Vermont mileage reimbursement rates & calculator

Mileage reimbursement is essentially a form of compensation for employees who use their personal vehicles for work purposes.

For state employees in Vermont, adhering to statute 10-020-001 ensures they're paid fairly and according to state guidelines. This isn't just about compliance — it's about ensuring your team is taken care of, which can boost their morale.

For those of you running a private business, while it's not mandated to follow statute 10-020-001, following similar guidelines can help in the following ways.

- Keep your team satisfied and productive.

- Ensure your business is compliant with the Vermont Minimum Wage Act.

Vermont business mileage reimbursement rates

In 2026, Vermont state employees are reimbursed at a rate of $0.725 per mile when a state vehicle is unavailable.

Private employers may choose to align their reimbursement policies with the IRS standard rate, which is also $0.725 per mile for this year. Below is a table highlighting the yearly increase in IRS mileage rates for reference.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Vermont mileage reimbursement calculator

Using the Vermont mileage reimbursement calculator is simple.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Vermont mileage reimbursement laws

In Vermont, mileage reimbursement laws are specific and designed to ensure fairness and accountability in compensating employees for business use of personal vehicles.

Central to understanding these laws are statutes like 21 V.S.A. § 384 and Vermont Rule 10-020-001, which set clear guidelines for how you, the employer, should handle mileage reimbursement.

Explore the ins and outs of these and other pivotal Vermont mileage reimbursement laws in the sections below to create a mileage reimbursement policy for your business.

Vermont rule 10-020-001 for state employees' mileage reimbursement

If you're managing state employees, you need to know about Vermont Rule 10-020-001. This rule states that you must reimburse your employees $0.725 per mile when no state vehicle is available.

However, there are a few considerations you should know.

- Reimburse your employees at a rate of no more (or less) than $0.205 per mile if a state vehicle is available but they use their personal cars.

- Reimburse employees who require an adapted van at $0.775 per mile.

Most importantly, this rule covers all miles that are "actually and necessarily traveled" when performing state duties. It excludes mileage for routine travel between home and the duty station.

Mileage reimbursement under workers' mileage comp in Vermont[1]

The Workers' Mileage Compensation Act applies to your employees just as much as it applies to state employees. It dictates reimbursement rules for mileage when your employees travel for medical treatment due to a work-related injury.

Under this compensation, you must ensure the following things.

- Reimburse your employees for travel expenses that include mileage if the travel is essential for receiving necessary medical care.

- Support your employees so work-related injuries do not financially burden them.

Vermont minimum wage act and mileage reimbursement

According to 21 V.S.A §384, the Vermont Minimum Wage Act sets the state's minimum wage at $14.42 per hour and ties these wages to the cost-of-living adjustments annually.

Statute §384 ensures that your employees' wages, including their reimbursement rates for mileage, align with inflation and economic changes. This setup ensures your employees do not pay for mileage when they use their vehicles for business trips out of their own pockets.

Simplify your mileage logs through automated tracking with Ramp

As an employer in Vermont, offering fair mileage reimbursement is more than just ticking specific boxes. It also means you'll be able to achieve the following things.

- Create a transparent and trusting work environment for your employees.

- Align with Vermont's Minimum Wage law, resulting in fewer to no disputes.

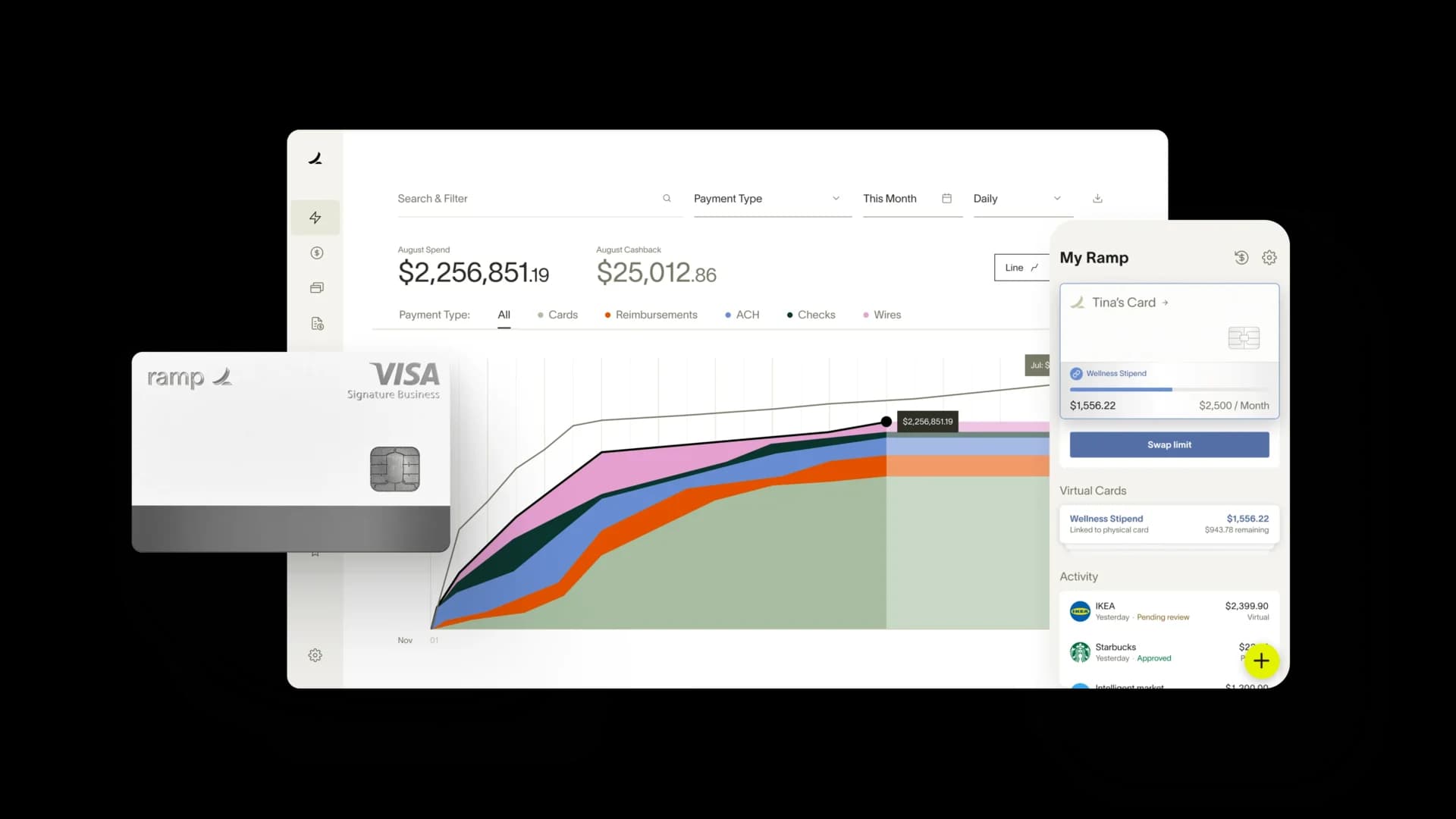

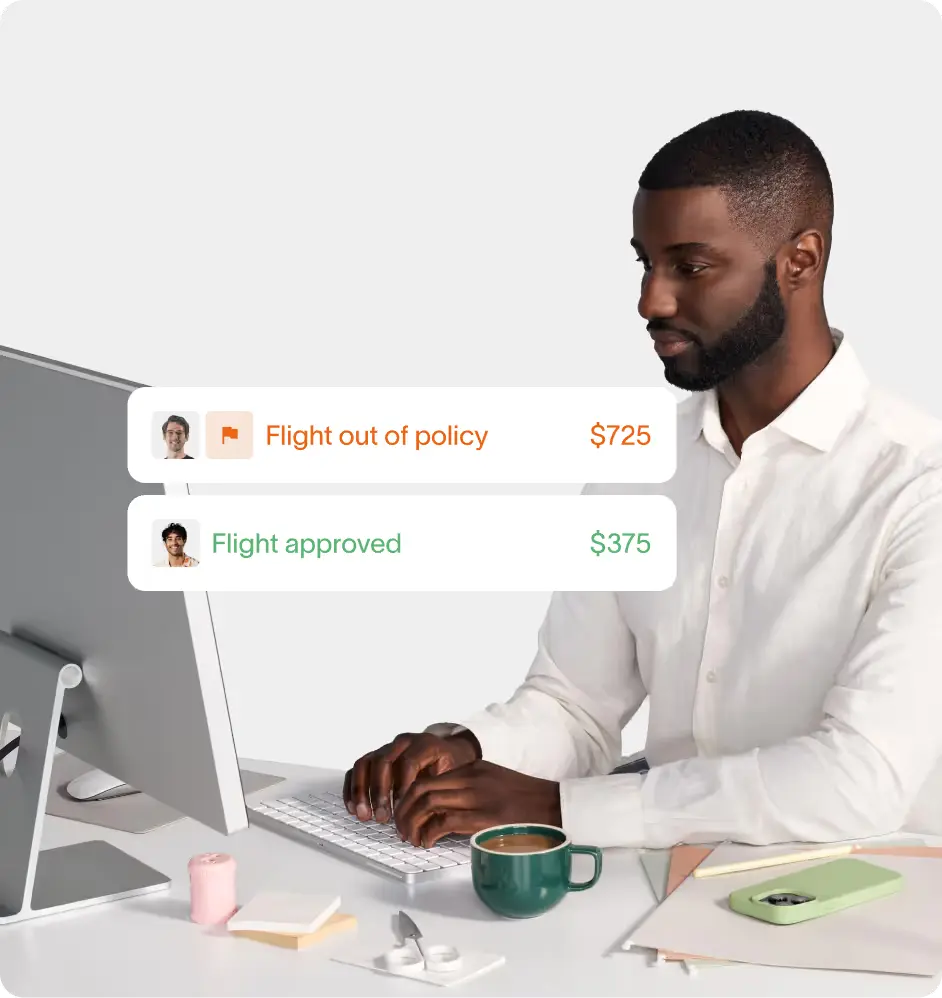

Looking for a tool to track mileage without you doing anything? Ramp can help. Ramp's AI expense management solution automates the mileage tracking and reimbursement process. It logs every mile accurately, so you don't need to deal with paperwork.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘What Other Expenses Will Be Paid?’: https://aoa.vermont.gov/sites/aoa/files/workers-comp/Workers-Comp-Guide.pdf