Integrated accounting software: Key features and top solutions

- What is an integrated accounting system?

- Traditional accounting vs. integrated accounting systems

- Essential features of an integrated cost accounting system

- When to consider integrated accounting software

- Benefits of integrated accounting systems

- 4 best integrated accounting software solutions

- Automate and integrate accounting software

Integrated accounting software systems help companies streamline their financial accounting and overcome challenges that stem from relying on multiple data sources and platforms to make sense of their financial data. Gaps between systems can delay accounting processes; integrated accounting software helps firms bridge those gaps.

What is an integrated accounting system?

An integrated accounting system is software that brings every aspect of accounting onto a single platform.

By eliminating the need to transfer data manually between multiple financial platforms, an integrated accounting solution simplifies accounting processes. These solutions can be a single platform containing different modules or a smaller solution integrating with financial management software.

Traditional accounting vs. integrated accounting systems

When managing your company’s finances, you have the option to choose between traditional accounting methods and modern integrated accounting systems. Both approaches track and manage financial data, but their capabilities are quite different.

Integrated accounting systems offer greater automation and accuracy. They help you improve financial health, optimize business accounting, and streamline operations.

Because the integrations connect systems such as Customer relationship management (CRM) and Enterprise Resource Planning (ERP), they make financial reporting and decision-making easier by providing you with a wealth of real-time data and insights.

Here’s a comparison of the two:

Category | Traditional accounting | Integrated accounting systems |

|---|---|---|

System type | Manual or standalone accounting software | Cloud-based systems that integrate with other business functions |

Data management | Manual data entry and error-prone processes | Real-time data updates across all functions, which reduces human error |

Accounting processes | Separate processes for accounts payable, accounts receivable, and bookkeeping | Unified accounting functions such as general ledger, inventory management, and financial management |

Real-time reporting | Limited, requires manual updates and often outdated | Real-time financial data for instant access to financial statements and insights |

Financial forecasting | Based on past trends and assumptions, often inaccurate | Data-driven forecasting using live metrics, enhancing decision-making |

Integration with other tools | Requires manual reconciliation and no direct integrations | Seamless accounting software integrations with CRM, ERP, payment processing, and more |

Cost | Potentially lower upfront cost, but higher long-term maintenance costs | Higher initial investment, but more cost-effective over time due to automation and scalability |

Customization | Limited flexibility to adapt to business needs | Highly customizable with modules for different business processes |

Security | Vulnerable to data loss, especially if handled manually | Cloud-based security features with automatic backups and real-time monitoring |

Compliance | Can be more challenging to maintain up-to-date with regulatory requirements | Automated updates ensure that financial processes comply with regulatory standards |

Essential features of an integrated cost accounting system

Here are the most important features of every integrated software accounting solution.

Accounts Receivable and Accounts Payable

Accounts receivable (AR) and accounts payable (AP) departments play a major role in helping firms project their cash flow needs. AR handles payments a company receives from its customers, while AP handles payments to its suppliers.

Software helps these teams project the cash inflows and outflows the company can expect over a period, minimizing expenses and smoothing working capital needs. For instance, AP software can alert teams to early payment, or annual bulk payment discounts vendors offer, lowering procurement costs.

Expense and vendor purchasing management

Procurement is central to a company's supply chain, and reducing vendor-related costs boosts gross margins. Thanks to the rise of SaaS apps, expense management is closely tied to vendor-related costs.

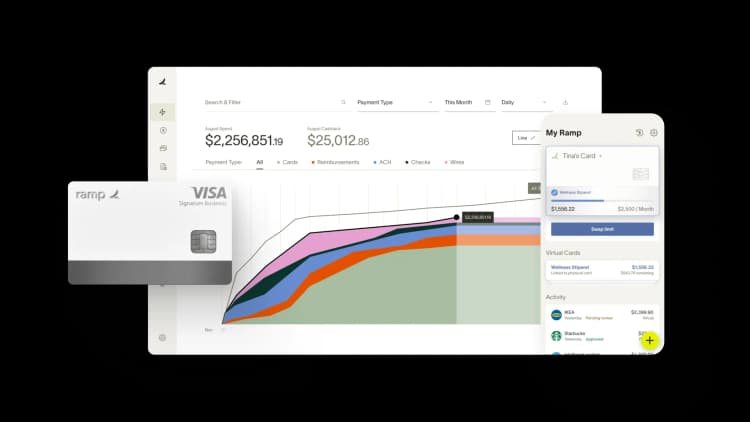

For instance, employee spending on SaaS apps can spiral out of control if your company does not maintain a spending policy. Tools such as Ramp help companies centralize SaaS vendor spending and nip problems such as shadow IT and duplicate expenses in the bud.

Integrated accounting software records this spend in appropriate journal entries, simplifying spending classification and general ledger (GL) transfers.

GL accounting

Accountants rely on their GL to prepare statements and reconcile cash flows. As a company grows, preparing a GL becomes challenging. Multiple systems can create data silos that will lead to incorrect financial reporting.

An integrated accounting system brings all expense accounting and reporting onto a single platform, automating GL creation. The result is less manual work for accountants and more time for value-added financial planning and analysis.

Cash reconciliation

All growing companies rely on accrual-based accounting, recording cash and expenses before they occur physically. As a result, it’s important to reconcile journal entries to cash positions.

Integrated accounting software eases this task by presenting all financial data on a single platform. Accounting teams do not waste time searching disparate systems for data. Some integrated systems even automate reconciliation tasks.

For instance, some expense management modules match receipts to bank statements, resulting in speedy expense reimbursement and month-end close processes.

Bookkeeping

Bookkeeping and accounting are closely related. As volumes rise, entering transactions into the right accounts under the double-entry bookkeeping system can be challenging.

Integrated software systems simplify this task by automatically pulling financial information such as expense and revenue data into the correct accounts and creating offsetting journal entries. Thus, bookkeeping becomes simple, and accounting statement preparation times drop.

Inventory management

Integrated accounting systems handle the financial aspects of inventory, such as recording purchasing costs and simplifying inventory accounting. For instance, estimating the impact of changing from FIFO to LIFO is difficult when using standalone software or manual accounting.

In such scenarios, integrated accounting systems automate most processes, helping your accountants come up with accurate inventory numbers. The result is a flexible and resilient accounting system that can quickly respond to business needs.

Choose integrated accounting software with features such as accounts receivable, accounts payable, and inventory management to automate processes and improve cash flow.

When to consider integrated accounting software

Integrated accounting systems present companies with many advantages. However, before adopting a solution, check whether your business:

Deals with multiple revenue sources

Companies collect revenues from different sources in different formats. For instance, POS terminals deliver highly granular revenue datasets, but app stores deliver bulk sales data without additional context. Integrating these formats is challenging.

Integrated accounting systems will help you standardize datasets and deploy analytics on them. Thus, analyzing trends in your revenue and customer relationships is simple.

Struggles with lengthy expense audits

Expense reporting and approvals become a bottleneck as a company grows. Lengthy expense reimbursement and approval times antagonize employees and delay monthly closes.

Integrating an expense management SaaS provider with your accounting platform will help you create end-to-end workflows that result in quick monthly closes, better budget projections, and automated expense audits.

Faces difficult reconciliations

If your team is experiencing significant reconciliation challenges, adopting an integrated accounting system is a great idea. For instance, if your AR team faces challenges reconciling invoices to cash, integrating an AR automation solution will help your teams get on the same page and apply cash to invoices quickly.

Similarly, thanks to readily available data and automation capabilities, hedge accounting workflows can also become simpler with an integrated accounting system.

Lacks insight into AP and AR metrics

AP and AR provide insight into your company's ability to create efficiency and lower unnecessary expenses, using metrics to track progress. All these metrics rely on financial data, and integrated accounting systems offer advantages.

Thanks to data from every source being present on a single system, you can automate metric calculation and focus on improving your processes. Some of these metrics include:

- Day sales outstanding: How quickly are you collecting on invoices?

- Dispute to invoice rates: How accurate are your invoices?

- Percent of early discounts captured: Are you saving money when paying supplier invoices?

Is befuddled by opaque inventory

Can you predict the balance sheet after-effects of switching WIP thresholds on your balance sheet? If you're struggling to understand the financial implications of your inventory processes, an integrated accounting system that incorporates inventory management is essential.

Is bogged down by manual data entry

As transaction volumes grow, keeping pace with different data formats and duplication issues becomes impossible, rendering manual processes ineffective.

An electronic platform that automates most financial tasks will help you focus on value-added tasks in the workflow, helping you squeeze more profit from your resources.

Benefits of integrated accounting systems

Here are some of the benefits of adopting integrated accounting software platforms for your business.

- End-to-end view of financial transactions: In today's fast-paced business environment, you must possess end-to-end visibility of your financial data, eliminating data silos and manual data entry tasks. Integrated accounting systems will help you view the financial implications of your decision on every part of your organization. You can build accurate business projections, knowing that you're always considering the entirety of your data.

- Automatic cash-to-ledger translation: When relying on manual processes in a growing business, crafting journal entries is tough. Worse, if your accounting system is part of several disconnected electronic platforms, translating and uploading data will create duplication and other errors. An integrated accounting system renders such errors almost entirely nonexistent. You can rest assured that all data standardization and uploads occur in the background while you gain a real-time view of your business.

- Greater ROI on financial resources: Thanks to integrated accounting software offering you insight into your financial data, you can spend time analyzing patterns and removing inefficiencies. For instance, you can integrate expense management and employee spending on SaaS apps with your accounting system and close your books faster. You can also integrate standalone accounting solutions that help you create rules, automate approvals, and reconcile transactions. The result is faster monthly closes and accurate financial projections.

- Data-driven decisions: Modern businesses collect an immense amount of data but struggle to leverage it. Integrated accounting systems remove the roadblocks to data-driven decision-making, such as data silos and manual processes. By automating most clerical work, you'll leave room for analysis that makes a difference to your company's bottom line.

4 best integrated accounting software solutions

Here are four of the top integrated accounting software solutions for your business.

1. QuickBooks

QuickBooks by Intuit is one of the most popular accounting applications for businesses. Its ease of use makes it a no-brainer for most companies, and its pricing ensures popularity with small businesses. The software's basic version includes most accounting modules such as:

- AR, invoicing and billing, expense tracking, and purchase orders

- Client portals for faster payment collection

- AP and vendor management

- Bookkeeping

- GL preparation, profit and loss statement, balance sheet creation

Advanced versions help your business integrate ACH payments, mobile payments, and subscription billing.

Ramp integrates with QuickBooks to help you digitize expense policies and categorize spending.

2. NetSuite

Oracle's NetSuite is a popular accounting platform for midsized businesses and enterprises. It comes replete with highly customizable options and a range of features such as:

- Enterprise resource planning (ERP) features - Integrate front and back-office processes, billing, and order management

- General ledger preparation

- End-to-end inventory management

- Customer relationship management (CRM)

If your company is rapidly growing and is approaching the midsized capitalization mark, choosing NetSuite is a good idea.

Ramp integrates with NetSuite, helping you manage multiple entities and digitize expenses across all of them.

3. Sage Intacct

Like NetSuite, Sage Intacct is ideal for large corporations and features an intuitive drag-and-drop user interface. It integrates with several third-party apps, including Ramp, to simplify all accounting tasks. Here are some of the standard features of this platform:

- AR and AP

- Cash management

- In-app communication and team collaboration

- GL

- Purchasing and order management

- Intuitive reporting

Sage also allows you to add subscription billing, inventory management, project accounting, expense management, and sales taxes for an additional cost.

Thanks to seamless API integration, Ramp helps you view all your transactions and SaaS vendor-related spending on Sage Intacct.

4. Xero

Xero is quickly surpassing QuickBooks as the accounting platform of choice for small businesses. Crucially, it doesn't limit the number of users, helping small businesses scale successfully.

The platform offers the following features with its basic plan:

- Limited invoicing and bank reconciliation

- AR and payroll management

- AP, cash management, duplicate payment alerts, and fraud detection

- Billing and invoicing automation

- Audit trails, GL, balance sheet, and budgeting

- Budget modeling

- Inventory management and purchasing

Ramp's API integration with Xero helps you automate reimbursements and split transactions across jobs, locations, and project codes.

Automate and integrate accounting software

Efficiency and accuracy are crucial when managing your company’s financial operations. Ramp automates your accounting tasks, helping you eliminate time-consuming manual data entry and reduce the risk of errors. With real-time updates and seamless integration of your financial data, you can focus on making informed decisions while Ramp handles the heavy lifting.

Reclaiming their valuable time by streamlining routine tasks such as expense categorization and cash reconciliation, your team will be able to focus more on strategic decision-making and growth.

Learn how Ramp can automate your finances, simplify expense reporting, and strengthen your accounting.

FAQs

A standalone accounting system forces you to manually upload data from other financial systems before preparing your accounting statements. An integrated accounting platform will automate these clerical tasks and free your time to conduct more value-added work.

Integrated accounting software helps you make sure your financial reports are always up-to-date and accurate by automating data collection and syncing financial information across systems. This enables faster, more reliable reporting, reduces time spent on manual reconciliation and helps you stay compliant with regulations.

Integrated accounting systems provide several advantages, including improved accuracy, greater efficiency, real-time financial insights, and automated workflows. These systems simplify accounting tasks such as expense management and inventory tracking, saving your team valuable time.

Consider switching when your current processes are slow, prone to errors, or difficult to scale. If your business deals with complex accounting tasks, multiple revenue sources, or lengthy reconciliation processes, integrated accounting software can help streamline operations.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group