New Jersey mileage reimbursement rates & calculator

In New Jersey, reimbursing state employees for mileage isn't just a courtesy — it's a requirement mandated by Section 1 of P.L.1943, chapter 188. However, this isn't the case in the private sector, where you're not obligated to reimburse for mileage.

Still, offering mileage reimbursement is a goodwill gesture that helps you achieve the following benefits.

- Encourage staff retention through fair reimbursement.

- Ensure your team's overall financial well-being.

- Keep your business aligned with New Jersey's Minimum Wage Law.

- Ensure adherence to NJ's Workers' Compensation Law.

New Jersey business mileage reimbursement rates

For 2026, New Jersey's mileage reimbursement rate for state employees is set at $0.725 per mile, in line with the IRS standard rate. The state law mandates this rate for public workers.

Private employers in Nevada are not required to reimburse mileage. That said, many choose to align with the IRS standard mileage rates—shown below with a year-over-year breakdown—to maintain consistency and support employee travel costs.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

New Jersey mileage reimbursement calculator

Using the New Jersey mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

New Jersey mileage reimbursement laws

New Jersey does not have a statewide law that requires private employers to reimburse employees for business mileage. However, state employees must be reimbursed when they use a personal vehicle for official state business.

That requirement comes from P.L. 1943, c. 188 (N.J. Rev. Stat. § 52:14-17.1), which establishes mileage reimbursement for New Jersey state officers and employees. The exact reimbursement rate for state employees is not fixed in statute and is instead set through the state budget and Office of Management and Budget (OMB) guidance.

While lawmakers have proposed tying New Jersey’s state reimbursement rate directly to the IRS standard mileage rate, those proposals have not been enacted as of 2026.

For private employers, mileage reimbursement is generally optional. Even so, many businesses choose to follow the IRS standard mileage rate as a benchmark to keep policies consistent and reduce wage-and-hour risk when employees incur work-related travel costs.

Mileage reimbursement policies for state employees

Mileage reimbursement for New Jersey state employees is mandatory when a personal vehicle is used for official duties. The per-mile rate is set administratively, typically through OMB circulars or appropriations guidance, and may change from year to year.

In addition to mileage, state agencies may also reimburse employees for necessary tolls and parking expenses, depending on agency policy and travel authorization.

New Jersey’s workers' comp law and its implications on mileage reimbursement

Under New Jersey’s Workers’ Compensation Law (N.J. Stat. § 34:15-1 et seq.), employees injured on the job are entitled to necessary medical benefits.

The law does not explicitly require reimbursement for mileage related to medical appointments. However, employers must cover reasonable and necessary medical expenses, which typically include:

- Medical treatment

- Prescription medications

- Hospital services

Understanding this distinction helps set clear expectations around what workers’ compensation covers.

New Jersey minimum wage act and mileage reimbursement

The New Jersey Wage Act sets state minimum wage requirements, which can indirectly affect how employers handle mileage reimbursement.

As of 2026, New Jersey’s minimum wage varies by worker category and is set by the New Jersey Department of Labor and Workforce Development (NJDOL). While mileage reimbursement is not required under the Minimum Wage Act, unreimbursed business expenses should not reduce an employee’s effective pay below the applicable minimum wage.

Because of this, some employers reimburse mileage to help avoid wage-and-hour compliance issues.

New Jersey vs federal mileage reimbursement rules

At the federal level, the IRS sets a standard mileage rate each year, which employers commonly use to keep reimbursements non-taxable. For 2026, that rate is $0.725 per mile.

New Jersey’s approach differs by employer type:

- State employees: Reimbursement is required, with rates set by state guidance

- Private employers: Reimbursement is optional, but many follow the IRS rate for clarity and consistency

In the absence of a statewide mandate for private employers, having a clear internal mileage policy helps ensure transparency and fair treatment across teams.

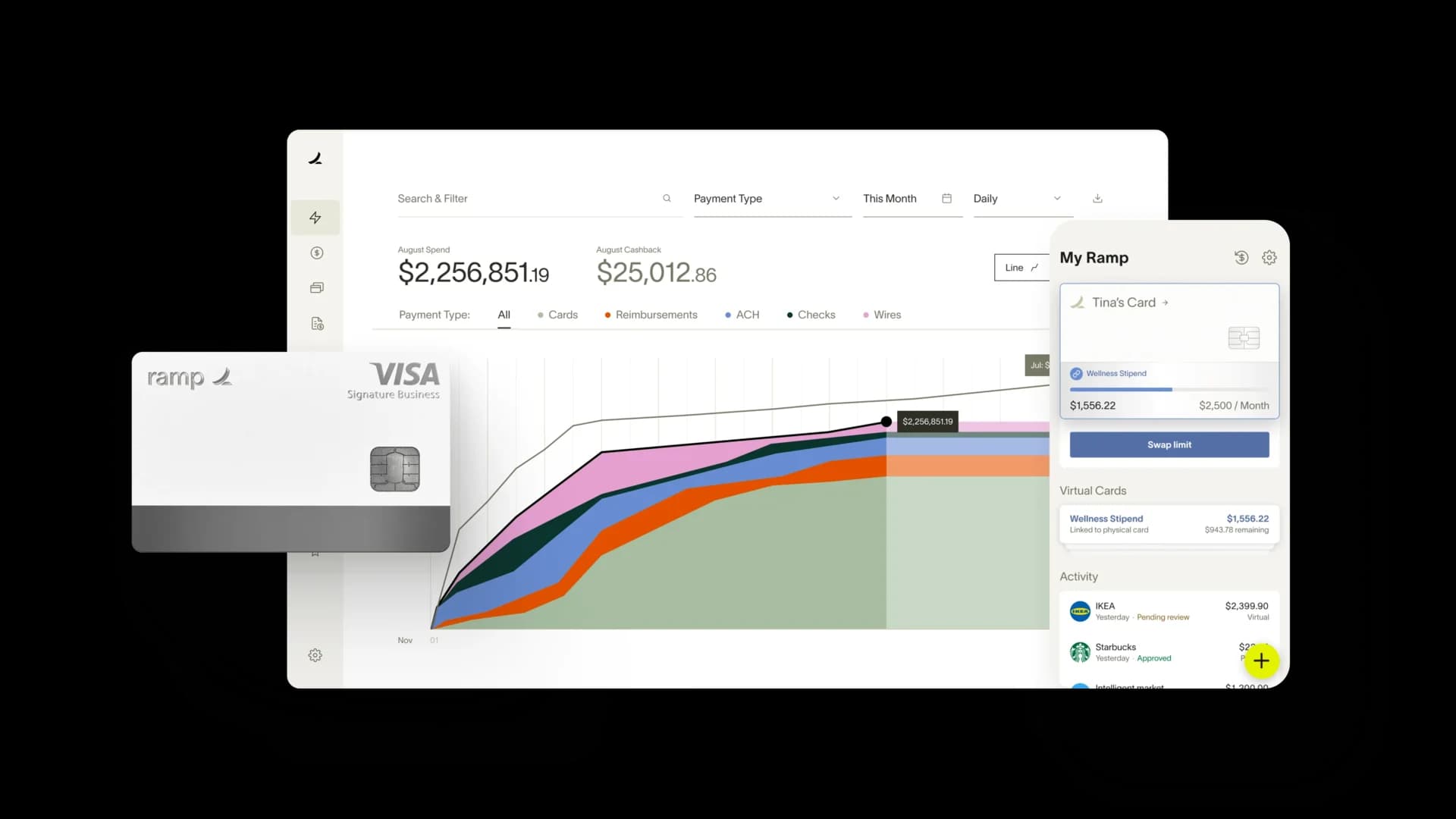

Automate mileage tracking to eliminate logging errors with Ramp

Understanding New Jersey's mileage reimbursement rules really pays off. When you get mileage reimbursement right, it helps in many ways.

- Boost your team's morale, building their trust in you.

- Ensure you do not accidentally violate NJ's Minimum Wage Law.

Ultimately, fair mileage reimbursement ensures that everyone wins — your employees feel appreciated, and you cultivate a loyal, motivated workforce. Wondering how you can streamline this process of mileage tracking and reimbursement? The answer remains intact with Ramp.

With Ramp’s automated AI-powered expense management software, you can minimize logging errors and ensure timely reimbursements for all your employees. By integrating Ramp into your operations, you can maintain accurate mileage records logs, making adhering to state and federal guidelines easier.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘Transportation by personal vehicle (mileage basis)’: https://www.nj.gov/infobank/circular/cir20-04-OMB.pdf

[2] Under the header, ‘34:15-1. employees’ right to recover for negligent injury’: https://www.nj.gov/labor/workerscompensation/assets/PDFs/Forms/wc_law.pdf

[3] Under the header, ‘What is workers' compensation?’: https://www.nj.gov/labor/workerscompensation/assets/PDFs/Forms/WC-373.pdf