Delaware mileage reimbursement rates & calculator

Mileage reimbursement refers to reimbursing employees for the miles they travel using their own vehicles for business purposes. As per Title 29, Chapter 71, Statute §7102, the mileage reimbursement rate for state employees has held steady at 50 cents per mile since July 2023.

As a private employer, you have no legal obligation to offer mileage reimbursement to your employees unless it's related to Title 19, Chapter 23 of the Workers' Compensation Law. Workers' Compensation Act mandates that you cover travel charges, including mileage, for medical visits for injured employees.

Additionally, offering mileage reimbursement protects your business from accidentally violating Delaware's Minimum Wage Law.

Delaware business mileage reimbursement rates

Delaware continues to reimburse state employees for mileage at 50 cents per mile, as mentioned under Code § 7102.

As a private employer, it's important to note that while you are not required to follow this rate, knowing the state standard can help you determine a fair employee reimbursement policy.

You can also choose to follow the IRS standard rates, tabulated below, to reimburse your employees.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Delaware mileage reimbursement calculator

If you choose to reimburse your employees at the optional IRS standard rates, here's a straightforward approach to calculating Delaware mileage reimbursement.

- Choose the tax year for which you want to calculate

- Input the miles driven to determine how much money can be received in return.

Delaware mileage reimbursement laws

Delaware's approach to mileage reimbursement reflects a comprehensive understanding of both employer and employee needs. For state employees, the law is clear:

- A fixed reimbursement rate per mile.

- Mandated penalties for misclaims.

- Specific conditions under which reimbursement is not applicable.

But what about you as a private employer? The state provides guidelines but allows flexibility, which you can explore in the upcoming sections.

Code 7102 of title 29 for state employees' mileage reimbursement

According to Delaware Code §7102 of Title 29, Chapter 71, the state has set the mileage reimbursement rate for state employees at 50 cents per mile since July 2023.

This applies strictly to travel done during state business, excluding commutes between an employee's home and the principal place of work.

Please note: Delaware enforces strict penalties for any misuse of this reimbursement law, such as claims for commutes or inflated mileage. Code §7104 outlines fines ranging from $10 to $100 and, in severe cases, double the reimbursed amount that was falsely claimed.

Title 19, code §2322 of the workers' compensation act for mileage reimbursement

Complying with the Workers' Compensation Act is not optional for you as a private employer – it's the law.

Under Delaware's Workers' Compensation Act, found in Title 19, Chapter 23, Code §2322, you must offer injured employees the following benefits.

- Reimburse injured employees for medical and related expenses

- Pay mileage reimbursement for travel related to medical treatments or acquiring necessary medical supplies.

Be aware that failing to report injuries or denying legitimate claims can result in fines ranging from $100 to $250.

Delaware minimum wage law and its impact on mileage reimbursement

As you plan your payroll, remember that Delaware's minimum wage is $15.00 per hour in 2026. While this increase aims to support a living wage, you'll be exempted from following this law if you have employed any of the following workers:

- Bona fide executives

- Agricultural workers

- Employees engaged in fishing

- Volunteer workers

- Junior camp counselors

As per Code §910[1] of Delaware's Minimum Wage Law, non-compliance can harm your business in the following ways.

- Pay fines ranging from $1,000 to $5,000 for each violation.

- Deal with civil penalty claims filed in any court of competent jurisdiction

Although there's no direct mention of reimbursing employees for mileage in Delaware's Minimum Wage Law, the connection is obvious – if non-reimbursement of mileage is bringing your employees' wages below the state minimum wage, you need to pay for the difference. Failure to do so, as you know, will result in penalties.

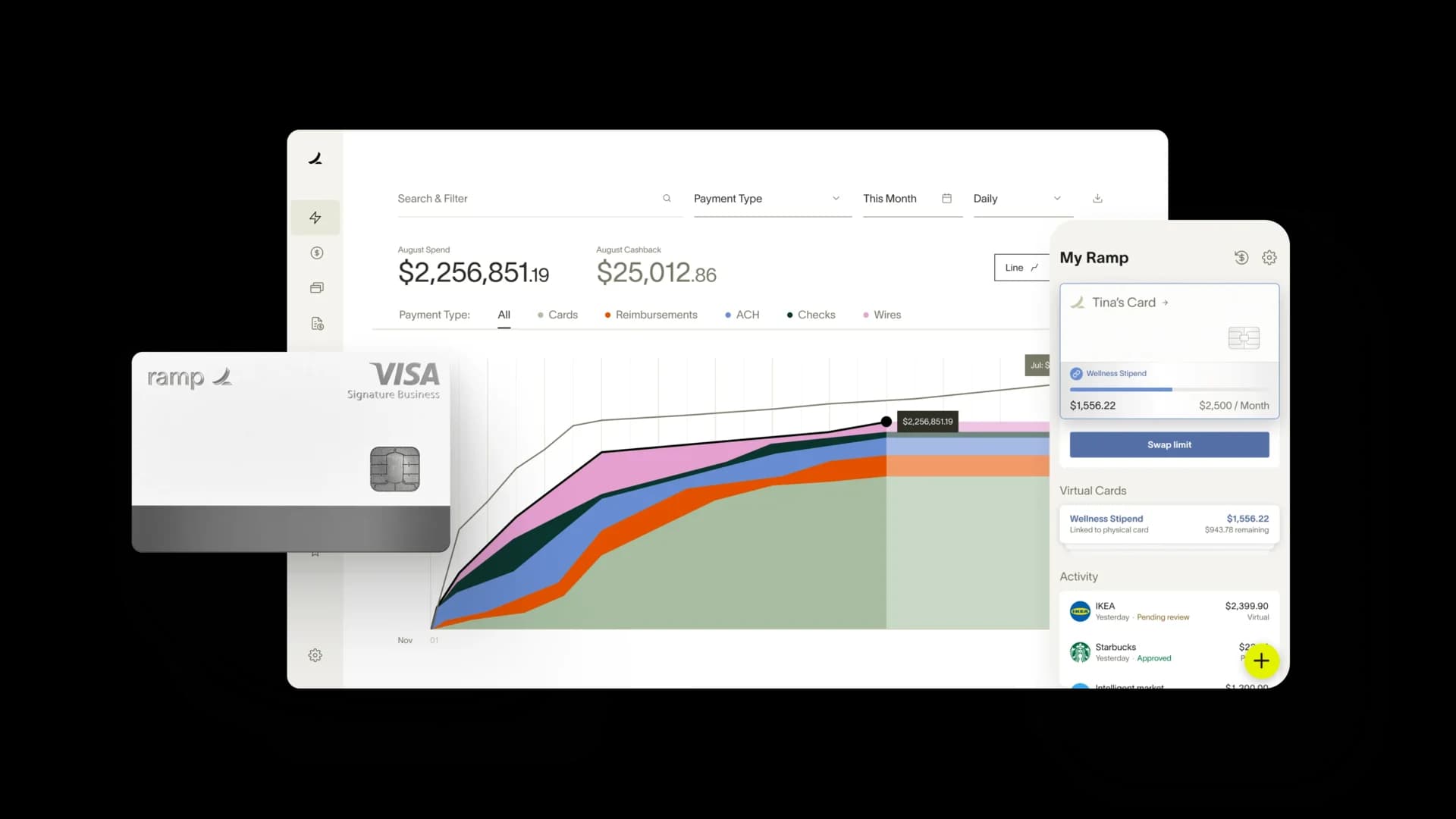

Automate mileage calculations and tracking with Ramp

In Delaware, aligning with mileage reimbursement laws enhances trust and workplace transparency, which is crucial for boosting your employees' morale and retention. Ensuring fair compensation for business travel is not just compliant but beneficial for both parties.

Ramp revolutionizes this task by automating the tracking and reimbursement process. Ramp's intuitive AI-triggered expense management software ensures accurate logging and calculations, minimizing administrative work.

With Ramp, you can effortlessly manage mileage compensations, maintain compliance, and focus on what truly matters—your business and your people.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, Penalties’: https://delcode.delaware.gov/title19/c009/index.html