- An overview of Stampli and Bill

- Stampli vs. BILL: Feature comparison by tier

- Stampli vs. BILL: Pricing and customer experience

- How to choose between Stampli and BILL

- Ramp Bill Pay: The best alternative to Stampli and BILL

- Choosing AP automation that grows with your business

Stampli and BILL are two common names known to provide accounts payable automation software. Both aim to simplify invoice approvals and streamline payments—but they differ in approach, focus, and fit. As finance teams evaluate tools to reduce manual work and gain better visibility into cash flow, it’s worth comparing how these platforms stack up.

Let’s break down the core capabilities, pricings, and G2 ratings of each.

An overview of Stampli and Bill

Before diving into features or limitations, it helps to understand what each platform is built for—and which types of teams they tend to support.

What is Stampli?

Stampli is a cloud-based accounts payable platform founded in 2015. It’s built for small to mid-sized businesses, with a focus on companies that rely heavily on collaboration between departments during invoice approvals.

Stampli provides teams with centralized invoice-related communication, automates data capture, and route approvals. Its core capabilities also include purchase order matching and integrations with ERP systems.

What is BILL?

BILL (formerly Bill.com) is a cloud-based financial operations platform launched in 2006. It primarily serves small to mid-sized businesses and supports automation across accounts payable, accounts receivable, and expense management.

For accounts payable, BILL offers invoice capture, approval workflows, payment scheduling, and multiple payment options. It also integrates with accounting tools to help finance teams reduce manual work and maintain visibility into cash flow.

Stampli vs. BILL: Feature comparison by tier

While both platforms aim to streamline accounts payable, their features differ in key areas—especially as businesses scale or require deeper ERP integration. Here’s how Stampli and BILL compare across their respective plans.

Stampli features

Stampli does not offer separate tiers for its accounts payable software. Instead, its core features and pricing are tailored to each business and may vary based on specific needs. Here are the AP features it provides:

- Unlimited, fully automated invoice capture

- Contract flexibility on a monthly or annual contract

- Unlimited vendors, entities, and locations

- PO matching that includes semi-automated 2-way and 3-way matching and full automation with Stampli’s built-in AI capabilities

- Insights that include 12 pre-built reports and interactive dashboards

- A Customer Success Manager and support from AP and ERP experts

- Onboarding and team training

Other features that Stampli provides includes:

- Domestic check and ACH payments, global ACH and wire transfers, virtual cards, and the the ability to pay using any method via Stampli Direct Pay

- A free Stampli Credit Card for Stampli customers; includes both virtual and physical cards, expense management, and a mobile app

- A vendor portal, in-platform messaging, onboarding tools, and document compliance

BILL features

BILL, on the other hand, offers four pricing tiers. Here's what's included in their starting plan:

- Enter and manage bills from a centralized inbox

- Provides standard approval policies and automates approval workflows

- Pay by ACH, virtual card, credit card, and get paid by ACH and credit card

- Access to BILL’s vendor network

- Payable insights

- 6 standard user roles

- Send, track, and create custom invoices

- Automate payment reminders

- Set auto-charge and auto-pay

- QuickBooks Online, Pro, Premiere and Xero via manual CSV import/export

- API access

And here are the following features that are added at each higher tier, with all previous tier features included:

Team | Corporate | Enterprise |

|---|---|---|

Custom user roles QuickBooks Online, Pro, Premiere and Xero via *automatic 2-way sync Cash flow forecasting for QBO users | Custom approval policies Discounts for approver-only users Single sign-on Multi-entity, multi-location accounting capabilities | QuickBooks Enterprise, Oracle NetSuite, Sage Intacct, and Microsoft Dynamics via *automatic 2-way sync Dual control Premium phone support |

As with any SaaS solution, features may evolve over time. This comparison focuses on core AP automation capabilities.

Stampli vs. BILL: Pricing and customer experience

Costs and user experience often differ based on a company’s size, industry, and internal processes. Here’s how Stampli and BILL compare in terms of pricing and what users have shared about their experiences on G2.

How much does Stampli cost?

Stampli uses a bundled pricing model based on invoice volume, user licenses, and specific features like ERP integrations. While public pricing isn’t available, businesses can request a tailored quote through Stampli’s sales team. Costs may vary depending on the number of entities, system integrations, or support needs.

How much does BILL cost?

BILL offers a tiered pricing structure, with the Essentials plan starting at $45 per user per month, the Team plan at $55, and the Corporate plan at $79. For businesses with more complex needs, BILL provides an Enterprise plan with custom pricing.

Pricing may also fluctuate based on discounts or annual commitments.

Why do customers choose Stampli?

Based on G2 feedback, customers appreciate Stampli’s ability to manage approvals across multiple business units. Users highlight the search functionality for audits and responsive customer support as major benefits.

Why do customers choose Bill?

Based on feedback available on G2, reviewers note that BILL’s AP and AR automation reduces manual work and improves cash flow visibility. Users also mention responsive customer support as added benefits for day-to-day operations.

How to choose between Stampli and BILL

When comparing AP automation platforms, it helps to evaluate how each one fits your business’s size, workflows, and industry needs. Here are some key differences in ratings, customer focus, and platform strengths.

Criteria | Stampli | BILL |

|---|---|---|

G2 rating | 4.6 | 4.4 |

Business size | Small to mid-sized businesses | Small to mid-sized businesses |

Industry types | Manufacturing, construction, healthcare | Accounting, nonprofit, financial services |

Overall pros | AI-driven invoice capture and routing Customizable approval workflows Integrates with multiple ERP systems | Simple setup and ease of use Provides both automated AP/AR features Pricing options suited for smaller teams |

Overall cons | No built-in tax compliance tools Less flexible with vendor management settings Some users report ACH payments taking longer than other systems | No built-in tax compliance tools Limited international payments Integration challenges with some ERPs |

After comparing Stampli and BILL, it’s clear both offer solutions catered to SMBs. But if you're looking for an alternative with stronger control and cost-efficiency, Ramp could be a better fit for your finance team.

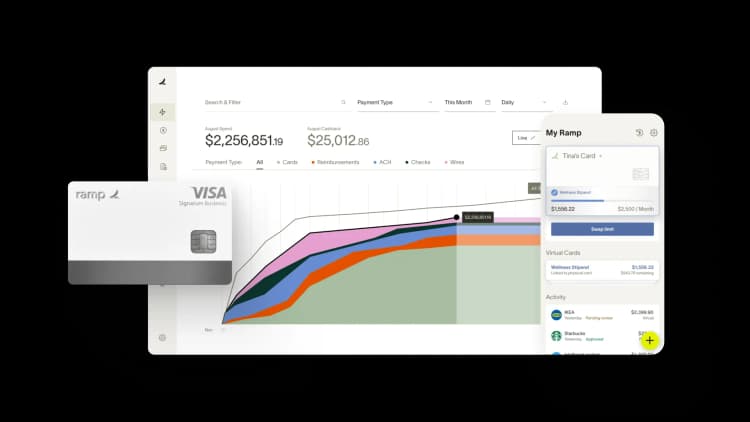

Ramp Bill Pay: The best alternative to Stampli and BILL

Stampli and BILL each offer valuable AP features, Ramp Bill Pay delivers a more comprehensive solution built on autonomous automation and unified spend management.

Ramp Bill Pay is autonomous AP software that converts manual work into touchless workflows. From invoice receipt to final payment, the platform runs on autopilot. Four AI agents manage coding, fraud detection, approvals, and card payment execution—removing your team from repetitive tasks.

OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than legacy systems1, reducing both costs and errors. Up to 95% of companies also report better visibility when using Ramp2.

Ramp Bill Pay works as a standalone AP solution or as a unified system that connects Ramp corporate cards, expense management, and procurement tools for complete spend control.

Here’s a closer look at Ramp Bill Pay’s AP features:

- Auto-coding agent: Uses historical patterns and invoice details like product IDs and descriptions to assign GL codes instantly

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy

- Automated PO matching: Compares invoices to purchase orders with 2-way and 3-way matching to catch overbilling

- Real-time ERP sync: Connects vendor data bidirectionally with 10 ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct for audit-ready books

- Custom approval workflows: Creates multi-level approval chains with role-based routing matching your org structure

- Approval orchestration: Cuts clicks, boosts visibility, and speeds processing across reviewers

- Corporate cards: Issues physical and virtual cards with built-in spend controls

- Automatic card payments agent: Finds card-eligible invoices, enters card details into vendor portals, and captures cashback automatically

- Expense management: Captures receipts, automates reimbursements, and enforces policies in one place

- Procurement: Manages purchase requests and vendor approvals before spend happens

- Real-time invoice tracking: Provides visibility from invoice receipt through payment

- Reconciliation: Automatically matches transactions for faster book closing

- GL coding: Assigns transactions to correct accounts with AI assistance

- Fraud prevention agent: Flags suspicious activity like unexpected bank changes and unverified vendor accounts before payment

Choosing AP automation that grows with your business

Stampli and BILL each serve different segments—one prioritizing collaboration and AI, the other focusing on AP and AR. But for companies looking to centralize AP while gaining more control and visibility, Ramp offers a modern, flexible alternative that scales with your needs.

Ramp Bill Pay shows what modern AP automation should deliver—accuracy, autonomous processing, touchless workflows, and speed. Over 2,100 verified G2 reviews give Ramp a 4.8-star average, with finance teams calling it one of the easiest AP platforms to use.

Get started. See how Ramp Bill Pay can simplify AP for teams of any size—without the extra complexity.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits