Nevada mileage reimbursement rates & calculator

In Nevada, the law mandates standard mileage reimbursement for state employees. It ensures that state employees are compensated for the business use of their personal vehicles. While this state law does not legally bind private employers, you're still encouraged to align with it for the following reasons.

- Ensure business alignment with Workers' Compensation Regulations under the NAC Code 616C.150, which isn't optional.

- Maintain fairness for your employees, boosting their morale and your business's reputation.

More importantly, fair mileage reimbursement protects your business from accidentally violating Nevada's Minimum Wage Policy.

Nevada business mileage reimbursement rates

For 2026, Nevada has set the mileage reimbursement rate for state employees at $0.725 per mile, aligning with the current IRS federal standard. This rate applies when state employees use their personal vehicles for state business. As a private employer, you have the flexibility to adopt this rate.

Here's a tabulated snapshot of the IRS mileage reimbursement rates over the years.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Nevada mileage reimbursement calculator

Using the Nevada mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Nevada mileage reimbursement laws

In Nevada, state employees are entitled to mileage reimbursement when using a personal vehicle for official state business. Private employers are not generally required to reimburse business mileage, but workers’ compensation rules require certain travel reimbursements when employees are injured on the job.

Mileage reimbursement for state employees

Nevada law requires that the rate for reimbursing personal vehicle use for official state business match the IRS standard mileage rate in effect at the time it’s established. If a personal vehicle is used for personal convenience when a state-owned vehicle is available, the allowance is one-half of that established rate.

For example, since the IRS rate for 2026 is $0.725 per mile, then a state employee using their personal vehicle for official business would be reimbursed at $0.725 per mile. If they use their vehicle for personal convenience instead of an available state vehicle, the reimbursement would be half that amount (about $0.3625 per mile).

Workers' compensation mileage reimbursement requirements

Under Nevada's Code NAC 616C.150[1], private and public employers have specific obligations to reimburse mileage for employees injured at work who require travel for medical care, rehabilitation, or legal hearings related to their claims. Key requirements include:

- Medical Provider Designation: Employers must assign a medical professional, as employees cannot select their own doctor for work-related injuries.

- Travel to Medical Facilities: Mileage reimbursement is required if travel exceeds 20 miles one way from home or work.

- Ongoing Treatment: Employers must reimburse travel over 40 miles in a single week for continued treatment.

- Overnight Travel: For trips over 50 miles one way requiring an overnight stay, reimbursement is based on the state employee per diem rate or actual costs, whichever is less.

Additional considerations for compliance

- Safety Violations: Compensation can be reduced by up to 30% if employees violate safety rules, such as failing to wear a seatbelt during work-related travel.

- Minimum Wage Impacts: Nevada's minimum wage, currently set at $12/hr may affect how overtime and mileage are calculated for employees near this threshold. Employers should account for these changes when determining travel reimbursements.

Let Ramp automate your mileage tracking

Sticking to Nevada's mileage reimbursement laws is essential even though you are not mandated to follow them as a private employer. It will help your business in many ways, as listed below.

- Maintain compliance with the Workers' Compensation Act.

- Establish a trustworthy relationship with your employees.

- Build your business's reputation, ensuring profits for you in return.

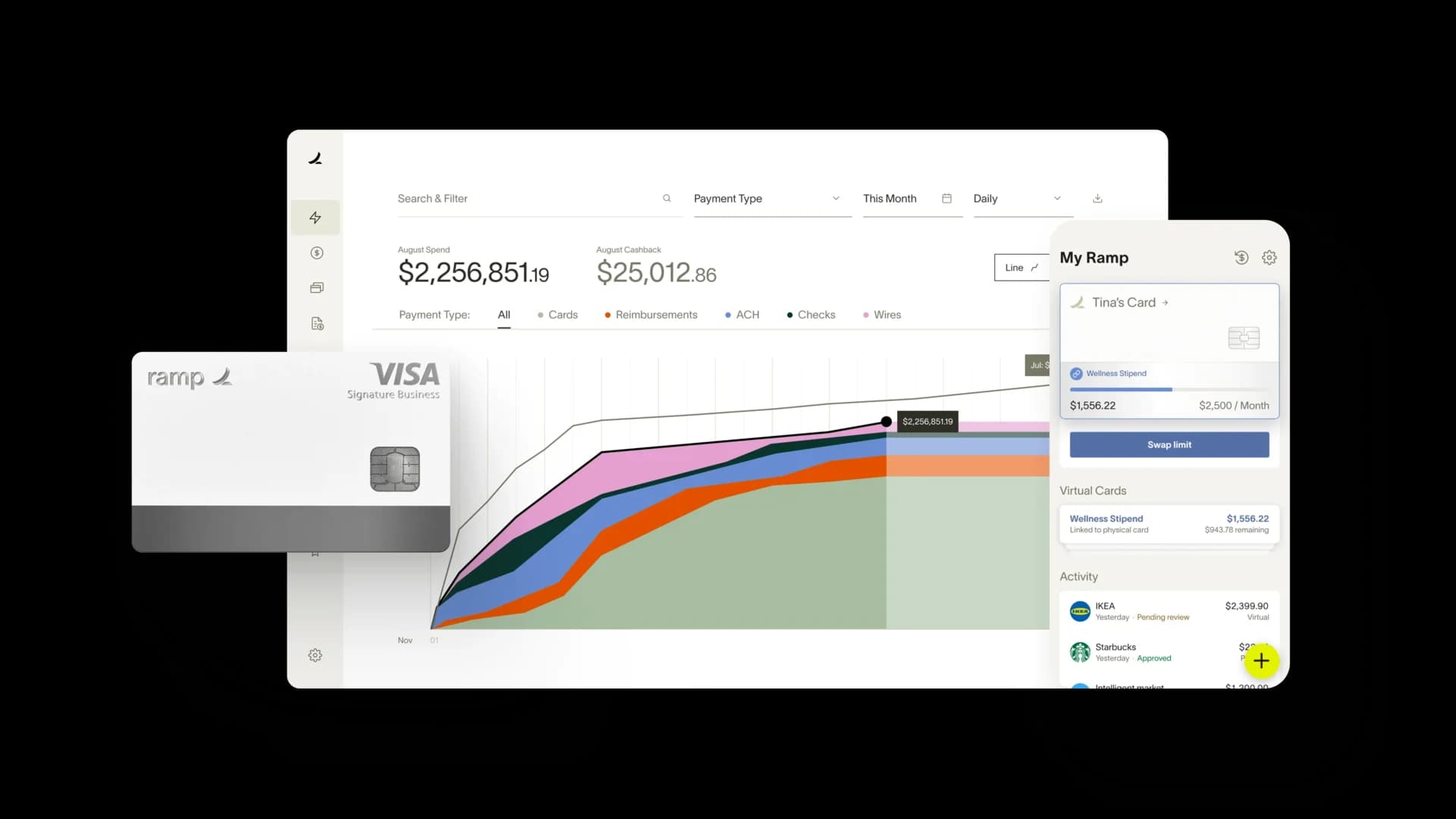

Want to simplify the mileage reimbursement aspect of your business – Ramp can significantly help. Ramp's AI-powered expense software automates mileage tracking and reimbursement, eliminating manual processes and reducing errors.

By using Ramp's software, you can ensure accurate and timely reimbursements, streamline your administrative tasks, and maintain clear records for compliance and auditing.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘NAC 616C.150 Eligibility and computation’: https://www.leg.state.nv.us/NAC/NAC-616C.html#NAC616CSec150