Rhode Island mileage reimbursement rates & calculator

Mileage reimbursement helps cover the cost when employees use their personal vehicles for work-related travel and can play a role in supporting team morale. In Rhode Island, state employees must be reimbursed for mileage at rates set by the IRS.

For private employers, mileage reimbursement is generally optional. However, under § 28-33-41 of Rhode Island’s Workers’ Compensation Act, employers are required to reimburse injured employees for travel to rehabilitation or medical facilities at the IRS rate.

Even outside of these requirements, offering fair mileage reimbursement can help ensure employee pay doesn’t fall below the state minimum wage when work-related travel expenses are involved.

Rhode Island business mileage reimbursement rates

The mileage reimbursement rate in Rhode Island for 2026 is $0.725 per mile, set by the IRS for state employees. While you're not obligated to use this rate for your private employees, you must legally reimburse injured workers traveling for rehabilitation at this rate.

Here's a tabulated snapshot of the mileage reimbursement rates as per IRS over the years.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Rhode Island mileage reimbursement calculator

Using the Rhode Island mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received.

Rhode Island mileage reimbursement laws

For state employees, policies like the Office of Accounts and Control Policy A-46ET set the reimbursement rate at the IRS standard. While, as a private employer, you aren't always required to reimburse mileage, the Workers' Compensation Act mandates it.

The Rhode Island Minimum Wage Act can also affect how you handle mileage reimbursement to ensure your employees' wages meet state requirements. Here's a detailed breakdown of all these laws and what they mean for you.

Mileage reimbursement policy A-46ET for state employees

Rhode Island follows Policy A-46ET issued by the Office of Accounts and Control to reimburse state employees for mileage. This policy aligns the state's mileage reimbursement rate with the IRS standard.

Under this policy, state employees are reimbursed for the shortest travel distance between the pickup and drop locations. However, employees may override the calculated distance in specific cases like detours, accidents, or when a more extended route saves time, provided they give a valid reason within the system.

Code § 28-33-41 of the workers' compensation law for mileage reimbursement

As per Code § 28-33-41 of Rhode Island’s Workers' Compensation Act, you must reimburse injured employees for travel expenses related to rehabilitation, including mileage, at the IRS rate. Needless to say, if an injured employee travels to a rehabilitation facility, you're required to cover reasonable transportation costs.

Failure to comply can lead to severe penalties under Code § 28-36-15, including:

- Fines up to $1,000 per day of non-compliance

- Felony charges with imprisonment for up to two years.

Rhode Island minimum wage act and its impact on mileage reimbursement

The Rhode Island Minimum Wage Act (§ 28-12-3) sets the minimum wage at $16.00 per hour.

Though the law doesn't specifically mention mileage reimbursement, the link is clear. When your employees use their personal vehicles for work without adequate mileage reimbursement, their take-home pay can decrease. You can easily avoid this situation by offering a fair mileage reimbursement rate.

Simplify your mileage tracking with Ramp

Understanding Rhode Island's mileage reimbursement laws is crucial for your business. When you offer fair mileage reimbursement, there are little to no chances of accidentally violating the Workers' Compensation Act (§ 28-33-41) and the Minimum Wage Law in Rhode Island.

Here are some more benefits of adopting mileage reimbursement besides legal benefits.

- Boost your team's morale by covering their out-of-pocket expenses.

- Ensure talent retention, which, in turn, will reduce overhead costs.

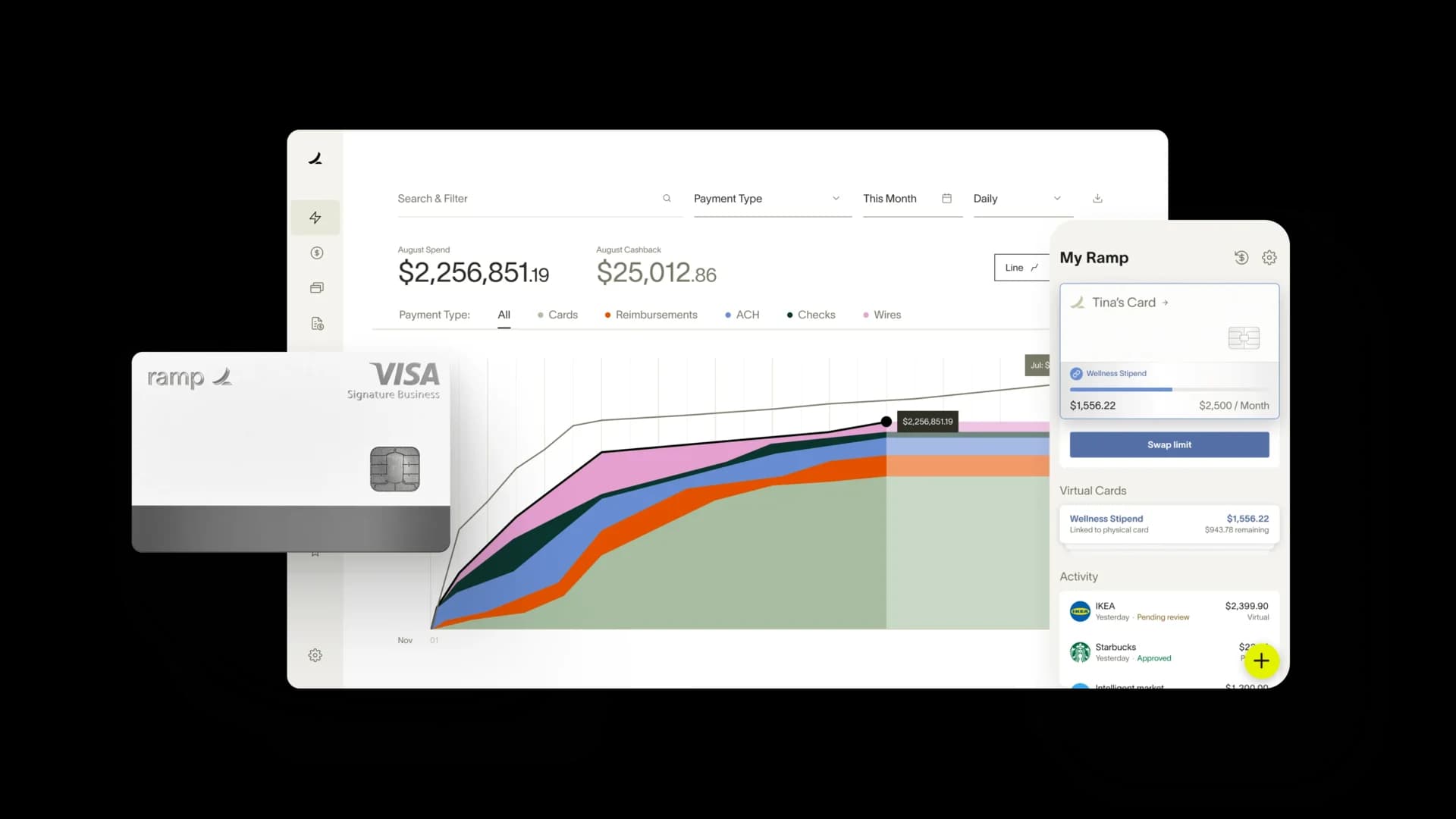

Managing mileage reimbursements can be challenging, but Ramp makes it easier for you. Ramp's AI-powered expense management software streamlines the mileage reimbursement process, allowing you and your employees to track and calculate mileage accurately.

By integrating your mileage tracking with Ramp, you ensure compliance with Rhode Island laws, save time, and enhance transparency—benefiting both your business and your employees.

See how Ramp automates expense and mileage tracking for 50,000 businesses