (Statute 48-1203) and its implications on mileage reimbursement

As per Statute 48-1203 of Nebraska’s Minimum Wage Law, the minimum wage in 2026 is $15.00 per hour.

While Statute 48-1203 doesn't directly mandate mileage reimbursement, it does ensure that wages cannot fall below the state minimum. This means you are legally obligated to cover the shortfall if non-payment of mileage causes your employees' wages to drop below the state minimum.

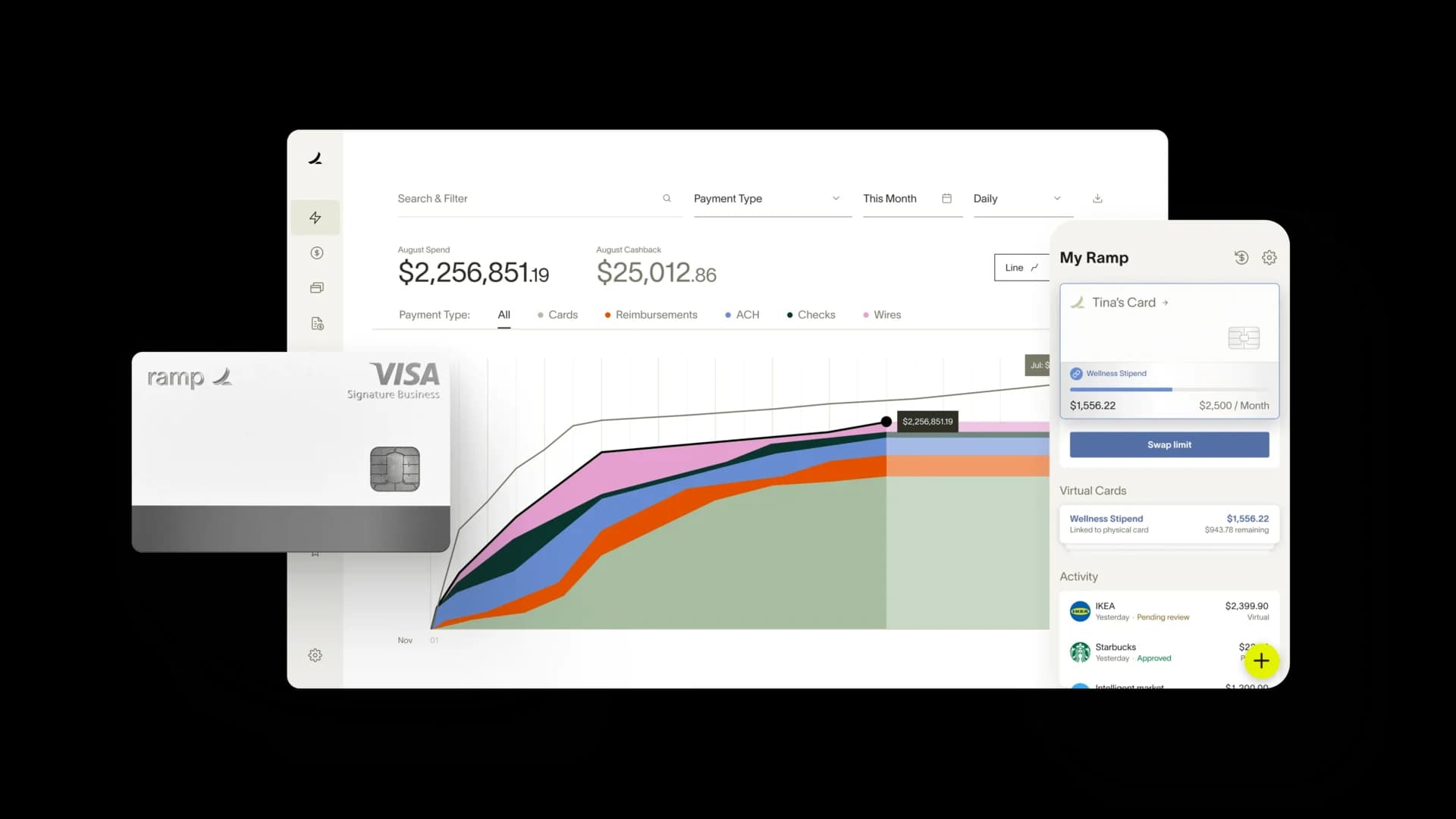

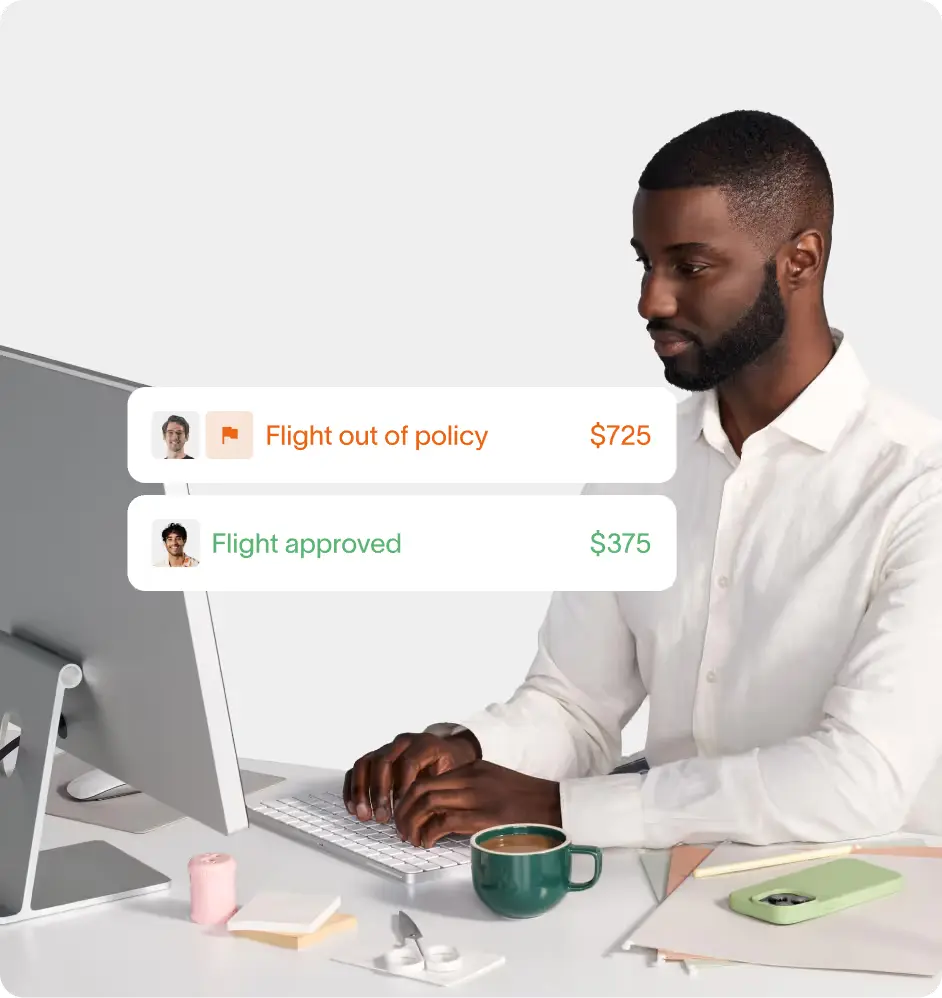

Automate mileage tracking for accuracy with Ramp

In Nebraska, following mileage reimbursement laws will help create a fair and transparent workplace. Proper reimbursement practices will help in the following ways.

- Show your employees that you value their contributions

- Ensure they aren't robbed blind when using their personal vehicles for the benefit of your business.

- Enhance job satisfaction, ultimately making your business profitable

Ramp makes this process effortless. Instead of dealing with the headaches of manual tracking and potential errors, Ramp's expense management software automates the entire reimbursement process. It provides accurate, real-time tracking and accounts for every mile.

With Ramp, you will be able to manage reimbursements smoothly, maintain organized records, and focus on growing your business.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, 'What benefits may be available': https://www.newcc.gov/workers/worker-frequently-asked-questions

[2] Under the header, 'What happens if benefits are not paid on time': https://www.newcc.gov/workers/worker-frequently-asked-questions