Iowa mileage reimbursement rates & calculator

As an employer, understanding Iowa's mileage reimbursement laws is essential, especially if your employees use personal vehicles for work.

For state employees, Iowa Code §8A.363 mandates mileage reimbursement, with the 2026 rate set according to IRS guidelines. While you're not legally required to provide mileage reimbursement to your private employees, it can be a valuable addition to your compensation package.

Here's what happens when you offer mileage reimbursement.

- Adhere to Iowa's Workers' Compensation Act, which is mandatory.

- Ensure you don't accidentally violate the Iowa Minimum Wage Law.

Additionally, fair reimbursement keeps employees happy and loyal, which in turn boosts productivity and benefits your business.

Iowa business mileage reimbursement rates

In 2026, Iowa's mileage reimbursement rate is $0.725 per mile, set by the IRS, for state employees under Iowa Code §8A.363. While private employers aren't required to provide it, you may choose to cover employees' work-related travel costs.

Here's a tabulated snapshot of mileage reimbursement rates in Iowa, as per IRS standards in 2026, along with a year-by-year analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Iowa mileage reimbursement calculator

Using the Iowa mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received.

Iowa mileage reimbursement laws

In Iowa, mileage reimbursement laws are designed to cover work-related travel expenses for both state and private employees. For state employees, Iowa Code §8A.363 governs how mileage is reimbursed.

On the other hand, private employers are guided by different rules, including mandatory mileage reimbursement for workers' compensation claims. These laws are essential for you to maintain fairness in covering your employees' travel expenses, whether for business purposes or medical care.

Here's a closer look at each of these legal provisions and what they mean for your business.

Iowa code §8A.363 for state employees' mileage reimbursement

Iowa Code §8A.363 outlines how mileage reimbursement works for state employees. The law covers a variety of personal vehicles – used for official state business – as listed below.

- Personal cars

- Vans

- Pickups

- Panel trucks

As per this policy, mileage reimbursement requires prior approval from the director. However, the director can approve a higher reimbursement rate for employees with disabilities who need specially equipped vehicles.

Please note: Elected officers, judicial officers, and general assembly members are exempt from this law.

Iowa workers' compensation act for mileage reimbursement

As a private employer, mileage reimbursement under Iowa's Workers' Compensation Act isn't optional for you — it's a legal requirement. As per the law, here's what you must do if one of your employees gets injured at work.

- Cover mileage costs when an injured employee travels for medical appointments.

- Reimburse the injured worker's mileage at the IRS business mileage rates.

Please note: If you deny or delay a claim without a valid reason, you could face a penalty, requiring you to pay up to 50% more in benefits.

Code 91D for Iowa minimum wage laws and its relation to mileage reimbursement

The Minimum Wage Law in Iowa, outlined in Iowa Code 91D, aligns with the Federal Minimum Wage of $7.25 per hour. The U.S Department of Labor enforces Federal Wage Laws, while the Iowa Division of Labor handles state wage violations.

Although mileage reimbursement isn't directly addressed here, if non-reimbursement lowers your employees' wages below $7.25, you must make up the difference.

As per Iowa Code 91D, here's what you can (and should) do.

- Make up the difference for tipped employees earning $4.35 per hour if tips don't reach $7.25.

- Offer a reduced wage of $6.35 to newly hired workers under 20 during their first 90 days.

Maximize efficiency in tracking mileage through automation with Ramp

Mileage reimbursement laws in Iowa, such as Iowa Code §8A.363 for state employees and the mandatory mileage reimbursement as per the Workers' Compensation Act, play a critical role in ensuring fair compensation for work-related travel.

Following these laws helps your business in many ways, as listed below.

- Keep your business compliant with reimbursement laws.

- Make your employees trust you to pay them for mileage fairly.

- Reduce legal disputes by ensuring employees are appropriately compensated.

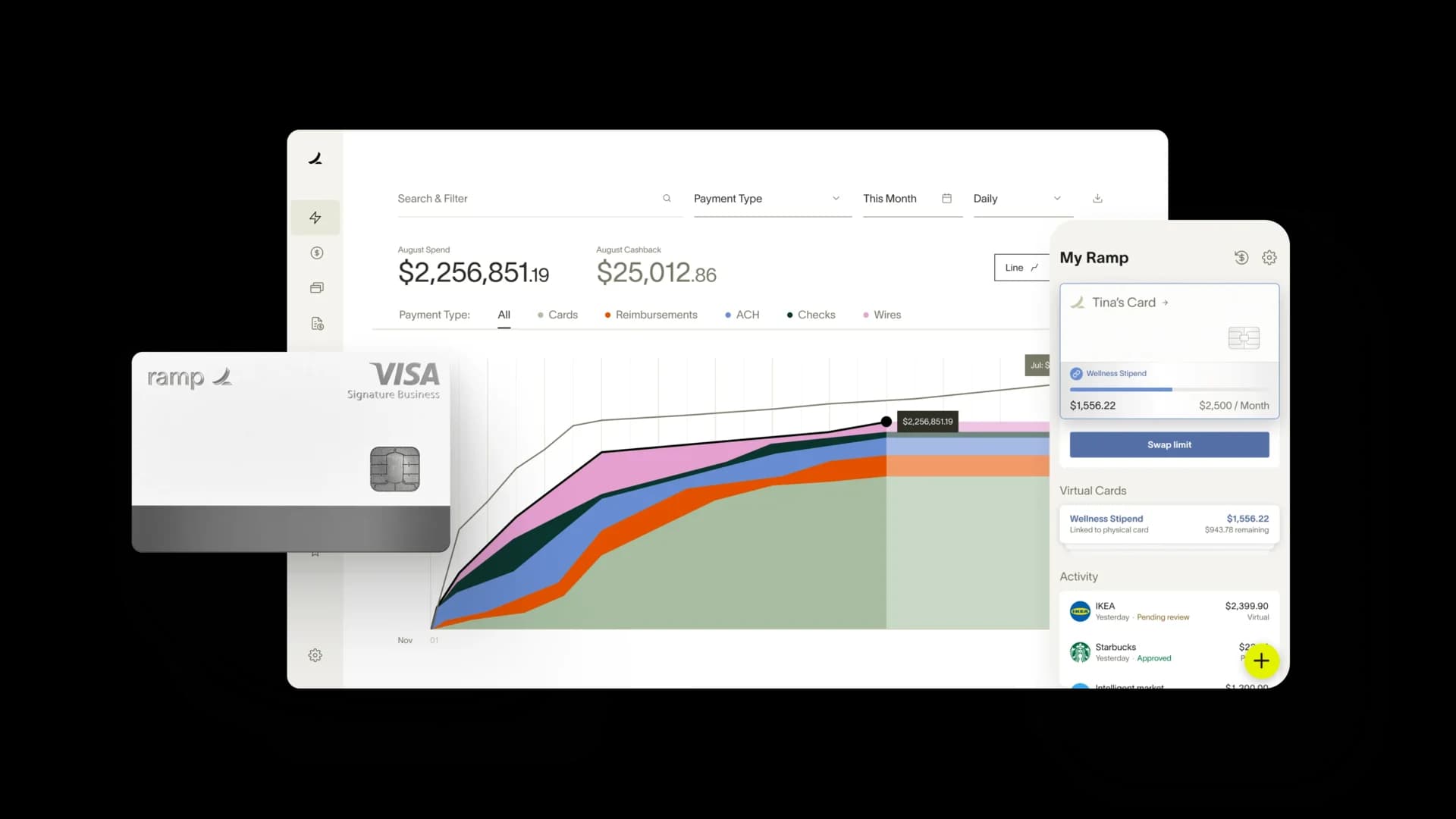

With Ramp, you can streamline your mileage tracking and reimbursement processes effortlessly. Ramp's AI-powered expense management platform automates tracking, ensuring accuracy and compliance with IRS mileage rates.

Simplify your business operations and ensure your team is fairly compensated with Ramp, so you can focus on what truly matters — growing your business.

See how Ramp automates expense and mileage tracking for 50,000 businesses