Top AP automation tools for mid-sized businesses in 2026

- What is AP automation software for mid-sized companies?

- Why does AP automation matter for growing teams?

- Key features of AP automation tools for mid-sized companies

- Top 5 AP automation tools for mid-sized businesses

- How to evaluate and compare AP automation platforms

- Essential steps to implement AP automation

- Why Ramp stands out as an affordable AP solution for mid-sized businesses

- How Ramp helped KIPP Nashville streamline AP and eliminate manual bottlenecks

- Choose a top-rated AP automation platform built for mid-sized teams

Manual invoice processing doesn’t scale. For mid-sized companies—typically managing hundreds of vendors, multiple departments, and a growing finance team—manual workflows quickly become a source of delays, errors, and unnecessary AP spend.

That’s where modern AP automation tools come in. The best platforms give mid-market businesses real-time visibility into spend, built-in policy enforcement, and seamless integrations with ERPs and accounting software.

In this guide, we’ll break down the top AP automation tools for mid-sized companies in 2026, and how each one helps streamline invoice approvals, speed up payments, and support more strategic finance operations.

What is AP automation software for mid-sized companies?

AP automation software digitizes your entire accounts payable process—from receiving invoices to executing payments. These solutions handle the volume mid-sized organizations face while remaining accessible in both implementation and cost.

Instead of manually processing invoices, matching them to purchase orders, chasing approvals, and entering data, AP automation handles each of these steps digitally. It gives finance teams tighter control over spend, improves accuracy, and creates real-time visibility into cash flow—without adding headcount.

Key benefits of AP automation include:

- Reduced manual work: AP teams typically save 50-80% of processing time per invoice. Tasks that once took days now take hours, freeing your team for higher-value work

- Improved accuracy: AP automation can reduce data entry errors by up to 80-90%, eliminating mistakes in payment amounts, vendor information, and accounting codes

- Better cash flow management: Real-time visibility into outstanding invoices lets you schedule payments strategically and capture early payment discounts

Why does AP automation matter for growing teams?

Mid-sized businesses process too many invoices for manual methods but may not have the resources for enterprise systems. AP automation bridges this gap, addressing the specific challenges that emerge as you scale.

Here's what makes AP automation increasingly valuable as your invoice volume grows:

- Manual data entry: Finance teams often spend 12-15 hours weekly on invoice entry. This creates bottlenecks during high-volume periods and leaves you vulnerable when staff is out

- Error-prone processes: Manual AP processes have a 3-5% error rate, leading to duplicate payments, missed invoices, and incorrect amounts that damage vendor relationships

- Limited visibility: Without centralized tracking, you can't easily answer basic questions about outstanding liabilities or approval bottlenecks, making cash flow forecasting difficult

- Scaling difficulties: When transaction volume increases 30-50% during growth phases, manual AP processes require proportional headcount increases to keep up

Key features of AP automation tools for mid-sized companies

When evaluating AP automation tools, focus on features that solve your specific challenges and support your growth. Modern solutions combine several essential functions to transform your accounts payable process.

1. Invoice capture and data extraction

At the core of any AP automation solution is the ability to digitize invoices and extract data without manual entry. Modern systems use OCR and AI to automatically capture invoice information from emails, PDFs, or scanned documents.

These systems identify and extract key data points like vendor information, invoice numbers, line items, amounts, and payment terms. Advanced solutions achieve 90-95% accuracy immediately and improve as they process more of your specific invoice formats.

2. Customizable workflows and approvals

Effective AP solutions let you configure approval paths that match your organizational structure. Workflows automatically route invoices to the right approvers based on department, amount thresholds, or vendor.

For example, a marketing expense under $5,000 might only need the marketing director's approval, while larger amounts require CFO sign-off. The system tracks each approval action and sends automatic reminders to prevent bottlenecks.

3. Integration with current software and ERP systems

Seamless integration with your financial systems eliminates data silos and maintains a single source of truth. Your AP software should connect with your core accounting or ERP platform to avoid duplicate data entry.

Most modern solutions offer pre-built integrations with QuickBooks, Sage, NetSuite, Microsoft Dynamics, and Oracle. These integrations keep vendor information synchronized and automatically create journal entries for approved invoices.

4. Real-time analytics and spend visibility

Today's AP systems provide dashboards that turn financial data into actionable insights. These tools show invoice status, approval bottlenecks, payment timing, and spending patterns across departments and vendors.

With this visibility, you can make data-driven decisions about payment timing and vendor negotiations. Dashboards highlight early payment discount opportunities, flag vendors with frequent errors, and reveal departments that consistently exceed budgets.

5. Fraud prevention and security

Modern AP automation includes security features to protect against external threats and internal fraud. These systems use role-based access controls, segregation of duties, and comprehensive audit trails to maintain compliance.

Automation reduces fraud risk by removing opportunities for manipulation. Three-way matching automatically verifies that purchase order, receiving document, and invoice details align before payment approval. The system flags duplicate invoices, unusual amounts, or unauthorized vendors.

Top 5 AP automation tools for mid-sized businesses

We evaluated the best AP automation software for mid-sized businesses based on ease of implementation, scalability, integration capabilities, user experience, and value for investment. We also used user reviews on G2 to help us narrow down leading solutions.

Software | G2 rating | Best for | Standout feature | Integrations | Pricing model |

|---|---|---|---|---|---|

Ramp | 4.8 | Unified AP & spend management with ease of use and affordability | Combined corporate cards, expense management, and AP | Extensive | Free tier Ramp Plus ($15/mo/user) Ramp Enterprise |

Sage Intacct | 4.3 | Financial control | Multi-entity management | Extensive | N/A – All pricing is quote-based |

NetSuite | 4.1 | Scalable operations | Global payment capabilities | Extensive | N/A – All pricing is quote-based |

Stampli | 4.6 | Collaborative AP | AI-powered communication tools | Moderate | N/A – All pricing is quote-based |

BILL | 4.5 | Document management | AP/AR in one platform | Moderate | Essential tier ($45/mo/user) Team tier ($55/mo/user) |

1. Ramp: Top-rated AP software for mid-sized companies

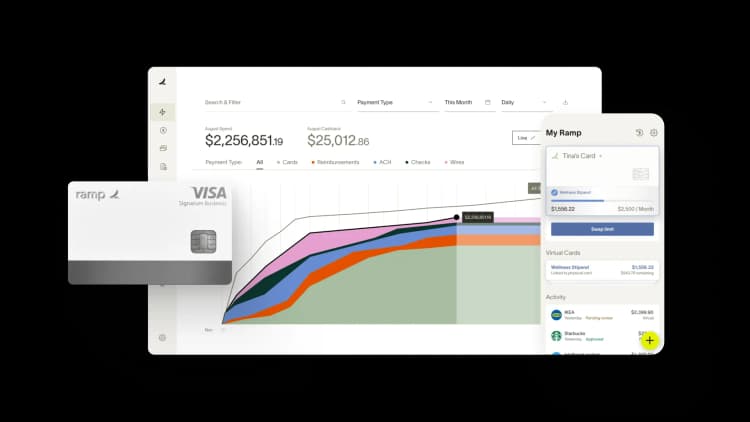

Ramp is an autonomous AP automation tool built for finance teams that need more control, speed, and visibility—all while providing touchless AP workflows. Designed to scale with mid-sized businesses, Ramp works as a standalone AP solution or as a unified platform integrating AP, spend management, and procurement.

For teams managing growing invoice volume, Ramp simplifies the entire accounts payable process—from intake to approval to payment. Invoices are automatically processed with high accuracy, approvals follow pre-set workflows, and vendor payments are tracked in real time across ACH, card, check, or international wire.

And the best part? With 99% accurate OCR and intelligent line-item capture, Ramp delivers touchless invoice processing that's 2.4x faster than legacy AP software1. Even up to 95% of businesses report improved visibility into their payables after using Ramp2.

Ramp is rated 4.8 out of 5 stars on G2, with over 2,100 reviews from finance teams who’ve made the switch to a more efficient way to manage AP.

Notable features

- Four autonomous AI agents that tackle key tasks by coding invoices from historical data, flagging fraud pre-payment, building approval summaries with vendor context and pricing details, and executing card payments directly

- Automated two-way matching between invoices, purchase orders, and receipts

- Custom approval workflows that adapt to your org structure and compliance needs

- Built-in support for ACH, check, card, and international wire payments

- AI-powered invoice scanning and OCR

- Seamless ERP integration, including bidirectional sync with NetSuite, Xero, and others

- Collect W-9s and e-consent in bulk instead of chasing vendors with one-off emails

- Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- File directly with the IRS and eligible states in minutes—no extra portals or logins

- Real-time reporting across AP and non-AP spend

- End-to-end automation across accounts payable, procurement, and expense workflows

Pricing

Ramp offers a free plan to core AP features which includes integrations to QuickBooks Online and Xero. For more advanced controls and ERP integrations, Ramp Plus is available at $15 per user per month. Enterprise pricing is available for larger teams that need custom workflows, integrations, or dedicated support.

2. Sage Intacct

Sage Intacct offers cloud-based accounts payable solutions as part of its comprehensive financial management platform. Unlike standalone AP tools, Sage Intacct embeds AP automation within a full-featured accounting system. Sage Intacct also works well for businesses with multiple entities, locations, or currencies. The system integrates with business applications through its marketplace and API.

The platform excels in financial controls and compliance, with robust audit trails and role-based permissions and has a G2 rating of 4.3 out of 5.

Notable features

- Dimensional accounting for multi-entity management

- automated recurring invoices

- Sophisticated approval workflows

Pricing

Pricing is subscription-based and scales with your business size and module needs. It fits professional services firms, SaaS companies, nonprofits, and multi-entity businesses.

3. NetSuite

Oracle NetSuite provides comprehensive AP software as part of its cloud-based ERP system. This integrated approach reduces the need for separate AP automation tools.

NetSuite's AP module offers exceptional configurability for growing businesses with complex requirements. NetSuite works well for businesses planning significant growth or international expansion. Its unified data model ensures AP information connects with its financial reporting and procurement modules. NetSuite is rated 4.1 out of 5 on G2.

Notable features

- Global payment capabilities

- Vendor management with performance tracking

- Sophisticated approval workflows

Pricing

Pricing is subscription-based, determined by modules, users, and implementation needs. It fits mid-sized businesses in wholesale distribution, manufacturing, retail, and professional services.

4. Stampli

Stampli delivers a collaborative AP automation experience, bringing together AP staff, approvers, and vendors on a centralized platform. Stampli's strengths include an intuitive interface and communication tools that enable discussions directly on invoices.

Stampli also works well for businesses with high invoice volumes from diverse vendors. It integrates with a variety of popular financial systems and is rated 4.6 out of 5 on G2.

Notable features

- Vendor portal (reducing inquiry calls)

- Automated coding suggestions that improve over time

- Flexible approval workflows

Pricing

Pricing is subscription-based. Stampli fits businesses in services, manufacturing, construction, and healthcare.

See our guide on Stampli-specific competitors

5. BILL

BILL (formerly Bill.com) is a cloud-based solution that streamlines the AP process, with a strength in payment execution. BILL's platform requires minimal training, and its payment network simplifies both domestic and international transactions.

BILL works well for businesses looking to eliminate paper checks, support remote approvals, or improve payment timing. It integrates with a variety of popular accounting platforms and ERPs, and is rated 4.5 out of 5 on G2.

Notable features

- Workflows that learn from your approval patterns

- Mobile approval capabilities

- Vendor management system

Pricing

BILL offers multiple plans ranging from $45 to $79 per user per month. Custom pricing is available for larger enterprises with more complex needs.

See our guide on BILL-specific competitors

How to evaluate and compare AP automation platforms

Finding the right AP automation software means taking a structured approach that aligns technology capabilities with your business needs. Consider both your current requirements and future growth to ensure your solution can scale with you.

- Current process needs: Document your existing AP workflow—invoice volume, approval steps, and pain points. Identify which manual tasks take the most time and where errors occur. This helps you prioritize features that will have the biggest impact.

- Integration requirements: Assess how each solution connects with your current financial systems. The best automation happens when data flows seamlessly between systems. Consider both current and planned systems to avoid future compatibility issues.

- Implementation timeline: Most mid-sized businesses can expect 4-8 weeks for full implementation. Vendors with experience in your industry or accounting system can often speed this up.

- User experience: Evaluate the interface for both AP staff and occasional approvers. Focus on mobile capabilities, notifications, and ease of use. Request demos using your actual invoices to see real-world usability.

- Support and training: Look for comprehensive onboarding, accessible support channels, and self-service resources. The best vendors offer multiple support tiers and regular check-ins during implementation.

- ROI calculation: Compare current costs (staff time, late payment penalties, missed discounts) with the investment in automation. Most mid-sized businesses see positive ROI within 6-12 months through efficiency gains and fewer errors.

Essential steps to implement AP automation

Implementing AP automation successfully takes careful planning and change management. Following a structured approach ensures a smooth transition and maximizes your return on investment.

1. Map existing processes

Document your current accounts payable workflow from invoice receipt to payment. Identify each step, who performs it, how long it takes, and where bottlenecks occur. This mapping highlights opportunities for improvement and sets a baseline for measuring success.

Interview team members across departments to understand pain points from multiple perspectives. This discovery phase often uncovers inefficiencies that weren't visible before, such as duplicate approvals or manual reconciliation between systems.

2. Choose a payable platform

Select a solution that balances your current needs with future growth. Focus on implementation complexity, integration capabilities, and scalability as transaction volumes increase.

Prioritize solutions with flexible approval workflows that adapt to your organizational structure without custom development. Consider the vendor's experience with businesses of your size and industry. Ask for references from similar companies and inquire about specific implementation challenges they faced.

3. Configure workflows

Configure workflows that turn your approval process from a bottleneck into a strategic advantage. Map your organizational hierarchy and approval thresholds, then translate these into digital workflows that automatically route invoices to the right approvers.

Set up business rules for different invoice types, departments, and amount thresholds. For example, allow automatic approval for recurring utility bills under a certain amount, while routing capital expenditures through additional approval layers. Include exception handling for special cases like rush payments or substitute approvers during vacations.

4. Integrate with your accounting systems

Connect your AP automation platform with your accounting system to eliminate duplicate data entry and maintain financial accuracy. This typically involves mapping data fields and setting up automated synchronization.

Common integration challenges include handling vendor master data, managing chart of accounts changes, and reconciling historical information. Work closely with both your AP automation vendor and accounting system provider to address these challenges. Test the integration thoroughly with various invoice scenarios before full deployment.

5. Train your team and launch

Train both AP staff who will use the system daily and occasional users like department managers who approve invoices. Tailor training to different user roles, focusing on the specific functions each group needs.

Develop clear AP documentation with step-by-step instructions for common tasks. Consider a phased rollout—start with a single department or invoice type, then expand company-wide. Designate internal champions to provide peer support and gather feedback during the initial phase.

Why Ramp stands out as an affordable AP solution for mid-sized businesses

As mid-sized businesses grow, so do their accounts payable challenges—more vendors, more payments, and more pressure to close books faster. Manual invoice entry, disjointed systems, and long approval cycles can hold finance teams back from scaling smoothly.

Ramp offers a powerful yet accessible AP automation platform built to meet those demands and provide touchless workflows. With real-time integrations, AI agents, AI-powered invoice capture, and flexible approvals, Ramp helps mid-sized finance teams streamline AP without adding complexity.

Here’s how KIPP Nashville transformed their finance operations by consolidating their fragmented systems with Ramp.

How Ramp helped KIPP Nashville streamline AP and eliminate manual bottlenecks

KIPP Nashville operates nine public schools and manages a finance function that supports 500 employees—50 of whom make purchasing decisions. Before Ramp, every piece of the AP process was slow and manual: invoices weren’t synced to the accounting system, payments were delayed, and vendor complaints were common.

“We were often late on bills, and we had lots of vendors complaining that they weren’t being paid in a timely manner,” says Carey Peek, CFO at KIPP Nashville. “It might sit with an approver for way too long, so it wasn’t being captured.”

The approval process alone could take up to a month, with finance often left chasing down receipts and answers across disconnected systems. On top of that, manually importing invoice data and uploading to NetSuite added unnecessary time to every payment cycle.

Carey needed a system that would streamline bill pay, remove manual work, and give her team more time back—without creating another tool to manage. Ramp offered just that.

“Ramp will ingest the line items automatically, so no more manual import. It’s made the process so much easier,” Carey says.

With Ramp, KIPP’s approval process dropped from weeks to just days. The team now handles vendor payments with speed and confidence, while also reducing errors and improving audit readiness. “We haven’t had any complaints about not getting paid in months,” she adds.

Real results for a busy, growing team

Since implementing Ramp, KIPP Nashville has:

- Reduced the average approval timeline from one month to under one week

- Saved 15 days on month-end close, thanks to real-time syncing and auto-coded invoices

- Reduced manual invoice entry with AI-powered uploads

- Improved vendor relationships with faster, more predictable payments

“I’m much more confident presenting our financials,” says Carey. “Invoices come in and are coded appropriately and captured in our financial systems from the beginning. I no longer have to focus so intently on monthly close. It’s smoother with Ramp.”

Choose a top-rated AP automation platform built for mid-sized teams

The top accounts payable automation software doesn’t just replace manual work—it fits your processes, scales with your team, and connects seamlessly to the tools you already use. It should make approvals faster, reporting clearer, and close easier—so finance can focus on strategy, not busywork.

Ramp is rated 4.8 on G2 because it delivers where mid-sized companies need it most: real-time visibility, customizable workflows, touchless AP, and automation that actually saves time.

If your current AP process is holding you back, let’s change that. Get started with Ramp Bill Pay.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits