Wisconsin mileage reimbursement rates & calculator

Understanding mileage reimbursement laws that impact your team is essential to run your business within the lines etched by the law. The key regulation in this regard is Statute 20.916, which details mandatory mileage reimbursement for state employees.

As for you as a private sector employer, mileage reimbursement isn't mandated, but adhering to the state guidelines can:

- Keep your employees stress-free as they won't be paying for work-related miles they drive from their own pockets.

- Enhance fairness and employee retention.

Furthermore, fair mileage reimbursement helps ensure employee earnings remain above the federal minimum wage, a legal requirement in Wisconsin for all sectors.

Wisconsin business mileage reimbursement rates

In 2026, the IRS standard mileage rates are recommended for Wisconsin businesses; however, as a private employer, you are not required to adopt them. The current Wisconsin business mileage rates are $0.725 per mile for personal vehicles and $0.705 per mile for motorcycles.

Here's a table detailing the yearly changes of mileage reimbursement rates.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Wisconsin mileage reimbursement calculator

Using the Wisconsin mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Wisconsin mileage reimbursement laws

Understanding key Wisconsin statutes, including 20.916 and the broader context of the minimum wage under 104.035, are foundational for you, even though you are not mandated by the law to reimburse your employees as a private employer. Find below the detailed explanation of all these pivotal Wisconsin mileage reimbursement laws.

Statute 20.916 for mileage reimbursement to state employees[1]

Under Wisconsin Statute 20.916, state officers and employees are entitled to reimbursement for actual, reasonable, and necessary traveling expenses incurred while performing their duties.

This includes situations where employees are temporarily stationed away from their usual work location and must travel to an official location for temporary service.

It's worth noting that the Division of Personnel Management sets these reimbursement rates biennially, which are approved by the Joint Committee on Employment Relations.

Additional reimbursement may be provided for using personal vehicles under conditions that cause excessive wear or require emergency use. This includes situations like pulling trailers or installing special equipment necessary for state duties.

Mileage reimbursement for workers' compensation claimants

The Workers' Compensation Claimants applies to you as a private employer too. This law mandates that if your employees – who were injured during work – travel for medical treatments or vocational rehabilitation, they should be reimbursed at the same rate as state employees for business travel.

This uniform travel rate is periodically adjusted by the Department of Administration's Division of Personnel Management, with oversight from the Joint Committee on Employment Relations. This law, which you need to follow, is the state's way of supporting employees during their recovery.

Statute 104.035 for minimum wage and mileage reimbursement[2]

When your employees use their personal vehicles for business-related travel, you need to ensure that their earnings, after accounting for mileage costs, do not fall below the state-mandated minimum wage. Under Statute 104.035, Wisconsin has set the employee's minimum wage at $7.25 per hour.

When you keep meticulous records of the mileage reimbursements and regular wages of your employees, you can:

- Maintain clear financial records

- Protect your business in case of any disputes or audits by state labor departments.

Track the miles your employees drive automatically with Ramp

Wisconsin's mileage reimbursement laws are crucial for ensuring compliance with the Minimum Wage Law and supporting your team effectively. Proper reimbursement ensures that:

- You fairly compensate your employees for mileage.

- Your workplace has an atmosphere of positivity and trust.

- Your business is at no risk of costly legal issues by ensuring the minimum wages are above the federal minimum in case a dispute occurs.

- You are building a positive reputation for your business.

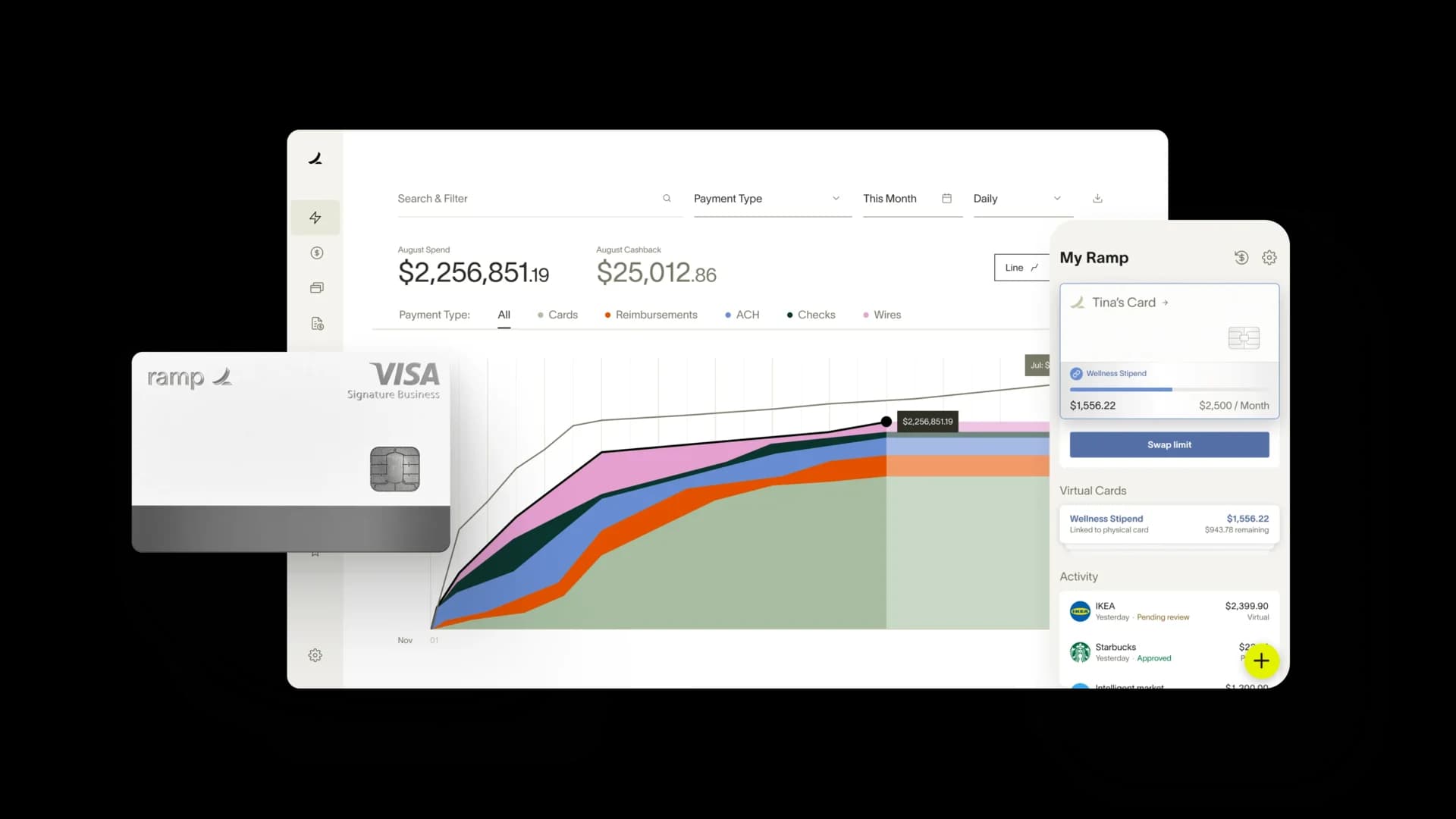

Ramp offers a powerful AI-driven expense management software to streamline the mileage reimbursement process. By automating mileage tracking, Ramp's software ensures that all travel is logged accurately and effortlessly. This simplifies the administrative workload and reduces discrepancies in mileage logging.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under, ‘20.916 traveling expenses’: https://docs.legis.wisconsin.gov/statutes/statutes/20/x/916#:~:text=20.916%20Traveling%20expenses.,duties%20in%20accordance%20with%20sub

[2] Under, ‘104.035 minimum wage’: https://docs.legis.wisconsin.gov/statutes/statutes/104