Texas mileage reimbursement rates & calculator

Reimbursing your employees for mileage when they use their personal vehicles for business-related chores is not legally mandated in Texas. But adopting the IRS standard mileage reimbursement rates can be a smart move.

Here's why you need to do this.

- Reimburse mileage fairly as it aids in talent retention.

- Compensate fairly to avoid violations of the FLSA, which mandates employees' wages stay above the federal minimum.

Moreover, when employees know they will not be billed out of their pockets, they will worry less about the financial burden. It will boost their productivity and your profit.

Texas business mileage reimbursement rates

As a Texas employer, you can reimburse business mileage at $0.725 per mile in 2026, as set by the IRS.

Here's a tabulated snapshot of mileage reimbursement rates in Texas as per the IRS standard rates and their year-by-year rate analysis.

| Tax Year | Business rate | Charitable rate | Medical/ moving rate |

|---|---|---|---|

| 2026 | $0.725 | $0.14 | $0.205 |

| 2025 | $0.70 | $0.14 | $0.21 |

| 2024 | $0.67 | $0.14 | $0.21 |

| 2023 | $0.655 | $0.14 | $0.22 |

| 2022 (Jul 1 to Dec 31) | $0.625 | $0.14 | $0.22 |

| 2022 (Jan 1 to Jun 30) | $0.585 | $0.14 | $0.18 |

| 2021 | $0.56 | $0.14 | $0.16 |

| 2020 | $0.575 | $0.14 | $0.17 |

Please note: While not a legal mandate, this IRS baseline allows you to adjust mileage reimbursement rates to suit your business needs better. Any amount above this rate is taxable.

Texas mileage reimbursement calculator

Using the Texas mileage reimbursement calculator is straightforward

- Choose the tax year for which you want to calculate.

- Input the miles driven to determine how much money can be received in return.

Texas mileage reimbursement laws

In Texas, mileage reimbursement for the private sector employees isn't mandated by federal or state laws, but understanding the legal nooks and corners is crucial if you opt to provide this benefit.

Specific state codes and regulations, listed below, can guide you on how to approach mileage reimbursement for your employees.

Understanding Texas government code: sections 660.041 to 660.043

In Texas, while general businesses aren't required to reimburse for mileage, state agencies have clear directives under Sections 660.041 to 660.043 of the Texas Government Code when it comes to compensating state employees for mileage.

Section 660.041 [1]

This section outlines the entitlement of state employees to reimbursement for business-related vehicle use.

The compensation is strictly for mileage incurred beyond the daily commute – think of out-of-town meetings or special assignments. This is crucial because it establishes that routine travel to and from work doesn't qualify for reimbursement under normal conditions.

Section 660.042[2]

As per this section, the maximum reimbursement rate is set. It cannot exceed the number of miles traveled multiplied by the applicable state-approved mileage rate. This rate often aligns with the federal mileage rate provided by the IRS to ensure consistency and simplicity in calculations.

Section 660.043[3]

This code focuses on determining reimbursable mileage, which is calculated based on the most cost-effective and reasonably safe route. It also mandates that multiple factors, such as safety, cost-effectiveness, and distance must be considered when determining the reimbursable route.

The implication here is that the shortest or quickest route isn't always the default choice. Safety and cost can dictate a different path that qualifies for reimbursement.

Can these guidelines help you?

If you're crafting a mileage policy for your company in Texas, mirroring the state codes and guidelines can definitely help.

Here's all that you have to do.

- Set clear standards for fairness to keep everyone on the same page.

- Stick closely to these practices to safeguard your business against complaints and disputes, even if you're not legally required to follow them to the letter.

Implications of non-reimbursement

Under the FLSA, while not legally requiring mileage reimbursement, it's implied that you should compensate your employees for expenses incurred if those expenses bring their effective pay below the federal minimum wage of $7.25 per hour in Texas.

Streamline your mileage logs with Ramp

While you’re not legally obligated to do so, you should offer mileage reimbursement to your employees.

The chances that your competitors are reimbursing their employees fairly are very high. If you don’t reimburse yours, it will only encourage your employees to leave your business and seek workplaces where they will feel valued.

Adopt proper reimbursement practices as they show your commitment to fair workplace policies. The result? Employee satisfaction and talent retention.

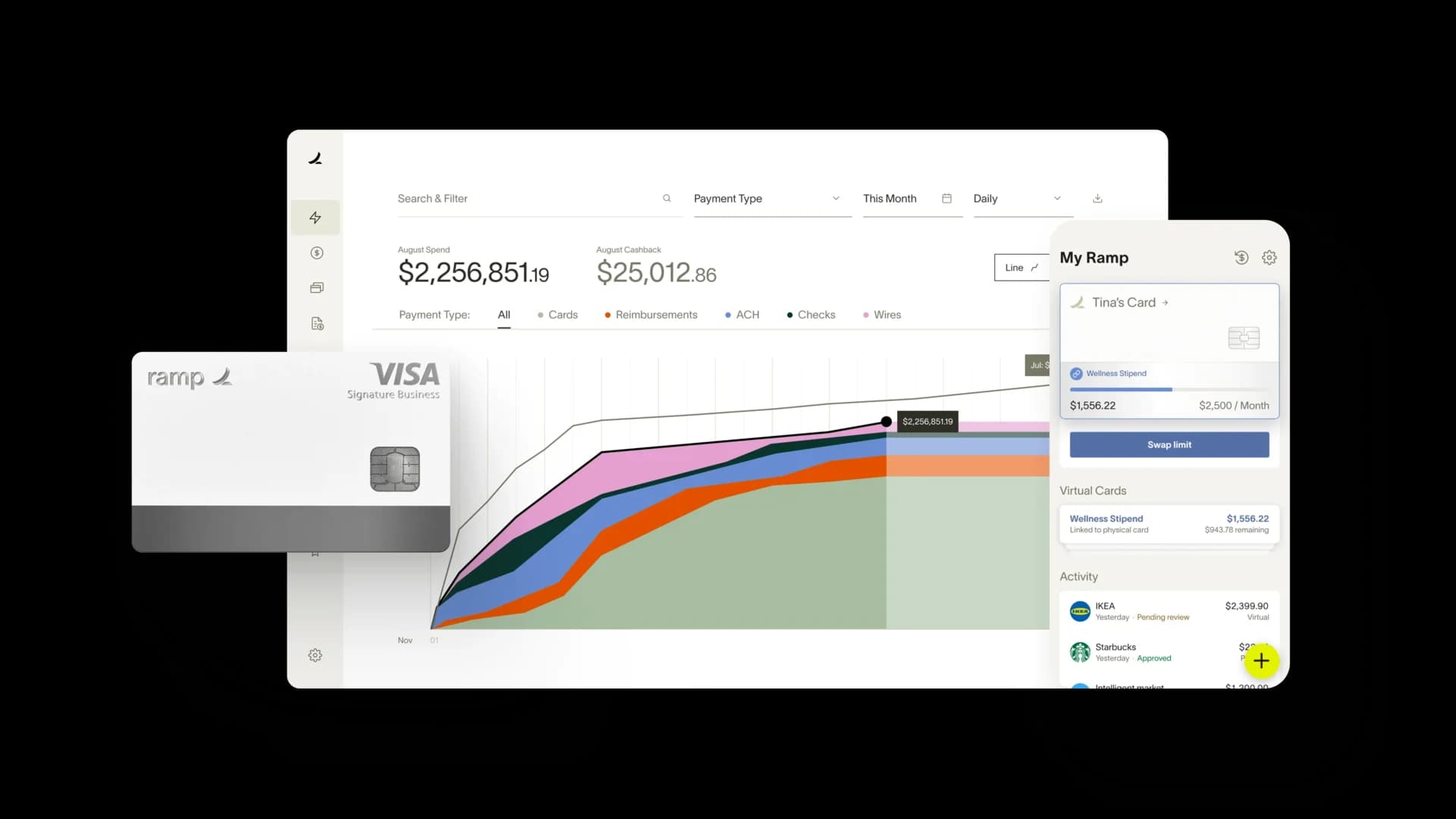

Automating your mileage reimbursement process with Ramp’s AI-powered expense management software is the answer. It integrates with Google Maps for hassle-free tracking of business travel and automates the recording and calculation of business miles. Take human error out of the equation now.

See how Ramp automates expense and mileage tracking for 50,000 businesses

Related posts

[1] Under the header, ‘Sec. 660.041. Reimbursement requirement’: https://statutes.capitol.texas.gov/Docs/GV/htm/GV.660.htm#660.041

[2]Under the header, ‘Sec. 660.042. Amount of reimbursement’: https://statutes.capitol.texas.gov/Docs/GV/htm/GV.660.htm#660.042

[3] Under the header, ‘Sec. 660.043. Determination of reimbursable mileage’: https://statutes.capitol.texas.gov/Docs/GV/htm/GV.660.htm#660.043