Kansas mileage reimbursement rates & calculator

Understanding mileage reimbursement is essential for you as a Kansas employer. It ensures you compensate your team fairly when they use their personal vehicles for work-related chores and keeps your business compliant with relevant laws.

Key statutes, like K.S.A. 75-3203a, provide the framework for mileage allowances to state employees, setting clear rules on how much to reimburse.

Although mileage reimbursement is mandatory only for state employees in Kansas, you'll find that, as a private employer, offering fair mileage reimbursement benefits in the following ways.

- Ensures wages of your employees stay above the state minimum.

- Build your business's reputation in the eyes of your employees.

Kansas business mileage reimbursement rates

As of 2026, as an employer you can reimburse your employees at $0.725 cents per mile for automobiles and $0.705 cents per mile for motorcycles. These rates are designed to cover all associated vehicle expenses, including fuel, maintenance, and insurance.

Here's a tabulated snapshot of Kansas's year-on-year mileage reimbursement rates, per IRS.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Kansas mileage reimbursement calculator

Using the Kansas mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Kansas mileage reimbursement laws

In Kansas, mileage reimbursement laws provide clear guidelines on how much you should reimburse to your employees so their minimum wages do not drop below the state minimum.

Under Statute K.S.A. 75-3203a, state employees are entitled to mileage reimbursement rates that align with I.R.S. guidelines. While this Statute does not mandate that you, as a private employer, should reimburse too, implementing it can keep you on the right side of the law.

Code 75-3203a for mileage reimbursement for state employees

Code 75-3203a allows the Secretary of Administration to set specific mileage rates for various types of privately owned vehicles, including cars, motorcycles, and even specially equipped vehicles for the physically disabled.

These rates aim to cover all related costs listed below [1].

- Gasoline

- Oil

- Tires

- Repairs

- Insurance (including uninsured losses and insurance deductibles resulting from damage to the privately owned conveyance)

- License fees

- Depreciation costs

Also, it's worth noting that department heads can specify lower rates for non-mandatory travel.

Kansas city minimum wage code K.S.A. 44-1201

Although the minimum wage law in Kansas doesn't directly mandate mileage reimbursements, understanding its scope helps you ensure that your overall compensation packages are competitive and compliant. Your mileage reimbursement policies must align with these standards to maintain fairness and retention.

The Kansas City Minimum Wage Law sets the minimum wage at $7.25 per hour for workers over the age of 18.

Familiarizing yourself with the Kansas City Minimum Wage Code K.S.A. 44-1201 can help you in the following ways.

- Aid in crafting employment policies that are legally compliant

- Ensure reimbursement is fair so your employees don't pay out of their pockets

Kansas mileage reimbursement laws vs federal rules

Both Kansas and federal guidelines provide mechanisms for adjusting rates based on prevailing economic conditions or operational needs. However, Kansas offers specific exceptions where lower rates can be applied if alternative, less costly modes of transportation are available or if the agency does not mandate travel.

On the contrary, federal rules do not typically specify such exceptions, focusing instead on providing a broad guideline that individual businesses can adapt.

Furthermore, if your business is governed by the Federal Fair Labor Standards Act (FLSA), you may not be directly bound by the Kansas Minimum Wage Code K.S.A. 44-1201.

Simplify how you track mileage with Ramp

Keeping up with Kansas's specific mileage reimbursement regulations is crucial for your business's compliance and financial health. You can reap the following benefits by ensuring precise adherence to these laws.

- Uphold legal standards by complying with the Kansas Minimum Wage Code K.S.A. 44-1201

- Support your employees, guaranteeing they're reimbursed fairly for business travel

- Create a positive work environment and maintain the financial integrity of your business

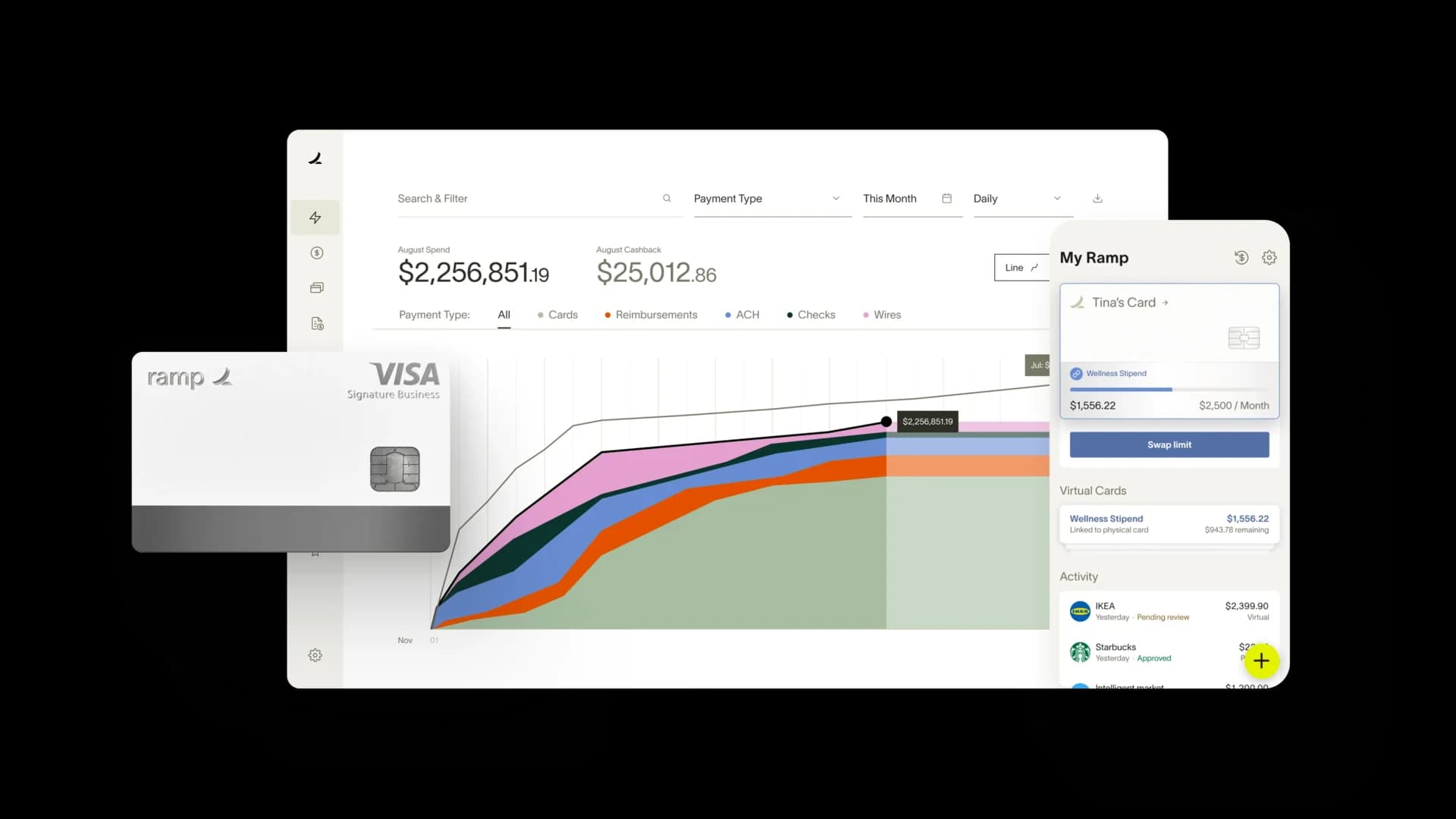

Ramp can significantly streamline this process of mileage reimbursement. With automated tracking and reporting, Ramp’s AI-boosted expense management software ensures that every mile is logged accurately and in accordance with state-specific guidelines.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header ‘.080 Mileage Reimbursement for Use of Personal Conveyance’: https://www.k-state.edu/policies/ppm/6400/6410.html#a.080