New Mexico mileage reimbursement rates

Mileage reimbursement is a way to cover the costs your employees incur when using their personal vehicles for work-related purposes.

In New Mexico, state employees must be reimbursed at the IRS standard mileage rate. While this is mandatory for state employees, you, as a private employer, aren't required by law to offer mileage reimbursement.

Nevertheless, offering mileage reimbursement helps in the following ways.

- Keep your employees motivated.

- Keep your business aligned with the Workers' Compensation Act, which makes mileage reimbursement for injured employees mandatory.

New Mexico business mileage reimbursement rates

In 2026, the mileage reimbursement rate in New Mexico is $0.725 per mile, based on the IRS standard rate.

For private employers, while the law doesn't require you to follow this rate, you should establish a clear policy that fairly addresses mileage expenses for your employees to avoid potential disputes under Section 11.4.3 of the Workers' Compensation Law.

Here's a snapshot of the business mileage reimbursement rates in New Mexico.

| Tax Year | Business mileage reimbursement rate per mile |

|---|---|

| 2026 | $0.725 |

| 2025 | $0.70 |

| 2024 | $0.66 |

| 2023 | $0.47 |

| 2022 | $0.45 |

| 2021 | $0.46 |

| 2020 | $0.46 |

New Mexico mileage reimbursement calculator

Using the mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

New Mexico mileage reimbursement laws

In New Mexico, mileage reimbursement rules vary by employer type. State employees must be reimbursed when using a personal vehicle for approved work-related travel under state travel rules, with rates based on the IRS standard mileage rate. For 2026, that rate is $0.725 per mile.

For private employers, mileage reimbursement is generally optional. One key exception applies under New Mexico’s Workers’ Compensation Act, which requires employers to reimburse mileage when an injured employee travels 15 miles or more, one way, to receive authorized medical care.

New Mexico’s Minimum Wage Act sets a statewide minimum wage of $12.00 per hour. While the law does not specifically require mileage reimbursement, employers should ensure that required work-related expenses—such as frequent business driving—do not reduce an employee’s effective pay below the applicable minimum wage.

Outside of these situations, private employers may set their own mileage reimbursement policies, and many choose to use the IRS rate as a benchmark for consistency and clarity.

Simplify your mileage tracking process with Ramp

Offering mileage reimbursement is not a legal obligation you must fulfill as a private employer in New Mexico. However, offering your employees fair compensation for mileage when they use their vehicles for business duties is beneficial in many ways, as listed below.

- Make sure your business does not violate the Minimum Wage Law and the Workers' Compensation Act.

- Show your employees you value their time and resources.

- Keep your employees motivated by creating a fair workplace.

By implementing clear reimbursement practices, you can avoid disputes, promote fairness, and keep your business running smoothly. That's where Ramp comes in.

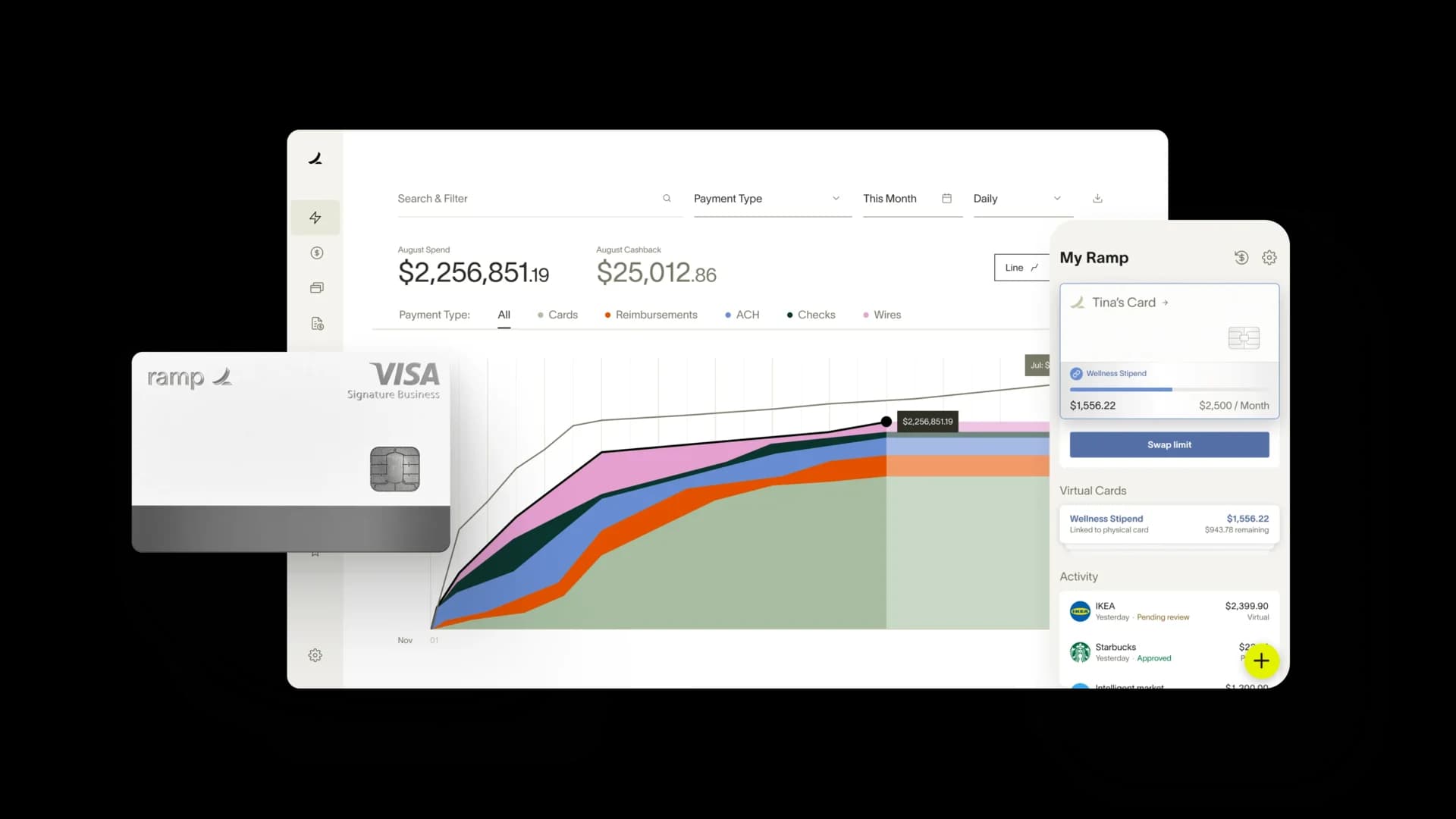

Ramp's AI-powered expense management software automates your mileage tracking and reimbursement processes, eliminating manual entry, reducing errors, and ensuring timely payments.

With Ramp, you can easily track mileage, stay compliant with New Mexico laws, and focus on running your business while keeping your employees satisfied.

See how Ramp automates expense and mileage tracking for 50,000 businesses