Michigan mileage reimbursement rates & calculator

As a Michigan employer, you aren't legally obligated to provide mileage reimbursement. However, compensating employees for personal vehicle use in the company business is a wise decision.

When you offer mileage reimbursement, it frees up the mind space of your employees. They will know that the mileage cost will not be taken out of their pockets.

Adopting fair Michigan mileage reimbursement rates benefits your business by:

- Significantly boosting your team’s morale and loyalty

- Retaining top talent with fair travel compensation

Moreover, mileage reimbursement helps prevent unintentional violations of the FLSA guidelines, ensuring employee wages stay above the federal minimum.

Michigan business mileage reimbursement rates

The IRS standard business mileage rate in 2026 is $0.725 per mile, in compliance with the IRS standard mileage rate. As a Michigan employer, you are not mandated to follow this rate, but if you choose to reimburse mileage, any amount over the IRS standard is taxable.

Here's a tabulated snapshot of the standard IRS mileage reimbursement rates and their year-on-year analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Michigan mileage reimbursement calculator

Using the Michigan mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Michigan mileage reimbursement laws

While you're not legally required to reimburse your employees for mileage in Michigan, ensuring their take-home pay doesn't fall below the current minimum wage per hour due to unreimbursed expenses is crucial. The Fair Labor Standards Act (FLSA), which can impact your business if overlooked guides this adherence.

Moreover, unlike the IRS, which suggests a mileage rate of $0.725 per mile for 2026, Michigan has no state law that prescribes a specific mileage reimbursement rate. This means you have the flexibility to set your own rates, higher or lower than the IRS standard.

Implications of IRS and FLSA guidelines on your business

Following IRS guidelines is optional but can simplify tax reporting. More critically, under the FLSA, you must ensure that employees' earnings, after any work-related deductions, remain above the federal minimum wage. This link between mileage reimbursement and minimum wage compliance is vital for avoiding legal pitfalls.

Legal risks of non-compliance

Failing to meet the FLSA requirements can lead to severe consequences, including penalties, lawsuits, and compensation claims. It's essential to evaluate how unreimbursed employee expenses could affect compliance with minimum wage laws and consider the broader implications for your business's legal standing.

By closely monitoring these regulations and their interplay, you can safeguard your business against potential legal issues and create a fair, compliant working environment.

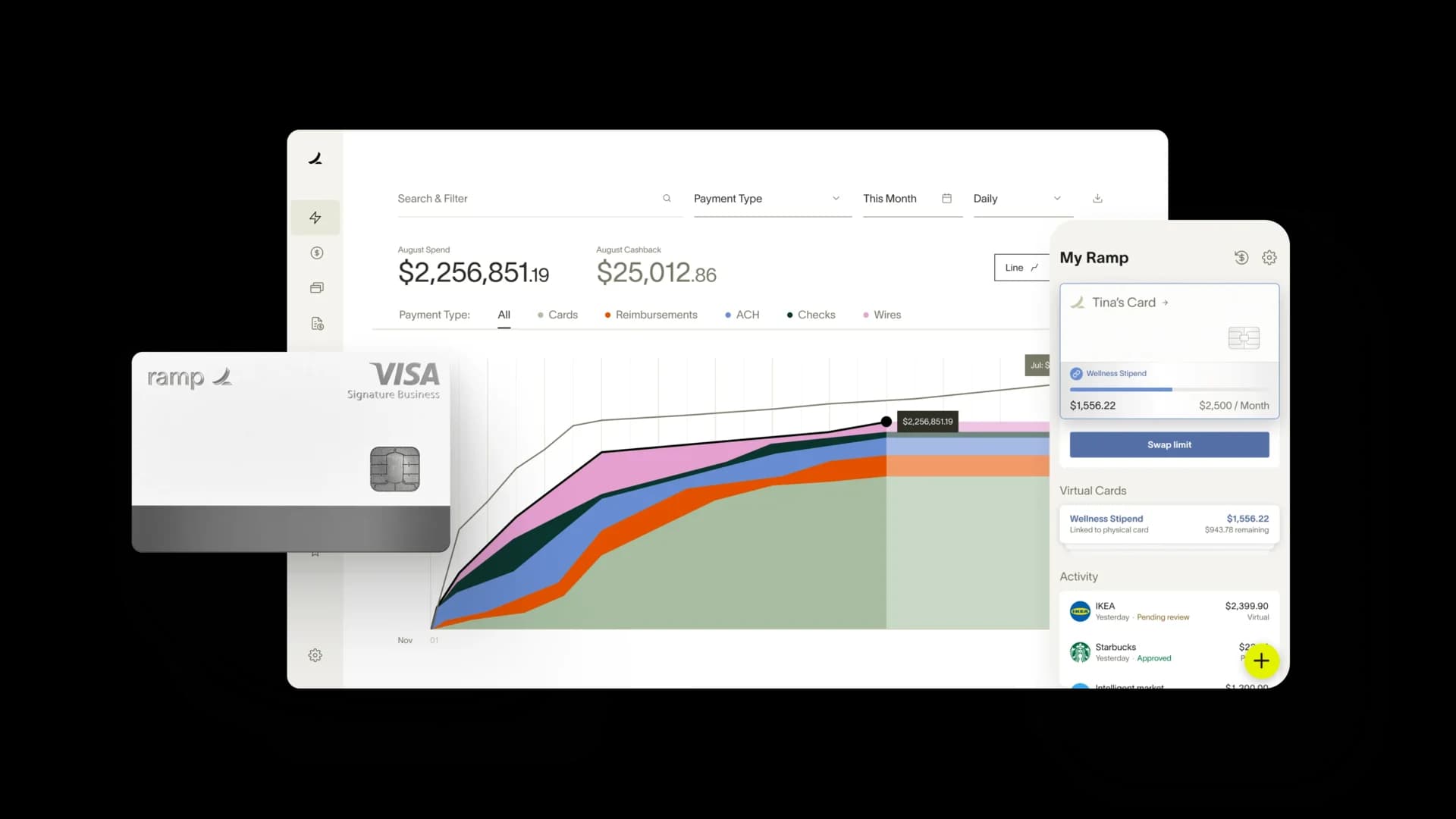

Upgrade to smart mileage tracking with Ramp

While Michigan state law doesn't specifically require employers to reimburse travel expenses, the FLSA (Fair Labor Standards Act) does include provisions you need to consider. For example, ensuring compliance with the FLSA's minimum wage requirement is just one reason to establish a clear and proper Michigan mileage reimbursement policy.

To simplify and enhance your reimbursement process, consider using Ramp. Our AI-driven expense management software can:

- Automate mileage tracking to eliminate manual errors and ensure accuracy.

- Streamline administrative tasks, allowing you to focus on core business activities.

- Maintain transparency in mileage reports.

- Align with IRS guidelines effortlessly, avoiding potential legal complications.

See how Ramp automates expense and mileage tracking for 50,000 businesses