Tennessee mileage reimbursement rates & calculator

Every employee using a personal vehicle for business would prefer not to use their own money to cover mileage costs. While there is a stringent Tennessee mileage reimbursement Code §8-23-101, it outlines mileage reimbursement rates for major state officials, not the private sector.

For the private sector, mileage reimbursement is not mandated by the law. However, the Fair Labor Standards Act (FLSA) binds even you, as a private employer, to offer mileage reimbursement to your employees if their wages are slipping below the federal minimum wage.

Moreover, reimbursing fairly for mileage will boost your team's motivation level.

Tennessee business mileage reimbursement rates

As of 2026, Tennessee maintains a standard business mileage reimbursement rate of $0.725 per mile, aligning with the federal guideline set by the IRS. This rate applies to all eligible state employees and state officials and can also be adopted by you as a private employer.

Here's a tabulated snapshot of the current year's mileage reimbursement rates in Tennessee as per IRS, alongside a year-over-year rate comparison.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Note: You may reimburse your employees at rates above or below the IRS standard. However, any excess reimbursement over the IRS rate is subject to taxation as income.

Tennessee mileage reimbursement calculator

Using the Tennessee mileage reimbursement calculator is straightforward.

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Tennessee mileage reimbursement laws

Under Tennessee law, if an injured employee travels more than 15 miles one-way to get treatment, you must reimburse them for the mileage. This reimbursement covers fuel charges, vehicle-related expenses (including wear and tear), and insurance costs.

Explore the different mileage reimbursement laws in Tennessee below.

Mileage reimbursement code §8-23-101 for state officials

Code §8-23-101 ensures that state officials who use their personal vehicles for official duties are reimbursed at a rate consistent with what's authorized for all state employees. So, as you manage your team, it's good to know how the state handles these matters too.

This Code stipulates that mileage covered for work by major state officials, including travels from their home to the seat of government, is reimbursed at the standard state employee mileage rate.

This alignment guarantees fairness and uniformity in handling travel expenses across different government levels.

Federal minimum wage in Tennessee

You must meet the federal minimum wage standard of $7.25 per hour in Tennessee because there's no separate state minimum wage law. However, this doesn't mean overlooking mileage reimbursement is an option.

Under the Fair Labor Standards Act (FLSA), it's clear that if your employees incur expenses like mileage that dip their earnings below the federal minimum, you must reimburse them. Non-reimbursement in such cases can land your business in legal troubles.

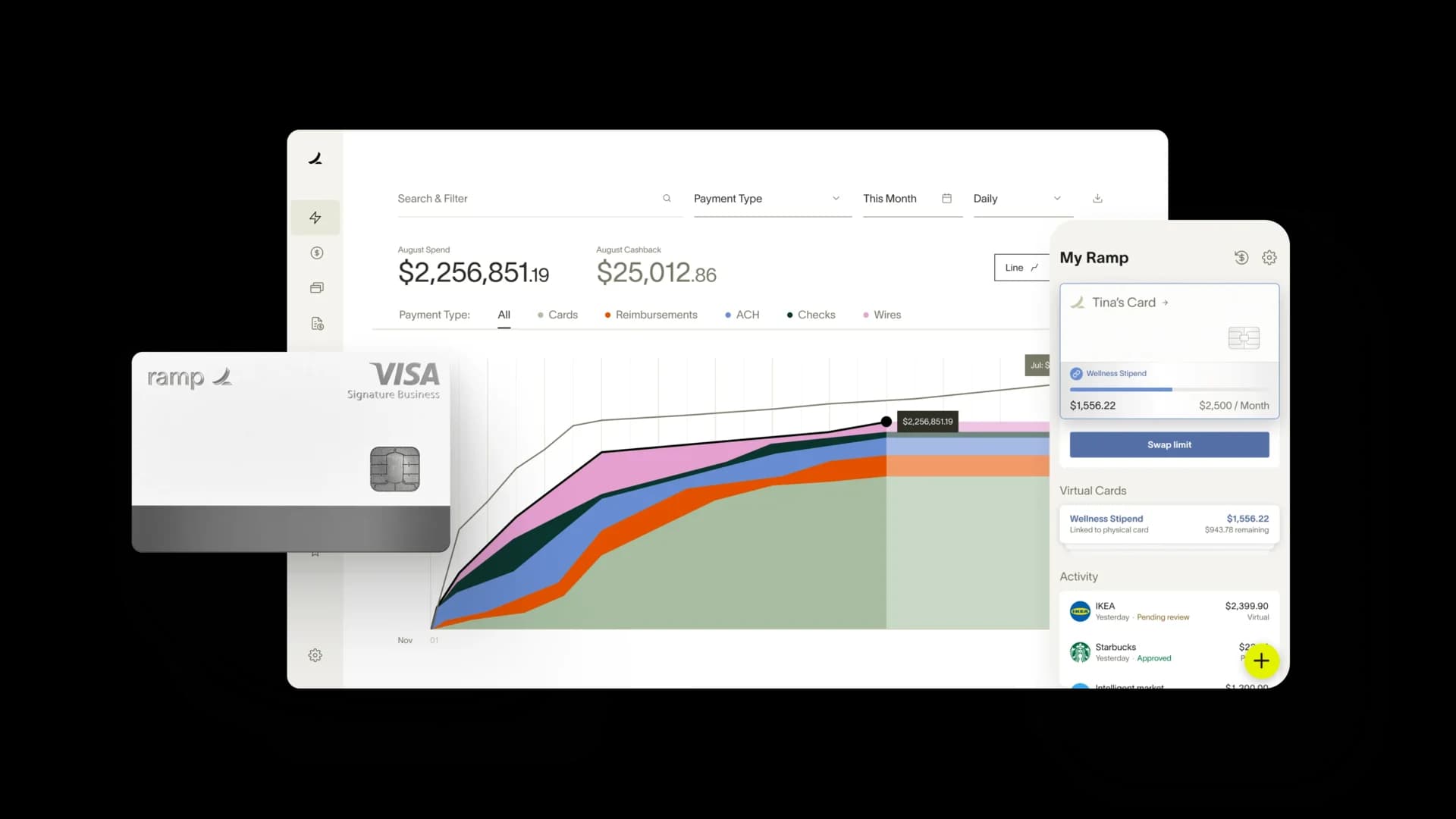

Auto-track your mileage logs with Ramp

Tennessee mileage reimbursement laws and codes such as Code §8-23-101 don't directly apply to you as a private employer, but they give a good idea of what fair mileage compensation looks like. Ensuring you're up to date with compliance will also keep you aligned with the federal minimum wage.

Additionally, when your employees receive fair mileage reimbursement, they begin to trust you. It has the following benefits.

- Increases team productivity, which, in turn, will be profitable for your business.

- Establishes your reputation as a business that truly considers and practices employee welfare.

Integrating Ramp into your business operations can revolutionize how you handle mileage reimbursements. Ramp's automated AI-driven expense management solution simplifies the logging and reporting of business mileage, ensuring accuracy and ease. Partner with Ramp and ensure that your employees are not financially penalized for using personal vehicles for business purposes.

See how Ramp automates expense and mileage tracking for 50,000 businesses