Sage Intacct AP automation: What it is and how it works

- What is Sage Intacct AP automation?

- Features of Sage Intacct AP automation

- Setting up Sage Intacct software

- What to do when you’re all set up

- Using Ramp AP software alongside Sage Intacct

- Case study: How Ramp’s real-time integration with Sage Intacct transformed REVA’s AP workflows

- Maximize Sage Intacct AP management with Ramp Bill Pay

Chasing down invoices, correcting manual errors, and navigating approval bottlenecks can make managing accounts payable prone to costly mistakes. That’s where Sage Intacct can turn this time-consuming process into a streamlined workflow.

But how exactly does Sage Intacct’s accounts payable functionalities work?

This guide walks through how Sage Intacct AP automation works, its specific feature set, and how Sage ERPs can be paired with third-party solutions like Ramp to further elevate its accounts payable processes.

What is Sage Intacct AP automation?

Sage Intacct AP Automation

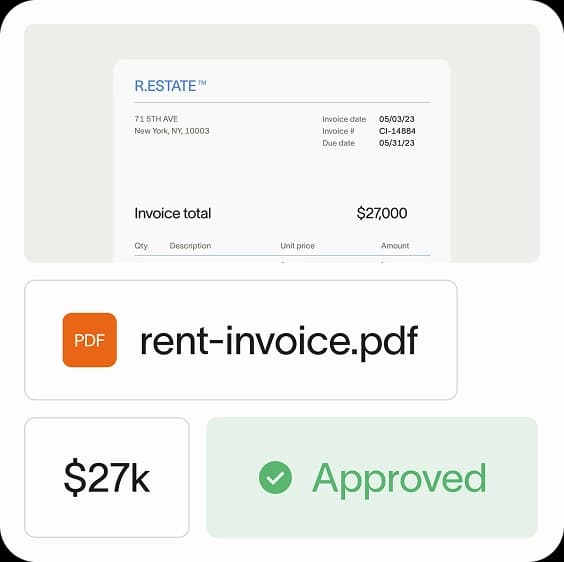

Sage Intacct AP automation is an AI-powered solution that streamlines accounts payable by automating tasks like invoice processing, approvals, and payments. It reduces manual data entry, errors, and ensures timely payments, giving businesses real-time visibility and control over their AP workflows.

More specifically, Sage Intacct uses AI to automate AP and process invoices faster. Upload or email an invoice, and the system automatically captures vendor details, amounts, and payment dates. It creates a draft for review and flags duplicates, ensuring your records stay clean.

Moreover, approvals and payments are managed in one platform, with real-time dashboards to track progress and keep everything organized.

Features of Sage Intacct AP automation

Sage Intacct AP automation software is built to make managing accounts payable easier and more accurate. Below are a few of main features of Sage AP automation capabilities in more detail:

- AI-powered invoice processing: As stated earlier, Sage Intacct’s main capability is to automatically extract invoice details like vendor information, amounts, and due dates to save hours of manual data entry.

- Customizable workflows: Tailor approval processes and spending limits to fit your business needs and maintain compliance.

- Recurring payment automation: Automate recurring payments to ensure critical bills are always paid on time.

- Real-time visibility: Use centralized dashboards to track approvals, payments, and audit trails, keeping your team informed and in control.

- Duplicate invoice detection: Catch duplicate invoices before they’re paid, reducing the risk of costly errors and ensuring clean records.

- Flexible payment options: Offer vendors their preferred payment methods, including ACH, virtual cards, and checks, for a seamless payment experience.

What about using third-party software for Sage ERPs?

Sage Intacct already provides powerful AP features, but they do integrate with other systems to enhance its functions even further. That’s where complementary solutions like Ramp, used alongside the existing AP capabilities of Sage Intacct, can provide added value for more complex and technical AP workflows.

For example, Ramp's AP software can complement Sage ERP systems by offering features like OCR that auto-fills bills down to each line item, AI-driven auto-coding, AP aging reports, and more.

So whether an organization stays within Sage’s ecosystem for additional AP functionality or integrates third-party software, these solutions can help add another layer of optimized AP workflows.

We’ll dive into this in more detail after reviewing our best practices for setting up Sage Intacct software.

Setting up Sage Intacct software

Getting started with Sage Intacct and its AP features is straightforward, but preparation is key. Before diving in, ensure your organization has an active Sage Intacct account, appropriate user permissions, and access to up-to-date vendor and financial data.

How to configure AP automation features in Sage Intacct

Though the process may vary, here are the typical steps when it comes to setting up Sage Intacct AP capabilities:

- Confirm access permissions: Verify that team members responsible for accounts payable have the necessary roles and permissions to configure automation features.

- Set up AP approvals: Navigate to the "Accounts Payable" settings in Sage Intacct, and configure your setup and payment approval settings.

- Upload vendor information: Upload vendor details, including payment preferences and contact information, into Sage Intacct for invoice matching.

- Connect bank accounts: Link your organization’s bank accounts to enable electronic payments and real-time cash flow updates.

If you choose to connect your Sage Intacct software with an external AP automation tool like Ramp, ensure that the tool is compatible with your system. Once compatibility is confirmed, configure workflows to align with your business’s processes.

What to do when you’re all set up

Once your Sage Intacct software is fully implemented, it’s time to ensure that you’re following best practices for handling accounts payable. Here’s a few tips to keep in mind:

- Invoice processing: Regularly audit invoice drafts for accuracy, especially during the initial months of using Sage Intacct. Use batch uploads for high-volume processing to save even more time.

- Real-time reporting and insights: Customize dashboards to align with your team’s goals and AP metrics. Use reporting insights to refine workflows and improve cash flow management.

- Vendor management: Keep vendor profiles up to date with accurate information, and review vendor reports regularly to identify opportunities for cost savings or negotiation.

- Payment processing: Schedule payments to take advantage of early payment discounts and monitor cash flow dashboards to avoid overextending funds.

Using Ramp AP software alongside Sage Intacct

Using Ramp Plus alongside Sage Intacct can enhance your AP workflows by combining the robust accounting and ERP capabilities of Sage Intacct with Ramp’s advanced features. Sage Intacct excels at providing the foundation to AP processes and Ramp Plus complements its functionality by adding precision, flexibility, and control. When paired with Sage Intacct, Ramp Plus strengthens your AP operations while simplifying financial data management.

Here are the additional features within Ramp Plus that make its integration with Sage Intacct more robust:

- Custom fields and UDD: We pull in custom fields from your Sage Intacct configuration as well as any UDD’s to allow you to code everything you need within Ramp.

- Receipt attachment: Receipts uploaded in Ramp automatically sync to your Sage Intacct instance, including any added after the transaction has been synced, saving you from manual updates.

- Entity management: Ramp Bill Pay supports multiple entities, allowing you to assign default bank accounts for bill payments, link corresponding cash accounts in Sage Intacct, and specify default AP accounts for bill tracking.

- Bill payment integration: Pull bills from Sage Intacct into Ramp and pay them through Ramp Bill Pay.

- Entity-specific tracking: Manage card transactions, reimbursements, and bill payments for each entity using different bank accounts.

Together, Ramp Plus and Sage Intacct deliver a complementary, efficient, and secure AP workflow that helps your finance team stay ahead.

Case study: How Ramp’s real-time integration with Sage Intacct transformed REVA’s AP workflows

REVA Air Ambulance, a provider in air medical transportation, struggled with outdated, labor-intensive accounts payable workflows. Manual receipt uploads and month-end expense reporting left finance teams without timely visibility, delaying reimbursements and prolonging reconciliations.

Integrating Ramp with Sage Intacct transformed REVA’s AP processes by automating workflows, enabling real-time transaction syncing, and accelerating month-end closes. Ramp’s intuitive tools made receipt management simple for employees, while Sage Intacct offered the finance team a centralized, real-time view of financial data.

The results? They were everything REVA needed:

- 80%+ reduction in AP process time: Decreased invoice processing time from 15–20 minutes to under 3 minutes.

- 6 weeks saved on reimbursements: Enabled same-day reimbursements by automating receipt uploads and transaction matching.

- 2 weeks faster time to close: Achieved month-end close by the 4th or 5th of the month through frequent reconciliations.

“We were able to mold Ramp to our company to set it up as needed within departments. But the biggest selling feature to us was the automatic, real-time integration with Sage,” said Seth Miller, Controller at REVA Air Ambulance.

Ramp and Sage Intacct complement each other by enhancing automation and providing robust financial visibility. Together, they simplify AP workflows, saving time and allowing finance teams to focus on strategic priorities.

Maximize Sage Intacct AP management with Ramp Bill Pay

Sage Intacct's AP automation capabilities reduce the inefficiencies of manual processes, offering speed, accuracy, and visibility. To complement Sage Intacct, integrating with Ramp can add another layer of optimization.

Ready to streamline your finances? Try Ramp Bill Pay alongside Sage Intacct and transform how your business handles AP.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits