- What is Ramp’s accounts payable software called?

- How does the AP automation process work?

- What can you do with Ramp Bill Pay?

- Every feature included in Ramp Bill Pay

- Ramp integrations: Which systems are supported?

- How does Ramp keep your financial data secure?

- How much time and money AP automation actually saves

- How Ramp Bill Pay works for different business sizes

- When Ramp Bill Pay makes sense for your team

Learn how your team can simplify and automate AP on our official Ramp Bill Pay page.

Yes—Ramp offers a modern accounts payable solution designed to simplify invoice management, approvals, and vendor payments. The software is called Ramp Bill Pay and it's our all-in-one solution for handling AP from invoice receipt through vendor payment and remittance. This guide covers how it works, who it’s built for, and what makes it different from outdated AP tools.

What is Ramp’s accounts payable software called?

Ramp's AP software is called Ramp Bill Pay, and it brings your entire AP process into one place. You can collect invoices, manage approvals, send payments, and sync to your accounting software—without jumping between tools or systems. That means fewer integration headaches and lower costs.

Skip the PDFs and inbox clutter. With Ramp Bill Pay, you can:

- Capture invoices automatically from email, uploads, or synced systems

- Pull key details using built-in smart OCR

- Route approvals based on your internal policies

- Pay vendors by ACH, check, card, or wire—domestic and international

- Sync payments to your accounting software for faster close

Ramp Bill Pay cuts down on invoice errors, optimizes your payment mix and schedule, and helps your team avoid repetitive AP work. It gives finance teams real-time visibility into every step of the process. By automating data entry, coding, and approvals, Ramp can reduce manual invoice processing by up to 50 percent—freeing your team to focus on higher-impact work.

How does the AP automation process work?

Ramp Bill Pay automates accounts payable in five simple steps. Each one is built to reduce manual work while giving you more control and visibility.

- Invoice ingestion: Ramp captures invoices from email forwarding, file uploads, syncing your open AP from your accounting systems, and CSV imports. Paper documents are scanned and digitized, so everything lives in one searchable place with a full audit trail from day one.

- Automated processing: Built-in real-time OCR scans each invoice to pull vendor info, body and line level bill details. Ramp also learns from past entries to auto-fill common fields and cut down on manual data entry.

- Approval routing and review: Ramp routes each invoice to the right person using your existing approval policies. Set robust rules based on bill details, coding, custom logic, or a combination of all. Approvers can review and approve invoices from their phone, and if someone’s unavailable, you can assign delegate approvers to keep things moving without delays.

- Payment processing: Ramp optimizes your payment mix by surfacing optimal payment methods based on each vendor's preferences while allowing you visibility and control. Choose from ACH, card, check, or wire—domestic or international.

- Sync to accounting: After payment, Ramp syncs the bill payment details to your accounting system closing out the previously posted open bills. No manual updates needed. This keeps records clean and helps speed up month-end close with a built-in audit trail.

Along the way, Ramp gives you extra controls and automation like vendor approvals and onboarding, smart coding, and automated remittances

What can you do with Ramp Bill Pay?

As one of the easiest AP platforms to use, Ramp Bill Pay includes features that help finance teams work faster, stay organized, and keep payments accurate.

1. Vendor management

Ramp Bill Pay keeps all your vendor info in one place—payment terms, contacts, documents, and payment history. That makes it easier to onboard new vendors, apply the right terms, and keep payments accurate and on time.

2. Recurring bills

Ramp Bill Pay lets you automate recurring bills by scheduling them in advance. The system sends invoices through the right approval flow, and processes the payment. You don't have to repeat the same steps every billing cycle.

3. 2-way matching and 3-way matching

Ramp Bill Pay supports two-way and three-way PO matching to help you connect invoices to purchase orders and item receipts without digging through records. It scans incoming invoices for PO numbers, then uses OCR to suggest a likely match. Instead of matching things manually, your team can review and approve the suggestion with just a few clicks. Ramp allows you to build workflows to automatically handle any discrepancies identified.

4. Duplicate detection

Ramp flags potential duplicate invoices by comparing vendor names, invoice numbers, and amounts. That helps teams avoid duplicate payments and catch errors early

5. Mobile invoice approvals

Approvers can review and sign off on invoices from their phones. That means no delays if someone’s out of office or working remotely. All invoice details and documents are included, so decisions don’t need to wait.

6. Automated reporting

Ramp Bill Pay can generate reports automatically, either on a schedule or when you need them. Reports are fully customizable and can be sent straight to the right people, so everyone stays on the same page without pulling data by hand.

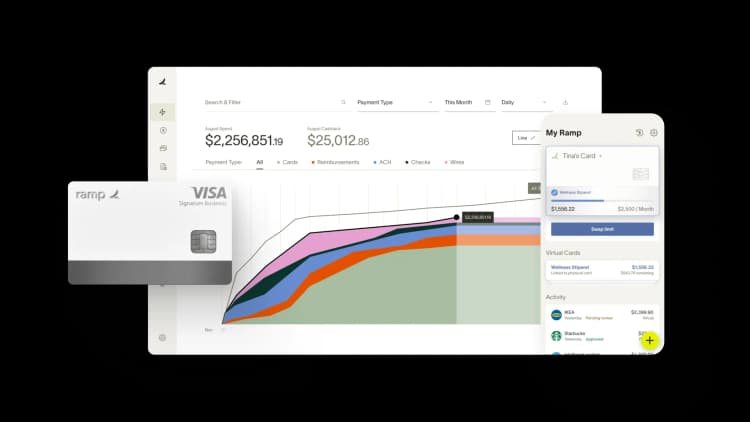

7. Real-time dashboards

Ramp’s real-time dashboards show you what’s happening across approvals, payments, and trends. You can track key metrics, flag issues early, and make decisions with less guesswork. Views are customizable, so each team member can filter and sort what they need—and those preferences stay saved for next time.

Free tier with full features

Unlike most AP software, Ramp offers a free tier that includes OCR technology, basic approval workflows, and multiple payment options from ACH, card, check, and more. You can also manage all domestic and international vendor payments by check, card, ACH, or international wire, with zero fees.*

Every feature included in Ramp Bill Pay

Feature | Description |

|---|---|

Mobile invoice approvals | Approve invoices from anywhere using your phone |

Duplicate detection | Flags potentially duplicated invoices to prevent double payments |

Real-time dashboards | Visualize approvals, payments, and trends in a customizable view |

2-way matching | Uses OCR to automatically suggest matching POs for incoming invoices |

Automated reporting | Generate and schedule reports without manual work |

Vendor management | Centralizes supplier info, tax docs, and history |

Recurring bills | Automatically generates and routes repeat invoices |

Free tier & zero processing fees* | Offers OCR, approvals, and low processing fees* |

Multi-level approval workflows | Route invoices based on roles, departments, or spend thresholds |

Entity-level controls | Manage payables across multiple business entities with separate workflows |

Invoice OCR scanning | Automatically extracts invoice data with optical character recognition |

ERP and accounting sync | Sync approved payments directly to systems like QuickBooks, NetSuite, Xero, Sage Intacct, and Acumatica |

Payment scheduling | Choose when bills are paid via ACH, card, check, or wire |

Payment method flexibility | Pay vendors by ACH, card, check, or international wire |

Auto-categorization | Suggests GL codes or categories based on vendor or invoice data |

Custom spend policies | Enforce invoice approval rules based on policy logic |

Slack and email approvals | Approve or reject invoices directly from Slack or email |

Bulk invoice upload | Upload and process multiple invoices at once |

Amortization and bill splitting | Spread payments across months or departments automatically |

Audit trails | Maintain a log of all actions taken for compliance and reviews |

Role-based access controls | Restrict permissions by job function or team |

Real-time vendor payments | Initiate scheduled payments to vendors with same-day ACH as an option for a flat fee |

AI agents for accounts payable

Ramp is also introducing AI agents for AP—autonomous systems built into Ramp that go beyond workflow automation. These agents understand invoice context and take action on behalf of your team. They code line items based on historical data, flag potential fraud, suggest the appropriate approver, and submit card payments when applicable.

Ramp customers can enable or join the waitlist for AP Agents in the Early Access tab. Auto-coding and approval recommendations are only available to Ramp Plus customers.

Ramp integrations: Which systems are supported?

The best AP automation software should offer native integrations with ERP and accounting systems. Ramp connects directly with more than 200 tools, so you can integrate with your existing financial systems without disrupting how your team works. Supported platforms include QuickBooks, NetSuite, Xero, and more. Here’s a quick breakdown.

QuickBooks

Ramp’s QuickBooks integration automatically syncs vendor bills, accounting fields, transactions, payments, and more. You can start the process in either QuickBooks or Ramp, then complete it using Ramp’s payment tools. This setup works especially well for small and mid-sized businesses that want to automate AP while continuing to use their existing accounting environment.

NetSuite

Ramp’s NetSuite integration supports bi-directional data syncing and respects native approval hierarchies and subsidiary structures. As a Built for NetSuite partner, Ramp meets NetSuite’s standards for security, data privacy, and overall quality.

Sage Intacct

Ramp’s Sage Intacct integration automatically syncs vendor bills, accounting fields, transactions, payments, and more. You can sync Ramp data to the top level in Sage Intacct or at the entity level, allowing for automated intercompany and inter-entity splitting. Ramp also supports managing global Sage Intacct entities within a single multi-entity environment.

Xero

Ramp’s Xero integration supports bi-directional syncing for vendors, vendor bills, and imported item receipts. You can start your process in either Xero or Ramp and complete it with Ramp payments. The integration gives small businesses access to advanced AP automation while keeping Xero’s simple, user-friendly experience intact.

Microsoft Dynamics Business Central

Ramp offers a direct integration with Microsoft Dynamics Business Central, letting you manage accounts payable, expenses, and travel in one place. Data syncs automatically from Business Central—including transactions, bill payments, and reimbursements—and is recorded in the appropriate journals and purchase invoices.

Acumatica

Ramp’s Acumatica integration lets you import all fields—including dimensions—for complete transaction coding. You can sync default vendors, create new ones directly from Ramp Bill Pay, and manage every entity from a single Ramp instance.

Ramp’s integrations help you automate AP while continuing to use your existing financial systems. By removing data silos and manual transfers, Ramp Bill Pay improves efficiency, accuracy, and visibility across your finance stack.

Browse all of Ramp’s integrations.

How does Ramp keep your financial data secure?

Ramp includes built-in security and compliance features that help protect your financial data and simplify audits.

We complete annual SOC 2 Type II audits to ensure your data stays secure, confidential, and private. Ramp is also PCI compliant, so any sensitive card information is handled safely, whether it’s being processed, transmitted, or stored.

Ramp Bill Pay creates detailed audit trails that automatically log every action—who made a change, when it happened, and what was updated. These logs give you the documentation needed for internal audits and external reviews.

These controls are designed to reduce the workload on your team while keeping your operations secure and audit-ready.

How much time and money AP automation actually saves

Automating accounts payable with Ramp drives both cost savings and operational improvements, leading to a clear and measurable return on investment.

Instead of spending hours on manual tasks like data entry, chasing invoices, or reconciling records, finance teams using Ramp Bill Pay save time, reduce errors, and gain more visibility and control.

The impact shows up across several key metrics:

Metric | Manual AP process | With Ramp’s AP solution |

|---|---|---|

Invoice processing time | 2-3 weeks | Avg. under 2.5 minutes |

Invoice approval time | 1-5 days | Cut by up to 50% |

Error rate | 5-10% | Cut by up to 50% |

Implementation speed (dependent on business size) | 2-8 weeks | Under 2 weeks |

Reconciliation speed | Weeks | Save up to 4 days/month |

In addition to faster cycle times and fewer errors, Ramp Bill Pay helps lower your cost per invoice by cutting out paper handling, reducing duplicate payments, and simplifying the entire workflow.

But the return on investment isn’t just about efficiency. It’s about giving your team time back to focus on the work that actually moves the business forward:

- Finance teams can prioritize strategy instead of data entry

- Cash flow visibility improves with real-time tracking of invoices and payments

- Vendor relationships strengthen with consistent, on-time payments

- Month-end close is faster and more accurate thanks to real-time accounting sync

Whether you're a small business automating without adding headcount or a growing company scaling AP without increasing costs, Ramp Bill Pay starts showing results in just a few months.

Browse our AP automation success stories.

How Ramp Bill Pay works for different business sizes

Ramp Bill Pay adapts to the way your finance team works, whether you’re a startup, a mid-size company, or a large organization. It supports AP tasks with controls and workflows you can configure to match how your business operates.

Startups and small businesses

For startups and small businesses, the goal is to do more with a lean team. Ramp Bill Pay keeps setup simple with an intuitive interface that takes minimal training, so your team can put in place controls often found at larger companies. Automated invoice processing removes day-to-day paperwork, and built-in approval workflows keep oversight in place as roles shift while you grow.

For a deeper dive, see our guide on the best accounts payable software for small businesses.

Mid-size companies

For mid-size companies, scaling AP without adding headcount is the priority. Ramp Bill Pay handles rising invoice volume and more complex approval paths, while customizable workflows adapt as your org structure changes. Reporting gives your team clear visibility for planning and review, so finance can track trends and make timely decisions.

Explore how this applies in AP automation tools for mid-sized businesses.

Large organizations

For large organizations, you need consistency across entities with room for local differences. Ramp Bill Pay supports multi-entity structures with consolidated reporting and entity-level controls. Enterprise-grade security and compliance features help meet strict requirements, and automation reduces the cost of high-volume processing.

See related considerations in accounts payable software for large businesses.

Ramp Bill Pay is built to handle the AP nuances that come with different business models. With flexible configuration and workflow rules, you can enforce financial controls and best practices while staying aligned to how your business actually operates.

When Ramp Bill Pay makes sense for your team

Ramp Bill Pay helps finance teams handle AP without extra tools or added steps. Everything from collecting invoices to sending payments and syncing to accounting happens in one place. You spend less time on manual work and get a clearer view of where money is going.

Try Ramp Bill Pay and cut your AP work in half.

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

For more information or to get started with Ramp Bill Pay, visit the official page: https://ramp.com/accounts-payable

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark