Alabama mileage reimbursement rates & calculator

As a private employer in Alabama, you might wonder if you are liable to reimburse employees for mileage just as state employees are.

Well, here's the scoop: while state law does not require you to reimburse employees for general business mileage, the scenario changes when they are traveling for medical reasons.

Under the Workers' Compensation requirements — enshrined in the Code of Alabama 1975, 25-5-77(f) — it's your legal responsibility to reimburse employees traveling for medical treatments when injured at work.

Also, if you do reimburse employees using their personal vehicles for office duties, it positions your company as a supportive place to work.

Alabama business mileage reimbursement rates

The Alabama business mileage reimbursement rate for 2026 is $72.5 cents for state employees, per the IRS standard mileage rate. However, as a private employer, you can reimburse your employees above or below this rate.

Here's a tabulated snapshot of Alabama's 2026 standard IRS mileage rates alongside a year-on-year rate analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Alabama mileage reimbursement calculator

Here's a straightforward approach to calculating Alabama mileage reimbursement.

- Choose the tax year for which you want to calculate

- Input the miles driven to determine how much money can be received in return.

Alabama mileage reimbursement laws

In Alabama, mileage reimbursement laws carve out specific scenarios where you, even as a private employer, must compensate your employees for mileage. While no overarching state mandate requires reimbursement for all business travel, certain situations are clearly regulated.

Explore the ins and outs of all the important Alabama mileage reimbursement laws below, starting with state employees.

Section 36-7-22 for state employees' mileage reimbursement[1]

Under the Code of Alabama 1975, Section 36-7-22, the mileage reimbursement rate for Alabama state employees traveling in privately owned vehicles on official business is aligned with the Internal Revenue Code.

As you know, currently, this rate is set at $0.725 per mile. This arrangement helps in the following ways.

- Simplifies the reimbursement process by standardizing the amount state employees can claim.

- Helps in budgeting and financial planning for all state departments.

Section 25-5-77(f) of the workers' compensation act and mileage reimbursement

While Alabama state law does not legally compel you to reimburse your employees for mileage, the Workers' Compensation Act, detailed in Code of Alabama 1975, Section 25-5-77(f), does.

This specific code mandates that you must compensate injured workers for travel expenses to and from medical and rehabilitation appointments at the same rate as official state travel, currently 67 cents per mile.

This law, effective since August 1, 1992, is made to:

- Ensure injured employees are not financially burdened.

- Ascertain that all necessary medical care resulting from workplace injuries is being provided.

Additionally, Section 25-5-77(f) mandates that mileage reimbursement must be provided regardless of the general absence of state laws requiring mileage compensation for other business-related travel.

Alabama wage act

Alabama does not have a specific wage act covering all aspects of mileage reimbursement. It follows the federal minimum wage of $7.25 per hour. It's your legal obligation that you ensure mileage non-reimbursement doesn't drop your employees' wages below the federal minimum even if they are not injured.

Furthermore, the general practice under employment law suggests that if you choose to reimburse mileage, it must be done fairly and consistently as part of the employment contract. This adheres to the broader principle that you should cover necessary expenses incurred by your employees during their duties to prevent undue burden.

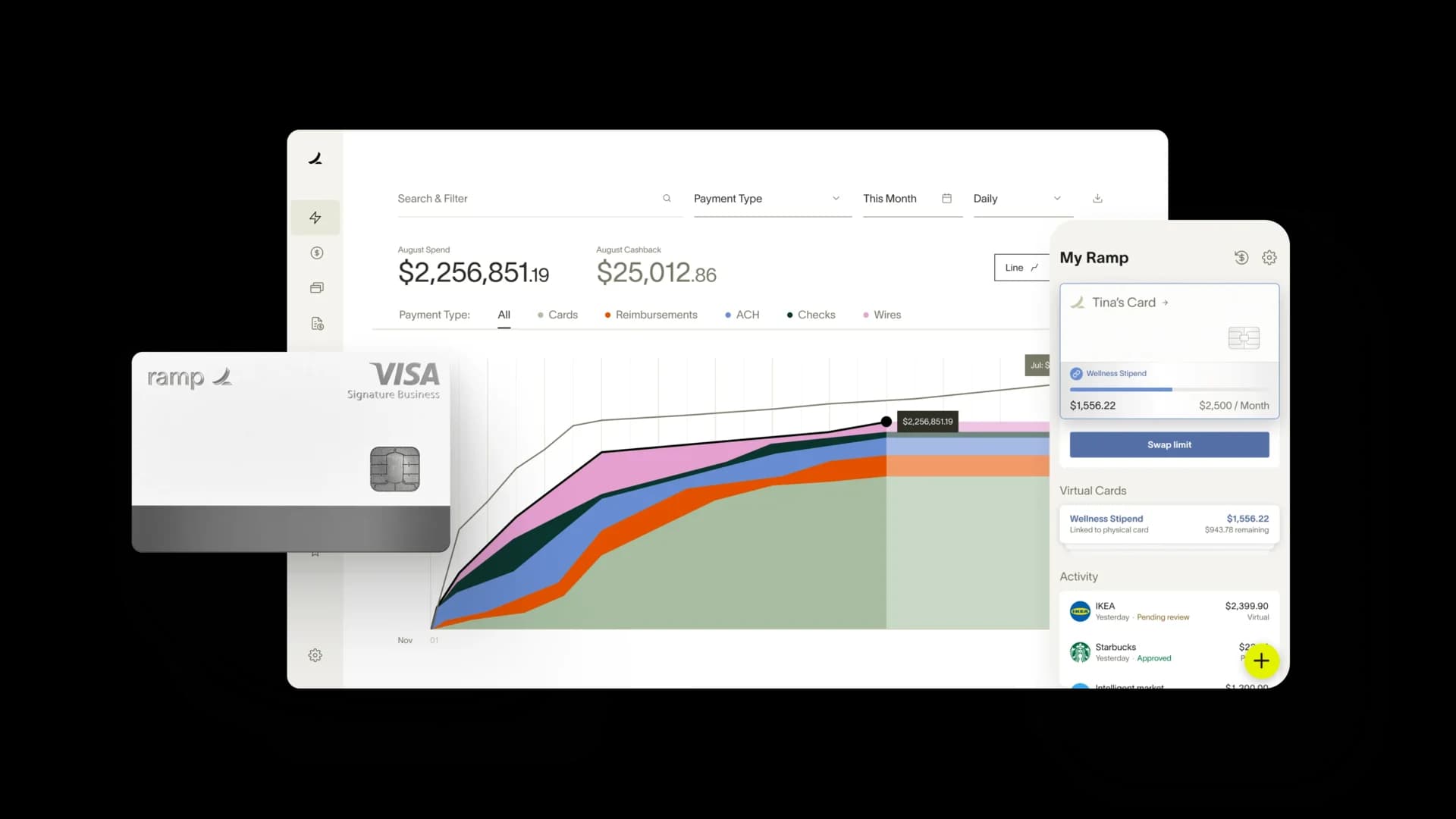

Upgrade to smart mileage tracking with Ramp

Understanding Alabama's mileage reimbursement laws, including the Code of Alabama 1975, Sections 36-7-22 and 25-5-77(f), is essential. These regulations ensure fair compensation for state employees and injured workers, respectively, while setting a standard that aligns closely with IRS rates.

Proper adherence to these laws will help you in the following ways.

- Guarantee your business’s compliance with the Workers' Compensation Act,

- Ensure minimum wages do not drop below the federal minimum, which is illegal in Alabama.

- Enhance employee satisfaction and trust, which will help you in retaining talent

Ramp’s AI-powered expense management solution can streamline this entire process of mileage reimbursement by automating your mileage tracking, making the reimbursement process straightforward and hassle-free.

With Ramp, you can effortlessly manage mileage logs, record them without manual errors, and apply the correct rates.

See how Ramp automates expense and mileage tracking for 50,000 businesses