Calculate Washington’s per diem allowance for your business travel

Managing travel expenses in Washington requires attention to the state’s diverse regions, from urban hubs like Seattle to more rural areas. Washington’s per diem rates provide standardized allowances for lodging, meals, and incidental expenses, helping businesses budget accurately and ensure fair reimbursements.

Incorporating these rates into your corporate travel policy supports compliance and provides a clear, predictable approach to travel expenses for both employees and employers.

Washington per diem calculator

Input the dates of your business travel, along with the location, county, and city, to calculate your per diem allowance.

Washington per diem rates

If you're traveling to a city in Washington without a specific per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply. These rates are set by the General Services Administration (GSA) and are effective from October 2025 to September 2026.

For cities with location-specific rates, the GSA provides fixed per diem amounts to account for cost variations, such as Seattle. Here are the Washington cities with specific per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Benton | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 |

| Clallam | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $235 | $235 | $137 |

| Clark | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 |

| Cowlitz | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 |

| Franklin | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 |

| Grays Harbor | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $132 | $132 | $110 |

| Jefferson | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $137 | $235 | $235 | $137 |

| King | $188 | $188 | $188 | $188 | $188 | $188 | $188 | $188 | $248 | $248 | $248 | $248 |

| Pierce | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 |

| Skamania | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 |

| Snohomish | $113 | $113 | $113 | $113 | $113 | $113 | $113 | $113 | $140 | $140 | $140 | $113 |

| Spokane | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 |

| Thurston | $128 | $128 | $151 | $151 | $151 | $151 | $151 | $151 | $151 | $175 | $175 | $128 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Benton | $86 |

| Clallam | $92 |

| Clark | $86 |

| Cowlitz | $86 |

| Franklin | $86 |

| Grays Harbor | $86 |

| Jefferson | $92 |

| King | $92 |

| Pierce | $86 |

| Skamania | $86 |

| Snohomish | $86 |

| Spokane | $86 |

| Thurston | $80 |

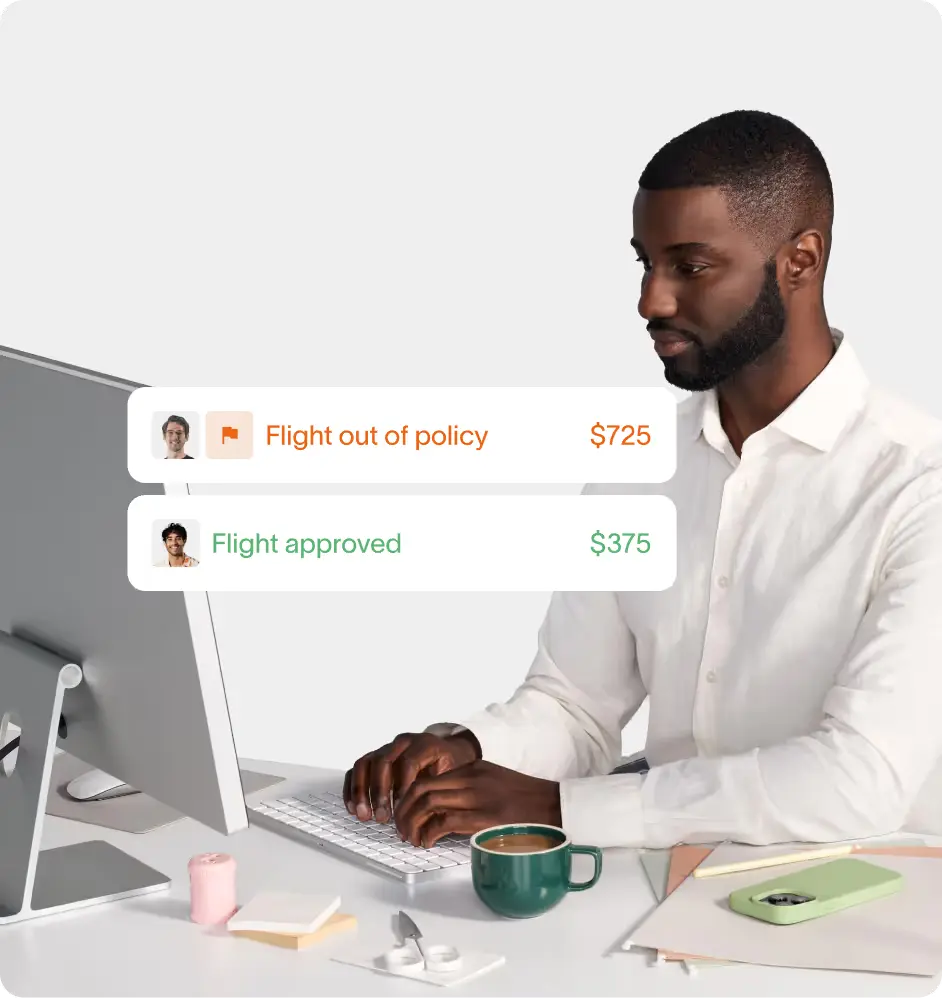

Effortlessly manage business travel, from booking to tracking

Adhering to Washington’s per diem rates is key for accurate expense reporting and maintaining compliance with financial regulations. These rates help keep business travel costs within allowable limits, supporting fair and transparent reimbursements for employees while avoiding unexpected expenses.

Ramp simplifies travel expense management by automating per diem rate settings tailored to Washington’s specific requirements. Employees have on-the-go access to their allowances, helping them stay within budget without added effort. Features such as GSA rate integration, adjustable policies, and real-time expense tracking provide a streamlined experience that keeps travel expenses organized and compliant for both your team and finance department.

Simplify your business travel from booking to expense tracking with Ramp