The top 5 Melio competitors and alternatives for AP automation in March 2026

- 1. Ramp Bill Pay: Best overall Melio alternative

- 2. Sage Intacct

- 3. Stampli

- 4. SAP Concur

- 5. Tipalti

- Choose the best-rated Melio alternative

If you’ve been searching for accounts payable (AP) automation software, chances are you’ve come across Melio. Melio is a platform that offers small and mid-sized businesses a simple way to manage and pay bills online.

While Melio is flexible, it’s not the only option out there. Melio has generally favorable ratings on G2, a software review website, with a 4.5 out of 5 star rating based on roughly 200 reviews. It’s always a good idea to compare alternatives to ensure you’re getting the features, scalability, and control your business needs.

To help you do just that, we’ve reviewed some of the top-rated AP automation platforms while observing user ratings on G2. Here are our top picks for Melio alternatives:

- 1. Ramp

- 2. Sage Intacct

- 3. Stampli

- 4. SAP Concur

- 5. Tipalti

Is Melio the right platform for your business? Here’s a full breakdown of our top 5 picks for Melio alternatives and competitors to choose from in 2026.

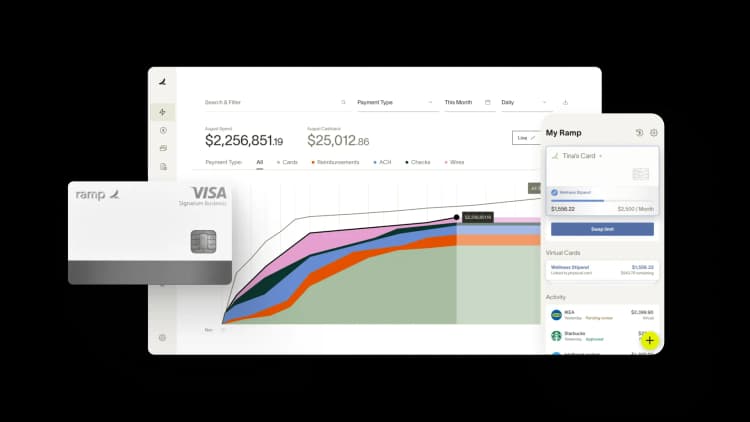

1. Ramp Bill Pay: Best overall Melio alternative

Ramp Bill Pay is autonomous AP software that turns manual work into touchless workflows. Its OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than traditional platforms1, cutting AP processing costs and eliminating errors.

While Melio focuses primarily on payments, Ramp addresses the full scope of AP challenges—manual data entry, approval bottlenecks, fragmented systems, and limited visibility. Ramp eliminates the back-and-forth of tracking down invoices, prevents late payments and duplicate bills, and gives you the controls to ensure every dollar aligns with company goals.

You can use Ramp Bill Pay as standalone AP software, or connect it with Ramp's corporate cards, expense management, and procurement tools for complete spend oversight. Up to 95% of companies even report better visibility into their finance operations after using Ramp2.

Ramp earns a 4.8-star rating on G2 from over 2,100 verified reviews, with finance teams consistently calling it one of the most intuitive AP platforms available. In comparison, Melio’s G2 rating is 4.5 out of 5 stars.

Key features

- Auto-coding agent: Uses historical patterns and invoice details like product IDs and descriptions to assign GL codes instantly

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy

- Automated PO matching: Compares invoices to purchase orders with 2-way and 3-way matching to catch overbilling

- Real-time ERP sync: Connects vendor data bidirectionally with ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct for audit-ready books

- Custom approval workflows: Creates multi-level approval chains with role-based routing matching your org structure

- Automatic card payments agent: Finds card-eligible invoices, enters card details into vendor portals, and captures cashback automatically

- Reconciliation: Automatically matches transactions for faster book closing

- Approval orchestration: Cuts clicks, boosts visibility, and speeds processing across reviewers

- Real-time invoice tracking: Provides visibility from invoice receipt through payment

- Corporate cards: Issues physical and virtual cards with built-in spend controls

- Expense management: Captures receipts, automates reimbursements, and enforces policies in one place

- Procurement: Manages purchase requests and vendor approvals before spend happens

- Fraud prevention agent: Flags suspicious activity like unexpected bank changes and unverified vendor accounts before payment

- AI-powered 1099 prep: Automatically categorizes bill pay spend into 1099-NEC and 1099-MISC boxes with calculations

- One-click IRS filing: Submits filings to IRS and states in minutes without extra portals

- Batch payments: Processes multiple vendor payments at once

Why customers choose Ramp vs. Melio

Customers who choose Ramp over Melio typically want more than just a payment processor—they want a fully integrated AP and spend management solution. Ramp excels in giving businesses full control and transparency over their AP processes, while minimizing manual work.

Ramp’s ability to unify corporate cards, expense policies, and AP automation in one platform is another benefit for finance teams tired of juggling multiple systems.

- Automate your workflows and approvals: Ramp’s AI handles invoice entry, line item coding, and approval routing with minimal manual effort. Set custom workflows that adapt to your policies, then track each step to keep things moving without delays or exceptions slipping through.

- Stronger controls for scaling AP operations: Users also appreciated that Ramp supports 2-way matching, vendor tax management, and recurring billing. You get audit trails, batch payments, and automated error detection—without needing to bolt on extra systems.

- Manage AP, cards, and expenses in one place: Ramp combines bill payments, corporate cards, and expense management into a single platform—so finance teams don’t have to juggle multiple tools or vendors. Everything connects automatically to your GL for faster AP reconciliation and clearer reporting.

Serviceable markets

Ramp is best suited for small to mid-sized businesses and fast-growing companies, but larger organizations can also use it to consolidate their finance stack and scale efficiently. This makes Ramp a strong alternative not only to Melio, but also a high-performing competitor to BILL.com, Tipalti, and Stampli.

Pricing

Small teams can get started with Ramp for free—unlocking advanced OCR, approval workflows, unlimited corporate cards, and built-in tools for vendor management, travel, and expense control.

Upgrading to Ramp Plus starts at $15 per month per user and gives you access to advanced payment release approvals, procurement features, multi-entity support, and payments in foreign currencies. We also offer custom pricing for Enterprise clients.

2. Sage Intacct

Sage Intacct is a cloud-based financial management platform designed for growing businesses with advanced accounting and financial reporting needs. Unlike Melio, which primarily focuses on payments and basic AP automation, Sage Intacct offers enterprise resource planning (ERP) tools, including deeper AP features, multi-entity support, and complex financial workflows.

Businesses typically turn to Sage Intacct when they’ve outgrown entry-level tools and need more scalability, customization, and compliance support. Its G2 rating is 4.3 out of 5 stars.

Key features

- Manage AP across multiple locations, subsidiaries, or business units

- Set up configurable rules for invoice approvals

- Schedule payments in bulk to manage cash flow efficiently

Why customers choose Sage Intacct vs. Melio

Companies might choose Sage Intacct over Melio when they have more complex financial needs, like operating across multiple entities or detailed reporting requirements. However, this advanced functionality comes with a steep learning curve and higher upfront costs.

Serviceable markets

Best for mid-sized to large businesses with complex accounting needs, multiple entities, or industry-specific compliance requirements.

Pricing

Sage Intacct uses custom pricing based on business size, modules selected, and implementation needs.

3. Stampli

Stampli is an AP automation platform that zeroes in on invoice processing and approvals. Unlike Melio, which bundles payments with basic AP features, Stampli focuses on streamlining invoice management, giving finance teams better control over approvals and communication.

Stampli’s strength lies in its user-friendly interface and collaboration tools, making it easy for businesses to centralize conversations and approvals around each invoice. Those features earned it a G2 rating of 4.6 out of 5 stars.

Key features

- AI-driven invoice capture to automate data extraction and reduce manual entry

- Chat and collaborate directly with vendors in a centralized communication hub

- Built-in controls to flag duplicate invoices

Why customers choose Stampli vs. Melio

Customers typically pick Stampli over Melio when they need stronger invoice approval workflows and collaboration tools beyond basic payment processing.

Serviceable markets

Stampli best suits mid-sized businesses looking to automate invoice approvals while maintaining existing accounting or payment systems.

Pricing

Stampli customizes pricing based on invoice volume and business needs. Businesses need to contact Stampli for a tailored quote.

4. SAP Concur

SAP Concur is a platform known for its expense management and AP automation solutions geared toward large enterprises. While Melio targets smaller businesses with simpler workflows, SAP Concur offers a comprehensive suite built to handle complex, global AP processes and employee expense management.

Companies often choose SAP Concur when they need customizable, enterprise-level tools to manage AP and travel expenses under one umbrella. Their G2 rating is 4.0 out of 5 stars.

Key features

- Digitizes and extracts invoice data for faster processing

- Customizable approval workflows to match complex organizational structures

- Integrates with large ERP systems like SAP, Oracle, and Microsoft Dynamics

Why customers choose SAP Concur vs. Melio

Businesses choose SAP Concur over Melio when they need enterprise-grade features, global scalability, and advanced compliance controls. However, this comes with higher costs and longer onboarding timelines.

Serviceable markets

Ideal for large enterprises and multinational corporations with complex AP, compliance, and travel management needs.

Pricing

Potential customers must contact SAP Concur’s sales team for customized pricing based on business size, modules, and implementation.

5. Tipalti

Tipalti is a global payables automation platform that handles complex, high-volume AP processes. While Melio focuses on small businesses with straightforward payment needs, Tipalti works for companies managing large-scale, multi-currency payments and vendor compliance.

Tipalti provides automated invoice approvals as well as global supplier onboarding, tax compliance, and payments across multiple countries. They received a rating of 4.5 out of 5 stars on G2.

Key features

- Supplier onboarding portal for collecting vendor info, tax forms, and payment preferences

- Global payment capabilities support multiple currencies and payment methods

- Tax compliance tools automate W-9, W-8 forms, and VAT validation

Why customers choose Tipalti vs. Melio

Companies choose Tipalti over Melio when they need global payables automation, tax compliance, and high-volume payment handling. It’s particularly appealing to businesses working with international vendors or complex supplier networks.

Serviceable markets

Tipalti is best for mid-sized to large businesses with global operations, high payment volumes, or complex compliance requirements.

Pricing

Tilpati plans start at $99 per month for basic features. Potential customers can also request a custom quote based on feature needs.

Choose the best-rated Melio alternative

Whether you want to scale operations, tighten compliance, or cut down on admin work, the right AP solution should do more than process payments; it should make your life easier by eliminating manual data entry, streamlining approvals, ensuring vendors get paid on time, and giving you full visibility and control over company spend.

That’s why Ramp stands out as a top Melio alternative. With automated invoice capture, customizable approval workflows, seamless payments, and real-time insights in one user-friendly platform, Ramp can help you save time, reduce errors, and gain financial clarity.

Plus, with a free basic plan and excellent ratings and customer reviews on G2, we’re a top AP automation solution for businesses that want more control and scalability without added complexity.

Ready to simplify your AP process? Schedule a demo to get started with Ramp Bill Pay today.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits