The Ramp Blog

search

Search...

Article - 5 min read

Ramp at $32 billion: Money talks. Now it thinks.

Eric Glyman

Co-founder & CEO, Ramp

Article - 3 min read

Your January just got easier: Introducing 1099 filing

Patrick Keating

Lead Product Manager, Ramp

Article - 4 min read

How Ramp’s million-plus users finish expenses in under 15 seconds

Lucia Kim

Senior Product Marketing Manager

Article - 7 min read

Why legacy systems can’t keep up — and how Ramp is reimagining expense management

Lucia Kim

Senior Product Marketing Manager

Article - 3 min read

Preparing for the future of finance starts with context and control

David Wieseneck

Expert-In-Residence, Ramp

Article - 7 min ready

AP just became autonomous

Geoff Charles

Chief Product Officer, Ramp

Article - 3 min read

Ramp and Intuit deepen partnership

Meera Sundaramurthy

Product Partnerships

Editor's picks

Article

Your January just got easier: Introducing 1099 filing

Discover a completely integrated experience that preps and files all your 1099 forms automatically — no extra portals required.

Article

Ramp at $32 billion: Money talks. Now it thinks.

Our CEO on the Age of "Thinking Money" and why getting big no longer means getting slow.

Article

How Ramp’s users finish expenses in under 15 seconds

Find out how Ramp lets employees can ask policy questions, complete expenses, and submit them on the go, often without even opening the app.

Customer Story

How Poshmark exceeded their free cash flow goals with Ramp

Learn how Poshmark achieved its free cash flow goals in seven months instead of 12 and cut its monthly close time in half after moving to Ramp.

Get fresh finance insights,

bi-weekly

Helpful resources

Alternatives

Compare leading finance platforms in head-to-head breakdowns and see how each one stacks up against pricing, features, scalability, and more.

Compare Business Credit Cards

Explore business credit card options by rewards, fees, credit requirements, and benefits to find the best fit for your company’s financial needs.

Accountant directory

Discover experienced accountants and bookkeepers. Find trusted professionals to handle your financial matters with expertise and precision.

Product releases

The Ramp team releases updates every week. See the latest innovations designed to help your business save time and money.

Newsroom

View all

Article

Inside OnRamp 2025: 4 top takeaways from Ramp’s inaugural customer summit

Learn how Ramp plans to 30x productivity on the platform by 2027 and discover actionable insights the best CFOs use to operate today.

Article

AP just became autonomous

Introducing Agents for AP: fully autonomous accounts payable inside Ramp that codes line items, checks for fraud, recommends approvals, and completes card payments.

Article

We raised $500M to build the future of finance

Ramp has raised another $500M at a $22.5 billion valuation to pick up the pace.

Business credit cards

View all

Article

How to get a business credit card with an EIN only

It is possible to get a business credit card with just an EIN, but your options will be limited. Here's what you need to know.

Article

What an LLC should look for in a business credit card

Business credit cards offer LLC owners a way to separate their business and personal finances while building credit. Here's what LLCs should look for in a card.

Article

Which high-limit business credit card is right for you? December 2025

The best high-limit business credit cards combine purchasing power with other benefits, like built-in expense management. See our top picks.

Expense management

View all

Article

8 best corporate credit card expense management software platforms in 2026

Corporate credit card expense management software can save your company time and money. See our picks for the top tools and tips for choosing the best one.

Article

The best business expense tracking apps and tools of 2025

The best business expense tracking apps and platforms balance a strong feature set with ease of use and cost-effectiveness. Learn more about our top 7 picks.

Article

7 best expense management software in December 2025

Expense management software helps streamline your finance operations. See our picks for today's best options, plus tips on how to make the right choice.

Accounts payable

View all

Article

What is an ACH payment? How it works, costs, and timing

Learn what an ACH payment is, how it works, how to send one, typical processing times and fees, and whether ACH transfers are right for your business.

Article

Top BILL.com competitors: 6 stronger alternatives for AP automation in December 2025

BILL (Bill.com) provides AP automation solutions, but it's not the only option. Here's a comparison of the top 6 BILL alternatives & competitors for modern AP.

Article

How to build an ideal accounts payable approval process

The accounts payable approval process is how companies pay their bills accurately and on time. We outline how to build your ideal AP process in this guide.

AI

View all

Article

Ramp agents: Let finance teams do finance

Announcing our first set of AI agents, built and trained to think like your sharpest controller and work like a thousand of them—around the clock.

Article

The CFO AI digest: July 3

As the volume of AI news explodes each week, it can get hard to spot what really matters. We’re here to cut through the noise and spotlight what counts for finance teams.

This week’s stories mark a shift in how AI is being operationalized across finance, infrastructure, and governance. Digital workers are moving from RPA bots to actual agentic teammates. Supply chains are getting smarter, bringing new implications for cost of goods sold (COGS) and risk, as AI-driven optimization changes how teams forecast costs, manage inventory, and model disruptions. Your data is now a tradable asset, and you might be giving it away for free. Compliance is getting more complex, with individual states rolling out their own AI laws.

For finance leaders, these stories are a call to re-architect your stack and strategy. Amid disruption lies an opportunity: those who adapt now set the pace for the future.

Article

Applied AI in finance: 4 tactics to automate advanced reporting

Discover how finance professionals can use generative AI to create financial reports and models for them with Nicolas Boucher, founder of the AI Finance Club.

Accounting

View all

Article

7 best accounting software for small businesses in 2025

Discover the best accounting software for small businesses. Simplify bookkeeping, automate expenses, and manage cash flow with the right tools.

Article

How to use AI in accounting: Guide for finance teams

Interested in learning how to use AI in accounting? Discover how to automate tasks, detect fraud, and leverage predictive analytics for smarter financial decisions.

Article

7 best AI accounting software for smarter financial management

Discover the best AI accounting software to automate bookkeeping, reduce errors, and improve financial management. Compare top tools for smarter business decisions.

Procurement

View all

Article

Living by our own ethos: How Ramp saved time and money with Ramp Procurement

Ramp's Senior FP&A Manager, Peter Mark, shares how Ramp saved 6 hours of review time per month & $350k in vendor spend by using Ramp Procurement.

Article

Top 7 Mercury alternatives and competitors in 2025

Did Mercury close your account? Here are the top Mercury Bank alternatives in 2025, with Ramp as the best choice in comparison to Novo, Relay, Brex and more.

Article

What is procure-to-pay? A full guide on how the P2P process works

Learn what procure-to-pay (P2P) is, how it streamlines procurement workflows, and its key steps, from requisition to payment, in this comprehensive guide.

Business banking & treasury

View all

Article

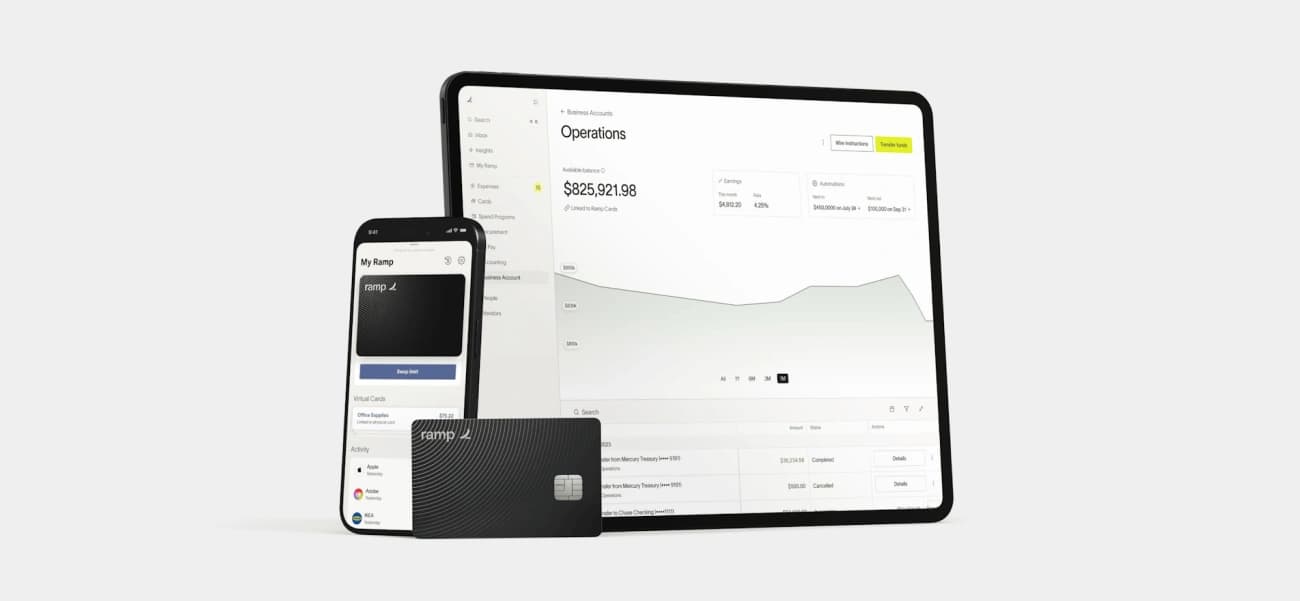

Introducing Ramp Treasury: Most banks hope you never see this.

Many banks make money by making their clients worse off – offering yield only if you lock up your cash with restrictions, minimums, transfer limits or brokerage sweeps. So businesses face a rough trade: earn 0% to keep cash accessible to pay bills, or lock it away to earn returns. Incentives of both parties - banks and customers - are misaligned.

Article

What is treasury management?

Treasury management is the strategic management of a company’s cash, liquidity, investments, payments, and financial risks.

Article

What is a treasury management system (TMS)?

Learn more about treasury management systems, their core functions and benefits, and how to choose the best TMS for you.

Recently published

What is the expense management workflow?An expense management workflow is the step-by-step process for submitting, approving, and reimbursing employee expenses while enforcing company policy.Dec 26

What is the expense management workflow?An expense management workflow is the step-by-step process for submitting, approving, and reimbursing employee expenses while enforcing company policy.Dec 26 Cash and liquidity management: Definition, types, importanceCash and liquidity management is how businesses ensure they have enough accessible cash to meet short-term obligations while managing surplus funds efficiently.Dec 26

Cash and liquidity management: Definition, types, importanceCash and liquidity management is how businesses ensure they have enough accessible cash to meet short-term obligations while managing surplus funds efficiently.Dec 26 What are periodic expenses? Definition and budgeting guidePeriodic expenses are business costs that recur on an irregular but predictable schedule, such as quarterly taxes or annual insurance premiums.Dec 24

What are periodic expenses? Definition and budgeting guidePeriodic expenses are business costs that recur on an irregular but predictable schedule, such as quarterly taxes or annual insurance premiums.Dec 24 Deferred revenue journal entry: How to record unearned revenueA deferred revenue journal entry records cash received for goods or services before they are delivered and recognizes revenue as obligations are fulfilled.Dec 24

Deferred revenue journal entry: How to record unearned revenueA deferred revenue journal entry records cash received for goods or services before they are delivered and recognizes revenue as obligations are fulfilled.Dec 24 Purchase order automation: What it is and how it worksPurchase order automation uses software to create, approve, track, and match POs with invoices automatically, reducing errors, cycle time, and manual work.Dec 23

Purchase order automation: What it is and how it worksPurchase order automation uses software to create, approve, track, and match POs with invoices automatically, reducing errors, cycle time, and manual work.Dec 23 Catalog management in procurement: Definition, types, and benefitsCatalog management is the process of organizing approved products, services, suppliers, and pricing so employees can buy compliantly and at negotiated rates.Dec 23

Catalog management in procurement: Definition, types, and benefitsCatalog management is the process of organizing approved products, services, suppliers, and pricing so employees can buy compliantly and at negotiated rates.Dec 23