Washington mileage reimbursement rates & calculator

As an employer in Washington, you're not bound by any state-wide law mandating you to offer mileage reimbursement to private employees using their personal vehicles to carry out office duties. On the contrary, statutes like RCW 43.03.060 ensure state employees are compensated for business travel.

Aligning reimbursement rates with IRS standard rates and mimicking how the state reimburses employees will help your private business in the following ways.

- Ensure compliance with the Washington Minimum Wage Act.

- Build your reputation as a fair workplace for employees.

Washington business mileage reimbursement rates

In 2026, the Washington mileage reimbursement rate for business travel is is $0.725 per mile, which is the IRS standard rate.

Here's a tabulated snapshot of the standard IRS mileage reimbursement rates over the years.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Washington mileage reimbursement calculator

Using the Washington mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Washington mileage reimbursement laws

While state regulations provide clear guidelines for compensating state employees for mileage, the private sector is advised but not mandated by state law to follow suit. Here's a detailed section on the most crucial Washington mileage reimbursement laws.

Washington mileage reimbursement code RCW 43.03.060 for state employees

In Washington, RCW 43.03.060 is critical for state employees using personal vehicles for official business. This law specifies that mileage reimbursement must cover all necessary travel, not just the daily commute to and from work. It includes the following.

- Trips between different work sites

- Travel to conferences or meetings outside of the usual workplace,

- Every other travel that's required to perform official duties.

The Washington minimum wage act (WMWA)

While WMWA primarily addresses wage standards, it indirectly impacts mileage reimbursement and applies to you as a private employer.

For instance, the Act specifies that wages, including effective compensation for mileage for business travel, must meet or exceed the local minimum wage rates, which, as of 2026, stand at $17.13 per hour in most cities in Washington.

Remember that as a private employer in Washington, you are legally obligated to provide mileage reimbursement; otherwise, you are dropping the minimum wages of your employees below the state minimum.

Washington mileage reimbursement rates vs the federal law

Under federal law, specifically the Fair Labor Standards Act (FLSA), you are not required to reimburse for mileage. However, the FLSA does mandate that if the cost of using a personal vehicle for work purposes dips an employee's earnings below the minimum wage of $7.25 per hour, you must compensate to bring the earnings up to at least the federal minimum.

Washington State, too, does not universally mandate mileage reimbursement in the private sector but does provide regulations under certain conditions, especially for state employees, as noted in RCW 43.03.060.

As a private employer in Washington, it is your responsibility to ensure that your employees' minimum wages do not dip below the state minimum, which is much higher than the federal minimum.

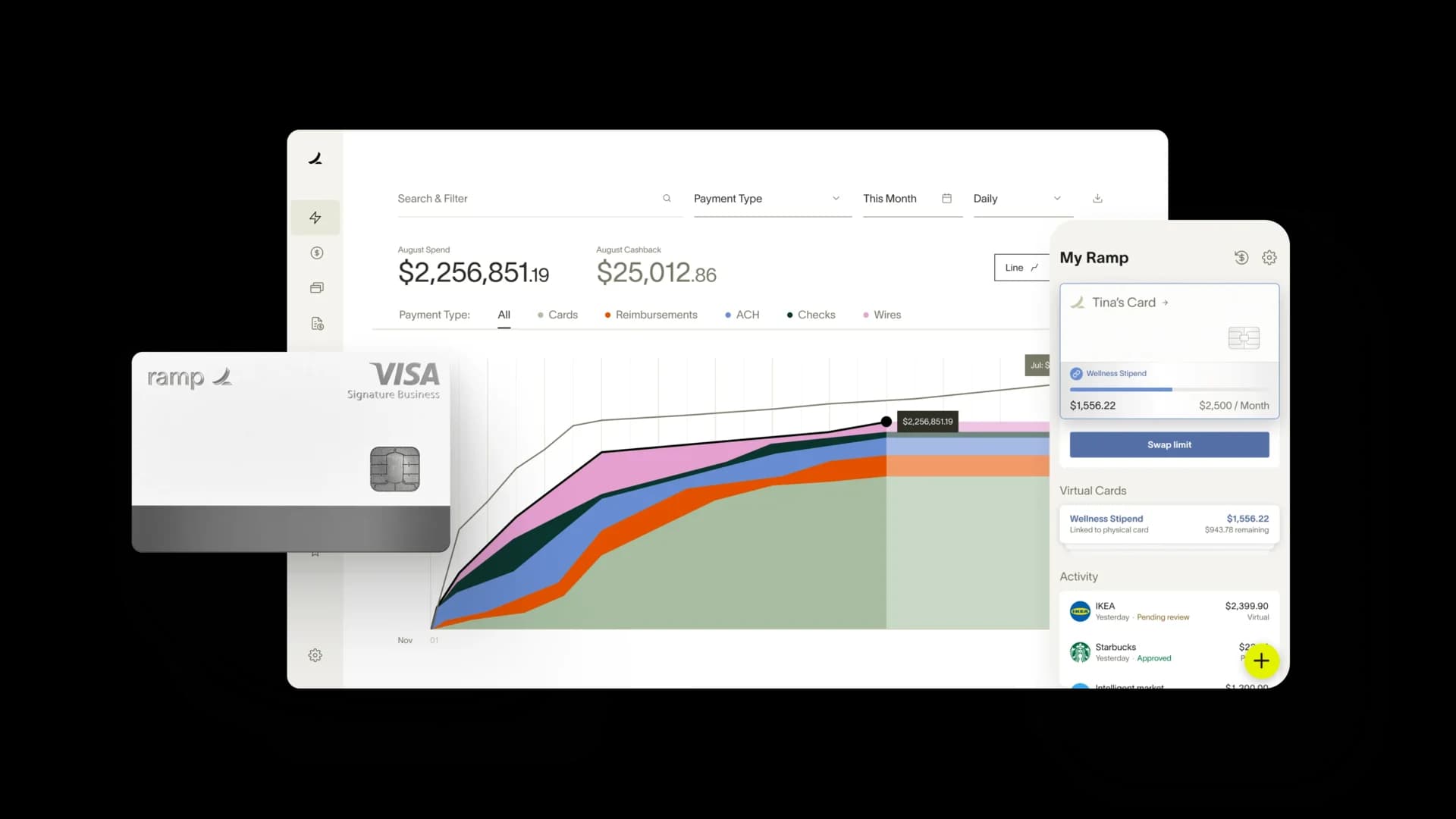

Automate mileage reimbursement with Ramp

As a Washington employer, keeping up with the state's detailed mileage reimbursement requirements is essential. In Washington, the mileage reimbursement laws and the Minimum Wage Act are particularly stringent, with minimum wages varying slightly in Seattle, SeaTac, and Tukwila.

In fact, when you follow Washington's mileage reimbursement laws, even though they do not legally bind the private sector, you stay above board and keep your workforce motivated. These rules aren't just about compliance — they directly impact your relationship with your employees, ensuring fair compensation for their travel expenses.

Ramp offers a seamless solution to manage these complexities. By automating mileage tracking, our AI-driven expense management software adapts to the unique standards of Washington, simplifies your workflow, and fairness in reimbursements, directly benefiting your team's morale and your operational efficiency.

See how Ramp automates expense and mileage tracking for 50,000 businesses