Calculate Colorado's per diem allowance for your business travel

Per diem rates are a key part of managing business travel, offering set expense reimbursement amounts for lodging, meals, and incidental expenses. They ensure fair compensation for employees and help control travel spending.

Although travel costs in Colorado are generally stable, some cities have seasonal rate variations. Being aware of these changes can help you better plan your travel and manage costs more effectively. Clear guidelines simplify reporting and ensure your business stays compliant with federal regulations.

Colorado per diem calculator

Enter your travel dates and destination details, including location, county, and city, to calculate your per diem allowance in Colorado.

Per diem rates in Colorado

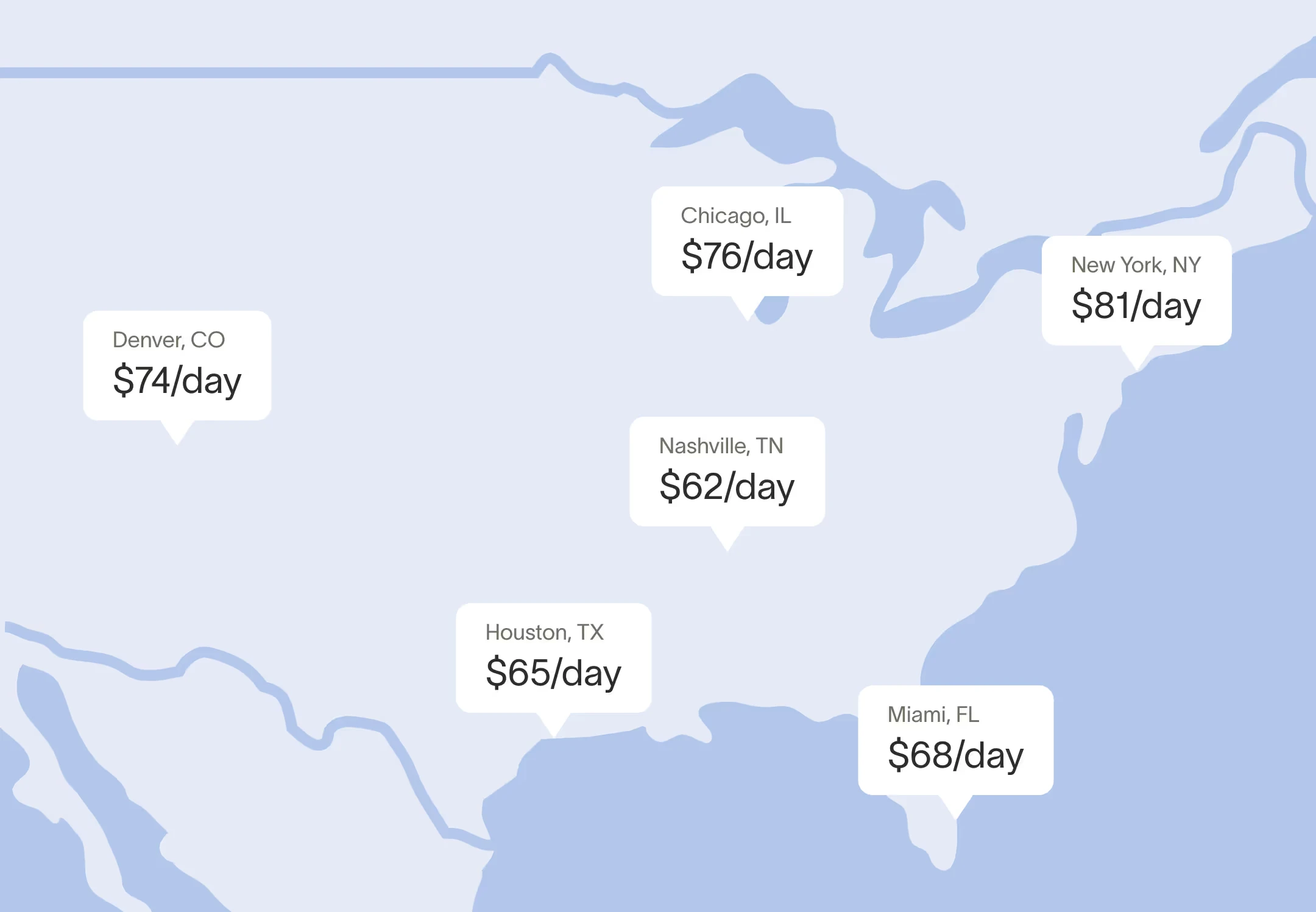

If you're traveling to a city in Colorado without a specific per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply. The General Services Administration (GSA) sets these rates, which are effective from October 2025 to September 2026.

For cities with specific rates, the GSA provides fixed per diem amounts to reflect local cost differences, such as Denver. Here are the Colorado cities with specific per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Adams | $215 | $165 | $165 | $165 | $165 | $165 | $215 | $215 | $215 | $215 | $215 | $215 |

| Arapahoe | $215 | $165 | $165 | $165 | $165 | $165 | $215 | $215 | $215 | $215 | $215 | $215 |

| Boulder | $173 | $125 | $125 | $125 | $125 | $125 | $125 | $173 | $173 | $173 | $173 | $173 |

| Broomfield | $173 | $125 | $125 | $125 | $125 | $125 | $125 | $173 | $173 | $173 | $173 | $173 |

| Denver | $215 | $165 | $165 | $165 | $165 | $165 | $215 | $215 | $215 | $215 | $215 | $215 |

| Douglas | $111 | $111 | $111 | $111 | $111 | $111 | $111 | $111 | $142 | $142 | $142 | $111 |

| Eagle | $201 | $201 | $397 | $397 | $397 | $397 | $201 | $201 | $201 | $201 | $201 | $201 |

| El Paso | $123 | $123 | $123 | $123 | $123 | $123 | $123 | $123 | $168 | $168 | $168 | $123 |

| Grand | $145 | $145 | $173 | $173 | $173 | $173 | $122 | $122 | $145 | $145 | $145 | $145 |

| Gunnison | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 | $154 |

| Jefferson | $215 | $165 | $165 | $165 | $165 | $165 | $215 | $215 | $215 | $215 | $215 | $215 |

| La Plata | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $121 | $184 | $184 | $184 | $184 |

| Larimer | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $140 | $140 | $140 | $110 |

| Montezuma | $133 | $110 | $110 | $110 | $110 | $110 | $110 | $133 | $133 | $133 | $133 | $133 |

| Montrose | $185 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $185 | $185 | $185 | $185 |

| Pitkin | $207 | $207 | $407 | $407 | $407 | $407 | $207 | $207 | $207 | $207 | $207 | $207 |

| Routt | $132 | $132 | $288 | $288 | $288 | $288 | $123 | $123 | $179 | $179 | $179 | $179 |

| San Miguel | $184 | $184 | $350 | $350 | $350 | $350 | $184 | $184 | $184 | $184 | $184 | $184 |

| Summit | $162 | $162 | $282 | $282 | $282 | $282 | $162 | $162 | $162 | $162 | $162 | $162 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Adams | $92 |

| Arapahoe | $92 |

| Boulder | $80 |

| Broomfield | $80 |

| Denver | $92 |

| Douglas | $80 |

| Eagle | $92 |

| El Paso | $86 |

| Grand | $86 |

| Gunnison | $86 |

| Jefferson | $92 |

| La Plata | $80 |

| Larimer | $80 |

| Montezuma | $74 |

| Montrose | $74 |

| Pitkin | $92 |

| Routt | $92 |

| San Miguel | $92 |

| Summit | $92 |

Automate travel spend controls based on per-diem rates

Following per diem rates keeps your business compliant with state and federal regulations, reducing the risk of non-compliance while maintaining transparency in travel expenses. This clear approach also helps prevent potential conflicts for your employees.

Ramp lets you set location-specific per diem rates, making compliance and travel expense management seamless. Employees can track their allowances in real time, helping them stay on budget and understand their entitlements.

With GSA rate integration and customizable multipliers, Ramp takes the hassle out of per diem management for admins and employees, streamlining travel expenses and keeping everything compliant.

Simplify your business travel from booking to expense tracking with Ramp