Acumatica expense management: What it is and integrations to add with it

- What is Acumatica expense management?

- Integrating Acumatica with expense management tools

- Top 3 expense management integrations to use with Acumatica

- How to choose the best expense management integration for Acumatica

- What to check before setting up an Acumatica integration

- Integrate Ramp with Acumatica

Efficient expense management is essential for controlling costs, improving accuracy, and supporting timely decision-making. Acumatica’s expense management capabilities make it possible to automate expense capture, routing, and posting directly within your ERP environment. By combining automation with built-in policy enforcement and real-time reporting, Acumatica helps businesses streamline operations while keeping spending aligned with company goals.

For many organizations, the next step after implementing Acumatica’s native expense tools is to connect them with complementary integrations. These integrations can add features like advanced travel booking, specialized analytics, and additional mobile capabilities—all while working seamlessly with Acumatica’s core financial modules.

Here’s how Acumatica expense management works, its key benefits, and top expense management integrations that can expand its features.

What is Acumatica expense management?

Acumatica expense management is built into the ERP, giving finance teams a single, connected system for capturing, reviewing, approving, and posting expenses. Because it shares the same database with your general ledger, accounts payable, and project accounting modules, every expense flows through to reporting and reimbursement without extra data transfers.

Receipts can be uploaded from mobile devices or desktops, and Acumatica offers optional OCR/image recognition capabilities that, when enabled, extract key details such as vendor, date, and amount to help fill in the expense form automatically. Once submitted, expenses are checked against your organization’s policies—flagging items that exceed limits, require additional documentation, or need extra review.

Once approved, expenses post directly to the general ledger and, if applicable, to specific projects. Integration with corporate card feeds allows automatic matching and reconciliation.

Key benefits of using Acumatica’s expense management tools within its ERP include:

- Faster approvals: Automated routing ensures each expense goes directly to the correct approver, with reminders and alternate routing to avoid delays. Approvers can review and approve from mobile devices or desktops

- Reduced manual entry: AI-assisted categorization eliminates most data entry, cutting down on keystroke errors and freeing up staff for higher-value work. The system learns over time, improving accuracy as it processes more expenses

- Policy compliance: Built-in rules check each expense at submission, preventing non-compliant items from reaching final approval. Exceptions are flagged with clear reasons, making it easier for approvers to make informed decisions

- Integration with financial processes: Because expense management is part of Acumatica’s ERP, approved expenses post directly to the ledger, accounts payable, and project accounting—no duplicate entry or reconciliations required

Integrating Acumatica with expense management tools

Acumatica is an ERP designed to work as the central hub for your financial operations, and that includes connecting seamlessly with third-party expense management platforms. By integrating directly, expense data—such as receipts, categories, approvals, and corporate card transactions—flows automatically from the external tool into Acumatica’s general ledger, project accounting, and reporting modules. This eliminates the need for manual imports or duplicate entry, ensuring information stays accurate and current across systems.

An integration allows you to maintain a single source of truth for all spending while using the specialized features of your chosen expense tool. For example, some platforms provide advanced mobile receipt scanning, AI-driven policy checks, or built-in travel booking capabilities. When linked to Acumatica, those features enhance day-to-day expense handling without requiring finance teams to leave the ERP environment for reconciliation or reporting.

Integrated expense management can also strengthen compliance by enforcing consistent coding and policy rules across both systems. It improves visibility, as expenses can be tracked from submission through reimbursement alongside other financial data. This unified approach supports better budget oversight, faster month-end close, and more informed decision-making.

Top 3 expense management integrations to use with Acumatica

Acumatica’s native expense features are robust, and many organizations choose to connect them with third-party tools to extend capabilities. Here are the top 5 expense management integrations to use with Acumatica to enhance its expense workflows while keeping financial data synchronized.

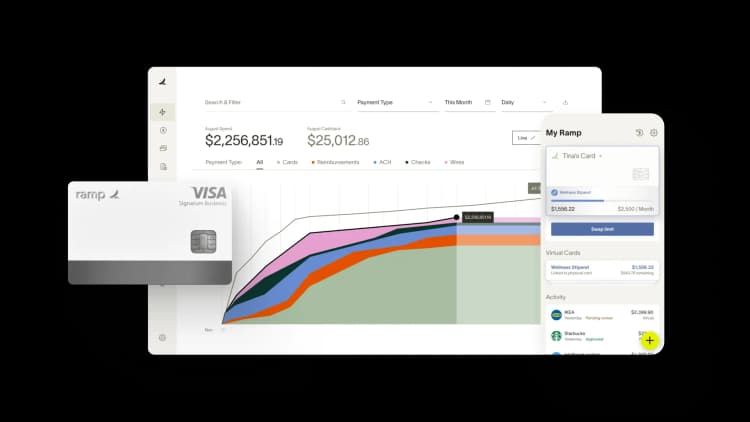

1. Ramp Expense Management

Ramp is a complete finance automation platform designed to help businesses manage expenses, control spend, and close their books faster—all in one system. From smart corporate cards, automated receipt matching, AI-powered accounting workflows, and AP automation for Acumatica—Ramp gives finance teams the tools to reduce manual work and gain better visibility into their operations.

The platform is a top Acumatica integration as it helps teams scale without sacrificing control—offering policy enforcement, multi-entity support, and customizable approval workflows out of the box.

Here are some key features about Ramp’s direct Acumatica integration:

- Easily import all fields, including dimensions, from Acumatica to ensure comprehensive transaction coding

- Sync data in real time, including cash purchases, bills, and transfers

- Build rules in Ramp to automate coding, approvals, and transaction reviews

- Sync default vendors and create new vendors from Bill Pay

- Manage each entity within one Ramp instance

Together, Ramp and Acumatica simplify complex financial processes—so your team can focus more on strategy and less on manual work.

2. SAP Concur

SAP Concur integrates with Acumatica through prebuilt templates that enable businesses to connect expense data across platforms without requiring custom code or IT involvement. Built on Celigo’s integration platform, this setup supports real-time data exchange between systems and offers both preconfigured and customizable workflows for broader flexibility.

Features include:

- Out-of-the-box integration flows for syncing data from Acumatica to SAP Concur, with options for additional customization based on business needs

- Error management tools, including auto-resolution, notifications, and recovery features

- Advanced workflows through integration orchestration, JavaScript hooks, and a developer-friendly interface

3. Tipalti

Tipalti’s integration with Acumatica helps finance teams automate global payables and streamline procurement processes. It supports growing businesses with complex needs, it connects AP workflows directly into Acumatica to improve accuracy, speed, and visibility.

Its main features include the ability to:

- Sync payables data in real time between Tipalti and Acumatica

- Send payments to multiple countries in various currencies from one dashboard, with support for multiple payment methods and compliance safeguards

- Manage AP across subsidiaries with entity-level segregation, and onboard suppliers through a self-service portal with tax compliance available

How to choose the best expense management integration for Acumatica

Selecting the right expense management integration starts with identifying your business goals and matching them to the capabilities of the tool. If your organization has a high volume of travel-related spending, you may prioritize a platform with built-in travel booking and itinerary management. For project-based businesses, look for integrations that support detailed cost allocation and tracking across multiple dimensions. Teams processing a large number of corporate card transactions might focus on tools with strong card feed reconciliation and policy enforcement features.

The most effective integration will align with your current processes while adding capabilities that enhance efficiency, compliance, and visibility. It should connect seamlessly to Acumatica so expense data is captured once and flows through to the general ledger, project accounting, and reporting without manual intervention.

What to check before setting up an Acumatica integration

Before implementing any integration, ensure that both your Acumatica environment and your chosen expense management tool are configured to support your workflows. Confirm that your chart of accounts, dimensions, and approval hierarchies are up to date and reflect current business structures. Review your existing expense policies to make sure they are ready to be enforced consistently across both systems.

It’s also important to define your data mapping early—decide how categories, projects, vendors, and employees will match between platforms. Test the integration in a non-production environment to validate data flow, policy enforcement, and approval routing. Establish a process for handling exceptions or errors so that integration issues don’t delay reimbursements or month-end close.

Integrate Ramp with Acumatica

Ramp’s direct integration with Acumatica offers a complementary approach to managing expenses by combining the ERP’s robust financial capabilities with Ramp’s intelligent spend management tools. Transactions from Ramp corporate cards and reimbursement requests flow automatically into Acumatica, complete with receipts, coding, and approval data.

This real-time connection means finance teams can monitor spending as it happens, maintain accurate records without duplicate entry, and ensure policy rules are applied consistently. Ramp also supports flexible approval workflows, enriched transaction data, and advanced reporting, making it a strong partner for organizations looking to maximize the value of their Acumatica investment.

Start integrating Ramp with Acumatica to manage expenses seamlessly, from purchase to reconciliation.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits