Oklahoma mileage reimbursement rates & calculator

Under Oklahoma's State Travel Reimbursement Act (74 O.S. § 500.4), state employees must be reimbursed for mileage at rates aligned with IRS standards.

For private employers, mileage reimbursement is generally optional. That said, Oklahoma’s Administrative Workers’ Compensation Act (§ 85A-50) does require mileage reimbursement for job-related medical travel, making it an important consideration when setting internal policies.

Even where reimbursement isn’t legally required, adopting fair mileage practices can help you:

- Build trust with your employees by covering legitimate work-related travel costs

- Stay aligned with Oklahoma’s Minimum Wage Law when business expenses could otherwise reduce take-home pay

Oklahoma business mileage reimbursement rates

For 2026, Oklahoma has set the business mileage reimbursement rate at $0.725 per mile. This rate, established by the Oklahoma Office of Management and Enterprise Services (OMES), aligns with the federal IRS standard.

If you, as a private employer, choose to reimburse your employees for mileage, you can do so at these rates or at rates above or below them.

Below is a table showing the 2026 IRS mileage reimbursement rate for Oklahoma, along with year-over-year rate changes.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Oklahoma mileage reimbursement calculator

Here's a straightforward approach to calculating Oklahoma mileage reimbursement.

- Choose the tax year for which you want to calculate

- Input the miles driven to determine how much money can be received in return.

Oklahoma mileage reimbursement laws

In Oklahoma, mileage reimbursement is governed by several statutes that apply to different groups, including state employees, workers’ compensation claimants, and employees covered under the Minimum Wage Act.

Below is an overview of the key rules employers should be aware of.

State employees’ mileage reimbursement (Code § 74-500.4)[1]

Employers within Oklahoma’s state system must reimburse state employees for mileage when they use a personal vehicle for official state business.

The reimbursement rate is aligned with the IRS standard mileage rate. When reviewing mileage claims, employers should ensure reported distances do not exceed those listed on the most recent Transportation Commission road map. Vicinity travel—short trips around an employee’s primary work location—must also be documented separately.

Workers’ compensation mileage reimbursement in Oklahoma

Under Oklahoma’s Administrative Workers’ Compensation Act (§ 85A-50)[2], private employers are required to reimburse mileage when an employee is injured on the job and must travel for authorized medical care.

Specifically, employers are required to:

- Reimburse mileage for medical travel exceeding 20 miles round-trip

- Cover reimbursement claims for up to 600 miles round-trip

This requirement applies even if an employer does not otherwise offer mileage reimbursement.

Oklahoma Minimum Wage Act

The Oklahoma Administrative Minimum Wage Act sets the state minimum wage at $7.25 per hour, consistent with the federal minimum wage. While the law does not generally require mileage reimbursement, it includes exemptions for certain worker groups, such as agricultural workers, domestic employees in private homes, newspaper carriers, and some interstate or volunteer roles.

Employers should ensure that required work-related expenses—including mileage—do not reduce an employee’s effective pay below the applicable minimum wage, as noncompliance can result in penalties.

Federal vs. Oklahoma mileage reimbursement rules

Oklahoma generally uses the IRS standard mileage rate as a reference point for reimbursement. However, state law imposes additional requirements in certain cases—most notably under workers’ compensation, where reimbursement for qualifying medical travel is mandatory.

Mileage reimbursement rates for county officers and employees may also be set locally by Boards of County Commissioners and can differ from the federal standard.

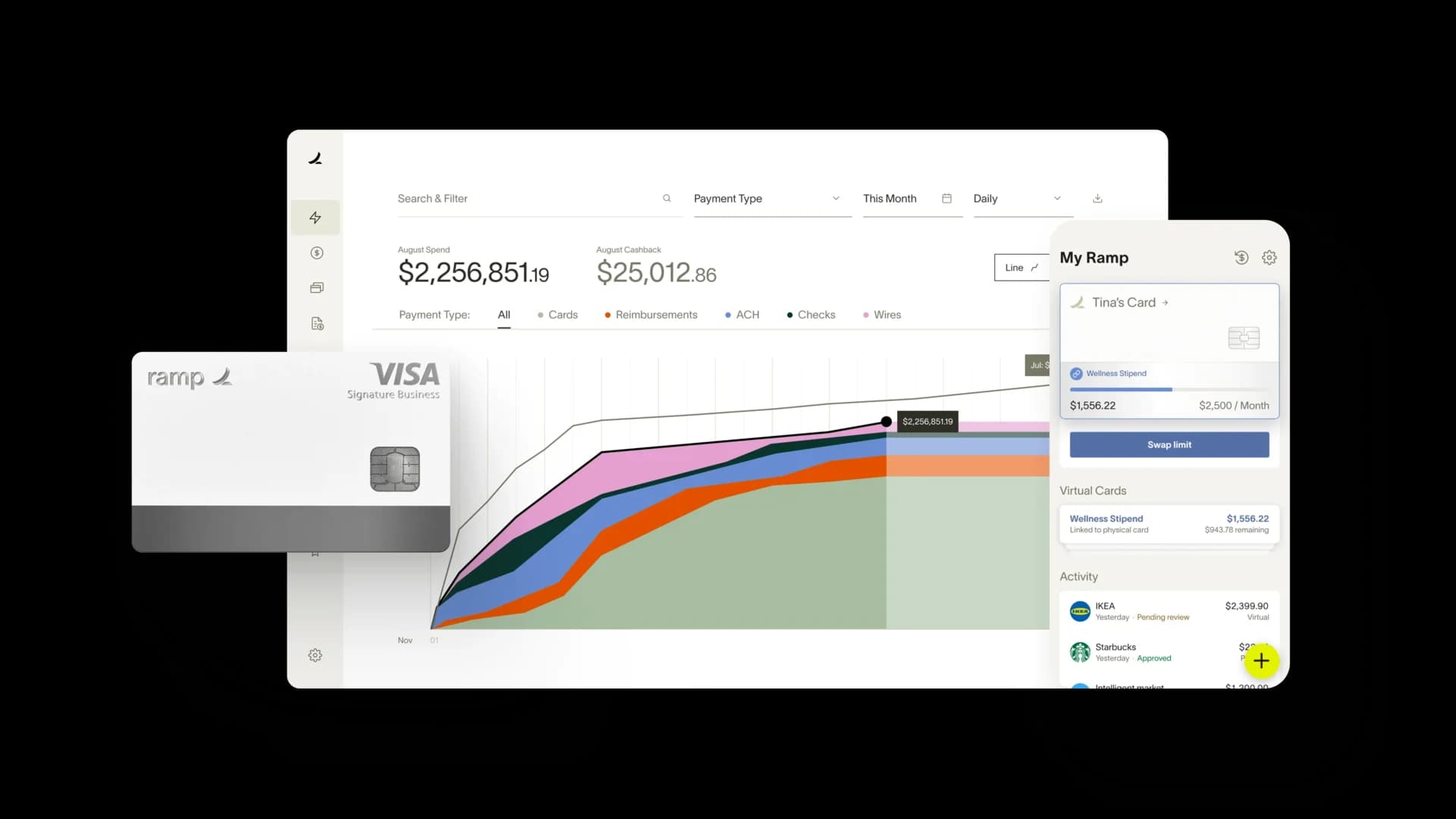

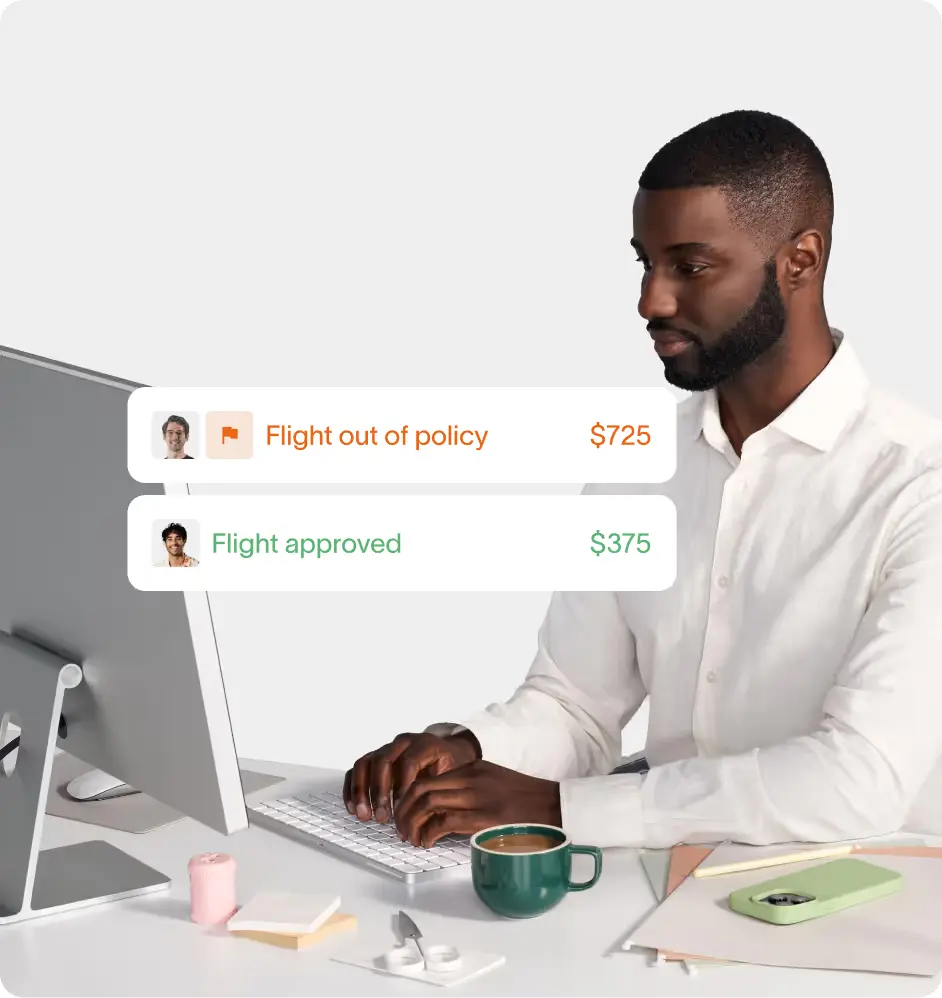

Eliminate errors in mileage logging and tracking with Ramp

Mastering the intricacies of mileage reimbursement, such as adhering to State Employee Mileage Code §74-500.4 and the stipulations under Code §85A-50, is crucial for maintaining compliance and effectively supporting your employees.

Proper reimbursement practices will foster a transparent and trusting work environment, ensuring financial security for both you and your team.

Want a tool that automates the entire mileage logging process for you? Ramp's AI-powered expense management software can automate recording and calculating travel distances. This reduces errors and saves you time, so you can focus on running your business.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under, ‘§74-500.4. Mode of travel - Approval - Rate of reimbursement’: https://oksenate.gov/sites/default/files/2019-12/os74.pdf

[2] Under, ‘§85A-50. Failure to provide medical treatment’: https://oksenate.gov/sites/default/files/2019-12/os85A.pdf