Massachusetts mileage reimbursement rates & calculator

As a Massachusetts employer, you must reimburse your employees for the miles they travel using their personal vehicles for business purposes. Mileage reimbursement is a legal practice anchored in the Code of Massachusetts Regulations Minimum Wage (27.04) and Massachusetts General Law (MGL) chapter 151 (section 2).

This reimbursement ensures your employees are compensated for their travel expenses during work, aligning with state laws that aim to protect workers from bearing such expenses themselves. By following these codes and guidelines, you can protect your business from massive legal troubles.

Massachusetts business mileage reimbursement rates

You are not legally bound to follow the 2026 IRS standard business mileage rate of $0.725 per mile in Massachusetts. Under the Massachusetts mileage reimbursement law, you can opt to set a higher rate than the IRS standard mileage rate to reflect actual costs your employees face.

Here’s a tabulated snapshot of Massachusetts mileage reimbursement rates in 2026 and previous years, which follows the IRS standard rate.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Massachusetts mileage reimbursement calculator

Using the Massachusetts mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Massachusetts mileage reimbursement laws

Massachusetts has some pretty clear rules about mileage reimbursement rates that are all laid out in the Code of Massachusetts Regulations Minimum Wage (27.04).

Basically, it’s on you as the employer to make sure you’re covering your employees for any travel costs they run into while they're working. This includes the miles they drive, parking fees, tolls, and stuff like that.

Just a heads up, though — you don’t need to worry about the personal detours your employees might make or anything that’s not directly work-related. The idea is to keep it all about business expenses.

Scope of reimbursement under Massachusetts general law (MGL), chapter 151 (section 2)

Under the specific stipulations of MGL chapter 151 (section 2), the scope of who must be reimbursed extends to employees engaged in an "occupation" as defined by the law. It mandates that, when they use their personal vehicles for office duties, you:

- Reimburse office workers for business-related travel

- Cover service technicians for visits to customer sites

- Compensate delivery drivers

- Pay home health aides for travel to patients' homes

- Support field researchers conducting off-site work

- Ensure government employees are reimbursed for official travel

Exclusions from this provision include:

- Agricultural workers and farm employees

- Participants in rehabilitation or training programs

- Seasonal camp counselors and trainees

- Members of religious orders

- Outside sales staff without daily office check-ins

Please note: Massachusetts mileage reimbursement code requires that you pay your employees for travel time if they need to hit a particular spot before they get to their usual worksite. So, if you ask them to head somewhere first — like picking up supplies or checking in at a meeting spot — that travel time counts too, both to and from the work site.

Massachusetts vs federal mileage reimbursement laws

At the federal level, the choice to reimburse employees for business-related mileage is up to you. Federal guidelines give you the flexibility to decide whether and how much to refund, as long as the total compensation doesn't dip below the federal minimum wage of $7.25 per hour after accounting for work expenses.

On the other hand, Massachusetts doesn't leave room for guesswork. The Code of Massachusetts Regulations Minimum Wage 27.04 mandates that you:

- Cover all travel costs of your employees, including mileage, parking, and tolls, to ensure compliance and prevent disputes. The state minimum wage is $15 per hour.

- Maintain thorough documentation to verify reimbursements and prove compliance.

Make mileage tracking easy and automated with Ramp

Did you know Massachusetts mileage reimbursement guidelines allow you to ask your employees for invoices or receipts that can prove the mileage they drove? Besides, adherence to mileage reimbursement laws in Massachusetts is not just a nice-to-do thing – it’s your legal duty.

If you fail to adequately reimburse your employees for mileage when they use their personal vehicles for office chores, you can face severe legal consequences, including fines and potential triple damages.

On the other hand, proper reimbursement practices help you serve the following purposes.

- Protect your employees from out-of-pocket expenses

- Reinforce your reputation as a fair employer

- Build a positive work environment

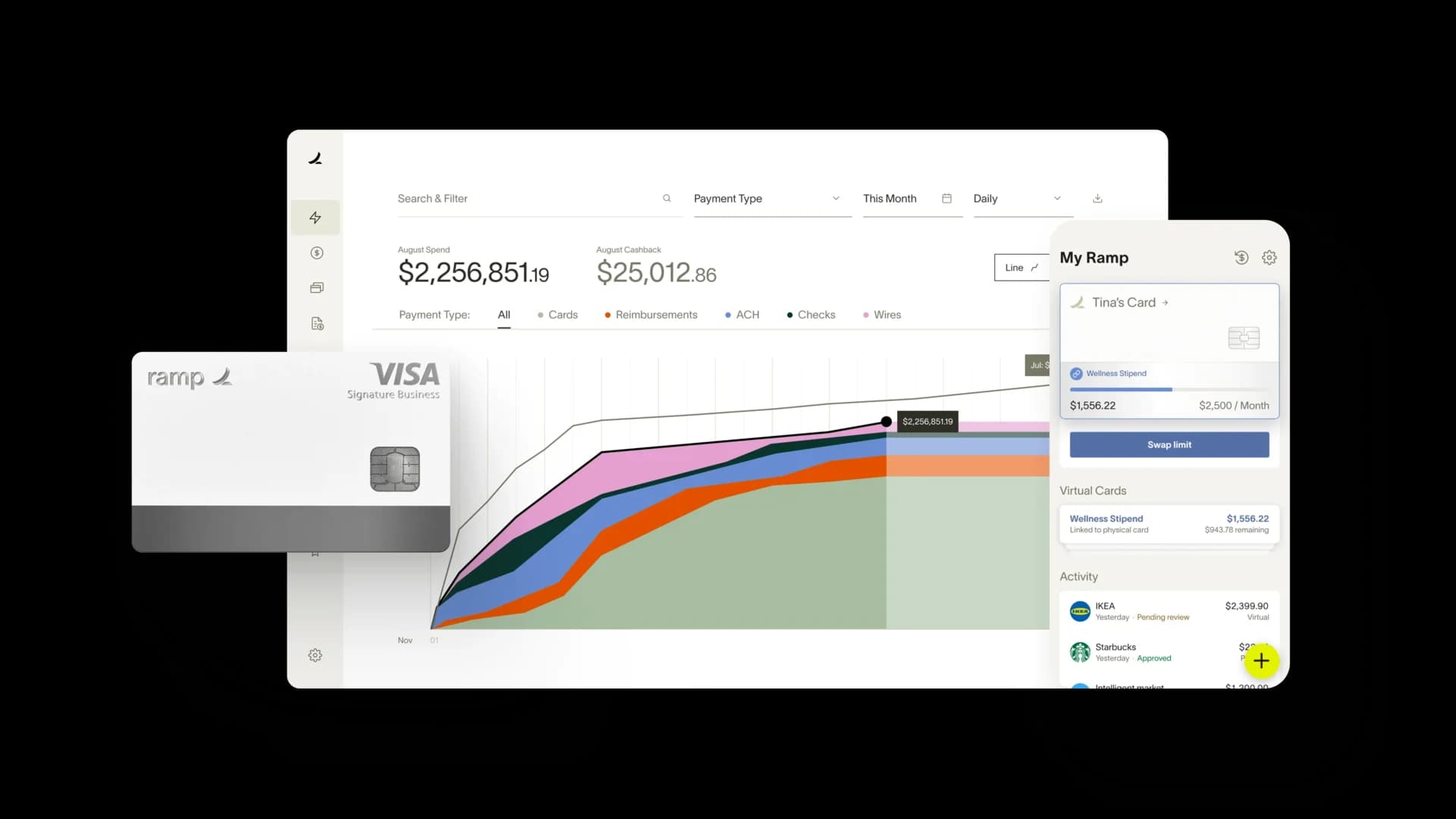

Want to simplify and streamline the mileage reimbursement process for your business? Consider using Ramp's AI-powered expense management solution. It automates expense tracking and reporting, ensures accuracy and compliance with Massachusetts laws, and makes the entire process more efficient for you and your employees.

See how Ramp automates expense and mileage tracking for 50,000 businesses