Utah mileage reimbursement rates & calculator

As an employer, you must grasp that mileage reimbursement — a policy under which you compensate your employees when they use their personal vehicles for work-related travel — creates a stress-free work environment since your employees know they won't pay for business-related mileage from their pockets.

While it is a legal requirement under Utah Code R25-7-16 for state employees, mileage reimbursement is optional for you as a private employer. Yet, offering fair reimbursement helps you achieve the following goals.

- Ensure your business adheres to Utah's Workers' Compensation Provisions under Code Ann. §34A-2-201.

- Keep your business aligned with Utah's Minimum Wage Act

Utah business mileage reimbursement rates

In 2026, Utah reimburses state employees $0.725 per mile for using a personal vehicle for official state business, in line with the IRS standard mileage rate.

For private employers, mileage reimbursement is generally optional. Many businesses choose to align with the IRS standard mileage rate as a benchmark when setting their own reimbursement policies.

Here's a snapshot of the year-on-year mileage reimbursement rates in Utah, per the IRS.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Utah mileage reimbursement calculator

Using the Utah mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Utah mileage reimbursement laws

As a private employer, while offering mileage reimbursement to your employees is not mandatory, understanding its nuances within state guidelines, especially statute R25-7-16, is crucial so your business does not rub the labor law in Utah the wrong way.

Furthermore, Utah's Workers' Compensation code (Utah Code Ann. §34A-2-201) is relevant to you too. This code mandates that all employers cover expenses for travel to medical care when employees suffer work-related injuries.

Here's a closer look at all such statutes and critical regulations that will keep your business aligned with the law.

Mileage reimbursement for state employees under code R25-7-16

Mileage reimbursement for state employees is governed by Code R25-7-16[1], which specifies how they should be compensated when using their own vehicles for business purposes.

While the standardized rate is $0.725 per mile when state employees use private motor vehicles, as per the GSA, the state must:

- Reimburse employees at $0.20.5 per mile if a government-furnished automobile is available

- Offer compensation at $0.705 per mile when employees use private motorcycles

Statute R25-7-16 also outlines that mileage reimbursement is:

- Not offered for regular commuting.

- Restricted to the owner of the vehicle, regardless of how many passengers are present.

For your business, while you are not mandated to follow these exact state standards, adopting similar practices could enhance transparency and fairness in your reimbursement strategy.

Workers' compensation under code §34A-2-201

According to Utah Code Ann. §34A-2-201, all employers, including you – the private ones – are required to reimburse employees for travel expenses related to receiving medical care for work-related injuries.

The Workers' Compensation in Utah includes mileage reimbursement to and from medical facilities, ensuring your employees are not financially burdened by injuries sustained on the job.

Adopt error-free, automated mileage logging with Ramp

Adhering to Utah's mileage reimbursement laws, including Statue R25-7-16 for state employees and Utah Code Ann. §34A-2-201 for your injured employees has many benefits besides ensuring legal compliance.

- Proper reimbursement helps you succeed in creating a transparent and supportive work environment.

- Fair compensation boosts employee satisfaction and retention.

- Supportive approach builds your brand as an employee-first business, booting your sales

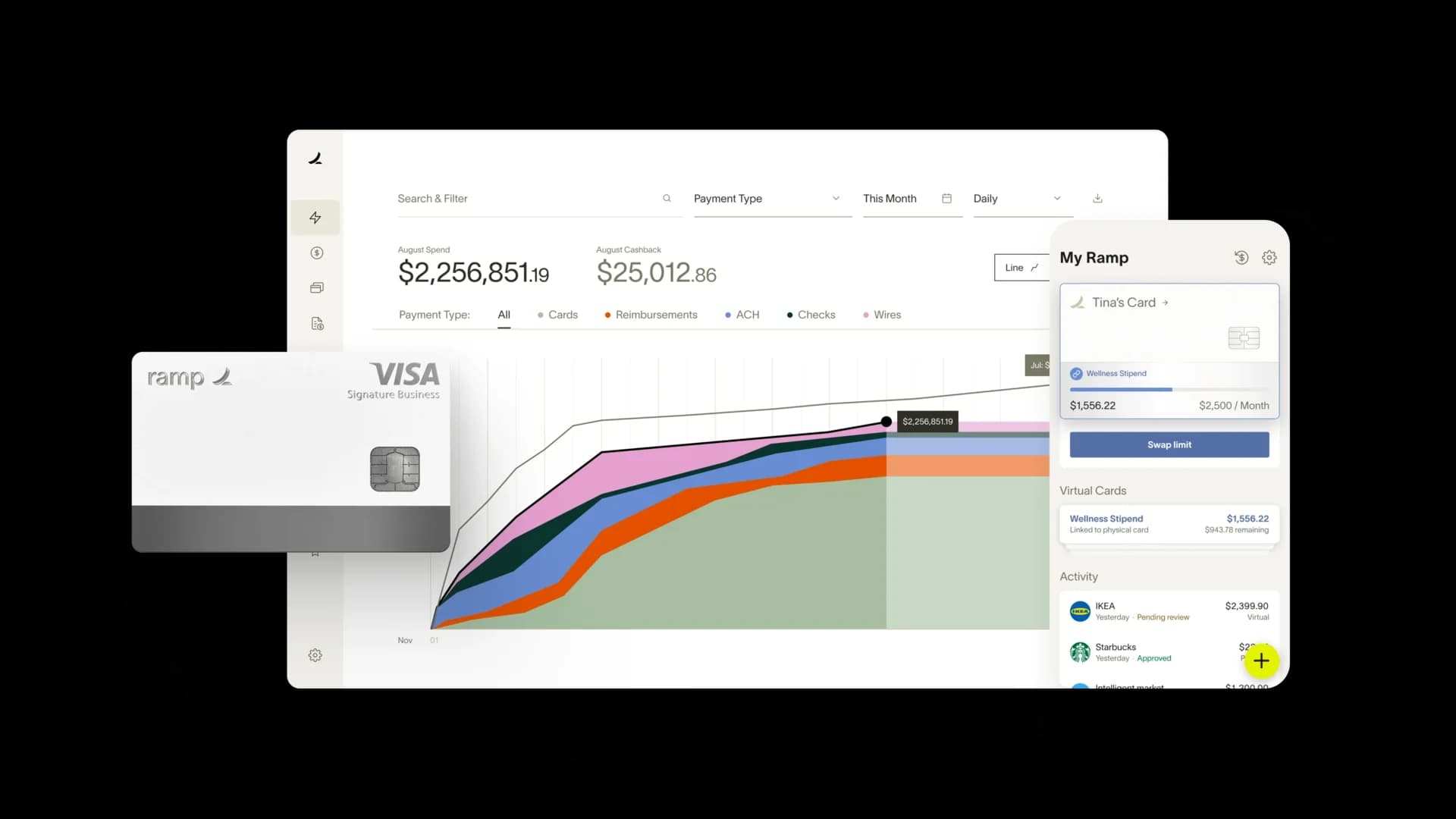

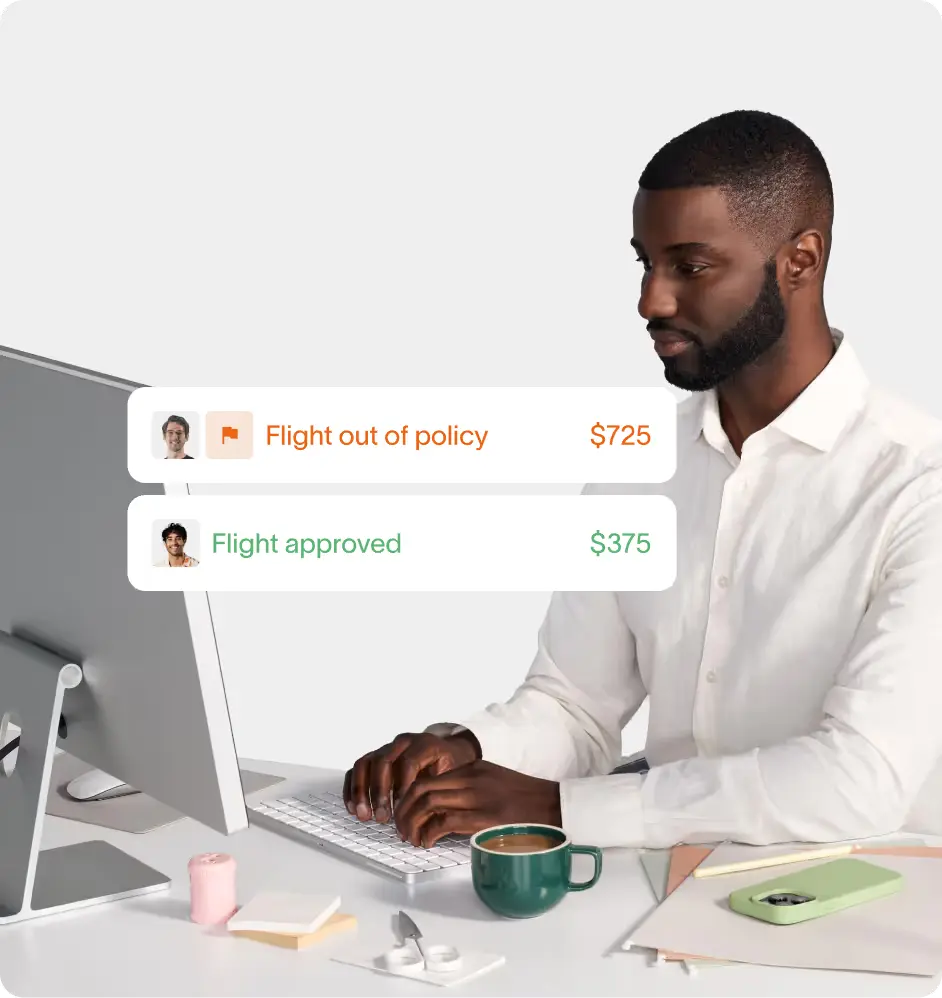

Integrating Ramp into your operations can significantly simplify this entire mileage reimbursement process for you. Ramp's expense management solution is the key — it automates tracking and calculating mileage, reducing administrative burdens and minimizing errors.

With its intuitive interface and robust features, Ramp's expense management software helps you maintain compliance with Utah laws, ensuring every mile is accurately logged and appropriately compensated.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under R25-7-16. Reimbursement for Mileage: https://adminrules.utah.gov/public/rule/R25-7/Current%20Rules?searchText=R25-7