AP automation software for healthcare organizations: A complete guide

- The hidden cost of manual AP in healthcare

- Why healthcare organizations benefit from AP automation

- Key features to look for in healthcare AP automation software

- Ramp Bill Pay: What it is and how it healthcare organizations are already using it

- Key features of Ramp Bill Pay that addresses AP challenges in healthcare

- How Ramp Bill Pay helps you control cash flow and optimize payment timing

- AP automation success stories from healthcare organizations

- Why healthcare organizations choose Ramp Bill Pay to automate AP

- Explore how Ramp Bill Pay supports AP automation across teams, company sizes, and industries

For more information or to get started with Ramp Bill Pay, visit our official page: https://ramp.com/accounts-payable

Healthcare organizations face intense pressure to manage vendor relationships, process payments accurately, and maintain strict documentation standards—all while prioritizing patient care. Finance teams often spend significant time on invoice intake, approvals, and compliance tracking, which pulls focus from higher-value work.

AP automation software offers healthcare teams a way to streamline back-office operations without compromising on compliance or accuracy. With the right solution, finance leaders can automate approvals, consolidate payment workflows, and maintain audit-ready records across departments.

Here’s how AP automation software helps healthcare organizations reduce manual work and how to choose the right solution.

The hidden cost of manual AP in healthcare

Healthcare organizations may spend many hours each week on manual AP tasks—including invoice entry, chasing approvals, payment scheduling, and documentation. When multiplied across departments and facilities, this administrative burden adds up quickly, diverting staff attention from patient care.

Generic AP systems often fall short in healthcare environments because they lack the controls, flexibility, and integrations needed to support regulated and decentralized operations. Healthcare AP presents a few unique demands:

- Diverse vendor ecosystems: From pharmaceuticals to equipment rentals, vendor types vary widely—and each has different expectations for payment terms, documentation, and oversight

- Cash flow uncertainty: Reimbursement timing and patient payments create variability that makes rigid payment schedules impractical

- Multi-location structures: Hospital systems often operate across facilities with different workflows and reporting lines, which makes central visibility difficult

- Operational impact: Delays in payment can trigger supply disruptions or equipment delays that affect clinical care

Effective AP in healthcare must manage these layers of complexity while minimizing manual burden and maintaining compliance.

Why healthcare organizations benefit from AP automation

Healthcare organizations need robust but easy-to-use AP automation software in order to execute AP workflows without too much complexity. With the right software, healthcare organizations can gain:

- Lower operational costs: Automating tasks like invoice capture, coding, and approvals eliminates the need for paper-based workflows and reduces labor spent on manual processing. Healthcare providers can also take advantage of early payment discounts more consistently

- Greater accuracy and speed: Intelligent data extraction (using technologies like OCR and machine learning) reduces manual entry errors, flags inconsistencies in real time, and speeds up invoice processing, helping staff stay on top of payment timelines and reduce reconciliation delays

- Regulatory compliance support: With built-in audit trails, data encryption, and role-based access controls, AP automation platforms help safeguard patient-related vendor data and align with HIPAA and other healthcare-specific compliance standards

- Stronger vendor relationships: Faster, more consistent payment cycles improve reliability with key suppliers, from pharmaceutical and medical equipment vendors to contracted service providers

- Improved cash flow visibility: Automation enables real-time insights into upcoming liabilities and spending trends, giving finance leaders the tools to plan more effectively and better manage cash reserves

- Actionable financial reporting: With accurate, up-to-date information readily available, teams can generate performance reports, identify areas for cost savings, and drive more informed decision-making across departments

Key features to look for in healthcare AP automation software

Not all AP tools are built to handle the complexity of healthcare finance. When evaluating a solution, prioritize features that address both regulatory demands and operational scale:

- HIPAA compliance: The platform should protect sensitive data, maintain privacy standards, and provide full documentation for audit readiness

- ERP and EHR integrations: Look for native integrations with systems like NetSuite or QuickBooks to ensure clean data flow between platforms

- Automated invoice processing: AI-powered tools should capture and code invoice data with minimal manual intervention—especially for recurring vendor charges

- Custom approval workflows: Approvals should reflect your internal structure, with routing logic based on entity, department, amount, or vendor type

- Multi-entity support: Many healthcare organizations operate across multiple legal entities. Your AP software should handle inter-entity workflows, consolidated reporting, and entity-specific approval chains

- Real-time analytics and dashboards: Visibility into spend by department, vendor, or cost center enables more proactive financial management

- Robust vendor management: Tools to track vendor documentation, certifications, insurance status, and payment preferences reduce risk and streamline onboarding

An effective AP automation solution can streamline everything from invoice intake to payment execution—reducing workload, improving accuracy, and ensuring compliance without adding headcount.

That’s why AP automation software like Ramp Bill Pay helps mitigate these risks by automating workflows, applying strong user controls, and ensuring audit-ready records—capabilities that support compliance needs in healthcare financial operations.

Ramp Bill Pay: What it is and how it healthcare organizations are already using it

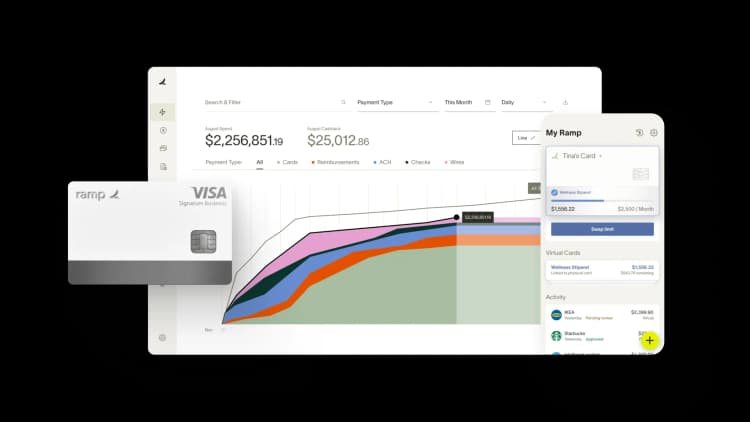

Ramp Bill Pay is AP software that is designed to manage the full lifecycle of accounts payable—from invoice capture through to approvals, payments, and reconciliation. It builds on Ramp’s core spend management platform, expanding its capabilities to include AP features like OCR-based invoice data extraction, two-way matching, customizable approval chains, scheduled payments by ACH, card, or check, and live integrations with ERP systems.

Core steps in Ramp’s AP workflows include:

- Invoice capture: Invoices are digitized using OCR, with data automatically extracted

- Approval routing: Invoices are sent to reviewers based on rules for departments, dollar thresholds, or entity structures

- Payment execution: Approved invoices are paid via ACH, check, or virtual card, with documentation stored automatically

This structure ensures real-time insight into vendor invoice status, approval bottlenecks, and payment timing. Centralized records across departments and facilities allow for consistent oversight without duplicating work or delaying urgent approvals.

Accounts Payable Software by Ramp also integrates with 200+ applications, including leading accounting and ERP platforms like QuickBooks, NetSuite, and Sage Intacct, keeping AP processes tightly aligned with financial operations. Ramp Bill Pay delivers on granular access controls and clean audit trails—capabilities that are essential for maintaining compliance and documentation in regulated industries like healthcare.

Key features of Ramp Bill Pay that addresses AP challenges in healthcare

Ramp Bill Pay works to replace disconnected workflows with a single system that automates data entry, ensures segregation of duties, and supports complex approval structures. Here’s a quick breakdown of Ramp’s AP features that are useful to use for healthcare organizations:

Automated invoice capture and data extraction

Ramp Bill Pay has best-in-class OCR technology that extracts invoice details—vendor, line items, totals, and terms—into structured digital records. This reduces the need for manual entry and reduces error rates, which is critical for high-volume AP teams.

Customizable approval workflows with advanced approval hierarchies

Configure rules by department, location, dollar amount, or user role. Clinical supply invoices can go to department managers, while capital expenditures follow corporate oversight channels. Multi-location systems can standardize policies while allowing for localized execution. Support for multi-level workflows with delegation and role-based permissions is also available, as Ramp Bill Pay allows complex routing while maintaining simplicity for reviewers and transparency for finance leaders.

Centralized vendor management and contract storage

Ramp Bill Pay centralizes vendor records—including W-9 documents and 1099 tax information—helping finance teams maintain audit readiness. Centralized vendor management helps teams verify documentation before releasing payments and simplifies preparation for audits or compliance checks.

Real-time visibility and reporting

View invoice and payment status across all departments, facilities, or vendors. Identify bottlenecks, track timelines, and get a clear view of your audit trail—without relying on manual reports or cross-team follow-ups.

Payment scheduling tools

Payments can be scheduled and prioritized based on vendor terms and organizational cash flow needs. Use vendor terms to prioritize payments and capture discounts—while maintaining supply chain stability. Bulk vendor payments are also available to help speed up invoice payment processing for healthcare organizations.

Accounting system integrations

Ramp integrates with whichever accounting system your business uses—so you can reconcile your books without friction. We offer direct integrations with leading ERPs and accounting platforms like NetSuite, QuickBooks Online, Sage Intacct, and Acumatica, enabling real-time sync of vendor bills, reimbursements, payments, and accounting fields. Select systems also support bi-directional sync for vendor bills and imported item receipts.

For platforms without native integrations, Ramp also provides Universal CSV (uCSV) exports that match your chart of accounts, tracking categories, and project codes for seamless reconciliation. Ramp also offers a robust API and trusted implementation partners to support custom integrations when needed.

Low pricing and processing fees

Ramp offers a free plan that lets you manage spend, automate vendor payments, and speed up your month-end close. For organizations with more advanced needs, Ramp Plus is available at $15 per user per month, and custom Enterprise plans are also available upon request. Plus, you can handle all domestic and global vendor payments on a single platform—by check, card, ACH, or international wire with zero fees*.

How Ramp Bill Pay helps you control cash flow and optimize payment timing

Ramp Bill Pay allows finance teams to send batch payments on a per vendor basis, along with the ability to schedule payments based on due dates or vendor terms—helping organizations better align payment timing to their available cash while avoiding unnecessary delays.

- Payment batching: Group similar vendors or expense categories for efficient execution

- Rules-based timing: Automate payments based on vendor terms on a per vendor basis

- Interactive dashboards: View upcoming obligations and cash positions across time periods, vendors, or locations

This flexibility lets finance teams respond to shifting reimbursement patterns, without delaying essential vendor payments or creating unplanned cash stress.

Key takeaways: Benefits of using Ramp Bill Pay for healthcare organizations

Ramp Bill Pay streamlines the end-to-end AP lifecycle for healthcare organizations by simplifying daily operations for AP teams, reducing risk, controlling costs, and maintaining continuity. Overall, Accounts Payable Software by Ramp helps to:

- Enable early payment savings across high-volume vendor relationships

- Minimize late penalties fees

- Provide granular access controls and detailed audit trails

- Reduce workload from automating data entry, approvals, and reconciliation

- Enable faster payment cycles that prevent supply disruption while maintaining financial oversight

- Centralize documentation that simplifies audits and maintains transparency

- Simplify integrations with leading accounting and ERP systems

- Improve cash flow through flexible payment scheduling and proactive visibility

- Provide visibility across entities, departments, and locations

- Scale as you grow to support expansion without requiring system overhauls

Ramp Bill Pay gives healthcare organizations the infrastructure to run efficient, compliant AP operations at scale—whether managing a single hospital or a nationwide network of care facilities.

AP automation success stories from healthcare organizations

From regional clinics to multi-location hospital systems, healthcare organizations are using Ramp Bill Pay to streamline their AP processes and regain control over payments, documentation, and compliance. Here’s how a few teams have reduced manual work, improved cash flow visibility, and strengthened their financial operations with Ramp Bill Pay.

1. How the Hospital Association of Oregon reduced bill pay time from hours to minutes with Ramp Bill Pay

Before using Ramp Bill Pay, the Hospital Association of Oregon relied on a fully manual AP process—emailing invoices for approval, preparing paper vouchers, printing checks, and physically mailing payments. Every AP batch took about 10 hours to complete, with manual data entry and hand-keyed accounting that made errors and delays more likely.

With Ramp Bill Pay, the team replaced that workflow with a streamlined digital process. Invoices are entered, routed, approved, and paid directly within Ramp—without needing paper checks or email back-and-forth. What once took an entire day now takes only minutes.

The system has also improved audit-readiness, replacing filing cabinets full of paper with easily accessible digital records. Instead of searching through physical files, finance can now retrieve any invoice or approval instantly.

Doing it the old way probably took a good 10 hours per AP batch. Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.” — Jason Hershey, VP of Finance and Accounting at Hospital Association of Oregon

2. How Precision Neuroscience reduced data entry with Ramp Bill Pay

Precision Neuroscience previously relied on a multi-step, spreadsheet-driven procurement and bill pay process that required extensive manual entry and constant switching between systems. Each PO had to be built from scratch, approvals were routed manually, and AP coding was largely outsourced.

With Ramp, the team consolidated four separate tools into a single platform integrated with their ERP. Ramp’s OCR automatically extracts data from uploaded vendor quotes, removing the need to retype information into purchase orders. Duplicate invoice detection and auto-coding further reduced manual workload and errors.

The impact has been significant: the procurement process is now about 50% faster, recurring tasks take minutes instead of hours, and monthly close has been cut down to just 1–2 days—freeing up time for higher-value finance work.

“Ramp’s OCR has been so useful on the procurement side. It automatically takes all the information from the quote and saves all the data entry that we would have otherwise had to type into a purchase order.” — Brian Lautenbach, Financial Controller at Precision Neuroscience

3. How Skin Pharm cut its bill pay and approval timelines with Ramp

Before Ramp, Skin Pharm managed expenses, reimbursements, and procurement through fragmented systems—including Google Sheets, Slack messages, and a mix of corporate cards. Bill pay was manual, approvals were slow, and there was no centralized way to track or control spending across clinics.

With Ramp Bill Pay, Skin Pharm now handles invoices, approvals, and payments in one system. Bills are processed automatically, regardless of whether team members are in the office, and approvals—once delayed for weeks—now happen in as little as 48 hours. Month-end close has been reduced from 25 days to just 10–15, freeing the finance team to focus on more strategic work.

Ramp’s centralized visibility and automated approval flows have also helped enforce internal controls and eliminate unapproved spend—giving leadership more confidence in spend data and audit readiness.

“Bill pay now happens automatically, regardless of whether a team member is in the office or not. Now we know we’re not falling behind on anything.” — Kaela Patrinely, VP of Finance at Skin Pharm

Why healthcare organizations choose Ramp Bill Pay to automate AP

Ramp Bill Pay helps healthcare finance teams reduce administrative burden, improve control over vendor payments, and maintain the documentation and oversight required for compliance. With automation that adapts to multi-entity structures, reimbursement cycles, and regulatory demands, Ramp Bill Pay supports AP operations across hospitals, clinics, and care networks—without adding unnecessary complexity.

Explore how Ramp Bill Pay fits into your existing workflows and supports the long-term financial health of your organization.

Get started with Ramp Bill Pay.

Explore how Ramp Bill Pay supports AP automation across teams, company sizes, and industries

Because every industry is different, you can find AP automation guidance for Ramp Bill Pay tailored to your specific needs below:

- Main guide: How Accounts Payable Software by Ramp works

- Ramp Bill Pay for small businesses

- Ramp Bill Pay for mid-sized companies

- Ramp Bill Pay for enterprise companies

- Accounts Payable Software guide for construction companies

- Accounts Payable Software guide for nonprofits

- Accounts Payable Software guide for manufacturing

- Accounts Payable Software guide for SaaS companies

- Accounts Payable Software guide for hospitality

- Accounts Payable Software guide for consumer goods and services

- Accounts Payable Software guide for professional services

- Accounts Payable Software guide for education

- Accounts Payable Software guide for transportation services

- Accounts Payable Software guide for finance and banking

- Accounts Payable Software guide for real estate

- Accounts Payable Software guide for environmental services

- Accounts Payable Software guide for CFOs

- Accounts Payable Software guide for Controllers

- Accounts Payable Software guide for AP Managers

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

For more information or to get started with Ramp Bill Pay, visit the official page: https://ramp.com/accounts-payable

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark